Supply-side economics

Encyclopedia

Supply-side economics is a school of macroeconomic thought that argues that economic growth

can be most effectively created by lowering barriers for people to produce (supply) goods and services, such as lowering income tax

and capital gains tax

rates, and by allowing greater flexibility by reducing regulation. According to supply-side economics, consumers will then benefit from a greater supply of goods and services at lower prices. Typical policy recommendations of supply-side economics are lower marginal tax rates and less regulation.

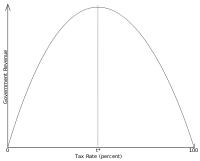

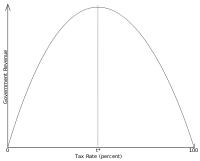

The Laffer curve

embodies a tenet of supply side economics: that government tax revenues are the same at 100% tax rates as at 0% tax rates. The tax rate that achieves highest government revenues is somewhere in between. At typical tax rates prevailing in the United States currently, higher tax rates generally lead to some increase in government tax revenue. Whether it is worth the corresponding decrease in economic growth that is often assumed by supply-side economists to accompany such a rate increase is a policy question. In 2003, a Congressional Budget Office

study was conducted to forecast whether currently proposed tax cuts would increase revenues. The study used dynamic scoring models as supply side advocates had wanted and was conducted by a supply side advocate. The majority of the models applied predicted that the proposed tax cuts would not increase revenues.

The term "supply-side economics" was thought, for some time, to have been coined by journalist Jude Wanniski

in 1975, but according to Robert D. Atkinson's Supply-Side Follies [p. 50], the term "supply side" ("supply-side fiscalists") was first used by Herbert Stein

, a former economic adviser to President Nixon, in 1976, and only later that year was this term repeated by Jude Wanniski. Its use connotes the ideas of economists Robert Mundell

and Arthur Laffer

. Today, supply-side economics is viewed by critics as a form of "trickle-down economics

".

to stabilize Western economies during the stagflation

of the 1970s, in the wake of the oil crisis in 1973

. It drew on a range of non-Keynesian economic thought, particularly the Chicago School

and Neo-Classical School

. The intellectual roots of supply-side economics have also been traced back to various early economic thinkers, such as Ibn Khaldun

, Jonathan Swift

, David Hume

, Adam Smith

, and Alexander Hamilton

.

As in classical economics

, supply-side economics proposed that production or supply

is the key to economic prosperity and that consumption

or demand

is merely a secondary consequence. Early on this idea had been summarized in Say's Law

of economics, which states: "A product is no sooner created, than it, from that instant, affords a market for other products to the full extent of its own value." John Maynard Keynes

, the founder of Keynesianism, summarized Say's Law as "supply creates its own demand." He turned Say's Law on its head in the 1930s by declaring that demand creates its own supply. However, Say's Law does not state that production creates a demand for the product itself, but rather a demand for "other products to the full extent of its own value." A better formulation of the law is that the supply of one good constitutes demand for one or more other goods. This requires that the original good has some value to another party and it is through willingness to trade this value that the producer of the new good can express his demand for another good.

In 1978, Jude Wanniski published The Way the World Works, in which he laid out the central thesis of supply-side economics and detailed the failure of high tax-rate progressive income tax systems and U.S. monetary policy under Nixon in the 1970s. Wanniski advocated lower tax rates and a return to some kind of gold standard

, similar to the 1944-1971 Bretton Woods System

that Nixon abandoned.

In 1983, economist Victor Canto, a disciple of Arthur Laffer

, published The Foundations of Supply-Side Economics. This theory focuses on the effects of marginal tax rate

s on the incentive to work and save, which affect the growth

of the "supply side" or what Keynesians call potential output

. While the latter focus on changes in the rate of supply-side growth in the long run, the "new" supply-siders often promised short-term results.

The supply-siders were influenced strongly by the idea of the Laffer curve

, which states that tax rates and tax revenues were distinct—that tax rates too high or too low will not maximize tax revenues. Supply-siders felt that in a high tax rate environment, lowering tax rates to the right level can raise revenue by causing faster economic growth

.

This led the supply-siders to advocate large reductions in marginal income and capital gains tax rates to encourage allocation of assets to investment, which would produce more supply. Jude Wanniski and many others advocate a zero capital gains rate. The increased aggregate supply would result in increased aggregate demand, hence the term "Supply-Side Economics".

Furthermore, in response to inflation, supply-siders called for indexed marginal income tax rates, as monetary inflation had pushed wage earners into higher marginal income tax bracket

s that remained static; that is, as wages increased to maintain purchasing power with prices, income tax brackets were not adjusted accordingly and thus wage earners were pushed into higher income tax brackets than tax policy had intended.

Supply-side economics has been criticized as essentially politically conservative. Supply-side advocates claim that they are not following an ideology, but are reinstating classical economics. Yet, supply-siders such as Jude Wanniski have argued for lower tax rates to increase tax revenues, and that redistribution of income through taxation was essential to the health of the polity

-- a view that is anathema to traditional conservatives.

Some economists see similarities between supply-side proposals and Keynesian economics. If the result of changes to the tax structure is a fiscal deficit then the 'supply-side' policy is effectively stimulating demand through the Keynesian multiplier

effect. Supply-side proponents would point out, in response, that the level of taxation and spending is important for economic incentives, not just the size of the deficit.

The Reagan administration

justified such changes in socioeconomic terms by invoking the old saying that "a rising tide lifts all boats".

and Adam Smith. Jude Wanniski has claimed both as supply-side thinkers due to their advocacy of a gold monetary standard and more specifically their focus on the agents of production in an economy. Barton Biggs

, chief investment strategist of Morgan Stanley

, described Wanniski's book about supply-side economics, The Way the World Works, as the "most important" economic book published since Marx's writings.

that causes economic participants to revert to less efficient means of satisfying their needs. As such, higher taxation leads to lower levels of specialization and lower economic efficiency. The idea is said to be illustrated by the Laffer curve

. (Case & Fair, 1999: 780, 781).

Crucial to the operation of supply-side theory is the expansion of free trade

and free movement of capital. It is argued that free capital movement, in addition to the classical reasoning of comparative advantage

, frequently allows an economic expansion. Lowering tax barriers to trade provides to the domestic economy all the advantages that the international economy gets from lower tariff barriers.

Supply-side economists have less to say on the effects of deficits, and sometimes cite Robert Barro

’s work that states that rational economic actors will buy bonds in sufficient quantities to reduce long term interest rates. Critics argue that standard exchange rate theory would predict, instead, a devaluation of the currency of the nation running the high budget deficit, and eventual "crowding out

" of private investment.

According to Mundell, "Fiscal discipline is a learned behavior." To put it another way, eventually the unfavourable effects of running persistent budget deficits will force governments to reduce spending in line with their levels of revenue. This view is also promoted by Victor Canto.

The central issue at stake is the point of diminishing returns on liquidity in the investment sector: Is there a point where additional money is "pushing on a string"? To the supply-side economist, reallocation away from consumption to private investment, and most especially from public investment to private investment, will always yield superior economic results. In standard monetarist and Keynesian theory, however, there will be a point where increases in asset prices will produce no new supply. A point where investment demand outruns potential investment supply, and produce instead asset inflation, or in common terms a bubble. The existence of this point, and where it is should it exist, is the essential question of the efficacy of supply-side economics.

irrespective of the quantity of money that must be created or withdrawn by the central bank

to achieve this target. This contrasts with monetarism's focus on the quantity of money, and Keynesian theory's emphasis on real aggregate demand. The important difference is that to a monetarist the quantity of money, specifically represented by the money supply

is the crucial determining variable for the relationship between the supply and demand for money, while to a Keynesian adequate demand to support the available money supply is important. Keynes famously remarked that "money doesn't matter".

This is an area where supply-side theory has been particularly influential. Under macroeconomic theory, the general level of price was based on the strict increase in price of a basket of goods. Under supply-side theory, the rate of inflation should be based on the substitutions that individuals make in the market place, and should take into account the improved quality of goods. In the late 1980s and through the 1990s, under Presidents of both American political parties, shifts were made in the calculation of the broadly followed measure of inflation the "Consumer Price Index for Urban Consumers", or CPI-U

, which reflected supply-side ideas on substitution. The argument for factoring in goods' quality was not accepted, which has led supply-side economists to claim that the actual CPI

is actually between 0.5% and 1% lower than the stated rate.

This area represents one of the points of contention between conservative economic theorists who argue for a quantity of money theory of inflation, including Austrian economics, many strict gold standard economists and traditional monetarists, and supply-side theorists. According to the increases in money supply during the 1990s, the real rate of inflation must be higher than is currently stated. These economists argue that the cost of housing is understated in the CPI-W, and that the inflation rate should be between 0.5% and 1% higher. It is for this reason that many central bankers, investment analysts and economists follow the GDP deflator

which measures the total output of the society and the prices paid for all goods, not merely consumer goods.

Some supply-siders view gold

as the best unit of account

with which to measure the price of fiat money

, which is defined as a money supply not directly limited by specie or hard assets. Hence the purest supply-siders are in general advocates of a gold standard. However the reverse is not true; many gold standard advocates are harsh critics of supply-side economics.

Supply-side economists assert that the value of money is purely dictated by the supply and demand for money. In fiat money system the government has a legislated monopoly

on the supply of base money. Hence it has some control over the value of money. Any decline in the value of money (or appreciation) is then viewed by some as the result of errant central bank policy.

Some contemporary economists do not consider supply-side economics a tenable economic theory, with Alan Blinder

calling it an "ill-fated" and perhaps "silly" school on the pages of a 2006 textbook. Greg Mankiw, former chairman of President George W. Bush's

Council of Economic Advisors, offered similarly sharp criticism of the school in the early editions of his introductory economics textbook. In a 1992 article for the Harvard International Review

, James Tobin

wrote, "[The] idea that tax cuts would actually increase revenues turned out to deserve the ridicule…" Nevertheless, cuts in capital gains rates have consistently increased government revenues, at least for a time.

Supply side proponents Trabandt and Uhlig argue that "static scoring overestimates the revenue loss for labor and capital tax cuts", and that instead "dynamic scoring

" is a better predictor for the effects of tax cuts. To address these criticisms, in 2003 the Congressional Budget Office conducted a dynamic scoring analysis of tax cuts advocated by supply advocates; Two of the nine models used in the study predicted a large improvement in the deficit over the next ten years resulting from tax cuts and the other seven models did not.

ended the convertibility of the US dollar into gold, which meant the end of the Bretton Woods system

. Commodity

prices, including oil and gold particularly, which had been rising steadily in response to the dollar glut, spiked upwards. The supply-side explanation for this event is that taxation on investment had depleted the incentive to capital investment either in new sources of materials or in substitute goods, which when combined with eroding confidence in the U.S. dollar

cause it to be rapidly devalued. Many supply siders agree with gold investors in saying that the value of commodities remained constant and that it was the dollar that devalued

.

At the same time the Mundell-Fleming model

of currency flows gained greater credence when it was codified into a single set of equations, and became increasingly influential in neo-liberal economics. The argument for a floating currency regime had first been adopted by Friedman, but supply-side economists such as Wanniski typically argued that exchange rates should be fixed relative to gold. Mundell was the author of the influential view that it was Johnson

's budget deficits that were the cause of inflationary pressure. However, as Lester Thurow

pointed out, the standard model of inflationary pressure shows that Johnson's peak year of deficits would have created only a small upward pressure, that instead it was persistent American trade deficits through the 1960s which had a greater effect on the imbalance between the value of the U.S. dollar and the gold

to which it was, in theory, convertible.

is defined as a period of slow economic growth and high unemployment (stagnation) while prices rise (inflation).

Robert Mundell believes Nixon's failure to cut taxes in the early 1970s to be the cause of stagflation

Robert Mundell believes Nixon's failure to cut taxes in the early 1970s to be the cause of stagflation

, his argument being that the incentive for individuals to invest was reduced to below zero. Measuring the S&P 500

in inflation-adjusted terms, the stock market

lost half of its value between the market peak of 1972 and its bottom in 1982, with money seeking better returns in real estate

and commodities instead. The argument from the supply-side point of view then goes on to state that the cuts in capital gains tax rates that were part of the 1981 tax package returned incentives to invest. The Keynesian point of view is that after a long bear market, money had fled from stocks and was set to return, once the expectation of inflation had been reduced. Neither of these two arguments fully accounts for the rise of equities over the course of the "long Bull Market" of 1982-2000.

The importance of this argument needs to be seen in light of the effects of the inflation of the late 1970s, where credit became constricted, as interest rates rose rapidly, and the number of borrowers who could qualify for even standard mortgages fell. Inflation acted as a tax on wage increases, because the highly progressive income tax system of the time meant that more and more households suffered from "bracket creep" - in which a wage increase would be reduced in value by the increased taxes collected. The effects of inflation produced, in 1980, a strong political consensus for a change in basic policy.

made supply-side economics a household phrase, and promised an across-the-board reduction in income tax rates and an even larger reduction in capital gains tax rates. (Case & Fair, 1999: 781, 782). When vying for the Republican party presidential nomination for the 1980 election, George H.W. Bush derided Reagan's supply-side policies as "voodoo economics". However, later he seemed to give lip service to these policies to secure the Republican nomination in 1988, and is speculated by some to have lost in his re-election bid in 1992 by allowing tax increases. (See: "Read my lips: No new taxes

".)

The centerpiece of the supply-side argument is the economic rebound from the 1980-1982 "double-dip recession", combined with the continued fall in commodity prices. The "across the board" tax cuts of 1981 are seen as the great motivator for the "Seven Fat Years". Critics of this view point out that the "rebound" from the recession of 1981-1982 is exactly in accordance with the "disinflation" scenario predicted by IS/LM model

s of the late 1970s: essentially that the increases in fed funds rates squeezed out inflation, and that federal budget deficits acted to "prime the pump". This model had been the basis of Volcker's federal reserve policy.

In 1981, Robert Mundell

told Ronald Reagan that by cutting upper bracket taxation rates and lowering tax rates on capital gains, national output would increase so much that tax revenues would also increase. Mundell claimed that the economic expansion would also mop up excess liquidity and bring inflation back under control. After the tax cuts were implemented, nominal revenues quickly returned to—and ultimately surpassed—previous levels. While revenues dropped as a share of GDP, supply-siders note they intended for this fall to happen, since cutting tax rates would reduce the amount of taxes collected relative to national income.

The question of whether the tax cuts proved Mundell's predictions correct has sparked much debate between supply-siders and mainstream economists. While nominal revenues rebounded after the tax cuts, mainstream economists note that comparing nominal tax collections over time fails to take inflation into account. By converting tax revenues from nominal to real terms, these economists have shown that tax revenues did not surpass their 1981 levels until 1987.

Defenders of supply-side economics also complain that the focus of the debate on government revenue tends to ignore the societal benefits of economic growth, primarily lower levels of unemployment, higher wages for workers and lower prices for consumers. This is a rhetorical argument derisively known as trickle-down economics, and should be viewed as distinct from the economic theory of supply-side economics.

In the United States

, commentators frequently equate supply-side economics with Reaganomics

. The fiscal policies of Ronald Reagan were largely based on supply-side economics. During Reagan's 1980 presidential campaign, the key economic concern was double digit inflation

, which Reagan described as "Too many dollars chasing too few goods", but rather than the usual dose of tight money, recession and layoffs, with their consequent loss of production and wealth, he promised a gradual and painless way to fight inflation by "producing our way out of it". Switching from an earlier monetarist policy, Federal Reserve chair Paul Volcker

began a policy of tighter monetary policies such as lower money supply growth to break the inflationary psychology and squeeze inflationary expectations out of the economic system

. Therefore, supply-side supporters argue, "Reaganomics" was only partially based on supply-side economics. However, under Reagan, Congress passed a plan that would slash taxes by $749 billion over five years. As a result, Jason Hymowitz cited Reagan—along with Jack Kemp

—as a great advocate for supply-side economics in politics and repeatedly praised his leadership.

Critics of "Reaganomics" claim it failed to produce much of the exaggerated gains some supply-siders had promised. Krugman

later summarized the situation: "When Ronald Reagan was elected, the supply-siders got a chance to try out their ideas. Unfortunately, they failed." Although he credited supply-side economics for being more successful than monetarism which he claimed "left the economy in ruins", he stated that supply-side economics produced results which fell "so far short of what it promised," describing the supply-side theory as "free lunches". Krugman and other critics point to increased budget deficits during the Reagan administration as proof that the Laffer Curve is wrong. Supply-side advocates claim that revenues increased, but that spending increased faster. However, they typically point to total revenues even though it was only income taxes rates that were cut while other taxes, notably payroll taxes were raised. That table also does not account for inflation. For example, of the increase from $600.6 billion in 1983 to $666.5 billion in 1984, $26 billion is due to inflation, $18.3 billion to corporate taxes and $21.4 billion to social insurance revenues (mostly FICA taxes). Income tax revenues in constant dollars

decreased by $2.77 billion in that year. Supply-siders cannot legitimately take credit for increased FICA tax revenue, because in 1983 FICA tax rates were increased from 6.7% to 7% and the ceiling was raised by $2,100. For the self employed, the FICA tax rate went from 9.35% to 14%. The FICA tax rate increased throughout Reagan's term, and rose to 7.51% in 1988 and the ceiling was raised by 61% through Reagan's two terms. Those tax hikes on wage earners, along with inflation, are the source of the revenue gains of the early 1980s.

It has been contended by some supply-side critics that the argument to lower taxes to increase revenues was a smokescreen for "starving" the government of revenues, in the hope that the tax cuts would lead to a commensurate drop in government spending. However, this did not turn out to be the case on the spending side; Paul Samuelson

called this notion "the tape worm theory—the idea that the way to get rid of a tape worm is [to] stab your patient in the stomach".

Reagan himself gave credence to Samuelson’s argument when he used this analogy, “We can lecture our children about extravagance until we run out of voice and breath. Or we can cure their extravagance by simply reducing their allowance.” There was a second smokescreen as well, closely related to the first. If there was not a drop in total government spending, what Reagan did achieve was to not only move the national debate to the right of center but to move the center itself. So, for his eight years and most of the period since then, political battles have been fought on the conservatives’ turf. How much or how little to cut Federal programs became the issue du jour. Efforts to prevent draconian cuts in discretionary programs for the poor, such as a campaign in the early 1980s by mainline Protestant denominations under the banner, “The Poor Have Suffered Enough,” quickly discovered this. To this day, subsequent similar attempts to increase or restore funds for these programs only confirmed the political lesson these church bodies learned, that the repositioning of where the battle would be joined may have been Reagan’s greatest domestic achievement.

Supply-side advocates like Wanniski counter that social and fiscal conservatives who supported the supply-side prescription on tax policy for this reason were misguided and did not understand the Laffer Curve.

There is frequent confusion on the meaning of the term 'supply-side economics', between the related ideas of the existence of the Laffer Curve and the belief that decreasing tax rates can increase tax revenues. But many supply-side economists doubt the latter claim, while still supporting the general policy of tax cuts. Economist Gregory Mankiw used the term "fad economics" to describe the notion of tax rate cuts increasing revenue in the third edition of his Principles of Macroeconomics textbook in a section entitled "Charlatans and Cranks":

's tax increases, since they did not change marginal capital gains tax rates, left the supply-side nature of the 1986 tax bill in place. Similarly, supply-side economists have argued that since the early phases of the massive tax breaks of George W. Bush's first two years were based on credits and not cuts in marginal rates, they did not act to stimulate the economy, although the effect on individual income remains the same.

More generally, traditional economists point to the "overhang" of deficits from the Reagan Era

, the S&L bailout

, the effects of a ballooning federal budget deficit, the defense budget cuts which began in earnest in 1989, and the expectation of a lack of continued fiscal discipline as the source of the recession. These arguments blame the legacy of Democratic

deficits forced upon Reagan, rather than deficits run up during Reagan's own administration. Critics of supply-side economics often argue the inflated government deficits that accompanied the arrival of supply-side economics are of greater concern than the stock market success of supply-side theory.

(CBO) predicted that the revenue generating effects of the specific tax cuts examined would be, in his words, "relatively small." Murray also suggested that Dan Crippen

may have lost his chance at reappointment as head of the CBO over the dynamic scoring

issue.

Before President Bush signed the 2003 tax cuts, the progressive, nonpartisan Economic Policy Institute

(EPI) released a statement signed by ten Nobel prize laureates entitled "Economists' statement opposing the Bush tax cuts

", which states that:

Nobel laureate economist Milton Friedman

agreed the tax cuts would reduce tax revenues and result in intolerable deficits, though he supported them as a means to restrain federal spending. Friedman characterized the reduced government tax revenue as "cutting their allowance".

Later analysis of the Bush tax cuts

by the Economic Policy Institute

claims that the Bush tax cuts have failed to promote growth, as all macroeconomic growth indicators, save the housing market, were well below average for the 2001 to 2005 business cycle. These critics argue that the Bush tax cuts have done little more than deprive government of revenue, and increase deficit and after-tax income inequality. In the two years since that report, though, growth has remained strong, and newer numbers dispute the conclusions of the EPI report. The Bush administration points to the long period of sustained growth, both in GDP and in overall job numbers, as well as increases in personal income and decreases in the government deficit.

The results of the tax cuts in the U.S. in 2001 and 2003 are mixed. While results show a temporary decline in tax receipts, they later recovered due to economic growth. In this analysis, it is difficult to discern the reason for the decreases in tax revenue because 2001 was the same year that the dot-com bubble

burst. Total Federal Revenues in FY2000 were $2,025 billion (in inflation adjusted dollars). In 2001, President George W. Bush signed the Economic Growth and Tax Relief Reconciliation Act of 2001

. Rather than wait for the start of the new fiscal year, income tax rate reductions started on July 1, 2001. In addition, rebate checks were sent to everyone that filed a 2000 income tax return (before Oct 1, the start of the new federal fiscal year). Federal revenues in FY2001 were $1,946 billion, $79 billion lower than in FY2000. More of the 2001 tax cut took effect at the start of FY2002, including cuts in the estate tax, retirement and educational savings. Federal revenues in FY2002 were $1,777 billion, $247 billion lower than in FY2000.

In 2003, President Bush signed the Jobs and Growth Tax Relief Reconciliation Act of 2003

. Income tax rates were immediately reduced and rebate checks issued (without waiting for the new fiscal year). Federal revenues in FY2003 were $1,665 billion, $360 billion lower than in FY2000. Federal revenues in FY2004 were 1,707 billion, $318 billion lower than in FY2000. Federal revenues in FY2005 were $1,888, $137 billion lower than in FY2000, but by 2006 revenue had completely recovered (in inflation adjusted dollars), with receipts at $2,037 Billion, $12 billion higher than 2000. The cumulative total of federal revenues less than in FY2000 for the fiscal years 2001-2005 was $1.142 trillion, with that amount expected to be recovered by 2011, with 2012 expected to produce an additional $400 billion in excess revenue over 2000.

Federal revenues include revenue from different taxes that were cut, stayed the same, or were raised. For example, the Social Security FICA

tax rate stayed the same while the maximum income subject to the tax was increased each year, resulting in a tax increase for those earning more than the previous limit. Social Security tax revenues increased each and every year. Including increasing tax revenues from taxes that stayed the same or were increased hides the magnitude of the revenue decrease in taxes that were cut. Income tax rates were cut and income tax revenues were lower than the FY2000 level each and every fiscal year from 2001–2005, a cumulative revenue decrease of $640 billion (measured in nominal dollars). But, by 2006 revenues exceeded the 2000 level. Likewise Corporate income tax rates were cut and revenues were lower than the FY2000 level each and every fiscal year from 2001-2004. But, by 2005 the inflation adjusted take exceeded that of 2000 by over 20%, and by 2006 nearly 50% higher. Since tax cuts took after a stock market crash, and their effects were contemporaneous with both a recession and the 9/11 attacks, it's unclear whether temporary decreases in government revenue were the result of those cuts, or to other factors affecting the economy.

In 2006, the CBO released a study titled "A Dynamic Analysis of Permanent Extension of the President's Tax Relief." This study found that under the best possible scenario, making tax cuts permanent would increase the economy "over the long run" by 0.7%. Since the "long run" is not defined, some commentators have suggested that 20 years should be used, making the annual best case GDP growth equal to 0.04%. When compared with the cost of the tax cuts, the best case growth scenario is still not sufficient to pay for the tax cuts. Previous official CBO estimates had identified the tax cuts as costing the equivalent of 1.4% of the GDP in revenue. According to the study, if the best case growth scenario is applied, the tax cuts would still cost the equivalent of 1.27% of the GDP.

This study was criticized by many economists, including Harvard Economics Professor Greg Mankiw, who pointed out that the CBO used a very low value for the earnings-weighted compensated labor supply elasticity of 0.14. In a paper published in the Journal of Public Economics, Mankiw and Matthew Weinzierl noted that the current economics research would place an appropriate value for labor supply elasticity at around 0.5,

although Dr. Mankiw notes, "unfortunately, the academic literature on this topic is far from conclusive."

A recent working paper sponsored by the IMF

showed "that the Laffer curve can arise even with very small changes in labor supply effects" but that "labor supply changes do not cause the Laffer effect." This is contrary to the supply-side explanation of the Laffer curve, in which the increases in tax revenue are held to be the result of an increase in labor supply. Instead their proposed mechanism for the Laffer effect was that "tax rate cuts can increase revenues by improving tax compliance." The study examined in particular the case of Russia which has comparatively high rates of tax evasion. In that case, their tax compliance model did yield significant revenue increases:

Some economists view supply-side as an ill-conceived economic theory. Critics of supply-side economics point to the lack of academic economics credentials by movement leaders such as Jude Wanniski and Robert Bartley to imply that the theories behind it are bankrupt. David Harper and others dismiss the theory as offering "nothing particularly new or controversial" to an updated view of classical economics. Nobel prize winning economist Paul Krugman

Some economists view supply-side as an ill-conceived economic theory. Critics of supply-side economics point to the lack of academic economics credentials by movement leaders such as Jude Wanniski and Robert Bartley to imply that the theories behind it are bankrupt. David Harper and others dismiss the theory as offering "nothing particularly new or controversial" to an updated view of classical economics. Nobel prize winning economist Paul Krugman

published a book dedicated to attacking the theory, and Reaganomics, under the title "Peddling Prosperity

". Mundell in his The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel

acceptance lecture (awarded for unrelated work in optimum currency area

) countered that the success of price stability was proof that the supply-side revolution had worked. The continuing debate over supply-side policies tends to focus on the massive federal and current account deficits, increased income inequality and its failure to promote growth.

In 2006 Sebastian Mallaby of The Washington Post

quoted George W. Bush

, Dick Cheney

, Bill Frist

, Chuck Grassley

, and Rick Santorum

misstating the effect of the Bush Administration's tax cuts. On January 3, 2007, George W. Bush wrote an article claiming "It is also a fact that our tax cuts have fueled robust economic growth and record revenues." Andrew Samwick

, who was Chief Economist on Bush's Council of Economic Advisers from 2003-2004 responded to the claim:

The Congressional Budget Office

(CBO) has estimated that extending the Bush tax cuts

of 2001-2003 beyond their 2010 expiration would increase deficits by $1.8 trillion dollars over the following decade. The CBO also completed a study in 2005 analyzing a hypothetical 10% income tax cut and concluded that under various scenarios there would be minimal offsets to the loss of revenue. In other words, deficits would increase by nearly the same amount as the tax cut in the first five years, with limited feedback revenue thereafter.

From time to time politicians make blunt claims that tax cuts increase government revenue (e.g. Mitch McConnell in July 2010 ) However, the Laffer Curve

clearly shows that only cutting tax rates to the right of peak economic performance rate will increase revenues, and that cutting tax rates to the left of the peak rate will decrease revenues.

The paradigm of a tax system which rewards investment over consumption was accepted across the political spectrum, and no plan not rooted in supply-side economic theories has been advanced in the United States since 1982 (with the exception of the Clinton tax increases of 1993) which had any serious chance of passage into law. In 1986, a tax overhaul, described by Mundell as "the completion of the supply-side revolution" was drafted. It included increases in payroll taxes, decreases in top marginal rates, and increases in capital gains taxes. Combined with the mortgage interest deduction and the regressive effects of state taxation, it produces closer to a flat-tax

effect. Proponents, such as Mundell and Laffer, point to the dramatic rise in the stock market as a sign that the tax overhaul was effective, although they note that the hike in capital gains may be more trouble than it was worth.

Cutting marginal tax rates can also be perceived as primarily beneficial to the wealthy, which commentators such as Paul Krugman see as politically rather than economically motivated.

The economist John Kenneth Galbraith

noted that supply side economics was not a new theory. He wrote, "Mr. David Stockman

has said that supply-side economics was merely a cover for the trickle-down approach to economic policy—what an older and less elegant generation called the horse-and-sparrow theory: If you feed the horse enough oats, some will pass through to the road for the sparrows." Galbraith claimed that the horse and sparrow theory was partly to blame for the Panic of 1896

.

Economic growth

In economics, economic growth is defined as the increasing capacity of the economy to satisfy the wants of goods and services of the members of society. Economic growth is enabled by increases in productivity, which lowers the inputs for a given amount of output. Lowered costs increase demand...

can be most effectively created by lowering barriers for people to produce (supply) goods and services, such as lowering income tax

Income tax

An income tax is a tax levied on the income of individuals or businesses . Various income tax systems exist, with varying degrees of tax incidence. Income taxation can be progressive, proportional, or regressive. When the tax is levied on the income of companies, it is often called a corporate...

and capital gains tax

Capital gains tax

A capital gains tax is a tax charged on capital gains, the profit realized on the sale of a non-inventory asset that was purchased at a lower price. The most common capital gains are realized from the sale of stocks, bonds, precious metals and property...

rates, and by allowing greater flexibility by reducing regulation. According to supply-side economics, consumers will then benefit from a greater supply of goods and services at lower prices. Typical policy recommendations of supply-side economics are lower marginal tax rates and less regulation.

The Laffer curve

Laffer curve

In economics, the Laffer curve is a theoretical representation of the relationship between government revenue raised by taxation and all possible rates of taxation. It is used to illustrate the concept of taxable income elasticity . The curve is constructed by thought experiment...

embodies a tenet of supply side economics: that government tax revenues are the same at 100% tax rates as at 0% tax rates. The tax rate that achieves highest government revenues is somewhere in between. At typical tax rates prevailing in the United States currently, higher tax rates generally lead to some increase in government tax revenue. Whether it is worth the corresponding decrease in economic growth that is often assumed by supply-side economists to accompany such a rate increase is a policy question. In 2003, a Congressional Budget Office

Congressional Budget Office

The Congressional Budget Office is a federal agency within the legislative branch of the United States government that provides economic data to Congress....

study was conducted to forecast whether currently proposed tax cuts would increase revenues. The study used dynamic scoring models as supply side advocates had wanted and was conducted by a supply side advocate. The majority of the models applied predicted that the proposed tax cuts would not increase revenues.

The term "supply-side economics" was thought, for some time, to have been coined by journalist Jude Wanniski

Jude Wanniski

Jude Thaddeus Wanniski was an American journalist, conservative commentator, and political economist.- Early life and education :...

in 1975, but according to Robert D. Atkinson's Supply-Side Follies [p. 50], the term "supply side" ("supply-side fiscalists") was first used by Herbert Stein

Herbert Stein

Herbert Stein was a senior fellow at the American Enterprise Institute and was on the board of contributors of The Wall Street Journal. He was chairman of the Council of Economic Advisers under President Nixon and President Ford. From 1974 until 1984, he was the A...

, a former economic adviser to President Nixon, in 1976, and only later that year was this term repeated by Jude Wanniski. Its use connotes the ideas of economists Robert Mundell

Robert Mundell

Robert Mundell, CC is a Nobel Prize-winning Canadian economist. Currently, Mundell is a professor of economics at Columbia University and the Chinese University of Hong Kong....

and Arthur Laffer

Arthur Laffer

Arthur Betz Laffer is an American economist who first gained prominence during the Reagan administration as a member of Reagan's Economic Policy Advisory Board . Laffer is best known for the Laffer curve, an illustration of the theory that there exists some tax rate between 0% and 100% that will...

. Today, supply-side economics is viewed by critics as a form of "trickle-down economics

Trickle-down economics

"Trickle-down economics" and "the trickle-down theory" are terms used in United States politics to refer to the idea that tax breaks or other economic benefits provided by government to businesses and the wealthy will benefit poorer members of society by improving the economy as a whole...

".

Historical origins

Supply-side economics developed during the 1970s in response to Keynesian economic policy, and in particular the failure of demand managementDemand management

Demand management is a planning methodology used to manage forecasted demand.-Demand management in economics:In economics, demand management is the art or science of controlling economic demand to avoid a recession...

to stabilize Western economies during the stagflation

Stagflation

In economics, stagflation is a situation in which the inflation rate is high and the economic growth rate slows down and unemployment remains steadily high...

of the 1970s, in the wake of the oil crisis in 1973

1973 oil crisis

The 1973 oil crisis started in October 1973, when the members of Organization of Arab Petroleum Exporting Countries or the OAPEC proclaimed an oil embargo. This was "in response to the U.S. decision to re-supply the Israeli military" during the Yom Kippur war. It lasted until March 1974. With the...

. It drew on a range of non-Keynesian economic thought, particularly the Chicago School

Chicago school

Chicago school may refer to:* Chicago school * Chicago school * Chicago school * Chicago school * Chicago school * Chicago School of Professional Psychology...

and Neo-Classical School

New classical macroeconomics

New classical macroeconomics, sometimes simply called new classical economics, is a school of thought in macroeconomics that builds its analysis entirely on a neoclassical framework. Specifically, it emphasizes the importance of rigorous foundations based on microeconomics...

. The intellectual roots of supply-side economics have also been traced back to various early economic thinkers, such as Ibn Khaldun

Ibn Khaldun

Ibn Khaldūn or Ibn Khaldoun was an Arab Tunisian historiographer and historian who is often viewed as one of the forerunners of modern historiography, sociology and economics...

, Jonathan Swift

Jonathan Swift

Jonathan Swift was an Irish satirist, essayist, political pamphleteer , poet and cleric who became Dean of St...

, David Hume

David Hume

David Hume was a Scottish philosopher, historian, economist, and essayist, known especially for his philosophical empiricism and skepticism. He was one of the most important figures in the history of Western philosophy and the Scottish Enlightenment...

, Adam Smith

Adam Smith

Adam Smith was a Scottish social philosopher and a pioneer of political economy. One of the key figures of the Scottish Enlightenment, Smith is the author of The Theory of Moral Sentiments and An Inquiry into the Nature and Causes of the Wealth of Nations...

, and Alexander Hamilton

Alexander Hamilton

Alexander Hamilton was a Founding Father, soldier, economist, political philosopher, one of America's first constitutional lawyers and the first United States Secretary of the Treasury...

.

As in classical economics

Classical economics

Classical economics is widely regarded as the first modern school of economic thought. Its major developers include Adam Smith, Jean-Baptiste Say, David Ricardo, Thomas Malthus and John Stuart Mill....

, supply-side economics proposed that production or supply

Supply (economics)

In economics, supply is the amount of some product producers are willing and able to sell at a given price all other factors being held constant. Usually, supply is plotted as a supply curve showing the relationship of price to the amount of product businesses are willing to sell.In economics the...

is the key to economic prosperity and that consumption

Consumption (economics)

Consumption is a common concept in economics, and gives rise to derived concepts such as consumer debt. Generally, consumption is defined in part by comparison to production. But the precise definition can vary because different schools of economists define production quite differently...

or demand

Demand

- Economics :*Demand , the desire to own something and the ability to pay for it*Demand curve, a graphic representation of a demand schedule*Demand deposit, the money in checking accounts...

is merely a secondary consequence. Early on this idea had been summarized in Say's Law

Say's law

Say's law, or the law of market, is an economic principle of classical economics named after the French businessman and economist Jean-Baptiste Say , who stated that "products are paid for with products" and "a glut can take place only when there are too many means of production applied to one kind...

of economics, which states: "A product is no sooner created, than it, from that instant, affords a market for other products to the full extent of its own value." John Maynard Keynes

John Maynard Keynes

John Maynard Keynes, Baron Keynes of Tilton, CB FBA , was a British economist whose ideas have profoundly affected the theory and practice of modern macroeconomics, as well as the economic policies of governments...

, the founder of Keynesianism, summarized Say's Law as "supply creates its own demand." He turned Say's Law on its head in the 1930s by declaring that demand creates its own supply. However, Say's Law does not state that production creates a demand for the product itself, but rather a demand for "other products to the full extent of its own value." A better formulation of the law is that the supply of one good constitutes demand for one or more other goods. This requires that the original good has some value to another party and it is through willingness to trade this value that the producer of the new good can express his demand for another good.

In 1978, Jude Wanniski published The Way the World Works, in which he laid out the central thesis of supply-side economics and detailed the failure of high tax-rate progressive income tax systems and U.S. monetary policy under Nixon in the 1970s. Wanniski advocated lower tax rates and a return to some kind of gold standard

Gold standard

The gold standard is a monetary system in which the standard economic unit of account is a fixed mass of gold. There are distinct kinds of gold standard...

, similar to the 1944-1971 Bretton Woods System

Bretton Woods system

The Bretton Woods system of monetary management established the rules for commercial and financial relations among the world's major industrial states in the mid 20th century...

that Nixon abandoned.

In 1983, economist Victor Canto, a disciple of Arthur Laffer

Arthur Laffer

Arthur Betz Laffer is an American economist who first gained prominence during the Reagan administration as a member of Reagan's Economic Policy Advisory Board . Laffer is best known for the Laffer curve, an illustration of the theory that there exists some tax rate between 0% and 100% that will...

, published The Foundations of Supply-Side Economics. This theory focuses on the effects of marginal tax rate

Marginal tax rate

In a tax system and in economics, the tax rate describes the burden ratio at which a business or person is taxed. There are several methods used to present a tax rate: statutory, average, marginal, effective, effective average, and effective marginal...

s on the incentive to work and save, which affect the growth

Economic growth

In economics, economic growth is defined as the increasing capacity of the economy to satisfy the wants of goods and services of the members of society. Economic growth is enabled by increases in productivity, which lowers the inputs for a given amount of output. Lowered costs increase demand...

of the "supply side" or what Keynesians call potential output

Potential output

In economics, potential output refers to the highest level of real Gross Domestic Product output that can be sustained over the long term. The existence of a limit is due to natural and institutional constraints...

. While the latter focus on changes in the rate of supply-side growth in the long run, the "new" supply-siders often promised short-term results.

The supply-siders were influenced strongly by the idea of the Laffer curve

Laffer curve

In economics, the Laffer curve is a theoretical representation of the relationship between government revenue raised by taxation and all possible rates of taxation. It is used to illustrate the concept of taxable income elasticity . The curve is constructed by thought experiment...

, which states that tax rates and tax revenues were distinct—that tax rates too high or too low will not maximize tax revenues. Supply-siders felt that in a high tax rate environment, lowering tax rates to the right level can raise revenue by causing faster economic growth

Economic growth

In economics, economic growth is defined as the increasing capacity of the economy to satisfy the wants of goods and services of the members of society. Economic growth is enabled by increases in productivity, which lowers the inputs for a given amount of output. Lowered costs increase demand...

.

This led the supply-siders to advocate large reductions in marginal income and capital gains tax rates to encourage allocation of assets to investment, which would produce more supply. Jude Wanniski and many others advocate a zero capital gains rate. The increased aggregate supply would result in increased aggregate demand, hence the term "Supply-Side Economics".

Furthermore, in response to inflation, supply-siders called for indexed marginal income tax rates, as monetary inflation had pushed wage earners into higher marginal income tax bracket

Tax bracket

Tax brackets are the divisions at which tax rates change in a progressive tax system . Essentially, they are the cutoff values for taxable income — income past a certain point will be taxed at a higher rate.-Example:Imagine that there are three tax brackets: 10%, 20%, and 30%...

s that remained static; that is, as wages increased to maintain purchasing power with prices, income tax brackets were not adjusted accordingly and thus wage earners were pushed into higher income tax brackets than tax policy had intended.

Supply-side economics has been criticized as essentially politically conservative. Supply-side advocates claim that they are not following an ideology, but are reinstating classical economics. Yet, supply-siders such as Jude Wanniski have argued for lower tax rates to increase tax revenues, and that redistribution of income through taxation was essential to the health of the polity

Polity

Polity is a form of government Aristotle developed in his search for a government that could be most easily incorporated and used by the largest amount of people groups, or states...

-- a view that is anathema to traditional conservatives.

Some economists see similarities between supply-side proposals and Keynesian economics. If the result of changes to the tax structure is a fiscal deficit then the 'supply-side' policy is effectively stimulating demand through the Keynesian multiplier

Multiplier (economics)

In economics, the fiscal multiplier is the ratio of a change in national income to the change in government spending that causes it. More generally, the exogenous spending multiplier is the ratio of a change in national income to any autonomous change in spending In economics, the fiscal...

effect. Supply-side proponents would point out, in response, that the level of taxation and spending is important for economic incentives, not just the size of the deficit.

The Reagan administration

Reagan Administration

The United States presidency of Ronald Reagan, also known as the Reagan administration, was a Republican administration headed by Ronald Reagan from January 20, 1981, to January 20, 1989....

justified such changes in socioeconomic terms by invoking the old saying that "a rising tide lifts all boats".

Marx and Smith

Both supply-siders and their opponents have been keen to claim the mantles of thinkers as diverse as Karl MarxKarl Marx

Karl Heinrich Marx was a German philosopher, economist, sociologist, historian, journalist, and revolutionary socialist. His ideas played a significant role in the development of social science and the socialist political movement...

and Adam Smith. Jude Wanniski has claimed both as supply-side thinkers due to their advocacy of a gold monetary standard and more specifically their focus on the agents of production in an economy. Barton Biggs

Barton Biggs

Barton M. Biggs is a money manager running Traxis Partners, a multi-billion dollar hedge fund based in New York City. He formerly held the title of "chief global strategist" for Morgan Stanley and was with that firm for 30 years....

, chief investment strategist of Morgan Stanley

Morgan Stanley

Morgan Stanley is a global financial services firm headquartered in New York City serving a diversified group of corporations, governments, financial institutions, and individuals. Morgan Stanley also operates in 36 countries around the world, with over 600 offices and a workforce of over 60,000....

, described Wanniski's book about supply-side economics, The Way the World Works, as the "most important" economic book published since Marx's writings.

Fiscal policy theory

Supply-side economics holds that increased taxation steadily reduces economic trade between economic participants within a nation and that it discourages investment. Taxes act as a type of trade barrier or tariffTariff

A tariff may be either tax on imports or exports , or a list or schedule of prices for such things as rail service, bus routes, and electrical usage ....

that causes economic participants to revert to less efficient means of satisfying their needs. As such, higher taxation leads to lower levels of specialization and lower economic efficiency. The idea is said to be illustrated by the Laffer curve

Laffer curve

In economics, the Laffer curve is a theoretical representation of the relationship between government revenue raised by taxation and all possible rates of taxation. It is used to illustrate the concept of taxable income elasticity . The curve is constructed by thought experiment...

. (Case & Fair, 1999: 780, 781).

Crucial to the operation of supply-side theory is the expansion of free trade

Free trade

Under a free trade policy, prices emerge from supply and demand, and are the sole determinant of resource allocation. 'Free' trade differs from other forms of trade policy where the allocation of goods and services among trading countries are determined by price strategies that may differ from...

and free movement of capital. It is argued that free capital movement, in addition to the classical reasoning of comparative advantage

Comparative advantage

In economics, the law of comparative advantage says that two countries will both gain from trade if, in the absence of trade, they have different relative costs for producing the same goods...

, frequently allows an economic expansion. Lowering tax barriers to trade provides to the domestic economy all the advantages that the international economy gets from lower tariff barriers.

Supply-side economists have less to say on the effects of deficits, and sometimes cite Robert Barro

Robert Barro

Robert Joseph Barro is an American classical macroeconomist and the Paul M. Warburg Professor of Economics at Harvard University. The Research Papers in Economics project ranked him as the 4th most influential economist in the world as of August 2011 based on his academic contributions...

’s work that states that rational economic actors will buy bonds in sufficient quantities to reduce long term interest rates. Critics argue that standard exchange rate theory would predict, instead, a devaluation of the currency of the nation running the high budget deficit, and eventual "crowding out

Crowding out (economics)

In economics, crowding out occurs when Expansionary Fiscal Policy causes interest rates to rise, thereby reducing private spending. That means increase in government spending crowds out investment spending....

" of private investment.

According to Mundell, "Fiscal discipline is a learned behavior." To put it another way, eventually the unfavourable effects of running persistent budget deficits will force governments to reduce spending in line with their levels of revenue. This view is also promoted by Victor Canto.

The central issue at stake is the point of diminishing returns on liquidity in the investment sector: Is there a point where additional money is "pushing on a string"? To the supply-side economist, reallocation away from consumption to private investment, and most especially from public investment to private investment, will always yield superior economic results. In standard monetarist and Keynesian theory, however, there will be a point where increases in asset prices will produce no new supply. A point where investment demand outruns potential investment supply, and produce instead asset inflation, or in common terms a bubble. The existence of this point, and where it is should it exist, is the essential question of the efficacy of supply-side economics.

Monetary policy theory

Some supply-siders advocate that monetary policy should be based on a price rule. The aim of monetary policy should be to target a specific value of moneyMoney

Money is any object or record that is generally accepted as payment for goods and services and repayment of debts in a given country or socio-economic context. The main functions of money are distinguished as: a medium of exchange; a unit of account; a store of value; and, occasionally in the past,...

irrespective of the quantity of money that must be created or withdrawn by the central bank

Central bank

A central bank, reserve bank, or monetary authority is a public institution that usually issues the currency, regulates the money supply, and controls the interest rates in a country. Central banks often also oversee the commercial banking system of their respective countries...

to achieve this target. This contrasts with monetarism's focus on the quantity of money, and Keynesian theory's emphasis on real aggregate demand. The important difference is that to a monetarist the quantity of money, specifically represented by the money supply

Money supply

In economics, the money supply or money stock, is the total amount of money available in an economy at a specific time. There are several ways to define "money," but standard measures usually include currency in circulation and demand deposits .Money supply data are recorded and published, usually...

is the crucial determining variable for the relationship between the supply and demand for money, while to a Keynesian adequate demand to support the available money supply is important. Keynes famously remarked that "money doesn't matter".

This is an area where supply-side theory has been particularly influential. Under macroeconomic theory, the general level of price was based on the strict increase in price of a basket of goods. Under supply-side theory, the rate of inflation should be based on the substitutions that individuals make in the market place, and should take into account the improved quality of goods. In the late 1980s and through the 1990s, under Presidents of both American political parties, shifts were made in the calculation of the broadly followed measure of inflation the "Consumer Price Index for Urban Consumers", or CPI-U

Consumer price index

A consumer price index measures changes in the price level of consumer goods and services purchased by households. The CPI, in the United States is defined by the Bureau of Labor Statistics as "a measure of the average change over time in the prices paid by urban consumers for a market basket of...

, which reflected supply-side ideas on substitution. The argument for factoring in goods' quality was not accepted, which has led supply-side economists to claim that the actual CPI

Consumer price index

A consumer price index measures changes in the price level of consumer goods and services purchased by households. The CPI, in the United States is defined by the Bureau of Labor Statistics as "a measure of the average change over time in the prices paid by urban consumers for a market basket of...

is actually between 0.5% and 1% lower than the stated rate.

This area represents one of the points of contention between conservative economic theorists who argue for a quantity of money theory of inflation, including Austrian economics, many strict gold standard economists and traditional monetarists, and supply-side theorists. According to the increases in money supply during the 1990s, the real rate of inflation must be higher than is currently stated. These economists argue that the cost of housing is understated in the CPI-W, and that the inflation rate should be between 0.5% and 1% higher. It is for this reason that many central bankers, investment analysts and economists follow the GDP deflator

GDP deflator

In economics, the GDP deflator is a measure of the level of prices of all new, domestically produced, final goods and services in an economy...

which measures the total output of the society and the prices paid for all goods, not merely consumer goods.

Some supply-siders view gold

Gold

Gold is a chemical element with the symbol Au and an atomic number of 79. Gold is a dense, soft, shiny, malleable and ductile metal. Pure gold has a bright yellow color and luster traditionally considered attractive, which it maintains without oxidizing in air or water. Chemically, gold is a...

as the best unit of account

Unit of account

A unit of account is a standard monetary unit of measurement of value/cost of goods, services, or assets. It is one of three well-known functions of money. It lends meaning to profits, losses, liability, or assets....

with which to measure the price of fiat money

Fiat money

Fiat money is money that has value only because of government regulation or law. The term derives from the Latin fiat, meaning "let it be done", as such money is established by government decree. Where fiat money is used as currency, the term fiat currency is used.Fiat money originated in 11th...

, which is defined as a money supply not directly limited by specie or hard assets. Hence the purest supply-siders are in general advocates of a gold standard. However the reverse is not true; many gold standard advocates are harsh critics of supply-side economics.

Supply-side economists assert that the value of money is purely dictated by the supply and demand for money. In fiat money system the government has a legislated monopoly

Monopoly

A monopoly exists when a specific person or enterprise is the only supplier of a particular commodity...

on the supply of base money. Hence it has some control over the value of money. Any decline in the value of money (or appreciation) is then viewed by some as the result of errant central bank policy.

Effect on tax revenues

Many early proponents argued that the size of the economic growth would be significant enough that the increased government revenue from a faster growing economy would be sufficient to compensate completely for the short-term costs of a tax cut, and that tax cuts could, in fact, cause overall revenue to increase. Some hold this was borne out during the 1980s when, advocates of supply-side economics claim, tax cuts ultimately led to an overall increase in governmental revenue due to stronger economic growth. Other economists, however, dispute this assertion.Some contemporary economists do not consider supply-side economics a tenable economic theory, with Alan Blinder

Alan Blinder

Alan Stuart Blinder is an American economist. He serves at Princeton University as the Gordon S. Rentschler Memorial Professor of Economics and Public Affairs in the Economics Department, Vice Chairman of The Observatory Group, and as co-director of Princeton’s Center for Economic Policy Studies,...

calling it an "ill-fated" and perhaps "silly" school on the pages of a 2006 textbook. Greg Mankiw, former chairman of President George W. Bush's

George W. Bush

George Walker Bush is an American politician who served as the 43rd President of the United States, from 2001 to 2009. Before that, he was the 46th Governor of Texas, having served from 1995 to 2000....

Council of Economic Advisors, offered similarly sharp criticism of the school in the early editions of his introductory economics textbook. In a 1992 article for the Harvard International Review

Harvard International Review

The Harvard International Review is a quarterly journal of international relations published by the Harvard International Relations Council...

, James Tobin

James Tobin

James Tobin was an American economist who, in his lifetime, served on the Council of Economic Advisors and the Board of Governors of the Federal Reserve System, and taught at Harvard and Yale Universities. He developed the ideas of Keynesian economics, and advocated government intervention to...

wrote, "[The] idea that tax cuts would actually increase revenues turned out to deserve the ridicule…" Nevertheless, cuts in capital gains rates have consistently increased government revenues, at least for a time.

Supply side proponents Trabandt and Uhlig argue that "static scoring overestimates the revenue loss for labor and capital tax cuts", and that instead "dynamic scoring

Dynamic scoring

Dynamic scoring predicts the impact of fiscal policy changes by forecasting the effects of economic agents' reactions to policy. It is an adaptation of static scoring, the traditional method for analyzing policy changes....

" is a better predictor for the effects of tax cuts. To address these criticisms, in 2003 the Congressional Budget Office conducted a dynamic scoring analysis of tax cuts advocated by supply advocates; Two of the nine models used in the study predicted a large improvement in the deficit over the next ten years resulting from tax cuts and the other seven models did not.

U.S. monetary and fiscal experience

Supply-side economists seek a cause and effect relationship between lowering marginal rates on capital formation and economic expansion. The supply-side history of economics since the 1960s hinges on the following key turning points:The 1970s

In 1971, Richard NixonRichard Nixon

Richard Milhous Nixon was the 37th President of the United States, serving from 1969 to 1974. The only president to resign the office, Nixon had previously served as a US representative and senator from California and as the 36th Vice President of the United States from 1953 to 1961 under...

ended the convertibility of the US dollar into gold, which meant the end of the Bretton Woods system

Bretton Woods system

The Bretton Woods system of monetary management established the rules for commercial and financial relations among the world's major industrial states in the mid 20th century...

. Commodity

Commodity

In economics, a commodity is the generic term for any marketable item produced to satisfy wants or needs. Economic commodities comprise goods and services....

prices, including oil and gold particularly, which had been rising steadily in response to the dollar glut, spiked upwards. The supply-side explanation for this event is that taxation on investment had depleted the incentive to capital investment either in new sources of materials or in substitute goods, which when combined with eroding confidence in the U.S. dollar

United States dollar

The United States dollar , also referred to as the American dollar, is the official currency of the United States of America. It is divided into 100 smaller units called cents or pennies....

cause it to be rapidly devalued. Many supply siders agree with gold investors in saying that the value of commodities remained constant and that it was the dollar that devalued

Devaluation

Devaluation is a reduction in the value of a currency with respect to those goods, services or other monetary units with which that currency can be exchanged....

.

At the same time the Mundell-Fleming model

Mundell-Fleming model

The Mundell–Fleming model, also known as the IS-LM-BP model, is an economic model first set forth by Robert Mundell and Marcus Fleming. The model is an extension of the IS-LM model...

of currency flows gained greater credence when it was codified into a single set of equations, and became increasingly influential in neo-liberal economics. The argument for a floating currency regime had first been adopted by Friedman, but supply-side economists such as Wanniski typically argued that exchange rates should be fixed relative to gold. Mundell was the author of the influential view that it was Johnson

Lyndon B. Johnson

Lyndon Baines Johnson , often referred to as LBJ, was the 36th President of the United States after his service as the 37th Vice President of the United States...

's budget deficits that were the cause of inflationary pressure. However, as Lester Thurow

Lester Thurow

Lester Carl Thurow is a former dean of the MIT Sloan School of Management and author of books on economic topics. Thurow was born in Livingston, Montana.-Education:...

pointed out, the standard model of inflationary pressure shows that Johnson's peak year of deficits would have created only a small upward pressure, that instead it was persistent American trade deficits through the 1960s which had a greater effect on the imbalance between the value of the U.S. dollar and the gold

Gold

Gold is a chemical element with the symbol Au and an atomic number of 79. Gold is a dense, soft, shiny, malleable and ductile metal. Pure gold has a bright yellow color and luster traditionally considered attractive, which it maintains without oxidizing in air or water. Chemically, gold is a...

to which it was, in theory, convertible.

Stagflation

StagflationStagflation

In economics, stagflation is a situation in which the inflation rate is high and the economic growth rate slows down and unemployment remains steadily high...

is defined as a period of slow economic growth and high unemployment (stagnation) while prices rise (inflation).

Stagflation

In economics, stagflation is a situation in which the inflation rate is high and the economic growth rate slows down and unemployment remains steadily high...

, his argument being that the incentive for individuals to invest was reduced to below zero. Measuring the S&P 500

S&P 500

The S&P 500 is a free-float capitalization-weighted index published since 1957 of the prices of 500 large-cap common stocks actively traded in the United States. The stocks included in the S&P 500 are those of large publicly held companies that trade on either of the two largest American stock...

in inflation-adjusted terms, the stock market

Stock market

A stock market or equity market is a public entity for the trading of company stock and derivatives at an agreed price; these are securities listed on a stock exchange as well as those only traded privately.The size of the world stock market was estimated at about $36.6 trillion...

lost half of its value between the market peak of 1972 and its bottom in 1982, with money seeking better returns in real estate

Real estate

In general use, esp. North American, 'real estate' is taken to mean "Property consisting of land and the buildings on it, along with its natural resources such as crops, minerals, or water; immovable property of this nature; an interest vested in this; an item of real property; buildings or...

and commodities instead. The argument from the supply-side point of view then goes on to state that the cuts in capital gains tax rates that were part of the 1981 tax package returned incentives to invest. The Keynesian point of view is that after a long bear market, money had fled from stocks and was set to return, once the expectation of inflation had been reduced. Neither of these two arguments fully accounts for the rise of equities over the course of the "long Bull Market" of 1982-2000.

The importance of this argument needs to be seen in light of the effects of the inflation of the late 1970s, where credit became constricted, as interest rates rose rapidly, and the number of borrowers who could qualify for even standard mortgages fell. Inflation acted as a tax on wage increases, because the highly progressive income tax system of the time meant that more and more households suffered from "bracket creep" - in which a wage increase would be reduced in value by the increased taxes collected. The effects of inflation produced, in 1980, a strong political consensus for a change in basic policy.

Reaganomics

Ronald ReaganRonald Reagan

Ronald Wilson Reagan was the 40th President of the United States , the 33rd Governor of California and, prior to that, a radio, film and television actor....

made supply-side economics a household phrase, and promised an across-the-board reduction in income tax rates and an even larger reduction in capital gains tax rates. (Case & Fair, 1999: 781, 782). When vying for the Republican party presidential nomination for the 1980 election, George H.W. Bush derided Reagan's supply-side policies as "voodoo economics". However, later he seemed to give lip service to these policies to secure the Republican nomination in 1988, and is speculated by some to have lost in his re-election bid in 1992 by allowing tax increases. (See: "Read my lips: No new taxes

Read my lips: no new taxes

"Read my lips: no new taxes" is a now-famous phrase spoken by then presidential candidate George H. W. Bush at the 1988 Republican National Convention as he accepted the nomination on August 18. Written by speechwriter Peggy Noonan, the line was the most prominent sound bite from the speech...

".)

The centerpiece of the supply-side argument is the economic rebound from the 1980-1982 "double-dip recession", combined with the continued fall in commodity prices. The "across the board" tax cuts of 1981 are seen as the great motivator for the "Seven Fat Years". Critics of this view point out that the "rebound" from the recession of 1981-1982 is exactly in accordance with the "disinflation" scenario predicted by IS/LM model

IS/LM model

The IS/LM model is a macroeconomic tool that demonstrates the relationship between interest rates and real output in the goods and services market and the money market...

s of the late 1970s: essentially that the increases in fed funds rates squeezed out inflation, and that federal budget deficits acted to "prime the pump". This model had been the basis of Volcker's federal reserve policy.

In 1981, Robert Mundell

Robert Mundell

Robert Mundell, CC is a Nobel Prize-winning Canadian economist. Currently, Mundell is a professor of economics at Columbia University and the Chinese University of Hong Kong....

told Ronald Reagan that by cutting upper bracket taxation rates and lowering tax rates on capital gains, national output would increase so much that tax revenues would also increase. Mundell claimed that the economic expansion would also mop up excess liquidity and bring inflation back under control. After the tax cuts were implemented, nominal revenues quickly returned to—and ultimately surpassed—previous levels. While revenues dropped as a share of GDP, supply-siders note they intended for this fall to happen, since cutting tax rates would reduce the amount of taxes collected relative to national income.

The question of whether the tax cuts proved Mundell's predictions correct has sparked much debate between supply-siders and mainstream economists. While nominal revenues rebounded after the tax cuts, mainstream economists note that comparing nominal tax collections over time fails to take inflation into account. By converting tax revenues from nominal to real terms, these economists have shown that tax revenues did not surpass their 1981 levels until 1987.

Defenders of supply-side economics also complain that the focus of the debate on government revenue tends to ignore the societal benefits of economic growth, primarily lower levels of unemployment, higher wages for workers and lower prices for consumers. This is a rhetorical argument derisively known as trickle-down economics, and should be viewed as distinct from the economic theory of supply-side economics.