Futures contract

Encyclopedia

In finance

, a futures contract is a standardized contract

between two parties to exchange a specified asset of standardized quantity and quality for a price agreed today (the futures price or the strike price

) with delivery occurring at a specified future date, the delivery date. The contracts are traded on a futures exchange

. The party agreeing to buy the underlying asset in the future, the "buyer" of the contract, is said to be "long

", and the party agreeing to sell the asset in the future, the "seller" of the contract, is said to be "short". The terminology reflects the expectations of the parties -- the buyer hopes or expects that the asset price is going to increase, while the seller hopes or expects that it will decrease. Note that the contract itself costs nothing to enter; the buy/sell terminology is a linguistic convenience reflecting the position each party is taking (long or short).

In many cases, the underlying asset to a futures contract may not be traditional commodities

at all – that is, for financial futures the underlying asset or item can be currencies, securities or financial instruments

and intangible assets or referenced items such as stock indexes and interest rates.

While the futures contract specifies a trade taking place in the future, the purpose of the futures exchange institution is to act as intermediary and minimize the risk of default by either party. Thus the exchange requires both parties to put up an initial amount of cash, the margin

. Additionally, since the futures price will generally change daily, the difference in the prior agreed-upon price and the daily futures price is settled daily also. The exchange will draw money out of one party's margin account and put it into the other's so that each party has the appropriate daily loss or profit. If the margin account goes below a certain value, then a margin call is made and the account owner must replenish the margin account. This process is known as marking to market. Thus on the delivery date, the amount exchanged is not the specified price on the contract but the spot value

(since any gain or loss has already been previously settled by marking to market).

A closely related contract is a forward contract

. A forward is like a futures in that it specifies the exchange of goods for a specified price at a specified future date. However, a forward is not traded on an exchange and thus does not have the interim partial payments due to marking to market. Nor is the contract standardized, as on the exchange.

Unlike an option

, both parties of a futures contract must fulfill the contract on the delivery date. The seller delivers the underlying asset to the buyer, or, if it is a cash-settled futures contract, then cash is transferred from the futures trader who sustained a loss to the one who made a profit. To exit the commitment prior to the settlement date, the holder of a futures position

can close out its contract obligations by taking the opposite position on another futures contract on the same asset and settlement date. The difference in futures prices is then a profit or loss.

described the story of Thales

, a poor philosopher from Miletus who developed a "financial device, which involves a principle of universal application". Thales used his skill in forecasting and predicted that the olive

harvest would be exceptionally good the next autumn. Confident in his prediction, he made agreements with local olive press owners to deposit his money with them to guarantee him exclusive use of their olive presses when the harvest was ready. Thales successfully negotiated low prices because the harvest was in the future and no one knew whether the harvest would be plentiful or poor and because the olive press owners were willing to hedge against the possibility of a poor yield. When the harvest time came, and many presses were wanted concurrently and suddenly, he let them out at any rate he pleased, and made a large quantity of money.

The first futures exchange market was the Dōjima Rice Exchange

in Japan in the 1730s, to meet the needs of samurai

who—being paid in rice, and after a series of bad harvests—needed a stable conversion to coin.

The Chicago Board of Trade

(CBOT) listed the first ever standardized 'exchange traded' forward contracts in 1864, which were called futures contracts. This contract was based on grain

trading and started a trend that saw contracts created on a number of different commodities

as well as a number of futures exchanges set up in countries around the world. By 1875 cotton futures were being traded in Mumbai

in India and within a few years this had expanded to futures on edible oilseeds complex

, raw jute

and jute goods and bullion.

ity by being highly standardized, usually by specifying:

To minimize credit risk

To minimize credit risk

to the exchange, traders must post a margin

or a performance bond

, typically 5%-15% of the contract's value.

To minimize counterparty risk to traders, trades executed on regulated futures exchanges are guaranteed by a clearing house. The clearing house becomes the buyer to each seller, and the seller to each buyer, so that in the event of a counterparty default the clearer assumes the risk of loss. This enables traders to transact without performing due diligence

on their counterparty.

Margin requirements are waived or reduced in some cases for hedgers

who have physical ownership of the covered commodity or spread traders who have offsetting contracts balancing the position.

Clearing margin are financial safeguards to ensure that companies or corporations perform on their customers' open futures and options contracts. Clearing margins are distinct from customer margins that individual buyers and sellers of futures and options contracts are required to deposit with brokers.

Customer margin Within the futures industry, financial guarantees required of both buyers and sellers of futures contracts and sellers of options contracts to ensure fulfillment of contract obligations. Futures Commission Merchants are responsible for overseeing customer margin accounts. Margins are determined on the basis of market risk and contract value. Also referred to as performance bond margin.

Initial margin is the equity required to initiate a futures position. This is a type of performance bond. The maximum exposure is not limited to the amount of the initial margin, however the initial margin requirement is calculated based on the maximum estimated change in contract value within a trading day. Initial margin is set by the exchange.

If a position involves an exchange-traded product, the amount or percentage of initial margin is set by the exchange concerned.

In case of loss or if the value of the initial margin is being eroded, the broker will make a margin call in order to restore the amount of initial margin available. Often referred to as “variation margin”, margin called for this reason is usually done on a daily basis, however, in times of high volatility a broker can make a margin call or calls intra-day.

Calls for margin are usually expected to be paid and received on the same day. If not, the broker has the right to close sufficient positions to meet the amount called by way of margin. After the position is closed-out the client is liable for any resulting deficit in the client’s account.

Some U.S. exchanges also use the term “maintenance margin”, which in effect defines by how much the value of the initial margin can reduce before a margin call is made. However, most non-US brokers only use the term “initial margin” and “variation margin”.

The Initial Margin requirement is established by the Futures exchange, in contrast to other securities Initial Margin (which is set by the Federal Reserve in the U.S. Markets).

A futures account is marked to market daily. If the margin drops below the margin maintenance requirement established by the exchange listing the futures, a margin call will be issued to bring the account back up to the required level.

Maintenance margin A set minimum margin per outstanding futures contract that a customer must maintain in his margin account.

Margin-equity ratio is a term used by speculators, representing the amount of their trading capital that is being held as margin at any particular time. The low margin requirements of futures results in substantial leverage of the investment. However, the exchanges require a minimum amount that varies depending on the contract and the trader. The broker may set the requirement higher, but may not set it lower. A trader, of course, can set it above that, if he does not want to be subject to margin calls.

Performance bond margin The amount of money deposited by both a buyer and seller of a futures contract or an options seller to ensure performance of the term of the contract. Margin in commodities is not a payment of equity or down payment on the commodity itself, but rather it is a security deposit.

Return on margin (ROM) is often used to judge performance because it represents the gain or loss compared to the exchange’s perceived risk as reflected in required margin. ROM may be calculated (realized return) / (initial margin). The Annualized ROM is equal to (ROM+1)(year/trade_duration)-1. For example if a trader earns 10% on margin in two months, that would be about 77% annualized.

Expiry (or Expiration in the U.S.) is the time and the day that a particular delivery month of a futures contract stops trading, as well as the final settlement price for that contract. For many equity index and interest rate futures contracts (as well as for most equity options), this happens on the third Friday of certain trading months. On this day the t+1 futures contract becomes the t futures contract. For example, for most CME

and CBOT

contracts, at the expiration of the December contract, the March futures become the nearest contract. This is an exciting time for arbitrage desks, which try to make quick profits during the short period (perhaps 30 minutes) during which the underlying

cash price and the futures price sometimes struggle to converge. At this moment the futures and the underlying assets are extremely liquid and any disparity between an index and an underlying asset is quickly traded by arbitrageurs. At this moment also, the increase in volume is caused by traders rolling over positions to the next contract or, in the case of equity index futures, purchasing underlying components of those indexes to hedge against current index positions. On the expiry date, a European equity arbitrage trading desk in London or Frankfurt will see positions expire in as many as eight major markets almost every half an hour.

arguments. This is typical for stock index futures

, treasury bond futures

, and futures on physical commodities when they are in supply (e.g. agricultural crops after the harvest). However, when the deliverable commodity is not in plentiful supply or when it does not yet exist - for example on crops before the harvest or on Eurodollar

Futures or Federal funds rate

futures (in which the supposed underlying instrument is to be created upon the delivery date) - the futures price cannot be fixed by arbitrage. In this scenario there is only one force setting the price, which is simple supply and demand

for the asset in the future, as expressed by supply and demand for the futures contract.

") apply when the deliverable asset exists in plentiful supply, or may be freely created. Here, the forward price represents the expected future value of the underlying discounted at the risk free rate

—as any deviation from the theoretical price will afford investors a riskless profit opportunity and should be arbitraged away.

Thus, for a simple, non-dividend paying asset, the value of the future/forward, F(t), will be found by compounding the present value S(t) at time t to maturity T by the rate of risk-free return r.

or, with continuous compounding

This relationship may be modified for storage costs, dividends, dividend yields, and convenience yields.

In a perfect market the relationship between futures and spot prices depends only on the above variables; in practice there are various market imperfections (transaction costs, differential borrowing and lending rates, restrictions on short selling) that prevent complete arbitrage. Thus, the futures price in fact varies within arbitrage boundaries around the theoretical price.

for the underlying asset in the futures.

In a deep and liquid market, supply and demand would be expected to balance out at a price which represents an unbiased expectation of the future price of the actual asset and so be given by the simple relationship.

.

.

By contrast, in a shallow and illiquid market, or in a market in which large quantities of the deliverable asset have been deliberately withheld from market participants (an illegal action known as cornering the market

), the market clearing price for the futures may still represent the balance between supply and demand but the relationship between this price and the expected future price of the asset can break down.

with respect to the risk-neutral probability. With this pricing rule, a speculator is expected to break even when the futures market fairly prices the deliverable commodity.

, or where a far future delivery price is higher than a nearer future delivery, is known as contango

. The reverse, where the price of a commodity for future delivery is lower than the spot price, or where a far future delivery price is lower than a nearer future delivery, is known as backwardation

.

There are many different kinds of futures contracts, reflecting the many different kinds of "tradable" assets about which the contract may be based such as commodities, securities (such as single-stock futures

), currencies or intangibles such as interest rates and indexes. For information on futures markets in specific underlying commodity markets

, follow the links. For a list of tradable commodities futures contracts, see List of traded commodities. See also the futures exchange

article.

Trading on commodities

began in Japan in the 18th century with the trading of rice and silk, and similarly in Holland with tulip bulbs. Trading in the US began in the mid 19th century, when central grain markets were established and a marketplace was created for farmers to bring their commodities and sell them either for immediate delivery (also called spot or cash market) or for forward delivery. These forward contracts were private contracts between buyers and sellers and became the forerunner to today's exchange-traded futures contracts. Although contract trading began with traditional commodities such as grains, meat and livestock, exchange trading has expanded to include metals, energy, currency and currency indexes, equities and equity indexes, government interest rates and private interest rates.

Exchanges

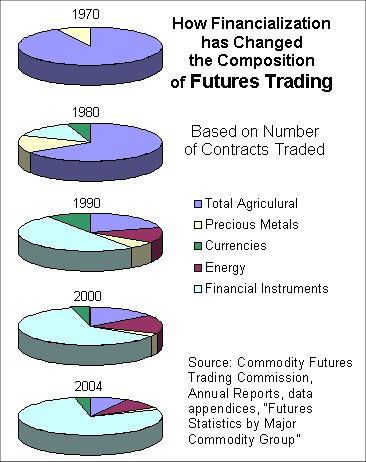

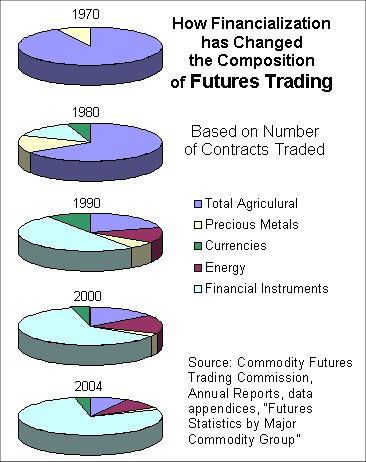

Contracts on financial instruments were introduced in the 1970s by the Chicago Mercantile Exchange

(CME) and these instruments became hugely successful and quickly overtook commodities futures in terms of trading volume and global accessibility to the markets. This innovation led to the introduction of many new futures exchanges worldwide, such as the London International Financial Futures Exchange

in 1982 (now Euronext.liffe), Deutsche Terminbörse (now Eurex

) and the Tokyo Commodity Exchange

(TOCOM). Today, there are more than 90 futures and futures options exchanges worldwide trading to include:

Third (month) futures contract codes are

Example: CLX0 is a Crude Oil (CL), November (X) 2010 (0) contract.

s, who have an interest in the underlying asset (which could include an intangible such as an index or interest rate) and are seeking to hedge out the risk of price changes; and speculators, who seek to make a profit by predicting market moves and opening a derivative

contract related to the asset "on paper", while they have no practical use for or intent to actually take or make delivery of the underlying asset. In other words, the investor is seeking exposure to the asset in a long futures or the opposite effect via a short futures contract.

s of a commodity or the owner of an asset or assets subject to certain influences such as an interest rate.

For example, in traditional commodity markets, farmer

s often sell futures contracts for the crops and livestock they produce to guarantee a certain price, making it easier for them to plan. Similarly, livestock producers often purchase futures to cover their feed costs, so that they can plan on a fixed cost for feed. In modern (financial) markets, "producers" of interest rate swaps or equity derivative

products will use financial futures or equity index futures to reduce or remove the risk on the swap

.

), though many hybrid types and unique styles exist. In general position traders hold positions for the long term (months to years), day traders (or active traders) enter multiple trades during the day and will have exited all positions by market close, and swing traders aim to buy or sell at the bottom or top of price swings. With many investors pouring into the futures markets in recent years controversy has risen about whether speculators are responsible for increased volatility in commodities like oil, and experts are divided on the matter.

An example that has both hedge and speculative notions involves a mutual fund

or separately managed account

whose investment objective is to track the performance of a stock index such as the S&P 500 stock index. The Portfolio manager

often "equitizes" cash inflows in an easy and cost effective manner by investing in (opening long) S&P 500 stock index futures. This gains the portfolio exposure to the index which is consistent with the fund or account investment objective without having to buy an appropriate proportion of each of the individual 500 stocks just yet. This also preserves balanced diversification, maintains a higher degree of the percent of assets invested in the market and helps reduce tracking error

in the performance of the fund/account. When it is economically feasible (an efficient amount of shares of every individual position within the fund or account can be purchased), the portfolio manager can close the contract and make purchases of each individual stock.

The social utility of futures markets is considered to be mainly in the transfer of risk

, and increased liquidity between traders with different risk and time preference

s, from a hedger to a speculator, for example.

are traded on futures, sometimes called simply "futures options". A put

is the option to sell a futures contract, and a call

is the option to buy a futures contract. For both, the option strike price

is the specified futures price at which the future is traded if the option is exercised. Futures are often used since they are delta one

instruments. Calls and options on futures may be priced similarly to those on traded assets by using an extension of the Black-Scholes formula, namely Black's formula for futures.

Investors can either take on the role of option seller/option writer or the option buyer. Option sellers are generally seen as taking on more risk because they are contractually obligated to take the opposite futures position if the options buyer exercises his or her right to the futures position specified in the option. The price of an option is determined by supply and demand principles and consists of the option premium, or the price paid to the option seller for offering the option and taking on risk.

are regulated by the Commodity Futures Trading Commission

(CFTC), an independent agency of the United States government

. The Commission has the right to hand out fines and other punishments for an individual or company who breaks any rules. Although by law

the commission regulates all transactions, each exchange can have its own rule, and under contract can fine companies for different things or extend the fine that the CFTC hands out.

The CFTC publishes weekly reports containing details of the open interest

of market participants for each market-segment that has more than 20 participants. These reports are released every Friday (including data from the previous Tuesday) and contain data on open interest split by reportable and non-reportable open interest as well as commercial and non-commercial open interest. This type of report is referred to as the 'Commitments of Traders Report

', COT-Report or simply COTR.

, which has oversight of the futures market in the United States, has made no comment as to why this trend is allowed to continue since economic theory and CBOT publications maintain that convergence of contracts with the price of the underlying commodity they represent is the basis of integrity for a futures market.

It follows that the function of 'price discovery', the ability of the markets to discern the appropriate value of a commodity reflecting current conditions, is degraded in relation to the discrepancy in price and the inability of producers to enforce contracts with the commodities they represent.

s are both contracts to deliver an asset on a future date at a prearranged price, they are different in two main respects:

, whereas forwards always trade over-the-counter

, or can simply be a signed contract between two parties.

Thus:

of a forward with the same agreed-upon delivery price and underlying asset (based on mark to market

).

Forwards do not have a standard. They may transact only on the settlement date. More typical would be for the parties to agree to true up, for example, every quarter. The fact that forwards are not margined daily means that, due to movements in the price of the underlying asset, a large differential can build up between the forward's delivery price and the settlement price, and in any event, an unrealized gain (loss) can build up.

Again, this differs from futures which get 'trued-up' typically daily by a comparison of the market value of the future to the collateral securing the contract to keep it in line with the brokerage margin requirements. This true-ing up occurs by the "loss" party providing additional collateral; so if the buyer of the contract incurs a drop in value, the shortfall or variation margin would typically be shored up by the investor wiring or depositing additional cash in the brokerage account.

In a forward though, the spread in exchange rates is not trued up regularly but, rather, it builds up as unrealized gain (loss) depending on which side of the trade being discussed. This means that entire unrealized gain (loss) becomes realized at the time of delivery (or as what typically occurs, the time the contract is closed prior to expiration) - assuming the parties must transact at the underlying currency's spot price to facilitate receipt/delivery.

The result is that forwards have higher credit risk

than futures, and that funding is charged differently.

In most cases involving institutional investors, the daily variation margin settlement guidelines for futures call for actual money movement only above some insignificant amount to avoid wiring back and forth small sums of cash. The threshold amount for daily futures variation margin for institutional investors is often $1,000.

The situation for forwards, however, where no daily true-up takes place in turn creates credit risk for forwards, but not so much for futures. Simply put, the risk of a forward contract is that the supplier will be unable to deliver the referenced asset, or that the buyer will be unable to pay for it on the delivery date or the date at which the opening party closes the contract.

The margining of futures eliminates much of this credit risk by forcing the holders to update daily to the price of an equivalent forward purchased that day. This means that there will usually be very little additional money due on the final day to settle the futures contract: only the final day's gain or loss, not the gain or loss over the life of the contract.

In addition, the daily futures-settlement failure risk is borne by an exchange, rather than an individual party, further limiting credit risk in futures.

Example:

Consider a futures contract with a $100 price: Let's say that on day 50, a futures contract with a $100 delivery price (on the same underlying asset as the future) costs $88. On day 51, that futures contract costs $90. This means that the "mark-to-market" calculation would requires the holder of one side of the future to pay $2 on day 51 to track the changes of the forward price ("post $2 of margin"). This money goes, via margin accounts, to the holder of the other side of the future. That is, the loss party wires cash to the other party.

A forward-holder, however, may pay nothing until settlement on the final day, potentially building up a large balance; this may be reflected in the mark by an allowance for credit risk. So, except for tiny effects of convexity bias (due to earning or paying interest on margin), futures and forwards with equal delivery prices result in the same total loss or gain, but holders of futures experience that loss/gain in daily increments which track the forward's daily price changes, while the forward's spot price converges to the settlement price. Thus, while under mark to market

accounting, for both assets the gain or loss accrues

over the holding period; for a futures this gain or loss is realized daily, while for a forward contract the gain or loss remains unrealized until expiry.

Note that, due to the path dependence

of funding, a futures contract is not, strictly speaking, a European-style derivative: the total gain or loss of the trade depends not only on the value of the underlying asset at expiry, but also on the path of prices on the way. This difference is generally quite small though.

With an exchange-traded future, the clearing house interposes itself on every trade. Thus there is no risk of counterparty default. The only risk is that the clearing house defaults (e.g. become bankrupt), which is considered very unlikely.

Finance

"Finance" is often defined simply as the management of money or “funds” management Modern finance, however, is a family of business activity that includes the origination, marketing, and management of cash and money surrogates through a variety of capital accounts, instruments, and markets created...

, a futures contract is a standardized contract

Contract

A contract is an agreement entered into by two parties or more with the intention of creating a legal obligation, which may have elements in writing. Contracts can be made orally. The remedy for breach of contract can be "damages" or compensation of money. In equity, the remedy can be specific...

between two parties to exchange a specified asset of standardized quantity and quality for a price agreed today (the futures price or the strike price

Strike price

In options, the strike price is a key variable in a derivatives contract between two parties. Where the contract requires delivery of the underlying instrument, the trade will be at the strike price, regardless of the spot price of the underlying instrument at that time.Formally, the strike...

) with delivery occurring at a specified future date, the delivery date. The contracts are traded on a futures exchange

Futures exchange

A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts; that is, a contract to buy specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future. These types of...

. The party agreeing to buy the underlying asset in the future, the "buyer" of the contract, is said to be "long

Long (finance)

In finance, a long position in a security, such as a stock or a bond, or equivalently to be long in a security, means the holder of the position owns the security and will profit if the price of the security goes up. Going long is the more conventional practice of investing and is contrasted with...

", and the party agreeing to sell the asset in the future, the "seller" of the contract, is said to be "short". The terminology reflects the expectations of the parties -- the buyer hopes or expects that the asset price is going to increase, while the seller hopes or expects that it will decrease. Note that the contract itself costs nothing to enter; the buy/sell terminology is a linguistic convenience reflecting the position each party is taking (long or short).

In many cases, the underlying asset to a futures contract may not be traditional commodities

Commodity

In economics, a commodity is the generic term for any marketable item produced to satisfy wants or needs. Economic commodities comprise goods and services....

at all – that is, for financial futures the underlying asset or item can be currencies, securities or financial instruments

Financial instruments

A financial instrument is a tradable asset of any kind, either cash; evidence of an ownership interest in an entity; or a contractual right to receive, or deliver, cash or another financial instrument....

and intangible assets or referenced items such as stock indexes and interest rates.

While the futures contract specifies a trade taking place in the future, the purpose of the futures exchange institution is to act as intermediary and minimize the risk of default by either party. Thus the exchange requires both parties to put up an initial amount of cash, the margin

Margin (finance)

In finance, a margin is collateral that the holder of a financial instrument has to deposit to cover some or all of the credit risk of their counterparty...

. Additionally, since the futures price will generally change daily, the difference in the prior agreed-upon price and the daily futures price is settled daily also. The exchange will draw money out of one party's margin account and put it into the other's so that each party has the appropriate daily loss or profit. If the margin account goes below a certain value, then a margin call is made and the account owner must replenish the margin account. This process is known as marking to market. Thus on the delivery date, the amount exchanged is not the specified price on the contract but the spot value

Spot price

The spot price or spot rate of a commodity, a security or a currency is the price that is quoted for immediate settlement . Spot settlement is normally one or two business days from trade date...

(since any gain or loss has already been previously settled by marking to market).

A closely related contract is a forward contract

Forward contract

In finance, a forward contract or simply a forward is a non-standardized contract between two parties to buy or sell an asset at a specified future time at a price agreed today. This is in contrast to a spot contract, which is an agreement to buy or sell an asset today. It costs nothing to enter a...

. A forward is like a futures in that it specifies the exchange of goods for a specified price at a specified future date. However, a forward is not traded on an exchange and thus does not have the interim partial payments due to marking to market. Nor is the contract standardized, as on the exchange.

Unlike an option

Option (finance)

In finance, an option is a derivative financial instrument that specifies a contract between two parties for a future transaction on an asset at a reference price. The buyer of the option gains the right, but not the obligation, to engage in that transaction, while the seller incurs the...

, both parties of a futures contract must fulfill the contract on the delivery date. The seller delivers the underlying asset to the buyer, or, if it is a cash-settled futures contract, then cash is transferred from the futures trader who sustained a loss to the one who made a profit. To exit the commitment prior to the settlement date, the holder of a futures position

Position (finance)

In financial trading, a position is a binding commitment to buy or sell a given amount of financial instruments, such as securities, currencies or commodities, for a given price....

can close out its contract obligations by taking the opposite position on another futures contract on the same asset and settlement date. The difference in futures prices is then a profit or loss.

Origin

AristotleAristotle

Aristotle was a Greek philosopher and polymath, a student of Plato and teacher of Alexander the Great. His writings cover many subjects, including physics, metaphysics, poetry, theater, music, logic, rhetoric, linguistics, politics, government, ethics, biology, and zoology...

described the story of Thales

Thales

Thales of Miletus was a pre-Socratic Greek philosopher from Miletus in Asia Minor, and one of the Seven Sages of Greece. Many, most notably Aristotle, regard him as the first philosopher in the Greek tradition...

, a poor philosopher from Miletus who developed a "financial device, which involves a principle of universal application". Thales used his skill in forecasting and predicted that the olive

Olive

The olive , Olea europaea), is a species of a small tree in the family Oleaceae, native to the coastal areas of the eastern Mediterranean Basin as well as northern Iran at the south end of the Caspian Sea.Its fruit, also called the olive, is of major agricultural importance in the...

harvest would be exceptionally good the next autumn. Confident in his prediction, he made agreements with local olive press owners to deposit his money with them to guarantee him exclusive use of their olive presses when the harvest was ready. Thales successfully negotiated low prices because the harvest was in the future and no one knew whether the harvest would be plentiful or poor and because the olive press owners were willing to hedge against the possibility of a poor yield. When the harvest time came, and many presses were wanted concurrently and suddenly, he let them out at any rate he pleased, and made a large quantity of money.

The first futures exchange market was the Dōjima Rice Exchange

Dojima Rice Exchange

The Dōjima Rice Exchange , located in Osaka, was the center of Japan's system of rice brokers, which developed independently and privately in the Edo period and would be seen as the forerunners to a modern banking system...

in Japan in the 1730s, to meet the needs of samurai

Samurai

is the term for the military nobility of pre-industrial Japan. According to translator William Scott Wilson: "In Chinese, the character 侍 was originally a verb meaning to wait upon or accompany a person in the upper ranks of society, and this is also true of the original term in Japanese, saburau...

who—being paid in rice, and after a series of bad harvests—needed a stable conversion to coin.

The Chicago Board of Trade

Chicago Board of Trade

The Chicago Board of Trade , established in 1848, is the world's oldest futures and options exchange. More than 50 different options and futures contracts are traded by over 3,600 CBOT members through open outcry and eTrading. Volumes at the exchange in 2003 were a record breaking 454 million...

(CBOT) listed the first ever standardized 'exchange traded' forward contracts in 1864, which were called futures contracts. This contract was based on grain

GRAIN

GRAIN is a small international non-profit organisation that works to support small farmers and social movements in their struggles for community-controlled and biodiversity-based food systems. Our support takes the form of independent research and analysis, networking at local, regional and...

trading and started a trend that saw contracts created on a number of different commodities

Commodity

In economics, a commodity is the generic term for any marketable item produced to satisfy wants or needs. Economic commodities comprise goods and services....

as well as a number of futures exchanges set up in countries around the world. By 1875 cotton futures were being traded in Mumbai

Mumbai

Mumbai , formerly known as Bombay in English, is the capital of the Indian state of Maharashtra. It is the most populous city in India, and the fourth most populous city in the world, with a total metropolitan area population of approximately 20.5 million...

in India and within a few years this had expanded to futures on edible oilseeds complex

Vegetable fats and oils

Vegetable fats and oils are lipid materials derived from plants. Physically, oils are liquid at room temperature, and fats are solid. Chemically, both fats and oils are composed of triglycerides, as contrasted with waxes which lack glycerin in their structure...

, raw jute

Jute

Jute is a long, soft, shiny vegetable fibre that can be spun into coarse, strong threads. It is produced from plants in the genus Corchorus, which has been classified in the family Tiliaceae, or more recently in Malvaceae....

and jute goods and bullion.

Standardization

Futures contracts ensure their liquidMarket liquidity

In business, economics or investment, market liquidity is an asset's ability to be sold without causing a significant movement in the price and with minimum loss of value...

ity by being highly standardized, usually by specifying:

- The underlyingUnderlyingIn finance, the underlying of a derivative is an asset, basket of assets, index, or even another derivative, such that the cash flows of the derivative depend on the value of this underlying...

asset or instrument. This could be anything from a barrel of crude oil to a short term interest rate. - The type of settlement, either cash settlement or physical settlement.

- The amount and units of the underlyingUnderlyingIn finance, the underlying of a derivative is an asset, basket of assets, index, or even another derivative, such that the cash flows of the derivative depend on the value of this underlying...

asset per contract. This can be the notional amountNotional amountThe notional amount on a financial instrument is the nominal or face amount that is used to calculate payments made on that instrument...

of bonds, a fixed number of barrels of oil, units of foreign currency, the notional amount of the deposit over which the short term interest rateInterest rateAn interest rate is the rate at which interest is paid by a borrower for the use of money that they borrow from a lender. For example, a small company borrows capital from a bank to buy new assets for their business, and in return the lender receives interest at a predetermined interest rate for...

is traded, etc. - The currencyCurrencyIn economics, currency refers to a generally accepted medium of exchange. These are usually the coins and banknotes of a particular government, which comprise the physical aspects of a nation's money supply...

in which the futures contract is quoted. - The grade of the deliverable. In the case of bonds, this specifies which bonds can be delivered. In the case of physical commodities, this specifies not only the quality of the underlying goods but also the manner and location of delivery. For example, the NYMEX Light Sweet Crude Oil contract specifies the acceptable sulphur content and API specific gravity, as well as the pricing point -- the location where delivery must be made.

- The delivery monthDelivery monthFor futures contracts specifying physical delivery, the delivery month is the month in which the seller must deliver, and the buyer must accept and pay for, the underlying. For contracts specifying cash settlement, the delivery month is the month of a final mark-to-market...

. - The last trading date.

- Other details such as the commodity tickCommodity tickFutures exchanges establish a minimum amount that the price of a commodity can fluctuate upward or downward. This minimum fluctuation is known as a tick or commodity tick...

, the minimum permissible price fluctuation.

Margin

Credit risk

Credit risk is an investor's risk of loss arising from a borrower who does not make payments as promised. Such an event is called a default. Other terms for credit risk are default risk and counterparty risk....

to the exchange, traders must post a margin

Margin (finance)

In finance, a margin is collateral that the holder of a financial instrument has to deposit to cover some or all of the credit risk of their counterparty...

or a performance bond

Performance bond

A performance bond is a surety bond issued by an insurance company or a bank to guarantee satisfactory completion of a project by a contractor.A job requiring a payment & performance bond will usually require a bid bond, to bid the job...

, typically 5%-15% of the contract's value.

To minimize counterparty risk to traders, trades executed on regulated futures exchanges are guaranteed by a clearing house. The clearing house becomes the buyer to each seller, and the seller to each buyer, so that in the event of a counterparty default the clearer assumes the risk of loss. This enables traders to transact without performing due diligence

Due diligence

"Due diligence" is a term used for a number of concepts involving either an investigation of a business or person prior to signing a contract, or an act with a certain standard of care. It can be a legal obligation, but the term will more commonly apply to voluntary investigations...

on their counterparty.

Margin requirements are waived or reduced in some cases for hedgers

Hedge (finance)

A hedge is an investment position intended to offset potential losses that may be incurred by a companion investment.A hedge can be constructed from many types of financial instruments, including stocks, exchange-traded funds, insurance, forward contracts, swaps, options, many types of...

who have physical ownership of the covered commodity or spread traders who have offsetting contracts balancing the position.

Clearing margin are financial safeguards to ensure that companies or corporations perform on their customers' open futures and options contracts. Clearing margins are distinct from customer margins that individual buyers and sellers of futures and options contracts are required to deposit with brokers.

Customer margin Within the futures industry, financial guarantees required of both buyers and sellers of futures contracts and sellers of options contracts to ensure fulfillment of contract obligations. Futures Commission Merchants are responsible for overseeing customer margin accounts. Margins are determined on the basis of market risk and contract value. Also referred to as performance bond margin.

Initial margin is the equity required to initiate a futures position. This is a type of performance bond. The maximum exposure is not limited to the amount of the initial margin, however the initial margin requirement is calculated based on the maximum estimated change in contract value within a trading day. Initial margin is set by the exchange.

If a position involves an exchange-traded product, the amount or percentage of initial margin is set by the exchange concerned.

In case of loss or if the value of the initial margin is being eroded, the broker will make a margin call in order to restore the amount of initial margin available. Often referred to as “variation margin”, margin called for this reason is usually done on a daily basis, however, in times of high volatility a broker can make a margin call or calls intra-day.

Calls for margin are usually expected to be paid and received on the same day. If not, the broker has the right to close sufficient positions to meet the amount called by way of margin. After the position is closed-out the client is liable for any resulting deficit in the client’s account.

Some U.S. exchanges also use the term “maintenance margin”, which in effect defines by how much the value of the initial margin can reduce before a margin call is made. However, most non-US brokers only use the term “initial margin” and “variation margin”.

The Initial Margin requirement is established by the Futures exchange, in contrast to other securities Initial Margin (which is set by the Federal Reserve in the U.S. Markets).

A futures account is marked to market daily. If the margin drops below the margin maintenance requirement established by the exchange listing the futures, a margin call will be issued to bring the account back up to the required level.

Maintenance margin A set minimum margin per outstanding futures contract that a customer must maintain in his margin account.

Margin-equity ratio is a term used by speculators, representing the amount of their trading capital that is being held as margin at any particular time. The low margin requirements of futures results in substantial leverage of the investment. However, the exchanges require a minimum amount that varies depending on the contract and the trader. The broker may set the requirement higher, but may not set it lower. A trader, of course, can set it above that, if he does not want to be subject to margin calls.

Performance bond margin The amount of money deposited by both a buyer and seller of a futures contract or an options seller to ensure performance of the term of the contract. Margin in commodities is not a payment of equity or down payment on the commodity itself, but rather it is a security deposit.

Return on margin (ROM) is often used to judge performance because it represents the gain or loss compared to the exchange’s perceived risk as reflected in required margin. ROM may be calculated (realized return) / (initial margin). The Annualized ROM is equal to (ROM+1)(year/trade_duration)-1. For example if a trader earns 10% on margin in two months, that would be about 77% annualized.

Settlement - physical versus cash-settled futures

Settlement is the act of consummating the contract, and can be done in one of two ways, as specified per type of futures contract:- Physical delivery - the amount specified of the underlying asset of the contract is delivered by the seller of the contract to the exchange, and by the exchange to the buyers of the contract. Physical delivery is common with commodities and bonds. In practice, it occurs only on a minority of contracts. Most are cancelled out by purchasing a covering position - that is, buying a contract to cancel out an earlier sale (covering a short), or selling a contract to liquidate an earlier purchase (covering a long). The Nymex crude futures contract uses this method of settlement upon expiration

- Cash settlement - a cash payment is made based on the underlying reference rateReference rateA reference rate is a rate that determines pay-offs in a financial contract and that is outside the control of the parties to the contract. It is often some form of LIBOR rate, but it can take many forms, such as a consumer price index, a house price index or an unemployment rate...

, such as a short term interest rate index such as EuriborEuriborThe Euro Interbank Offered Rate is a daily reference rate based on the averaged interest rates at which Eurozone banks offer to lend unsecured funds to other banks in the euro wholesale money market .-Scope:...

, or the closing value of a stock market indexStock market indexA stock market index is a method of measuring a section of the stock market. Many indices are cited by news or financial services firms and are used as benchmarks, to measure the performance of portfolios such as mutual funds....

. The parties settle by paying/receiving the loss/gain related to the contract in cash when the contract expires. Cash settled futures are those that, as a practical matter, could not be settled by delivery of the referenced item - i.e. how would one deliver an index? A futures contract might also opt to settle against an index based on trade in a related spot market. Ice Brent futures use this method.

Expiry (or Expiration in the U.S.) is the time and the day that a particular delivery month of a futures contract stops trading, as well as the final settlement price for that contract. For many equity index and interest rate futures contracts (as well as for most equity options), this happens on the third Friday of certain trading months. On this day the t+1 futures contract becomes the t futures contract. For example, for most CME

Chicago Mercantile Exchange

The Chicago Mercantile Exchange is an American financial and commodity derivative exchange based in Chicago. The CME was founded in 1898 as the Chicago Butter and Egg Board. Originally, the exchange was a non-profit organization...

and CBOT

Chicago Board of Trade

The Chicago Board of Trade , established in 1848, is the world's oldest futures and options exchange. More than 50 different options and futures contracts are traded by over 3,600 CBOT members through open outcry and eTrading. Volumes at the exchange in 2003 were a record breaking 454 million...

contracts, at the expiration of the December contract, the March futures become the nearest contract. This is an exciting time for arbitrage desks, which try to make quick profits during the short period (perhaps 30 minutes) during which the underlying

Underlying

In finance, the underlying of a derivative is an asset, basket of assets, index, or even another derivative, such that the cash flows of the derivative depend on the value of this underlying...

cash price and the futures price sometimes struggle to converge. At this moment the futures and the underlying assets are extremely liquid and any disparity between an index and an underlying asset is quickly traded by arbitrageurs. At this moment also, the increase in volume is caused by traders rolling over positions to the next contract or, in the case of equity index futures, purchasing underlying components of those indexes to hedge against current index positions. On the expiry date, a European equity arbitrage trading desk in London or Frankfurt will see positions expire in as many as eight major markets almost every half an hour.

Pricing

When the deliverable asset exists in plentiful supply, or may be freely created, then the price of a futures contract is determined via arbitrageArbitrage

In economics and finance, arbitrage is the practice of taking advantage of a price difference between two or more markets: striking a combination of matching deals that capitalize upon the imbalance, the profit being the difference between the market prices...

arguments. This is typical for stock index futures

Stock market index future

In finance, a stock market index future is a cash-settled futures contract on the value of a particular stock market index.-Market:The turnover for the global market in exchange-traded equity index futures is notionally valued, for 2008, by the Bank for International Settlements at USD 130...

, treasury bond futures

Interest rate future

An interest rate futures is a financial derivative with an interest-bearing instrument as the underlying asset.Examples include Treasury-bill futures, Treasury-bond futures and Eurodollar futures....

, and futures on physical commodities when they are in supply (e.g. agricultural crops after the harvest). However, when the deliverable commodity is not in plentiful supply or when it does not yet exist - for example on crops before the harvest or on Eurodollar

Eurodollar

Eurodollars are time deposits denominated in U.S. dollars at banks outside the United States, and thus are not under the jurisdiction of the Federal Reserve. Consequently, such deposits are subject to much less regulation than similar deposits within the U.S., allowing for higher margins. The term...

Futures or Federal funds rate

Federal funds rate

In the United States, the federal funds rate is the interest rate at which depository institutions actively trade balances held at the Federal Reserve, called federal funds, with each other, usually overnight, on an uncollateralized basis. Institutions with surplus balances in their accounts lend...

futures (in which the supposed underlying instrument is to be created upon the delivery date) - the futures price cannot be fixed by arbitrage. In this scenario there is only one force setting the price, which is simple supply and demand

Supply and demand

Supply and demand is an economic model of price determination in a market. It concludes that in a competitive market, the unit price for a particular good will vary until it settles at a point where the quantity demanded by consumers will equal the quantity supplied by producers , resulting in an...

for the asset in the future, as expressed by supply and demand for the futures contract.

Arbitrage arguments

Arbitrage arguments ("Rational pricingRational pricing

Rational pricing is the assumption in financial economics that asset prices will reflect the arbitrage-free price of the asset as any deviation from this price will be "arbitraged away"...

") apply when the deliverable asset exists in plentiful supply, or may be freely created. Here, the forward price represents the expected future value of the underlying discounted at the risk free rate

Risk-free interest rate

Risk-free interest rate is the theoretical rate of return of an investment with no risk of financial loss. The risk-free rate represents the interest that an investor would expect from an absolutely risk-free investment over a given period of time....

—as any deviation from the theoretical price will afford investors a riskless profit opportunity and should be arbitraged away.

Thus, for a simple, non-dividend paying asset, the value of the future/forward, F(t), will be found by compounding the present value S(t) at time t to maturity T by the rate of risk-free return r.

or, with continuous compounding

This relationship may be modified for storage costs, dividends, dividend yields, and convenience yields.

In a perfect market the relationship between futures and spot prices depends only on the above variables; in practice there are various market imperfections (transaction costs, differential borrowing and lending rates, restrictions on short selling) that prevent complete arbitrage. Thus, the futures price in fact varies within arbitrage boundaries around the theoretical price.

Pricing via expectation

When the deliverable commodity is not in plentiful supply (or when it does not yet exist) rational pricing cannot be applied, as the arbitrage mechanism is not applicable. Here the price of the futures is determined by today's supply and demandSupply and demand

Supply and demand is an economic model of price determination in a market. It concludes that in a competitive market, the unit price for a particular good will vary until it settles at a point where the quantity demanded by consumers will equal the quantity supplied by producers , resulting in an...

for the underlying asset in the futures.

In a deep and liquid market, supply and demand would be expected to balance out at a price which represents an unbiased expectation of the future price of the actual asset and so be given by the simple relationship.

.

.By contrast, in a shallow and illiquid market, or in a market in which large quantities of the deliverable asset have been deliberately withheld from market participants (an illegal action known as cornering the market

Cornering the market

In finance, to corner the market is to get sufficient control of a particular stock, commodity, or other asset to allow the price to be manipulated. Another definition: "To have the greatest market share in a particular industry without having a monopoly...

), the market clearing price for the futures may still represent the balance between supply and demand but the relationship between this price and the expected future price of the asset can break down.

Relationship between arbitrage arguments and expectation

The expectation based relationship will also hold in a no-arbitrage setting when we take expectations with respect to the risk-neutral probability. In other words: a futures price is martingaleMartingale (probability theory)

In probability theory, a martingale is a model of a fair game where no knowledge of past events can help to predict future winnings. In particular, a martingale is a sequence of random variables for which, at a particular time in the realized sequence, the expectation of the next value in the...

with respect to the risk-neutral probability. With this pricing rule, a speculator is expected to break even when the futures market fairly prices the deliverable commodity.

Contango and backwardation

The situation where the price of a commodity for future delivery is higher than the spot priceSpot price

The spot price or spot rate of a commodity, a security or a currency is the price that is quoted for immediate settlement . Spot settlement is normally one or two business days from trade date...

, or where a far future delivery price is higher than a nearer future delivery, is known as contango

Contango

Contango is the market condition wherein the price of a forward or futures contract is trading above the expected spot price at contract maturity. The resulting futures or forward curve would typically be upward sloping , since contracts for further dates would typically trade at even higher prices...

. The reverse, where the price of a commodity for future delivery is lower than the spot price, or where a far future delivery price is lower than a nearer future delivery, is known as backwardation

Backwardation

Normal backwardation, also sometimes called backwardation, is the market condition wherein the price of a forward or futures contract is trading below the expected spot price at contract maturity. The resulting futures or forward curve would typically be downward sloping , since contracts for...

.

Futures contracts and exchanges

ContractsThere are many different kinds of futures contracts, reflecting the many different kinds of "tradable" assets about which the contract may be based such as commodities, securities (such as single-stock futures

Single-stock futures

Single-stock futuresIn finance, a single-stock futures is a type of futures contracts between two parties to exchange a specified number of stocks in company for a price agreed today with delivery occurring at a specified future date, the delivery date. The contracts are traded on a futures exchange...

), currencies or intangibles such as interest rates and indexes. For information on futures markets in specific underlying commodity markets

Commodity markets

Commodity markets are markets where raw or primary products are exchanged. These raw commodities are traded on regulated commodities exchanges, in which they are bought and sold in standardized contracts....

, follow the links. For a list of tradable commodities futures contracts, see List of traded commodities. See also the futures exchange

Futures exchange

A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts; that is, a contract to buy specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future. These types of...

article.

- Foreign exchange marketForeign exchange marketThe foreign exchange market is a global, worldwide decentralized financial market for trading currencies. Financial centers around the world function as anchors of trading between a wide range of different types of buyers and sellers around the clock, with the exception of weekends...

- Money marketMoney marketThe money market is a component of the financial markets for assets involved in short-term borrowing and lending with original maturities of one year or shorter time frames. Trading in the money markets involves Treasury bills, commercial paper, bankers' acceptances, certificates of deposit,...

- Bond marketBond marketThe bond market is a financial market where participants can issue new debt, known as the primary market, or buy and sell debt securities, known as the Secondary market, usually in the form of bonds. The primary goal of the bond market is to provide a mechanism for long term funding of public and...

- Equity market

- Soft Commodities market

Trading on commodities

Commodity

In economics, a commodity is the generic term for any marketable item produced to satisfy wants or needs. Economic commodities comprise goods and services....

began in Japan in the 18th century with the trading of rice and silk, and similarly in Holland with tulip bulbs. Trading in the US began in the mid 19th century, when central grain markets were established and a marketplace was created for farmers to bring their commodities and sell them either for immediate delivery (also called spot or cash market) or for forward delivery. These forward contracts were private contracts between buyers and sellers and became the forerunner to today's exchange-traded futures contracts. Although contract trading began with traditional commodities such as grains, meat and livestock, exchange trading has expanded to include metals, energy, currency and currency indexes, equities and equity indexes, government interest rates and private interest rates.

Exchanges

Contracts on financial instruments were introduced in the 1970s by the Chicago Mercantile Exchange

Chicago Mercantile Exchange

The Chicago Mercantile Exchange is an American financial and commodity derivative exchange based in Chicago. The CME was founded in 1898 as the Chicago Butter and Egg Board. Originally, the exchange was a non-profit organization...

(CME) and these instruments became hugely successful and quickly overtook commodities futures in terms of trading volume and global accessibility to the markets. This innovation led to the introduction of many new futures exchanges worldwide, such as the London International Financial Futures Exchange

London International Financial Futures and Options Exchange

The London International Financial Futures and Options Exchange is a futures exchange based in London. LIFFE is now part of NYSE Euronext following its takeover by Euronext in January 2002 and Euronext's merger with New York Stock Exchange in April 2007.-History:The London International Financial...

in 1982 (now Euronext.liffe), Deutsche Terminbörse (now Eurex

Eurex

Eurex is one of the world's leading derivatives exchanges, providing European benchmark derivatives featuring open and low-cost electronic access globally...

) and the Tokyo Commodity Exchange

Tokyo Commodity Exchange

The Tokyo Commodity Exchange is a non-profit organization, and regulates trading of futures contracts and option products of all commodities in Japan...

(TOCOM). Today, there are more than 90 futures and futures options exchanges worldwide trading to include:

- CME GroupCME GroupThe CME Group bases prices for US gasoline on Brent Crude rather than West Texas Intermediate Crude , which many believe is responsible for artificially high gas prices for US consumers...

(formerly CBOT and CME) -- Currencies, Various Interest Rate derivatives (including US Bonds); Agricultural (Corn, Soybeans, Soy Products, Wheat, Pork, Cattle, Butter, Milk); Index (Dow Jones Industrial Average); Metals (Gold, Silver), Index (NASDAQ, S&P, etc.) - IntercontinentalExchangeIntercontinentalExchangeIntercontinentalExchange, Inc., known as ICE, is an American financial company that operates Internet-based marketplaces which trade futures and over-the-counter energy and commodity contracts as well as derivative financial products...

(ICE Futures Europe) - formerly the International Petroleum ExchangeInternational Petroleum ExchangeThe International Petroleum Exchange, based in London, was one of the world's largest energy futures and options exchanges. Its flagship commodity, Brent Crude was a world benchmark for oil prices, but the exchange also handled futures contracts and options on fuel oil, natural gas, electricity ,...

trades energy including crude oil, heating oil, natural gasNatural gasNatural gas is a naturally occurring gas mixture consisting primarily of methane, typically with 0–20% higher hydrocarbons . It is found associated with other hydrocarbon fuel, in coal beds, as methane clathrates, and is an important fuel source and a major feedstock for fertilizers.Most natural...

and unleaded gas - NYSE Euronext - which absorbed EuronextEuronextEuronext N.V. is a pan-European stock exchange based in Amsterdam and with subsidiaries in Belgium, France, Netherlands, Portugal and the United Kingdom. In addition to equities and derivatives markets, the Euronext group provides clearing and information services...

into which London International Financial Futures and Options ExchangeLondon International Financial Futures and Options ExchangeThe London International Financial Futures and Options Exchange is a futures exchange based in London. LIFFE is now part of NYSE Euronext following its takeover by Euronext in January 2002 and Euronext's merger with New York Stock Exchange in April 2007.-History:The London International Financial...

or LIFFE was merged. (LIFFE had taken over London Commodities Exchange ("LCE") in 1996)- softs: grains and meats. Inactive market in Baltic ExchangeBaltic ExchangeThe Baltic Exchange is the world's only independent source of maritime market information for the trading and settlement of physical and derivative contracts...

shipping. Index futures include EURIBOREuriborThe Euro Interbank Offered Rate is a daily reference rate based on the averaged interest rates at which Eurozone banks offer to lend unsecured funds to other banks in the euro wholesale money market .-Scope:...

, FTSE 100, CAC 40CAC 40The CAC 40 is a benchmark French stock market index. The index represents a capitalization-weighted measure of the 40 most significant values among the 100 highest market caps on the Paris Bourse...

, AEX indexAEX indexThe AEX index, derived from Amsterdam Exchange index, is a stock market index composed of Dutch companies that trade on Euronext Amsterdam, formerly known as the Amsterdam Stock Exchange. Started in 1983, the index is composed of a maximum of 25 of the most actively traded securities on the exchange...

. - South African Futures Exchange - SAFEX

- Sydney Futures Exchange

- Tokyo Stock ExchangeTokyo Stock ExchangeThe , called or TSE for short, is located in Tokyo, Japan and is the third largest stock exchange in the world by aggregate market capitalization of its listed companies...

TSE (JGB Futures, TOPIX Futures) - Tokyo Commodity ExchangeTokyo Commodity ExchangeThe Tokyo Commodity Exchange is a non-profit organization, and regulates trading of futures contracts and option products of all commodities in Japan...

TOCOM - Tokyo Financial Exchange - TFX - (Euroyen Futures, OverNight CallRate Futures, SpotNext RepoRate Futures)

- Osaka Securities ExchangeOsaka Securities Exchangeis the second largest securities exchange in Japan, in terms of amount of business handled. As of 31 December 2007, the Osaka Securities Exchange had 477 listed companies with a combined market capitalization of $212 billion. The Nikkei 225 Futures, introduced at the Osaka Securities Exchange in...

OSE (Nikkei Futures, RNP Futures) - London Metal ExchangeLondon Metal ExchangeThe London Metal Exchange is the futures exchange with the world's largest market in options, and futures contracts on base and other metals. As the LME offers contracts with daily expiry dates of up to three months from trade date, along with longer-dated contracts up to 123 months, it also...

- metals: copperCopperCopper is a chemical element with the symbol Cu and atomic number 29. It is a ductile metal with very high thermal and electrical conductivity. Pure copper is soft and malleable; an exposed surface has a reddish-orange tarnish...

, aluminiumAluminiumAluminium or aluminum is a silvery white member of the boron group of chemical elements. It has the symbol Al, and its atomic number is 13. It is not soluble in water under normal circumstances....

, leadLeadLead is a main-group element in the carbon group with the symbol Pb and atomic number 82. Lead is a soft, malleable poor metal. It is also counted as one of the heavy metals. Metallic lead has a bluish-white color after being freshly cut, but it soon tarnishes to a dull grayish color when exposed...

, zincZincZinc , or spelter , is a metallic chemical element; it has the symbol Zn and atomic number 30. It is the first element in group 12 of the periodic table. Zinc is, in some respects, chemically similar to magnesium, because its ion is of similar size and its only common oxidation state is +2...

, nickelNickelNickel is a chemical element with the chemical symbol Ni and atomic number 28. It is a silvery-white lustrous metal with a slight golden tinge. Nickel belongs to the transition metals and is hard and ductile...

, tinTinTin is a chemical element with the symbol Sn and atomic number 50. It is a main group metal in group 14 of the periodic table. Tin shows chemical similarity to both neighboring group 14 elements, germanium and lead and has two possible oxidation states, +2 and the slightly more stable +4...

and steel - IntercontinentalExchangeIntercontinentalExchangeIntercontinentalExchange, Inc., known as ICE, is an American financial company that operates Internet-based marketplaces which trade futures and over-the-counter energy and commodity contracts as well as derivative financial products...

(ICE Futures U.S.) - formerly New York Board of Trade - softs: cocoa, coffeeCoffeeCoffee is a brewed beverage with a dark,init brooo acidic flavor prepared from the roasted seeds of the coffee plant, colloquially called coffee beans. The beans are found in coffee cherries, which grow on trees cultivated in over 70 countries, primarily in equatorial Latin America, Southeast Asia,...

, cottonCottonCotton is a soft, fluffy staple fiber that grows in a boll, or protective capsule, around the seeds of cotton plants of the genus Gossypium. The fiber is almost pure cellulose. The botanical purpose of cotton fiber is to aid in seed dispersal....

, orange juiceOrange juiceOrange juice is a popular beverage made from oranges. It is made by extraction from the fresh fruit, by desiccation and subsequent reconstitution of dried juice, or by concentration of the juice and the subsequent addition of water to the concentrate...

, sugarSugarSugar is a class of edible crystalline carbohydrates, mainly sucrose, lactose, and fructose, characterized by a sweet flavor.Sucrose in its refined form primarily comes from sugar cane and sugar beet... - New York Mercantile ExchangeNew York Mercantile ExchangeThe New York Mercantile Exchange is the world's largest physical commodity futures exchange. It is located at One North End Avenue in the World Financial Center in the Battery Park City section of Manhattan, New York City...

CME Group- energy and metals: crude oil, gasolineGasolineGasoline , or petrol , is a toxic, translucent, petroleum-derived liquid that is primarily used as a fuel in internal combustion engines. It consists mostly of organic compounds obtained by the fractional distillation of petroleum, enhanced with a variety of additives. Some gasolines also contain...

, heating oilHeating oilHeating oil, or oil heat, is a low viscosity, flammable liquid petroleum product used as a fuel for furnaces or boilers in buildings. Home heating oil is often abbreviated as HHO...

, natural gasNatural gasNatural gas is a naturally occurring gas mixture consisting primarily of methane, typically with 0–20% higher hydrocarbons . It is found associated with other hydrocarbon fuel, in coal beds, as methane clathrates, and is an important fuel source and a major feedstock for fertilizers.Most natural...

, coalCoalCoal is a combustible black or brownish-black sedimentary rock usually occurring in rock strata in layers or veins called coal beds or coal seams. The harder forms, such as anthracite coal, can be regarded as metamorphic rock because of later exposure to elevated temperature and pressure...

, propanePropanePropane is a three-carbon alkane with the molecular formula , normally a gas, but compressible to a transportable liquid. A by-product of natural gas processing and petroleum refining, it is commonly used as a fuel for engines, oxy-gas torches, barbecues, portable stoves, and residential central...

, goldGold as an investmentOf all the precious metals, gold is the most popular as an investment. Investors generally buy gold as a hedge or harbor against economic, political, or social fiat currency crises...

, silverSilver as an investmentSilver, like other precious metals, may be used as an investment. For more than four thousand years, silver has been regarded as a form of money and store of value. However, since the end of the silver standard, silver has lost its role as legal tender in many developed countries such as the...

, platinumPlatinum as an investmentPlatinum has a much shorter history in the financial sector than either gold or silver, which were known to ancient civilizations.Platinum is relatively scarce even among the precious metals. New mine production totals approximately only 5 million troy ounces a year...

, copperCopperCopper is a chemical element with the symbol Cu and atomic number 29. It is a ductile metal with very high thermal and electrical conductivity. Pure copper is soft and malleable; an exposed surface has a reddish-orange tarnish...

, aluminum and palladiumPalladium as an investmentLike other precious metals, palladium may be used as an investment. Palladium price peaked near US$1,100 per troy ounce in January 2001 driven mainly on speculation of the catalytic converter demand from the automobile industry. Palladium is traded in the spot market with the code "XPD"... - Dubai Mercantile ExchangeDubai Mercantile ExchangeThe Dubai Mercantile Exchange is a commodity exchange based in Dubai currently listing its flagship futures contract, DME Oman Crude Oil Futures Contract...

- Korea ExchangeKorea ExchangeKorea Exchange is the sole securities exchange operator in South Korea. It is headquartered in Busan, and has an office for cash markets and market oversight in Seoul.- History :...

- KRX - Singapore ExchangeSingapore ExchangeSingapore Exchange Limited is an investment holding company located in Singapore and providing different services related to securities and derivatives trading and others. SGX is a member of the World Federation of Exchanges and the Asian and Oceanian Stock Exchanges FederationSingapore Exchange...

- SGX - into which merged Singapore International Monetary ExchangeSingapore International Monetary ExchangeThe Singapore International Monetary Exchange was a futures exchange in Singapore.It was founded in 1984. On 1 December 1999, SIMEX merged with the Stock Exchange of Singapore to form the Singapore Exchange ....

(SIMEX) - ROFEX - Rosario (Argentina) Futures Exchange

Codes

Most Futures contracts codes are four characters. The first two characters identify the contract type, the third character identifies the month and the last character is the last digit of the year.Third (month) futures contract codes are

- January = F

- February = G

- March = H

- April = J

- May = K

- June = M

- July = N

- August = Q

- September = U

- October = V

- November = X

- December = Z

Example: CLX0 is a Crude Oil (CL), November (X) 2010 (0) contract.

Who trades futures?

Futures traders are traditionally placed in one of two groups: hedgerHedge (finance)

A hedge is an investment position intended to offset potential losses that may be incurred by a companion investment.A hedge can be constructed from many types of financial instruments, including stocks, exchange-traded funds, insurance, forward contracts, swaps, options, many types of...

s, who have an interest in the underlying asset (which could include an intangible such as an index or interest rate) and are seeking to hedge out the risk of price changes; and speculators, who seek to make a profit by predicting market moves and opening a derivative

Derivative (finance)

A derivative instrument is a contract between two parties that specifies conditions—in particular, dates and the resulting values of the underlying variables—under which payments, or payoffs, are to be made between the parties.Under U.S...

contract related to the asset "on paper", while they have no practical use for or intent to actually take or make delivery of the underlying asset. In other words, the investor is seeking exposure to the asset in a long futures or the opposite effect via a short futures contract.

Hedgers

Hedgers typically include producers and consumerConsumer

Consumer is a broad label for any individuals or households that use goods generated within the economy. The concept of a consumer occurs in different contexts, so that the usage and significance of the term may vary.-Economics and marketing:...

s of a commodity or the owner of an asset or assets subject to certain influences such as an interest rate.

For example, in traditional commodity markets, farmer

Farmer

A farmer is a person engaged in agriculture, who raises living organisms for food or raw materials, generally including livestock husbandry and growing crops, such as produce and grain...