Stock market index

Encyclopedia

Stock market

A stock market or equity market is a public entity for the trading of company stock and derivatives at an agreed price; these are securities listed on a stock exchange as well as those only traded privately.The size of the world stock market was estimated at about $36.6 trillion...

. Many indices are cited by news or financial services firms and are used as benchmarks

Benchmarking

Benchmarking is the process of comparing one's business processes and performance metrics to industry bests and/or best practices from other industries. Dimensions typically measured are quality, time and cost...

, to measure the performance of portfolio

Portfolio (finance)

Portfolio is a financial term denoting a collection of investments held by an investment company, hedge fund, financial institution or individual.-Definition:The term portfolio refers to any collection of financial assets such as stocks, bonds and cash...

s such as mutual fund

Mutual fund

A mutual fund is a professionally managed type of collective investment scheme that pools money from many investors to buy stocks, bonds, short-term money market instruments, and/or other securities.- Overview :...

s.

Alternatively, an index may also be considered as an instrument (after all it can be traded) which derives its value from other instruments or indices. The index may be weighted to reflect the market capitalization of its components, or may be a simple index which merely represents the net change in the prices of the underlying instruments.

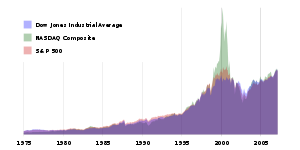

Most publicly quoted stock market indices (like the two quoted below) are weighted.

Types of indices

Stock market indices may be classed in many ways. A 'world' or 'global' stock market index includes (typically large) companies without regard for where they are domiciled or traded. Two examples are MSCI WorldMSCI World

The MSCI World is a stock market index of over 1,600 'world' stocks. It is maintained by MSCI Inc., formerly Morgan Stanley Capital International, and is often used as a common benchmark for 'world' or 'global' stock funds....

and S&P Global 100

S&P Global 100

The S&P Global 100 Index is a stock market index of global stocks from Standard & Poor's.The S&P Global 100 measures the performance of 100 multi-national companies. It includes 100 large-cap companies from the S&P Global 1200 whose businesses are global in nature, and that derive a substantial...

.

A 'national' index represents the performance of the stock market of a given nation—and by proxy, reflects investor sentiment on the state of its economy. The most regularly quoted market indices are national indices composed of the stocks of large companies listed on a nation's largest stock exchanges, such as the American S&P 500

S&P 500

The S&P 500 is a free-float capitalization-weighted index published since 1957 of the prices of 500 large-cap common stocks actively traded in the United States. The stocks included in the S&P 500 are those of large publicly held companies that trade on either of the two largest American stock...

, the Japanese Nikkei 225

Nikkei 225

The , more commonly called the Nikkei, the Nikkei index, or the Nikkei Stock Average , is a stock market index for the Tokyo Stock Exchange . It has been calculated daily by the Nihon Keizai Shimbun newspaper since 1950. It is a price-weighted average , and the components are reviewed once a year...

, the Russian RTSI, the Indian SENSEX and the British FTSE 100.

The concept may be extended well beyond an exchange. The Wilshire 5000

Wilshire 5000

The Wilshire 5000 Total Market Index, or more simply the Wilshire 5000, is a market-capitalization-weighted index of the market value of all stocks actively traded in the United States. Currently, the index contains over 4,100 components...

Index, the original total market index, represents the stocks of nearly every publicly traded company in the United States

United States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

, including all U.S. stocks traded on the New York Stock Exchange

New York Stock Exchange

The New York Stock Exchange is a stock exchange located at 11 Wall Street in Lower Manhattan, New York City, USA. It is by far the world's largest stock exchange by market capitalization of its listed companies at 13.39 trillion as of Dec 2010...

(but not ADR

American Depositary Receipt

An American depositary receipt is a negotiable security that represents the underlying securities of a non-U.S. company that trades in the US financial markets...

s or limited partnership

Limited partnership

A limited partnership is a form of partnership similar to a general partnership, except that in addition to one or more general partners , there are one or more limited partners . It is a partnership in which only one partner is required to be a general partner.The GPs are, in all major respects,...

s), NASDAQ

NASDAQ

The NASDAQ Stock Market, also known as the NASDAQ, is an American stock exchange. "NASDAQ" originally stood for "National Association of Securities Dealers Automated Quotations". It is the second-largest stock exchange by market capitalization in the world, after the New York Stock Exchange. As of...

and American Stock Exchange

American Stock Exchange

NYSE Amex Equities, formerly known as the American Stock Exchange is an American stock exchange situated in New York. AMEX was a mutual organization, owned by its members. Until 1953, it was known as the New York Curb Exchange. On January 17, 2008, NYSE Euronext announced it would acquire the...

. Russell Investment Group

Russell Investment Group

Russell Investments is a subsidiary of Northwestern Mutual and is headquartered in Seattle, Washington, U.S.A. Its previous headquarters were located in Tacoma, Washington, south of Seattle. The firm is a Turnkey Asset Management Program and provides investment products and services to individuals...

added to the family of indices by launching the Russel Global Index.

More specialised indices exist tracking the performance of specific sectors of the market. Some examples include the Wilshire US REIT which tracks more than 80 American

United States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

real estate investment trust

Real estate investment trust

A real estate investment trust or REIT is a tax designation for a corporate entity investing in real estate. The purpose of this designation is to reduce or eliminate corporate tax. In return, REITs are required to distribute 90% of their taxable income into the hands of investors...

s and the Morgan Stanley Biotech Index which consists of 36 American

United States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

firms in the biotechnology

Biotechnology

Biotechnology is a field of applied biology that involves the use of living organisms and bioprocesses in engineering, technology, medicine and other fields requiring bioproducts. Biotechnology also utilizes these products for manufacturing purpose...

industry. Other indices may track companies of a certain size, a certain type of management, or even more specialized criteria — one index published by Linux Weekly News tracks stocks of companies that sell products and services based on the Linux

Linux

Linux is a Unix-like computer operating system assembled under the model of free and open source software development and distribution. The defining component of any Linux system is the Linux kernel, an operating system kernel first released October 5, 1991 by Linus Torvalds...

operating environment.

Index versions

Some indices, such as the S&P 500S&P 500

The S&P 500 is a free-float capitalization-weighted index published since 1957 of the prices of 500 large-cap common stocks actively traded in the United States. The stocks included in the S&P 500 are those of large publicly held companies that trade on either of the two largest American stock...

, have multiple versions. These versions can differ based on how the index components are weighted

Weight function

A weight function is a mathematical device used when performing a sum, integral, or average in order to give some elements more "weight" or influence on the result than other elements in the same set. They occur frequently in statistics and analysis, and are closely related to the concept of a...

and on how dividend

Dividend

Dividends are payments made by a corporation to its shareholder members. It is the portion of corporate profits paid out to stockholders. When a corporation earns a profit or surplus, that money can be put to two uses: it can either be re-invested in the business , or it can be distributed to...

s are accounted for. For example, there are three versions of the S&P 500

S&P 500

The S&P 500 is a free-float capitalization-weighted index published since 1957 of the prices of 500 large-cap common stocks actively traded in the United States. The stocks included in the S&P 500 are those of large publicly held companies that trade on either of the two largest American stock...

index: price return, which only considers the price of the components, total return, which accounts for dividend reinvestment, and net total return, which accounts for dividend reinvestment after the deduction of a withholding tax. As another example, the Wilshire 4500

Wilshire 4500

The Wilshire 4500 Completion Index, more commonly the Wilshire 4500, is a market capitalization-weighted index of all stocks actively traded in the United States with the exception of the stocks included in the S&P 500 index...

and Wilshire 5000

Wilshire 5000

The Wilshire 5000 Total Market Index, or more simply the Wilshire 5000, is a market-capitalization-weighted index of the market value of all stocks actively traded in the United States. Currently, the index contains over 4,100 components...

indices have five versions each: full capitalization total return, full capitalization price, float-adjusted total return, float-adjusted price, and equal weight. The difference between the full capitalization, float-adjusted, and equal weight versions is in how index components are weighted.

Weighting

An index may also be classified according to the method used to determine its price. In a price-weightedPrice-weighted

A price-weighted index is a stock market index where each constituent makes up a fraction of the index that is proportional to its price. For a stock market index this implies that stocks are included in proportions based on their quoted prices. A stock trading at $100 will thus be making up 10...

index such as the Dow Jones Industrial Average

Dow Jones Industrial Average

The Dow Jones Industrial Average , also called the Industrial Average, the Dow Jones, the Dow 30, or simply the Dow, is a stock market index, and one of several indices created by Wall Street Journal editor and Dow Jones & Company co-founder Charles Dow...

, Amex Major Market Index

Amex Major Market Index

The AMEX Major Market Index or NYSE Arca Major Market Index or XMI is the American Stock Exchange price-weighted average of 20 Blue Chip industrial stocks of major U.S. Corporations; several of the stocks are also components of the Dow Jones Industrial Average . None of them trade on the Amex;...

, and the NYSE ARCA Tech 100 Index

NYSE ARCA Tech 100 Index

The NYSE Arca Tech 100 Index is a price-weighted index composed of common stocks and ADRs of technology-related companies listed on US stock exchanges. The index is maintained by the New York Stock Exchange, but includes stocks that trade on exchanges other than the NYSE...

, the price of each component stock is the only consideration when determining the value of the index. Thus, price movement of even a single security will heavily influence the value of the index even though the dollar shift is less significant in a relatively highly valued issue, and moreover ignoring the relative size of the company as a whole. In contrast, a market-value weighted or capitalization-weighted index such as the Hang Seng Index

Hang Seng Index

The Hang Seng Index is a freefloat-adjusted market capitalization-weighted stock market index in Hong Kong. It is used to record and monitor daily changes of the largest companies of the Hong Kong stock market and is the main indicator of the overall market performance in Hong Kong...

factors in the size of the company. Thus, a relatively small shift in the price of a large company will heavily influence the value of the index. In a market-share weighted index, price is weighted relative to the number of shares, rather than their total value.

Traditionally, capitalization- or share-weighted indices all had a full weighting, i.e. all outstanding shares were included. Recently, many of them have changed to a float-adjusted weighting which helps indexing

Index fund

An index fund or index tracker is a collective investment scheme that aims to replicate the movements of an index of a specific financial market, or a set of rules of ownership that are held constant, regardless of market conditions.-Tracking:Tracking can be achieved by trying to hold all of the...

.

A modified capitalization-weighted index is a hybrid between capitalization weighting and equal weighting. It is similar to a capitalization weighting with one main difference: the largest stocks are capped to a percent of the weight of the total stock index and the excess weight will be redistributed equally amongst the stocks under that cap. Moreover, in 2005, Standard & Poor's introduced the S&P Pure Growth Style Index and S&P Pure Value Style Index which was attribute-weighted. That is, a stock's weight in the index is decided by the score it gets relative to the value attributes that define the criteria of a specific index, the same measure used to select the stocks in the first place. For these two stocks, a score is calculated for every stock, be it their growth score or the value score (a stock cannot be both) and accordingly they are weighted for the index.

Criticism of capitalization-weighting

The use of capitalization-weighted indices is often justified by the central conclusion of modern portfolio theoryModern portfolio theory

Modern portfolio theory is a theory of investment which attempts to maximize portfolio expected return for a given amount of portfolio risk, or equivalently minimize risk for a given level of expected return, by carefully choosing the proportions of various assets...

that the optimal investment strategy for any investor is to hold the market portfolio, the capitalization-weighted portfolio of all assets. However, empirical tests conclude that market indices are not efficient. This can be explained by the fact that these indices do not include all assets or by the fact that the theory does not hold. The practical conclusion is that using capitalization-weighted portfolios is not necessarily the optimal method.

As a consequence, capitalization-weighting has been subject to severe criticism (see e.g. Haugen and Baker 1991, Amenc, Goltz, and Le Sourd 2006, or Hsu 2006), pointing out that the mechanics of capitalization-weighting lead to trend-following strategies that provide an inefficient risk-return trade-off.

Also, while capitalization-weighting is the standard in equity index construction, different weighting schemes exist. First, while most indices use capitalization-weighting, additional criteria are often taken into account, such as sales/revenue and net income (see the “Guide to the Dow Jones Global Titan 50 Index”, January 2006). Second, as an answer to the critiques of capitalization-weighting, equity indices with different weighting schemes have emerged, such as "wealth"-weighted (Morris, 1996), “fundamental”-weighted

Fundamentally based indexes

Fundamentally based indexes are indices in which stocks are weighted by one of many economic fundamental factors, especially accounting figures which are commonly used when performing corporate valuation, or by a composite of several fundamental factors...

(Arnott

Robert D. Arnott

Robert D. Arnott is an American entrepreneur, investor, editor and writer who focuses on articles about quantitative investing. He is the father of Richard Wiles-Arnott, Sydney Arnott, and Robin Arnott. He edited the CFA Institute's Financial Analysts Journal from 2002–2006, and has edited three...

, Hsu and Moore 2005), “diversity”-weighted (Fernholz, Garvy, and Hannon 1998) or equal-weighted indices.

Indices and passive investment management

There has been an accelerating trend in recent decades to create passively managedPassive management

Passive management is a financial strategy in which an investor invests in accordance with a pre-determined strategy that doesn't entail any forecasting...

mutual fund

Mutual fund

A mutual fund is a professionally managed type of collective investment scheme that pools money from many investors to buy stocks, bonds, short-term money market instruments, and/or other securities.- Overview :...

s that are based on market indices, known as index fund

Index fund

An index fund or index tracker is a collective investment scheme that aims to replicate the movements of an index of a specific financial market, or a set of rules of ownership that are held constant, regardless of market conditions.-Tracking:Tracking can be achieved by trying to hold all of the...

s. Advocates claim that index funds routinely beat a large majority of actively managed

Active management

Active management refers to a portfolio management strategy where the manager makes specific investments with the goal of outperforming an investment benchmark index...

mutual funds; one study claimed that over time, the average actively managed fund has returned 1.8% less than the S&P 500

S&P 500

The S&P 500 is a free-float capitalization-weighted index published since 1957 of the prices of 500 large-cap common stocks actively traded in the United States. The stocks included in the S&P 500 are those of large publicly held companies that trade on either of the two largest American stock...

index - a result nearly equal to the average expense ratio of mutual funds (fund expenses are a drag on the funds' return by exactly that ratio). Since index funds attempt to replicate the holdings of an index, they obviate the need for — and thus many costs of — the research entailed in active management, and have a lower churn rate

Churn rate

Churn rate , in its broadest sense, is a measure of the number of individuals or items moving into or out of a collective over a specific period of time...

(the turnover of securities which lose fund managers' favor and are sold, with the attendant cost of commissions and capital gains taxes).

Indices are also a common basis for a related type of investment, the exchange-traded fund

Exchange-traded fund

An exchange-traded fund is an investment fund traded on stock exchanges, much like stocks. An ETF holds assets such as stocks, commodities, or bonds, and trades close to its net asset value over the course of the trading day. Most ETFs track an index, such as the S&P 500 or MSCI EAFE...

or ETF. Unlike an index fund, which is priced daily, an ETF is priced continuously, is optionable, and can be sold short.

Ethical stock market indices

A notable specialised index type is those for ethical investing indices that include only those companies satisfying ecological or social criteria, e.g. those of The Calvert GroupCalvert Social Index

The Calvert Social Index is a stock market index created by Calvert Investments as a benchmark of large companies that are considered socially responsible or ethical. It currently consists of 468 companies, weighted by market capitalization, selected from approximately 1,000 of the largest publicly...

, KLD

Domini 400 Social Index

This FTSE KLD 400 Social Index was launched in 1990 and is designed to help socially conscious investors weigh social and environmental factors in their investment choices....

, FTSE4Good Index

FTSE4Good Index

The FTSE4Good Index series is a series of ethical investment stock market indices launched in 2001 by the FTSE Group. A number of stock market indices are available, for example covering UK shares, US shares, European markets, and Japan, with inclusion based on a range of corporate social...

, Dow Jones Sustainability Index

Dow Jones Sustainability Index

Launched in September 1999, the Dow Jones Sustainability Indexes are a family of indexes evaluating the performance of the world’s leaders in sustainability. They are the longest-running global sustainability benchmarks worldwide and have become the key reference point in Sustainability Investing...

and Wilderhill Clean Energy Index.

In 2010, the OIC announced the initiation of a stock index that complies with Islamic law

Sharia

Sharia law, is the moral code and religious law of Islam. Sharia is derived from two primary sources of Islamic law: the precepts set forth in the Quran, and the example set by the Islamic prophet Muhammad in the Sunnah. Fiqh jurisprudence interprets and extends the application of sharia to...

's ban on alcohol, tobacco and gambling. Other such equities, such as the Dow Jones Islamic Market World Index, already exist.

Another important trend is strict mechanical criteria for inclusion and exclusion to prevent market manipulation, e.g. in Canada when Nortel

Nortel

Nortel Networks Corporation, formerly known as Northern Telecom Limited and sometimes known simply as Nortel, was a multinational telecommunications equipment manufacturer headquartered in Mississauga, Ontario, Canada...

was permitted to rise to over 30% of the TSE 300 index

TSE 300 index

The TSE 300 Index was a Canadian stock market index that tracked the prices of 300 influential stocks which were traded on the Toronto Stock Exchange. Since May 1, 2002, it has been replaced by the S&P/TSX Composite Index....

value. Ethical indices have a particular interest in mechanical criteria, seeking to avoid accusations of ideological bias in selection, and have pioneered techniques for inclusion and exclusion of stocks based on complex criteria. Another means of mechanical selection is mark-to-future methods that exploit scenarios produced by multiple analysts weighted according to probability, to determine which stocks have become too risky to hold in the index of concern.

Critics of such initiatives argue that many firms satisfy mechanical "ethical criteria", e.g. regarding board composition or hiring practices, but fail to perform ethically with respect to shareholders, e.g. Enron

Enron

Enron Corporation was an American energy, commodities, and services company based in Houston, Texas. Before its bankruptcy on December 2, 2001, Enron employed approximately 22,000 staff and was one of the world's leading electricity, natural gas, communications, and pulp and paper companies, with...

. Indeed, the seeming "seal of approval" of an ethical index may put investors more at ease, enabling scams. One response to these criticisms is that trust in the corporate management, index criteria, fund or index manager, and securities regulator, can never be replaced by mechanical means, so "market transparency" and "disclosure" are the only long-term-effective paths to fair markets.

Environmental stock market indices

An environmental stock market index aims to provide a quantitative measure of the environmental damage caused by the companies in an index. Indices of this nature face much of the same criticism as Ethical indices do — that the 'score' given is partially subjective.However, whereas 'ethical' issues (for example, does a company use a sweatshop

Sweatshop

Sweatshop is a negatively connoted term for any working environment considered to be unacceptably difficult or dangerous. Sweatshop workers often work long hours for very low pay, regardless of laws mandating overtime pay or a minimum wage. Child labour laws may be violated. Sweatshops may have...

) are largely subjective and difficult to score, an environmental impact is often quantifiable through scientific methods. So it is broadly possible to assign a 'score' to (say) the damage caused by a tonne of mercury

Mercury (element)

Mercury is a chemical element with the symbol Hg and atomic number 80. It is also known as quicksilver or hydrargyrum...

dumped into a local river. It is harder to develop a scoring method that can compare different types of pollutant — for example does one hundred tonnes of carbon dioxide

Carbon dioxide

Carbon dioxide is a naturally occurring chemical compound composed of two oxygen atoms covalently bonded to a single carbon atom...

emitted to the air cause more or less damage (via climate change

Climate change

Climate change is a significant and lasting change in the statistical distribution of weather patterns over periods ranging from decades to millions of years. It may be a change in average weather conditions or the distribution of events around that average...

) than one tonne of mercury dumped in a river (and poisoning all the fish).

Generally, most environmental economists attempting to create an environmental index would attempt to quantify damage in monetary terms. So one tonne of carbon dioxide might cause $100 worth of damage, whereas one tonne of mercury might cause $50,000 (as it is highly toxic). Companies can therefore be given an 'environmental impact' score, based on the cost they impose on the environment. Quantification of damage in this nature is extremely difficult, as pollutants tend to be market externalities and so have no easily measurable cost by definition.

Innovations Awards to Stock Indices

The William F. Sharpe Indexing Achievement Awards are presented annually in order to recognize the most important contributions to the indexing industry over the preceding year.- Most Innovative Benchmark Index

- 2004 — CBOE S&P 500 BuyWrite Index (BXM)

- 2005 — FTSEFTSEFTSE may refer to:* The FTSE Group* Stock market indices published by the FTSE Group, particularly the FTSE 100 Index on the London Stock Exchange* The Fundamental theorem of software engineering...

/RAFI Fundamental Index SeriesFundamentally based indexesFundamentally based indexes are indices in which stocks are weighted by one of many economic fundamental factors, especially accounting figures which are commonly used when performing corporate valuation, or by a composite of several fundamental factors... - 2006 — Standard and Poor’s Case-Shiller House Prices Indices

- 2007 - CBOE S&P 500 PutWrite Index (PUT)

- Most Innovative ETF

- 2004 — iSharesISharesiShares are a family of exchange-traded funds managed by BlackRock. The first iShares were known as WEBS but were since rebranded.Each iShares fund tracks a bond or stock market index...

MSCI EAFEMSCI EAFEThe MSCI EAFE Index is a stock market index that is designed to measure the equity market performance of developed markets outside of the U.S. & Canada...

(EFA) and Emerging Markets - 2005 — EasyETF GSCI Commodities ETF

- 2006 — PowerShares DB Commodity Index Tracking Fund (DBC) and PowerShares G10 Currency Harvest Fund (DBV)

- 2007 - SPDR DJ Wilshire International Real Estate ETF

- 2004 — iShares

- Most Innovative Index Product

- 2004 — CBOE Volatility Index (VIX) Futures

- 2005 — Options on Vanguard VIPERS at the CBOE

- 2006 — Chicago Board Options ExchangeChicago Board Options ExchangeThe Chicago Board Options Exchange , located at 400 South LaSalle Street in Chicago, is the largest U.S. options exchange with annual trading volume that hovered around one billion contracts at the end of 2007...

Options on the CBOE Volatility Index (VIXVIXVIX is the ticker symbol for the Chicago Board Options Exchange Market Volatility Index, a popular measure of the implied volatility of S&P 500 index options. Often referred to as the fear index or the fear gauge, it represents one measure of the market's expectation of stock market volatility over...

) - 2007 - iPath ETNs

- 2009 - Thomson Reuters Realized Volatility IndexThomson Reuters Realized Volatility IndexThe Thomson Reuters Realized Volatility Index is a newly developed stock market index from Thomson Reuters Indices. It measures and forecasts realized volatility at a variety of time horizons - from one day to several months.- Function :...

- Best Index-related Research Paper

- 2004 — Steven Schoenfeld

- 2005 — Rob Arnott

- 2006 — Eugene F. Fama and Kenneth R. French

- 2007 - Benchmarking Benchmarks: Measuring Characteristic Selectivity, By Kingsley Fong, David R. Gallagher, Adrian Lee, University of New South Wales

- Lifetime Achievement Award

- 2004 — Tim Harbert

- 2005 — William Sharpe and Nathan Most

- 2006 — Burton G. Malkiel and Ronald J. Ryan

- 2007 - John C. Bogle, Paul A. Samuelson, Patricia C. Dunn, William L. Fouse and John A. Prestbo

Lists

- Index of accounting articles

- Index of economics articles

- Index of management articles

- List of stock exchanges

- List of stock market indices

- Outline of financeOutline of financeThe following outline is provided as an overview of and topical guide to finance:Finance – addresses the ways in which individuals, businesses and organizations raise, allocate and use monetary resources over time, taking into account the risks entailed in their projects.- Overview :The word...

- Outline of marketingOutline of marketingThe following outline is provided as an overview of and topical guide to marketing:Marketing refers to the social and managerial processes by which products, services and value are exchanged in order to fulfil individuals' or group's needs and wants...

See also

- Exchange-traded fundExchange-traded fundAn exchange-traded fund is an investment fund traded on stock exchanges, much like stocks. An ETF holds assets such as stocks, commodities, or bonds, and trades close to its net asset value over the course of the trading day. Most ETFs track an index, such as the S&P 500 or MSCI EAFE...

- Index (economics)Index (economics)In economics and finance, an index is a statistical measure of changes in a representative group of individual data points. These data may be derived from any number of sources, including company performance, prices, productivity, and employment. Economic indices track economic health from...

- Index fundIndex fundAn index fund or index tracker is a collective investment scheme that aims to replicate the movements of an index of a specific financial market, or a set of rules of ownership that are held constant, regardless of market conditions.-Tracking:Tracking can be achieved by trying to hold all of the...

- Passive managementPassive managementPassive management is a financial strategy in which an investor invests in accordance with a pre-determined strategy that doesn't entail any forecasting...

External links

- Stock Index Profile at Wikinvest