Interest rate

Encyclopedia

An interest rate is the rate at which interest

is paid by a borrower for the use of money that they borrow from a lender. For example, a small company borrows capital from a bank to buy new assets for their business, and in return the lender receives interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower. Interest rates are normally expressed as a percentage

of the principal for a period of one year.

Interest rates targets are also a vital tool of monetary policy

and are taken into account when dealing with variables like investment

, inflation

, and unemployment

.

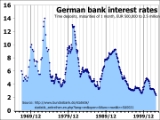

In the past two centuries, interest rates have been variously set either by national governments or central banks. For example, the Federal Reserve federal funds rate

In the past two centuries, interest rates have been variously set either by national governments or central banks. For example, the Federal Reserve federal funds rate

in the United States has varied between about 0.25% to 19% from 1954 to 2008, while the Bank of England

base rate varied between 0.5% and 15% from 1989 to 2009, and Germany experienced rates close to 90% in the 1920s down to about 2% in the 2000s. During an attempt to tackle spiraling hyperinflation in 2007, the Central Bank of Zimbabwe increased interest rates for borrowing to 800%.

The interest rates on prime credits in the late 1970s and early 1980s were far higher than had been recorded – higher than previous US peaks since 1800, than British peaks since 1700, or than Dutch peaks since 1600; "since modern capital markets came into existence, there have never been such high long-term rates" as in this period.

For example, suppose a household deposits $100 with a bank for 1 year and they receive interest of $10. At the end of the year their balance is $110. In this case, the nominal interest rate

is 10% per annum.

The real interest rate, which measures the purchasing power

of interest receipts, is calculated by adjusting the nominal rate charged to take inflation

into account. (See real vs. nominal in economics.)

If inflation in the economy has been 10% in the year, then the $110 in the account at the end of the year buys the same amount as the $100 did a year ago. The real interest rate

, in this case, is zero.

After the fact, the 'realized' real interest rate, which has actually occurred, is given by the Fisher equation

, and is

where p = the actual inflation rate over the year.

The linear approximation

is widely used.

The expected real returns on an investment, before it is made, are:

where:

for investments which ultimately includes the money market

, bond market

, stock market

and currency market as well as retail financial institutions like bank

s.

Exactly how these markets function is a complex question. However, economists generally agree that the interest rates yielded by any investment take into account:

This rate incorporates the deferred consumption and alternative investments elements of interest.

, people form an expectation of what will happen to inflation

in the future. They then ensure that they offer or ask a nominal interest rate that means they have the appropriate real interest rate

on their investment.

This is given by the formula:

where:

in investments is taken into consideration. This is why very volatile

investments like share

s and junk bonds have higher returns than safer ones like government bond

s.

The extra interest charged on a risky investment is the risk premium

. The required risk premium is dependent on the risk preferences of the lender.

If an investment is 50% likely to go bankrupt, a risk-neutral

lender will require their returns to double. So for an investment normally returning $100 they would require $200 back. A risk-averse lender would require more than $200 back and a risk-loving

lender less than $200. Evidence suggests that most lenders are in fact risk-averse.

Generally speaking a longer-term investment carries a maturity risk premium, because long-term loans are exposed to more risk of default during their duration.

than in less fungible

investments. Cash is on hand to be spent immediately if the need arises, but some investments require time or effort to transfer into spendable form. This is known as liquidity preference

. A 1-year loan, for instance, is very liquid compared to a 10-year loan. A 10-year US Treasury bond, however, is liquid because it can easily be sold on the market.

Assuming perfect information, pe is the same for all participants in the market, and this is identical to:

where

The total interest on an investment depends on the timescale the interest is calculated on, because interest paid may be compounded

.

In finance

, the effective interest rate is often derived from the yield

, a composite measure which takes into account all payments of interest and capital from the investment.

In retail finance, the annual percentage rate

and effective annual rate concepts have been introduced to help consumers easily compare different products with different payment structures.

on a macroeconomic scale. The current thought is that if interest rates increase across the board, then investment decreases, causing a fall in national income. However, the Austrian School of Economics

sees higher rates as leading to greater investment in order to earn the interest to pay the depositors. Higher rates encourage more saving and thus more investment and thus more jobs to increase production to increase profits. Higher rates also discourage economically unproductive lending such as consumer credit and mortgage lending. Also consumer credit tends to be used by consumers to buy imported products whereas business loans tend to be domestic and lead to more domestic job creation [and/or capital investment in machinery] in order to increase production to earn more profit.

A government institution, usually a central bank

, can lend money to financial institutions to influence their interest rates as the main tool of monetary policy

. Usually central bank interest rates are lower than commercial interest rates since banks borrow money from the central bank then lend the money at a higher rate to generate most of their profit.

By altering interest rates, the government institution is able to affect the interest rates faced by everyone who wants to borrow money for economic investment

. Investment can change rapidly in response to changes in interest rates and the total output.

largely by targeting the federal funds rate

. This is the rate that banks charge each other for overnight loans of federal funds

, which are the reserves held by banks at the Fed.

Open market operations are one tool within monetary policy implemented by the Federal Reserve to steer short-term interest rates. Using the power to buy and sell treasury securities.

supply.

By setting i*n, the government institution can affect the markets to alter the total of loans, bonds and shares issued. Generally speaking, a higher real interest rate reduces the broad money supply.

Through the quantity theory of money

, increases in the money supply lead to inflation.

.

For instance,

is only approximate. In reality, the relationship is

so

The two approximations, eliminating higher order terms, are:

The formulae in this article are exact if logarithm

s of indices

are used in place of rates.

However, central bank rates can, in fact, be negative; in July 2009 Sweden's Riksbank

was the first central bank to use negative interest rates, lowering its deposit rate to –0.25%, a policy advocated by deputy governor Lars E. O. Svensson

.

This negative interest rate is possible because Swedish banks, as regulated companies, must hold these reserves with the central bank—they do not have the option of holding cash.

Negative interest rates have been proposed in the past, notably in the late 19th century by Silvio Gesell

. A negative interest rate can be described (as by Gesell) as a "tax on holding money"; he proposed it as the Freigeld

(free money) component of his Freiwirtschaft

(free economy) system. To prevent people from holding cash (and thus earning 0%), Gesell suggested issuing money for a limited duration, after which it must be exchanged for new bills— attempts to hold money thus result in it expiring and becoming worthless.

Historical interest rates can be found at:

Interest

Interest is a fee paid by a borrower of assets to the owner as a form of compensation for the use of the assets. It is most commonly the price paid for the use of borrowed money, or money earned by deposited funds....

is paid by a borrower for the use of money that they borrow from a lender. For example, a small company borrows capital from a bank to buy new assets for their business, and in return the lender receives interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower. Interest rates are normally expressed as a percentage

Percentage

In mathematics, a percentage is a way of expressing a number as a fraction of 100 . It is often denoted using the percent sign, “%”, or the abbreviation “pct”. For example, 45% is equal to 45/100, or 0.45.Percentages are used to express how large/small one quantity is, relative to another quantity...

of the principal for a period of one year.

Interest rates targets are also a vital tool of monetary policy

Monetary policy

Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting a rate of interest for the purpose of promoting economic growth and stability. The official goals usually include relatively stable prices and low unemployment...

and are taken into account when dealing with variables like investment

Investment

Investment has different meanings in finance and economics. Finance investment is putting money into something with the expectation of gain, that upon thorough analysis, has a high degree of security for the principal amount, as well as security of return, within an expected period of time...

, inflation

Inflation

In economics, inflation is a rise in the general level of prices of goods and services in an economy over a period of time.When the general price level rises, each unit of currency buys fewer goods and services. Consequently, inflation also reflects an erosion in the purchasing power of money – a...

, and unemployment

Unemployment

Unemployment , as defined by the International Labour Organization, occurs when people are without jobs and they have actively sought work within the past four weeks...

.

Historical interest rates

Federal funds rate

In the United States, the federal funds rate is the interest rate at which depository institutions actively trade balances held at the Federal Reserve, called federal funds, with each other, usually overnight, on an uncollateralized basis. Institutions with surplus balances in their accounts lend...

in the United States has varied between about 0.25% to 19% from 1954 to 2008, while the Bank of England

Bank of England

The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694, it is the second oldest central bank in the world...

base rate varied between 0.5% and 15% from 1989 to 2009, and Germany experienced rates close to 90% in the 1920s down to about 2% in the 2000s. During an attempt to tackle spiraling hyperinflation in 2007, the Central Bank of Zimbabwe increased interest rates for borrowing to 800%.

The interest rates on prime credits in the late 1970s and early 1980s were far higher than had been recorded – higher than previous US peaks since 1800, than British peaks since 1700, or than Dutch peaks since 1600; "since modern capital markets came into existence, there have never been such high long-term rates" as in this period.

Reasons for interest rate change

- Political short-term gain: Lowering interest rates can give the economy a short-run boost. Under normal conditions, most economists think a cut in interest rates will only give a short term gain in economic activity that will soon be offset by inflation. The quick boost can influence elections. Most economists advocate independent central banks to limit the influence of politics on interest rates.

- Deferred consumption: When money is loaned the lender delays spending the money on consumptionConsumption (economics)Consumption is a common concept in economics, and gives rise to derived concepts such as consumer debt. Generally, consumption is defined in part by comparison to production. But the precise definition can vary because different schools of economists define production quite differently...

goods. Since according to time preferenceTime preferenceIn economics, time preference pertains to how large a premium a consumer places on enjoyment nearer in time over more remote enjoyment....

theory people prefer goods now to goods later, in a free market there will be a positive interest rate. - Inflationary expectations: Most economies generally exhibit inflationInflationIn economics, inflation is a rise in the general level of prices of goods and services in an economy over a period of time.When the general price level rises, each unit of currency buys fewer goods and services. Consequently, inflation also reflects an erosion in the purchasing power of money – a...

, meaning a given amount of money buys fewer goods in the future than it will now. The borrower needs to compensate the lender for this. - Alternative investments: The lender has a choice between using his money in different investments. If he chooses one, he forgoes the returns from all the others. Different investments effectively compete for funds.

- Risks of investment: There is always a risk that the borrower will go bankruptBankruptcyBankruptcy is a legal status of an insolvent person or an organisation, that is, one that cannot repay the debts owed to creditors. In most jurisdictions bankruptcy is imposed by a court order, often initiated by the debtor....

, abscond, die, or otherwise defaultDefault (finance)In finance, default occurs when a debtor has not met his or her legal obligations according to the debt contract, e.g. has not made a scheduled payment, or has violated a loan covenant of the debt contract. A default is the failure to pay back a loan. Default may occur if the debtor is either...

on the loan. This means that a lender generally charges a risk premiumRisk premiumA risk premium is the minimum amount of money by which the expected return on a risky asset must exceed the known return on a risk-free asset, in order to induce an individual to hold the risky asset rather than the risk-free asset...

to ensure that, across his investments, he is compensated for those that fail. - Liquidity preference: People prefer to have their resources available in a form that can immediately be exchanged, rather than a form that takes time or money to realize.

- Taxes: Because some of the gains from interest may be subject to taxes, the lender may insist on a higher rate to make up for this loss.

Real vs nominal interest rates

The nominal interest rate is the amount, in money terms, of interest payable.For example, suppose a household deposits $100 with a bank for 1 year and they receive interest of $10. At the end of the year their balance is $110. In this case, the nominal interest rate

Nominal interest rate

In finance and economics nominal interest rate or nominal rate of interest refers to the rate of interest before adjustment for inflation ; or, for interest rates "as stated" without adjustment for the full effect of compounding...

is 10% per annum.

The real interest rate, which measures the purchasing power

Purchasing power

Purchasing power is the number of goods/services that can be purchased with a unit of currency. For example, if you had taken one dollar to a store in the 1950s, you would have been able to buy a greater number of items than you would today, indicating that you would have had a greater purchasing...

of interest receipts, is calculated by adjusting the nominal rate charged to take inflation

Inflation

In economics, inflation is a rise in the general level of prices of goods and services in an economy over a period of time.When the general price level rises, each unit of currency buys fewer goods and services. Consequently, inflation also reflects an erosion in the purchasing power of money – a...

into account. (See real vs. nominal in economics.)

If inflation in the economy has been 10% in the year, then the $110 in the account at the end of the year buys the same amount as the $100 did a year ago. The real interest rate

Real interest rate

The "real interest rate" is the rate of interest an investor expects to receive after allowing for inflation. It can be described more formally by the Fisher equation, which states that the real interest rate is approximately the nominal interest rate minus the inflation rate...

, in this case, is zero.

After the fact, the 'realized' real interest rate, which has actually occurred, is given by the Fisher equation

Fisher equation

The Fisher equation in financial mathematics and economics estimates the relationship between nominal and real interest rates under inflation....

, and is

where p = the actual inflation rate over the year.

The linear approximation

Linear approximation

In mathematics, a linear approximation is an approximation of a general function using a linear function . They are widely used in the method of finite differences to produce first order methods for solving or approximating solutions to equations.-Definition:Given a twice continuously...

is widely used.

The expected real returns on an investment, before it is made, are:

where:

-

= real interest rate

= real interest rate -

= nominal interest rate

= nominal interest rate -

= expected or projected inflation over the year

= expected or projected inflation over the year

Market interest rates

There is a marketMarket

A market is one of many varieties of systems, institutions, procedures, social relations and infrastructures whereby parties engage in exchange. While parties may exchange goods and services by barter, most markets rely on sellers offering their goods or services in exchange for money from buyers...

for investments which ultimately includes the money market

Money market

The money market is a component of the financial markets for assets involved in short-term borrowing and lending with original maturities of one year or shorter time frames. Trading in the money markets involves Treasury bills, commercial paper, bankers' acceptances, certificates of deposit,...

, bond market

Bond market

The bond market is a financial market where participants can issue new debt, known as the primary market, or buy and sell debt securities, known as the Secondary market, usually in the form of bonds. The primary goal of the bond market is to provide a mechanism for long term funding of public and...

, stock market

Stock market

A stock market or equity market is a public entity for the trading of company stock and derivatives at an agreed price; these are securities listed on a stock exchange as well as those only traded privately.The size of the world stock market was estimated at about $36.6 trillion...

and currency market as well as retail financial institutions like bank

Bank

A bank is a financial institution that serves as a financial intermediary. The term "bank" may refer to one of several related types of entities:...

s.

Exactly how these markets function is a complex question. However, economists generally agree that the interest rates yielded by any investment take into account:

- The risk-free cost of capital

- Inflationary expectations

- The level of risk in the investment

- The costs of the transaction

This rate incorporates the deferred consumption and alternative investments elements of interest.

Inflationary expectations

According to the theory of rational expectationsRational expectations

Rational expectations is a hypothesis in economics which states that agents' predictions of the future value of economically relevant variables are not systematically wrong in that all errors are random. An alternative formulation is that rational expectations are model-consistent expectations, in...

, people form an expectation of what will happen to inflation

Inflation

In economics, inflation is a rise in the general level of prices of goods and services in an economy over a period of time.When the general price level rises, each unit of currency buys fewer goods and services. Consequently, inflation also reflects an erosion in the purchasing power of money – a...

in the future. They then ensure that they offer or ask a nominal interest rate that means they have the appropriate real interest rate

Real interest rate

The "real interest rate" is the rate of interest an investor expects to receive after allowing for inflation. It can be described more formally by the Fisher equation, which states that the real interest rate is approximately the nominal interest rate minus the inflation rate...

on their investment.

This is given by the formula:

where:

-

= offered nominal interest rate

= offered nominal interest rate -

= desired real interest rate

= desired real interest rate -

= inflationary expectations

= inflationary expectations

Risk

The level of riskRisk

Risk is the potential that a chosen action or activity will lead to a loss . The notion implies that a choice having an influence on the outcome exists . Potential losses themselves may also be called "risks"...

in investments is taken into consideration. This is why very volatile

Volatility (finance)

In finance, volatility is a measure for variation of price of a financial instrument over time. Historic volatility is derived from time series of past market prices...

investments like share

Share (finance)

A joint stock company divides its capital into units of equal denomination. Each unit is called a share. These units are offered for sale to raise capital. This is termed as issuing shares. A person who buys share/shares of the company is called a shareholder, and by acquiring share or shares in...

s and junk bonds have higher returns than safer ones like government bond

Government bond

A government bond is a bond issued by a national government denominated in the country's own currency. Bonds are debt investments whereby an investor loans a certain amount of money, for a certain amount of time, with a certain interest rate, to a company or country...

s.

The extra interest charged on a risky investment is the risk premium

Risk premium

A risk premium is the minimum amount of money by which the expected return on a risky asset must exceed the known return on a risk-free asset, in order to induce an individual to hold the risky asset rather than the risk-free asset...

. The required risk premium is dependent on the risk preferences of the lender.

If an investment is 50% likely to go bankrupt, a risk-neutral

Risk neutral

In economics and finance, risk neutral behavior is between risk aversion and risk seeking. If offered either €50 or a 50% chance of each of €100 and nothing, a risk neutral person would have no preference between the two options...

lender will require their returns to double. So for an investment normally returning $100 they would require $200 back. A risk-averse lender would require more than $200 back and a risk-loving

Risk-loving

In economics and finance, a risk lover is a person who has a preference for risk. While most investors are considered risk averse, one could view casino goers as risk loving...

lender less than $200. Evidence suggests that most lenders are in fact risk-averse.

Generally speaking a longer-term investment carries a maturity risk premium, because long-term loans are exposed to more risk of default during their duration.

Liquidity preference

Most investors prefer their money to be in cashCash

In common language cash refers to money in the physical form of currency, such as banknotes and coins.In bookkeeping and finance, cash refers to current assets comprising currency or currency equivalents that can be accessed immediately or near-immediately...

than in less fungible

Fungibility

Fungibility is the property of a good or a commodity whose individual units are capable of mutual substitution, such as crude oil, wheat, precious metals or currencies...

investments. Cash is on hand to be spent immediately if the need arises, but some investments require time or effort to transfer into spendable form. This is known as liquidity preference

Liquidity preference

In macroeconomic theory, Liquidity preference refers to the demand for money, considered as liquidity. The concept was first developed by John Maynard Keynes in his book The General Theory of Employment, Interest and Money to explain determination of the interest rate by the supply and demand...

. A 1-year loan, for instance, is very liquid compared to a 10-year loan. A 10-year US Treasury bond, however, is liquid because it can easily be sold on the market.

A market interest-rate model

A basic interest rate pricing model for an assetAssuming perfect information, pe is the same for all participants in the market, and this is identical to:

where

- in is the nominal interest rate on a given investment

- ir is the risk-free return to capital

- i*n = the nominal interest rate on a short-term risk-free liquid bond (such as U.S. Treasury Bills).

- rp = a risk premium reflecting the length of the investment and the likelihood the borrower will default

- lp = liquidity premium (reflecting the perceived difficulty of converting the asset into money and thus into goods).

Interest rate notations

What is commonly referred to as the interest rate in the media is generally the rate offered on overnight deposits by the Central Bank or other authority, annualized.The total interest on an investment depends on the timescale the interest is calculated on, because interest paid may be compounded

Compound interest

Compound interest arises when interest is added to the principal, so that from that moment on, the interest that has been added also itself earns interest. This addition of interest to the principal is called compounding...

.

In finance

Finance

"Finance" is often defined simply as the management of money or “funds” management Modern finance, however, is a family of business activity that includes the origination, marketing, and management of cash and money surrogates through a variety of capital accounts, instruments, and markets created...

, the effective interest rate is often derived from the yield

Yield (finance)

In finance, the term yield describes the amount in cash that returns to the owners of a security. Normally it does not include the price variations, at the difference of the total return...

, a composite measure which takes into account all payments of interest and capital from the investment.

In retail finance, the annual percentage rate

Annual percentage rate

The term annual percentage rate , also called nominal APR, and the term effective APR, also called EAR, describe the interest rate for a whole year , rather than just a monthly fee/rate, as applied on a loan, mortgage loan, credit card, etc. It is a finance charge expressed as an annual rate...

and effective annual rate concepts have been introduced to help consumers easily compare different products with different payment structures.

Elasticity of substitution

The elasticity of substitution (full name should be the marginal rate of substitution of the relative allocation) affects the real interest rate. The larger the magnitude of the elasticity of substitution, the more the exchange, and the lower the real interest rate.Output and unemployment

Interest rates are the main determinant of investmentInvestment

Investment has different meanings in finance and economics. Finance investment is putting money into something with the expectation of gain, that upon thorough analysis, has a high degree of security for the principal amount, as well as security of return, within an expected period of time...

on a macroeconomic scale. The current thought is that if interest rates increase across the board, then investment decreases, causing a fall in national income. However, the Austrian School of Economics

Austrian School

The Austrian School of economics is a heterodox school of economic thought. It advocates methodological individualism in interpreting economic developments , the theory that money is non-neutral, the theory that the capital structure of economies consists of heterogeneous goods that have...

sees higher rates as leading to greater investment in order to earn the interest to pay the depositors. Higher rates encourage more saving and thus more investment and thus more jobs to increase production to increase profits. Higher rates also discourage economically unproductive lending such as consumer credit and mortgage lending. Also consumer credit tends to be used by consumers to buy imported products whereas business loans tend to be domestic and lead to more domestic job creation [and/or capital investment in machinery] in order to increase production to earn more profit.

A government institution, usually a central bank

Central bank

A central bank, reserve bank, or monetary authority is a public institution that usually issues the currency, regulates the money supply, and controls the interest rates in a country. Central banks often also oversee the commercial banking system of their respective countries...

, can lend money to financial institutions to influence their interest rates as the main tool of monetary policy

Monetary policy

Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting a rate of interest for the purpose of promoting economic growth and stability. The official goals usually include relatively stable prices and low unemployment...

. Usually central bank interest rates are lower than commercial interest rates since banks borrow money from the central bank then lend the money at a higher rate to generate most of their profit.

By altering interest rates, the government institution is able to affect the interest rates faced by everyone who wants to borrow money for economic investment

Investment

Investment has different meanings in finance and economics. Finance investment is putting money into something with the expectation of gain, that upon thorough analysis, has a high degree of security for the principal amount, as well as security of return, within an expected period of time...

. Investment can change rapidly in response to changes in interest rates and the total output.

Open Market Operations in the United States

The Federal Reserve (often referred to as 'The Fed') implements monetary policyMonetary policy

Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting a rate of interest for the purpose of promoting economic growth and stability. The official goals usually include relatively stable prices and low unemployment...

largely by targeting the federal funds rate

Federal funds rate

In the United States, the federal funds rate is the interest rate at which depository institutions actively trade balances held at the Federal Reserve, called federal funds, with each other, usually overnight, on an uncollateralized basis. Institutions with surplus balances in their accounts lend...

. This is the rate that banks charge each other for overnight loans of federal funds

Federal funds

In the United States, federal funds are overnight borrowings by banks to maintain their bank reserves at the Federal Reserve. Banks keep reserves at Federal Reserve Banks to meet their reserve requirements and to clear financial transactions...

, which are the reserves held by banks at the Fed.

Open market operations are one tool within monetary policy implemented by the Federal Reserve to steer short-term interest rates. Using the power to buy and sell treasury securities.

Money and inflation

Loans, bonds, and shares have some of the characteristics of money and are included in the broad moneyBroad money

In economics, broad money is a measure of the money supply that includes more than just physical money such as currency and coins . It generally includes demand deposits at commercial banks, and any monies held in easily accessible accounts...

supply.

By setting i*n, the government institution can affect the markets to alter the total of loans, bonds and shares issued. Generally speaking, a higher real interest rate reduces the broad money supply.

Through the quantity theory of money

Quantity theory of money

In monetary economics, the quantity theory of money is the theory that money supply has a direct, proportional relationship with the price level....

, increases in the money supply lead to inflation.

Mathematical note

Because interest and inflation are generally given as percentage increases, the formulae above are (linear) approximationsLinear approximation

In mathematics, a linear approximation is an approximation of a general function using a linear function . They are widely used in the method of finite differences to produce first order methods for solving or approximating solutions to equations.-Definition:Given a twice continuously...

.

For instance,

is only approximate. In reality, the relationship is

so

The two approximations, eliminating higher order terms, are:

The formulae in this article are exact if logarithm

Logarithm

The logarithm of a number is the exponent by which another fixed value, the base, has to be raised to produce that number. For example, the logarithm of 1000 to base 10 is 3, because 1000 is 10 to the power 3: More generally, if x = by, then y is the logarithm of x to base b, and is written...

s of indices

Index (economics)

In economics and finance, an index is a statistical measure of changes in a representative group of individual data points. These data may be derived from any number of sources, including company performance, prices, productivity, and employment. Economic indices track economic health from...

are used in place of rates.

Negative interest rates

Interest rates are usually positive, but not always. Given the alternative of holding cash, and thus earning 0%, rather than lending it out, profit-seeking lenders will not lend below 0%, as that will guarantee a loss, and a bank offering a negative deposit rate will find few takers, as savers will instead hold cash.However, central bank rates can, in fact, be negative; in July 2009 Sweden's Riksbank

Sveriges Riksbank

Sveriges Riksbank, or simply Riksbanken, is the central bank of Sweden and the world's oldest central bank. It is sometimes called the Swedish National Bank or the Bank of Sweden .-History:...

was the first central bank to use negative interest rates, lowering its deposit rate to –0.25%, a policy advocated by deputy governor Lars E. O. Svensson

Lars E. O. Svensson

Lars E. O. Svensson, born 1947, is an Swedish economist on the faculty of Princeton University. He has published significant research in macroeconomics, especially monetary economics, international trade and general equilibrium theory. He is among the most influential economists in the world...

.

This negative interest rate is possible because Swedish banks, as regulated companies, must hold these reserves with the central bank—they do not have the option of holding cash.

Negative interest rates have been proposed in the past, notably in the late 19th century by Silvio Gesell

Silvio Gesell

Silvio Gesell was a German merchant, theoretical economist, social activist, anarchist and founder of Freiwirtschaft.-Life:...

. A negative interest rate can be described (as by Gesell) as a "tax on holding money"; he proposed it as the Freigeld

Freigeld

In the theory of Freiwirtschaft, Freigeld is a monetary unit proposed by Silvio Gesell.- Properties :Freigeld has several special properties:...

(free money) component of his Freiwirtschaft

Freiwirtschaft

is an economic idea founded by Silvio Gesell in 1916. He called it . In 1932, a group of Swiss businessmen used his ideas to found WIR....

(free economy) system. To prevent people from holding cash (and thus earning 0%), Gesell suggested issuing money for a limited duration, after which it must be exchanged for new bills— attempts to hold money thus result in it expiring and becoming worthless.

See also

- Rate of return on investment

- Central bankCentral bankA central bank, reserve bank, or monetary authority is a public institution that usually issues the currency, regulates the money supply, and controls the interest rates in a country. Central banks often also oversee the commercial banking system of their respective countries...

- Discount rateDiscount rateThe discount rate can mean*an interest rate a central bank charges depository institutions that borrow reserves from it, for example for the use of the Federal Reserve's discount window....

- FinanceFinance"Finance" is often defined simply as the management of money or “funds” management Modern finance, however, is a family of business activity that includes the origination, marketing, and management of cash and money surrogates through a variety of capital accounts, instruments, and markets created...

- InterestInterestInterest is a fee paid by a borrower of assets to the owner as a form of compensation for the use of the assets. It is most commonly the price paid for the use of borrowed money, or money earned by deposited funds....

- MacroeconomicsMacroeconomicsMacroeconomics is a branch of economics dealing with the performance, structure, behavior, and decision-making of the whole economy. This includes a national, regional, or global economy...

- Monetary policyMonetary policyMonetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting a rate of interest for the purpose of promoting economic growth and stability. The official goals usually include relatively stable prices and low unemployment...

- Real interest rateReal interest rateThe "real interest rate" is the rate of interest an investor expects to receive after allowing for inflation. It can be described more formally by the Fisher equation, which states that the real interest rate is approximately the nominal interest rate minus the inflation rate...

- Short rate modelShort rate modelIn the context of interest rate derivatives, a short-rate model is a mathematical model that describes the future evolution of interest rates by describing the future evolution of the short rate, usually written r_t \,.-The short rate:...

- Financial repressionFinancial repressionFinancial repression is a term used to describe several measures which governments employ to channel funds to themselves which in a deregulated market would go elsewhere. Financial repression can be particularly effective at liquidating debt....

External links

You can see a list of current interest rates at these sites:Historical interest rates can be found at: