Income tax

Overview

Tax

To tax is to impose a financial charge or other levy upon a taxpayer by a state or the functional equivalent of a state such that failure to pay is punishable by law. Taxes are also imposed by many subnational entities...

levied on the income

Income

Income is the consumption and savings opportunity gained by an entity within a specified time frame, which is generally expressed in monetary terms. However, for households and individuals, "income is the sum of all the wages, salaries, profits, interests payments, rents and other forms of earnings...

of individuals or businesses (corporations or other legal entities). Various income tax systems exist, with varying degrees of tax incidence

Tax incidence

In economics, tax incidence is the analysis of the effect of a particular tax on the distribution of economic welfare. Tax incidence is said to "fall" upon the group that, at the end of the day, bears the burden of the tax...

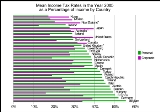

. Income taxation can be progressive

Progressive tax

A progressive tax is a tax by which the tax rate increases as the taxable base amount increases. "Progressive" describes a distribution effect on income or expenditure, referring to the way the rate progresses from low to high, where the average tax rate is less than the marginal tax rate...

, proportional

Flat tax

A flat tax is a tax system with a constant marginal tax rate. Typically the term flat tax is applied in the context of an individual or corporate income that will be taxed at one marginal rate...

, or regressive

Regressive tax

A regressive tax is a tax imposed in such a manner that the tax rate decreases as the amount subject to taxation increases. "Regressive" describes a distribution effect on income or expenditure, referring to the way the rate progresses from high to low, where the average tax rate exceeds the...

. When the tax is levied on the income of companies, it is often called a corporate tax

Corporate tax

Many countries impose corporate tax or company tax on the income or capital of some types of legal entities. A similar tax may be imposed at state or lower levels. The taxes may also be referred to as income tax or capital tax. Entities treated as partnerships are generally not taxed at the...

, corporate income tax, or profit tax. Individual income taxes often tax the total income of the individual (with some deductions permitted), while corporate income taxes often tax net income (the difference between gross receipts, expenses, and additional write-offs).

Unanswered Questions