Federal Reserve Bank

Encyclopedia

Federal Reserve System

The Federal Reserve System is the central banking system of the United States. It was created on December 23, 1913 with the enactment of the Federal Reserve Act, largely in response to a series of financial panics, particularly a severe panic in 1907...

, the central bank

Central bank

A central bank, reserve bank, or monetary authority is a public institution that usually issues the currency, regulates the money supply, and controls the interest rates in a country. Central banks often also oversee the commercial banking system of their respective countries...

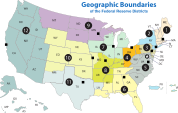

ing system of the United States. The twelve federal reserve banks together divide the nation into twelve Federal Reserve Districts, the twelve banking districts created by the Federal Reserve Act

Federal Reserve Act

The Federal Reserve Act is an Act of Congress that created and set up the Federal Reserve System, the central banking system of the United States of America, and granted it the legal authority to issue Federal Reserve Notes and Federal Reserve Bank Notes as legal tender...

of 1913. The twelve Federal Reserve Banks are jointly responsible for implementing the monetary policy

Monetary policy

Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting a rate of interest for the purpose of promoting economic growth and stability. The official goals usually include relatively stable prices and low unemployment...

set by the Federal Open Market Committee

Federal Open Market Committee

The Federal Open Market Committee , a committee within the Federal Reserve System, is charged under United States law with overseeing the nation's open market operations . It is the Federal Reserve committee that makes key decisions about interest rates and the growth of the United States money...

. Each federal reserve bank is also responsible for the regulation of the commercial banks within its own particular district.

History

Alexander HamiltonAlexander Hamilton

Alexander Hamilton was a Founding Father, soldier, economist, political philosopher, one of America's first constitutional lawyers and the first United States Secretary of the Treasury...

, the first Secretary of Treasury, started a movement advocating the creation of a central bank. The Bank Bill created by Alexander Hamilton was a proposal to institute a National Bank, in order to improve the economic stability of the nation after its independence from Britain. Although the national bank was to be used as a tool for the government, it was to be privately owned. Hamilton wrote several articles providing information regarding his national bank idea. The articles expressed the validity and "would be" success of the national bank based upon: incentives for the rich to invest, ownerships of bonds and shares, rooted in fiscal management, and stable monetary system.

In response to this, the First Bank of the United States was established in 1791, its charter signed by George Washington. The First Bank of the United States

First Bank of the United States

The First Bank of the United States is a National Historic Landmark located in Philadelphia, Pennsylvania within Independence National Historical Park.-Banking History:...

was headquartered in Philadelphia, but had branches in other major cities. The Bank performed the basic banking functions of accepting deposits, issuing bank notes, making loans and purchasing securities.

When its charter expired twenty years later, the US was without a central bank for a few years, during which it suffered an unusual inflation. In 1816, James Madison signed the Second Bank of the United States

Second Bank of the United States

The Second Bank of the United States was chartered in 1816, five years after the First Bank of the United States lost its own charter. The Second Bank of the United States was initially headquartered in Carpenters' Hall, Philadelphia, the same as the First Bank, and had branches throughout the...

into existence. When that bank's charter expired, the United States went without a central bank for forty years.

Then, in 1873, Congress nationalized money for the first time, imposing what was effectively a gold standard, in the place of the bimetallic standard set in place by the Founders. The Coinage Act of 1873 set off a cycle of growth and depression/panic

Bank run

A bank run occurs when a large number of bank customers withdraw their deposits because they believe the bank is, or might become, insolvent...

that came to be known as the "business cycle". One such crisis, the Panic of 1907

Panic of 1907

The Panic of 1907, also known as the 1907 Bankers' Panic, was a financial crisis that occurred in the United States when the New York Stock Exchange fell almost 50% from its peak the previous year. Panic occurred, as this was during a time of economic recession, and there were numerous runs on...

, was headed off by a private conglomerate, who set themselves up as "lenders of last resort" to banks in trouble. This effort succeeded in stopping the panic, and led to calls for a Federal agency to do the same thing.

In response to this, the Federal Reserve System

Federal Reserve System

The Federal Reserve System is the central banking system of the United States. It was created on December 23, 1913 with the enactment of the Federal Reserve Act, largely in response to a series of financial panics, particularly a severe panic in 1907...

was created by the Federal Reserve Act

Federal Reserve Act

The Federal Reserve Act is an Act of Congress that created and set up the Federal Reserve System, the central banking system of the United States of America, and granted it the legal authority to issue Federal Reserve Notes and Federal Reserve Bank Notes as legal tender...

of 1913, establishing a new central bank intended to serve as a formal "lender of last resort" to banks in times of liquidity crisis—panics where depositors tried to withdraw their money faster than a bank could pay it out.

The legislation provided for a system that included a number of regional Federal Reserve Banks and a seven-member governing board. All national banks were required to join the system and other banks could join. The Federal Reserve Banks opened for business in November 1914. Congress created Federal Reserve notes to provide the nation with an elastic supply of currency. The notes were to be issued to Federal Reserve Banks for subsequent transmittal to banking institutions in accordance with the needs of the public.

Legal status

The twelve regional Federal Reserve Banks were established as the operating arms of the nation's central banking systemFederal Banking

Federal banking is the term for the way the Federal Reserve distributes its money. The Reserve operates twelve banking districts around the country which oversee money distribution within their respective districts...

. They are organized much like private corporations—possibly leading to some confusion about ownership.

The Federal Reserve Banks have an intermediate legal status, with some features of private corporations and some features of public federal agencies. The United States has an interest in the Federal Reserve Banks as tax-exempt federally-created instrumentalities whose profits belong to the federal government, but this interest is not proprietary. In Lewis v. United States, the United States Court of Appeals for the Ninth Circuit

United States Court of Appeals for the Ninth Circuit

The United States Court of Appeals for the Ninth Circuit is a U.S. federal court with appellate jurisdiction over the district courts in the following districts:* District of Alaska* District of Arizona...

stated that: "The Reserve Banks are not federal instrumentalities for purposes of the FTCA [the Federal Tort Claims Act

Federal Tort Claims Act

The Federal Tort Claims Act or "FTCA", , is a statute enacted by the United States Congress in 1948. "Federal Tort Claims Act" was also previously the official short title passed by the Seventy-ninth Congress on August 2, 1946 as Title IV of the Legislative Reorganization Act, 60 Stat...

], but are independent, privately owned and locally controlled corporations." The opinion went on to say, however, that: "The Reserve Banks have properly been held to be federal instrumentalities for some purposes." Another relevant decision is Scott v. Federal Reserve Bank of Kansas City, in which the distinction is made between Federal Reserve Banks, which are federally-created instrumentalities, and the Board of Governors, which is a federal agency.

Function

The Federal Reserve SystemFederal Reserve System

The Federal Reserve System is the central banking system of the United States. It was created on December 23, 1913 with the enactment of the Federal Reserve Act, largely in response to a series of financial panics, particularly a severe panic in 1907...

provides the government with a ready source of loans, it is also the safe depository for federal monies. The Federal Reserve is also a low cost mechanism for transferring funds and it is an inexpensive agent for meeting payments on the national debt and government salaries. The Federal Reserve Banks were created as instrumentalities to carry out the policies of the Federal Reserve System.

The Federal Reserve Banks issue shares of stock

Stock

The capital stock of a business entity represents the original capital paid into or invested in the business by its founders. It serves as a security for the creditors of a business since it cannot be withdrawn to the detriment of the creditors...

to member banks. However, owning Federal Reserve Bank stock is quite different from owning stock in a private company. The Federal Reserve Banks are not operated for profit, and ownership of a certain amount of stock is, by law, a condition of membership in the system. The stock may not be sold or traded or pledged as security for a loan

Loan

A loan is a type of debt. Like all debt instruments, a loan entails the redistribution of financial assets over time, between the lender and the borrower....

; dividends are, by law, limited to 6% per year.

The dividends paid to member banks are considered partial compensation for the lack of interest paid on member banks' required reserves held at the Federal Reserve. By law, banks in the United States must maintain fractional reserves, most of which are kept on account at the Federal Reserve. Historically, the Federal Reserve did not pay interest on these funds. The Federal Reserve now has authority, granted by Congress in the Emergency Economic Stabilization Act (EESA) of 2008, to pay interest on these funds.

A major responsibility of The Federal Reserve is to oversee their banking and financial systems. Overseeing the banking and financial systems of a bank is crucial in a society.

Finances

Each Federal Reserve Bank funds its own operations, primarily from interest on its loans and on the securities it holds. Expenses and dividends paid are typically a small fraction of a Federal Reserve Bank's income each year. The remainder is deposited to the Treasury as interest on outstanding Federal Reserve Notes.The Federal Reserve Banks conduct ongoing internal audit

Financial audit

A financial audit, or more accurately, an audit of financial statements, is the verification of the financial statements of a legal entity, with a view to express an audit opinion...

s of their operations to ensure that their accounts are accurate and comply with the Federal Reserve System's accounting principles. The banks are also subject to two types of external auditing. Since 1978 the Government Accountability Office

Government Accountability Office

The Government Accountability Office is the audit, evaluation, and investigative arm of the United States Congress. It is located in the legislative branch of the United States government.-History:...

(GAO) has conducted regular audits of the banks' operations. The GAO audits are reported to the public, but they may not review a bank's monetary policy decisions or disclose them to the public. Since 1999 each bank has also been required to submit to an annual audit by an external accounting firm, which produces a confidential report to the bank and a summary statement for the bank's annual report. Some members of Congress continue to advocate a more public and intrusive GAO audit of the Federal Reserve System, but Federal Reserve representatives support the existing restrictions to prevent political influence over long-range economic decisions.

Banks

- 1st District (A) - Federal Reserve Bank of BostonFederal Reserve Bank of BostonThe Federal Reserve Bank of Boston, commonly known as the Boston Fed, is responsible for the First District of the Federal Reserve, which covers most of Connecticut , Massachusetts, Maine, New Hampshire, Rhode Island and Vermont. It is headquartered in the Federal Reserve Bank Building in Boston,...

- 2nd District (B) - Federal Reserve Bank of New YorkFederal Reserve Bank of New YorkThe Federal Reserve Bank of New York is one of the 12 Federal Reserve Banks of the United States. It is located at 33 Liberty Street, New York, NY. It is responsible for the Second District of the Federal Reserve System, which encompasses New York state, the 12 northern counties of New Jersey,...

- 3rd District (C) - Federal Reserve Bank of PhiladelphiaFederal Reserve Bank of PhiladelphiaThe Federal Reserve Bank of Philadelphia, headquartered in Philadelphia, Pennsylvania, is responsible for the Third District of the Federal Reserve, which covers eastern Pennsylvania, the 9 southern counties of New Jersey, and Delaware...

- 4th District (D) - Federal Reserve Bank of ClevelandFederal Reserve Bank of ClevelandThe Federal Reserve Bank of Cleveland is the Cleveland-based headquarters of the U.S. Federal Reserve System's Fourth District. The district is composed of Ohio, western Pennsylvania, eastern Kentucky, and the northern panhandle of West Virginia. It has branch offices in Cincinnati and Pittsburgh....

, with branches in Cincinnati, Ohio and Pittsburgh, Pennsylvania - 5th District (E) - Federal Reserve Bank of RichmondFederal Reserve Bank of RichmondThe Federal Reserve Bank of Richmond is the headquarters of the Fifth District of the Federal Reserve located in Richmond, Virginia. It covers the District of Columbia, Maryland, Virginia, North Carolina, South Carolina and most of West Virginia. Branch offices are located in Baltimore, Maryland...

, with branches in Baltimore, MarylandBaltimoreBaltimore is the largest independent city in the United States and the largest city and cultural center of the US state of Maryland. The city is located in central Maryland along the tidal portion of the Patapsco River, an arm of the Chesapeake Bay. Baltimore is sometimes referred to as Baltimore...

and Charlotte, North CarolinaCharlotte, North CarolinaCharlotte is the largest city in the U.S. state of North Carolina and the seat of Mecklenburg County. In 2010, Charlotte's population according to the US Census Bureau was 731,424, making it the 17th largest city in the United States based on population. The Charlotte metropolitan area had a 2009... - 6th District (F) - Federal Reserve Bank of AtlantaFederal Reserve Bank of AtlantaThe Federal Reserve Bank of Atlanta is responsible for the sixth district, which covers the states of Alabama, Florida, and Georgia, 74 counties in the eastern two-thirds of...

, with branches in Birmingham, AlabamaBirmingham, AlabamaBirmingham is the largest city in Alabama. The city is the county seat of Jefferson County. According to the 2010 United States Census, Birmingham had a population of 212,237. The Birmingham-Hoover Metropolitan Area, in estimate by the U.S...

; Jacksonville, FloridaJacksonville, FloridaJacksonville is the largest city in the U.S. state of Florida in terms of both population and land area, and the largest city by area in the contiguous United States. It is the county seat of Duval County, with which the city government consolidated in 1968...

; Miami, Florida; Nashville, TennesseeNashville, TennesseeNashville is the capital of the U.S. state of Tennessee and the county seat of Davidson County. It is located on the Cumberland River in Davidson County, in the north-central part of the state. The city is a center for the health care, publishing, banking and transportation industries, and is home...

; and New Orleans, Louisiana - 7th District (G) - Federal Reserve Bank of ChicagoFederal Reserve Bank of ChicagoThe Federal Reserve Bank of Chicago is one of twelve regional Reserve Banks that, along with the Board of Governors in Washington, D.C., make up the nation's central bank....

, with a branch in Detroit, Michigan - 8th District (H) - Federal Reserve Bank of St. Louis, with branches in Little Rock, ArkansasLittle Rock, ArkansasLittle Rock is the capital and the largest city of the U.S. state of Arkansas. The Metropolitan Statistical Area had a population of 699,757 people in the 2010 census...

; Louisville, KentuckyLouisville, KentuckyLouisville is the largest city in the U.S. state of Kentucky, and the county seat of Jefferson County. Since 2003, the city's borders have been coterminous with those of the county because of a city-county merger. The city's population at the 2010 census was 741,096...

; and Memphis, TennesseeMemphis, TennesseeMemphis is a city in the southwestern corner of the U.S. state of Tennessee, and the county seat of Shelby County. The city is located on the 4th Chickasaw Bluff, south of the confluence of the Wolf and Mississippi rivers.... - 9th District (I) - Federal Reserve Bank of MinneapolisFederal Reserve Bank of MinneapolisThe Federal Reserve Bank of Minneapolis, located in Minneapolis, Minnesota, in the United States, covers the 9th District of the Federal Reserve, including Minnesota, Montana, North and South Dakota, northwestern Wisconsin, and the Upper Peninsula of Michigan...

, with a branch in Helena, MontanaHelena, MontanaHelena is the capital city of the U.S. state of Montana and the county seat of Lewis and Clark County. The 2010 census put the population at 28,180. The local daily newspaper is the Independent Record. The Helena Brewers minor league baseball and Helena Bighorns minor league hockey team call the... - 10th District (J) - Federal Reserve Bank of Kansas CityFederal Reserve Bank of Kansas CityThe Federal Reserve Bank of Kansas City covers the 10th District of the Federal Reserve, which includes Colorado, Kansas, Nebraska, Oklahoma, Wyoming, and portions of western Missouri and northern New Mexico. The Bank has branches in Denver, Oklahoma City, and Omaha. The current president is...

, with branches in Denver, Colorado; Oklahoma City, OklahomaOklahoma cityOklahoma City is the capital and largest city of the U.S. state of Oklahoma.Oklahoma City may also refer to:*Oklahoma City metropolitan area*Downtown Oklahoma City*Uptown Oklahoma City*Oklahoma City bombing*Oklahoma City National Memorial...

; and Omaha, NebraskaOmaha, NebraskaOmaha is the largest city in the state of Nebraska, United States, and is the county seat of Douglas County. It is located in the Midwestern United States on the Missouri River, about 20 miles north of the mouth of the Platte River... - 11th District (K) - Federal Reserve Bank of DallasFederal Reserve Bank of DallasThe Federal Reserve Bank of Dallas covers the Eleventh Federal Reserve District, which includes Texas, northern Louisiana and southern New Mexico....

, with branches in El Paso, TexasEl Paso, TexasEl Paso, is a city in and the county seat of El Paso County, Texas, United States, and lies in far West Texas. In the 2010 census, the city had a population of 649,121. It is the sixth largest city in Texas and the 19th largest city in the United States...

; Houston, Texas; and San Antonio, Texas - 12th District (L) - Federal Reserve Bank of San FranciscoFederal Reserve Bank of San FranciscoThe Federal Reserve Bank of San Francisco is the federal bank for the twelfth district in the United States. The twelfth district is made up of nine western states-—Alaska, Arizona, California, Hawaii, Idaho, Nevada, Oregon, Utah, and Washington--plus the Northern Mariana Islands, American Samoa,...

, with branches in Los Angeles, California; Portland, OregonPortland, OregonPortland is a city located in the Pacific Northwest, near the confluence of the Willamette and Columbia rivers in the U.S. state of Oregon. As of the 2010 Census, it had a population of 583,776, making it the 29th most populous city in the United States...

; Salt Lake City, Utah; and Seattle, Washington

The New York Federal Reserve district is the largest by asset value. San Francisco, followed by Kansas City and Minneapolis, represent the largest geographical districts. Missouri

Missouri

Missouri is a US state located in the Midwestern United States, bordered by Iowa, Illinois, Kentucky, Tennessee, Arkansas, Oklahoma, Kansas and Nebraska. With a 2010 population of 5,988,927, Missouri is the 18th most populous state in the nation and the fifth most populous in the Midwest. It...

is the only state to have two Federal Reserve Banks (Kansas City and St. Louis). California, Missouri

Missouri

Missouri is a US state located in the Midwestern United States, bordered by Iowa, Illinois, Kentucky, Tennessee, Arkansas, Oklahoma, Kansas and Nebraska. With a 2010 population of 5,988,927, Missouri is the 18th most populous state in the nation and the fifth most populous in the Midwest. It...

, Ohio

Ohio

Ohio is a Midwestern state in the United States. The 34th largest state by area in the U.S.,it is the 7th‑most populous with over 11.5 million residents, containing several major American cities and seven metropolitan areas with populations of 500,000 or more.The state's capital is Columbus...

, Pennsylvania

Pennsylvania

The Commonwealth of Pennsylvania is a U.S. state that is located in the Northeastern and Mid-Atlantic regions of the United States. The state borders Delaware and Maryland to the south, West Virginia to the southwest, Ohio to the west, New York and Ontario, Canada, to the north, and New Jersey to...

, and Tennessee

Tennessee

Tennessee is a U.S. state located in the Southeastern United States. It has a population of 6,346,105, making it the nation's 17th-largest state by population, and covers , making it the 36th-largest by total land area...

are the only states which have two Federal Reserve Bank branches seated within their states, with Missouri, Pennsylvania, and Tennessee having branches of two different districts within the same state. In the 12th District, the Seattle Branch serves Alaska, and the San Francisco Bank serves Hawaii. New York, Richmond, and San Francisco are the only banks that oversee non-U.S. state

U.S. state

A U.S. state is any one of the 50 federated states of the United States of America that share sovereignty with the federal government. Because of this shared sovereignty, an American is a citizen both of the federal entity and of his or her state of domicile. Four states use the official title of...

territories. The System serves these territories as follows: the New York Bank serves the Commonwealth of Puerto Rico and the U.S. Virgin Islands; the Richmond Bank serves the District of Columbia; the San Francisco Bank serves American Samoa, Guam, and the Commonwealth of the Northern Mariana Islands. The Board of Governors last revised the branch boundaries of the System in February 1996.

Assets

| Federal Reserve Bank | Total assets (09/15/2010) |

|---|---|

| All banks | $2.299T |

| New York Federal Reserve Bank of New York The Federal Reserve Bank of New York is one of the 12 Federal Reserve Banks of the United States. It is located at 33 Liberty Street, New York, NY. It is responsible for the Second District of the Federal Reserve System, which encompasses New York state, the 12 northern counties of New Jersey,... |

$1.106T |

| Richmond Federal Reserve Bank of Richmond The Federal Reserve Bank of Richmond is the headquarters of the Fifth District of the Federal Reserve located in Richmond, Virginia. It covers the District of Columbia, Maryland, Virginia, North Carolina, South Carolina and most of West Virginia. Branch offices are located in Baltimore, Maryland... |

$257B |

| San Francisco Federal Reserve Bank of San Francisco The Federal Reserve Bank of San Francisco is the federal bank for the twelfth district in the United States. The twelfth district is made up of nine western states-—Alaska, Arizona, California, Hawaii, Idaho, Nevada, Oregon, Utah, and Washington--plus the Northern Mariana Islands, American Samoa,... |

$224B |

| Atlanta Federal Reserve Bank of Atlanta The Federal Reserve Bank of Atlanta is responsible for the sixth district, which covers the states of Alabama, Florida, and Georgia, 74 counties in the eastern two-thirds of... |

$162B |

| Chicago Federal Reserve Bank of Chicago The Federal Reserve Bank of Chicago is one of twelve regional Reserve Banks that, along with the Board of Governors in Washington, D.C., make up the nation's central bank.... |

$124B |

| Dallas Federal Reserve Bank of Dallas The Federal Reserve Bank of Dallas covers the Eleventh Federal Reserve District, which includes Texas, northern Louisiana and southern New Mexico.... |

$88B |

| Philadelphia Federal Reserve Bank of Philadelphia The Federal Reserve Bank of Philadelphia, headquartered in Philadelphia, Pennsylvania, is responsible for the Third District of the Federal Reserve, which covers eastern Pennsylvania, the 9 southern counties of New Jersey, and Delaware... |

$80B |

| Cleveland Federal Reserve Bank of Cleveland The Federal Reserve Bank of Cleveland is the Cleveland-based headquarters of the U.S. Federal Reserve System's Fourth District. The district is composed of Ohio, western Pennsylvania, eastern Kentucky, and the northern panhandle of West Virginia. It has branch offices in Cincinnati and Pittsburgh.... |

$61B |

| Boston Federal Reserve Bank of Boston The Federal Reserve Bank of Boston, commonly known as the Boston Fed, is responsible for the First District of the Federal Reserve, which covers most of Connecticut , Massachusetts, Maine, New Hampshire, Rhode Island and Vermont. It is headquartered in the Federal Reserve Bank Building in Boston,... |

$59B |

| Kansas City Federal Reserve Bank of Kansas City The Federal Reserve Bank of Kansas City covers the 10th District of the Federal Reserve, which includes Colorado, Kansas, Nebraska, Oklahoma, Wyoming, and portions of western Missouri and northern New Mexico. The Bank has branches in Denver, Oklahoma City, and Omaha. The current president is... |

$55B |

| St. Louis | $42B |

| Minneapolis Federal Reserve Bank of Minneapolis The Federal Reserve Bank of Minneapolis, located in Minneapolis, Minnesota, in the United States, covers the 9th District of the Federal Reserve, including Minnesota, Montana, North and South Dakota, northwestern Wisconsin, and the Upper Peninsula of Michigan... |

$41B |

See also

- Federal Reserve SystemFederal Reserve SystemThe Federal Reserve System is the central banking system of the United States. It was created on December 23, 1913 with the enactment of the Federal Reserve Act, largely in response to a series of financial panics, particularly a severe panic in 1907...

- Federal Reserve ActFederal Reserve ActThe Federal Reserve Act is an Act of Congress that created and set up the Federal Reserve System, the central banking system of the United States of America, and granted it the legal authority to issue Federal Reserve Notes and Federal Reserve Bank Notes as legal tender...

- Federal Reserve BranchesFederal Reserve BranchesThere are 24 Federal Reserve Branches. As late as 2008, there were 25 branches, but in October 2008 the Federal Reserve Bank of New York Buffalo Branch was closed.List of Federal Reserve Branches* Boston* New York...

- List of regions of the United States#Federal Reserve banks