Value at risk

Encyclopedia

In financial mathematics and financial risk management

, Value at Risk (VaR) is a widely used risk measure

of the risk of loss

on a specific portfolio

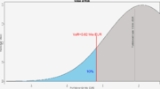

of financial assets. For a given portfolio, probability

and time horizon, VaR is defined as a threshold value such that the probability that the mark-to-market loss on the portfolio over the given time horizon exceeds this value (assuming normal markets and no trading in the portfolio) is the given probability level.

For example, if a portfolio of stocks has a one-day 5% VaR of $1 million, there is a 0.05 probability that the portfolio will fall in value by more than $1 million over a one day period if there is no trading. Informally, a loss of $1 million or more on this portfolio is expected on 1 day in 20. A loss which exceeds the VaR threshold is termed a “VaR break.” Thus, VaR is a piece of jargon favored in the financial world for a percentile

of the predictive probability distribution

for the size of a future financial loss.

VaR has five main uses in finance

: risk management

, risk measurement, financial control

, financial reporting

and computing regulatory capital

. VaR is sometimes used in non-financial applications as well.

Important related ideas are economic capital

, backtesting

, stress testing

, expected shortfall

, and tail conditional expectation.

The reason for assuming normal markets and no trading, and to restricting loss to things measured in daily accounts

, is to make the loss observable

. In some extreme financial events it can be impossible to determine losses, either because market prices are unavailable or because the loss-bearing institution breaks up. Some longer-term consequences of disasters, such as lawsuits, loss of market confidence and employee morale and impairment of brand names can take a long time to play out, and may be hard to allocate among specific prior decisions. VaR marks the boundary between normal days and extreme events. Institutions can lose far more than the VaR amount; all that can be said is that they will not do so very often.

The probability level is about equally often specified as one minus the probability of a VaR break, so that the VaR in the example above would be called a one-day 95% VaR instead of one-day 5% VaR. This generally does not lead to confusion because the probability of VaR breaks is almost always small, certainly less than 0.5.

Although it virtually always represents a loss, VaR is conventionally reported as a positive number. A negative VaR would imply the portfolio has a high probability of making a profit, for example a one-day 5% VaR of negative $1 million implies the portfolio has a 5% chance of making more than $1 million over the next day.

Another inconsistency is VaR is sometimes taken to refer to profit-and-loss at the end of the period, and sometimes as the maximum loss at any point during the period. The original definition was the latter, but in the early 1990s when VaR was aggregated across trading desks and time zones, end-of-day valuation was the only reliable number so the former became the de facto definition. As people began using multiday VaRs in the second half of the 1990s they almost always estimated the distribution at the end of the period only. It is also easier theoretically to deal with a point-in-time estimate versus a maximum over an interval. Therefore the end-of-period definition is the most common both in theory and practice today.

; it specifies a property

VaR must have, but not how to compute VaR. Moreover, there is wide scope for interpretation in the definition. This has led to two broad types of VaR, one used primarily in risk management

and the other primarily for risk measurement. The distinction is not sharp, however, and hybrid versions are typically used in financial control

, financial reporting

and computing regulatory capital

.

To a risk manager, VaR is a system, not a number. The system is run periodically (usually daily) and the published number is compared to the computed price movement in opening positions over the time horizon. There is never any subsequent adjustment to the published VaR, and there is no distinction between VaR breaks caused by input errors (including Information Technology

breakdowns, fraud

and rogue trading

), computation errors (including failure to produce a VaR on time) and market movements.

A frequentist

claim is made, that the long-term frequency of VaR breaks will equal the specified probability, within the limits of sampling error, and that the VaR breaks will be independent

in time and independent

of the level of VaR. This claim is validated by a backtest

, a comparison of published VaRs to actual price movements. In this interpretation, many different systems could produce VaRs with equally good backtests

, but wide disagreements on daily VaR values.

For risk measurement a number is needed, not a system. A Bayesian probability

claim is made, that given the information and beliefs at the time, the subjective probability

of a VaR break was the specified level. VaR is adjusted after the fact to correct errors in inputs and computation, but not to incorporate information unavailable at the time of computation. In this context, “backtest

” has a different meaning. Rather than comparing published VaRs to actual market movements over the period of time the system has been in operation, VaR is retroactively computed on scrubbed data over as long a period as data are available and deemed relevant. The same position data and pricing models are used for computing the VaR as determining the price movements.

Although some of the sources listed here treat only one kind of VaR as legitimate, most of the recent ones seem to agree that risk management VaR is superior for making short-term and tactical decisions today, while risk measurement VaR should be used for understanding the past, and making medium term and strategic decisions for the future. When VaR is used for financial control

or financial reporting

it should incorporate elements of both. For example, if a trading desk

is held to a VaR limit, that is both a risk-management rule for deciding what risks to allow today, and an input into the risk measurement computation of the desk’s

risk-adjusted return at the end of the reporting period.

the VaR of the portfolio at the confidence level

the VaR of the portfolio at the confidence level  is given by the smallest number

is given by the smallest number  such that the probability that the loss

such that the probability that the loss  exceeds

exceeds  is not larger than

is not larger than  "

"

The left equality is a definition of VaR. The right equality assumes an underlying probability distribution, which makes it true only for parametric VaR. Risk managers typically assume that some fraction of the bad events will have undefined losses, either because markets are closed or illiquid, or because the entity bearing the loss breaks apart or loses the ability to compute accounts. Therefore, they do not accept results based on the assumption of a well-defined probability distribution. Nassim Taleb

has labeled this assumption, "charlatanism." On the other hand, many academics prefer to assume a well-defined distribution, albeit usually one with fat tails

. This point has probably caused more contention among VaR theorists than any other.

and a risk metric. This sometimes leads to confusion. Sources earlier than 1995 usually emphasize the risk measure, later sources are more likely to emphasize the metric.

The VaR risk measure defines risk as mark-to-market loss on a fixed portfolio over a fixed time horizon, assuming normal markets. There are many alternative risk measures in finance. Instead of mark-to-market, which uses market prices to define loss, loss is often defined as change in fundamental value

. For example, if an institution holds a loan

that declines in market price because interest

rates go up, but has no change in cash flows or credit quality, some systems do not recognize a loss. Or we could try to incorporate the economic

cost of things not measured in daily financial statements

, such as loss of market confidence or employee morale, impairment of brand names or lawsuits.

Rather than assuming a fixed portfolio over a fixed time horizon, some risk measures incorporate the effect of expected trading (such as a stop loss order

) and consider the expected holding period of positions. Finally, some risk measures adjust for the possible effects of abnormal markets, rather than excluding them from the computation.

The VaR risk metric summarizes the distribution

of possible losses by a quantile

, a point with a specified probability of greater losses. Common alternative metrics are standard deviation

, mean absolute deviation

, expected shortfall

and downside risk

.

Publishing a daily number, on-time and with specified statistical

properties holds every part of a trading organization to a high objective standard. Robust backup systems and default assumptions must be implemented. Positions that are reported, modeled or priced incorrectly stand out, as do data feeds that are inaccurate or late and systems that are too-frequently down. Anything that affects profit and loss that is left out of other reports will show up either in inflated VaR or excessive VaR breaks. “A risk-taking institution that does not compute VaR might escape disaster, but an institution that cannot compute VaR will not.”

The second claimed benefit of VaR is that it separates risk into two regime

s. Inside the VaR limit, conventional statistical methods are reliable. Relatively short-term and specific data can be used for analysis. Probability estimates are meaningful, because there are enough data to test them. In a sense, there is no true risk because you have a sum of many independent

observations with a left bound on the outcome. A casino doesn't worry about whether red or black will come up on the next roulette spin. Risk managers encourage productive risk-taking in this regime, because there is little true cost. People tend to worry too much about these risks, because they happen frequently, and not enough about what might happen on the worst days.

Outside the VaR limit, all bets are off. Risk should be analyzed with stress testing

based on long-term and broad market data. Probability statements are no longer meaningful. Knowing the distribution of losses beyond the VaR point is both impossible and useless. The risk manager should concentrate instead on making sure good plans are in place to limit the loss if possible, and to survive the loss if not.

One specific system uses three regimes.

"A risk manager has two jobs: make people take more risk the 99% of the time it is safe to do so, and survive the other 1% of the time. VaR is the border."

for a fixed income

portfolio

or beta for an equity

business. These cannot be combined in a meaningful way. It is also difficult to aggregate results available at different times, such as positions marked in different time zone

s, or a high frequency trading desk with a business holding relatively illiquid

positions. But since every business contributes to profit and loss in an additive

fashion, and many financial

businesses mark-to-market daily, it is natural to define firm-wide risk using the distribution of possible losses at a fixed point in the future.

In risk measurement, VaR is usually reported alongside other risk metrics such as standard deviation

, expected shortfall

and “greeks

” (partial derivative

s of portfolio value with respect to market factors). VaR is a distribution-free

metric, that is it does not depend on assumptions about the probability distribution of future gains and losses. The probability level is chosen deep enough in the left tail of the loss distribution to be relevant for risk decisions, but not so deep as to be difficult to estimate with accuracy.

VaR can be estimated either parametrically (for example, variance

-covariance

VaR or delta-gamma VaR) or nonparametrically (for examples, historical simulation

VaR or resampled

VaR). Nonparametric methods of VaR estimation are discussed in Markovich and Novak .

, economics

and finance

. Financial risk management has been a concern of regulators and financial executives for a long time as well. Retrospective analysis has found some VaR-like concepts in this history. But VaR did not emerge as a distinct concept until the late 1980s. The triggering event was the stock market crash of 1987

. This was the first major financial crisis in which a lot of academically-trained quants

were in high enough positions to worry about firm-wide survival.

The crash was so unlikely given standard statistical models, that it called the entire basis of quant

finance into question. A reconsideration of history led some quants to decide there were recurring crises, about one or two per decade, that overwhelmed the statistical assumptions embedded in models used for trading

, investment management

and derivative

pricing. These affected many markets at once, including ones that were usually not correlated

, and seldom had discernible economic cause or warning (although after-the-fact explanations were plentiful). Much later, they were named "Black Swans

" by Nassim Taleb and the concept extended far beyond finance

.

If these events were included in quantitative analysis they dominated results and led to strategies that did not work day to day. If these events were excluded, the profits made in between "Black Swans" could be much smaller than the losses suffered in the crisis. Institutions could fail as a result.

VaR was developed as a systematic way to segregate extreme events, which are studied qualitatively over long-term history and broad market events, from everyday price movements, which are studied quantitatively using short-term data in specific markets. It was hoped that "Black Swans" would be preceded by increases in estimated VaR or increased frequency of VaR breaks, in at least some markets. The extent to which this has proven to be true is controversial.

Abnormal markets and trading were excluded from the VaR estimate in order to make it observable. It is not always possible to define loss if, for example, markets are closed as after 9/11, or severely illiquid, as happened several times in 2008. Losses can also be hard to define if the risk-bearing institution fails or breaks up. A measure that depends on traders taking certain actions, and avoiding other actions, can lead to self reference.

This is risk management VaR. It was well established in quantative trading

groups at several financial institutions, notably Bankers Trust

, before 1990, although neither the name nor the definition had been standardized. There was no effort to aggregate VaRs across trading desks.

The financial events of the early 1990s found many firms in trouble because the same underlying bet had been made at many places in the firm, in non-obvious ways. Since many trading desks already computed risk management VaR, and it was the only common risk measure that could be both defined for all businesses and aggregated without strong assumptions, it was the natural choice for reporting firmwide risk. J. P. Morgan CEO Dennis Weatherstone

famously called for a “4:15 report” that combined all firm risk

on one page, available within 15 minutes of the market close.

Risk measurement VaR was developed for this purpose. Development was most extensive at J. P. Morgan, which published the methodology and gave free access to estimates of the necessary underlying parameters in 1994. This was the first time VaR had been exposed beyond a relatively small group of quants. Two years later, the methodology was spun off into an independent for-profit business now part of RiskMetrics Group.

In 1997, the U.S. Securities and Exchange Commission ruled that public corporations must disclose quantitative information about their derivatives

activity. Major bank

s and dealers chose to implement the rule by including VaR information in the notes to their financial statements

.

Worldwide adoption of the Basel II Accord, beginning in 1999 and nearing completion today, gave further impetus to the use of VaR. VaR is the preferred measure

of market risk

, and concepts similar to VaR are used in other parts of the accord.

More recently David Einhorn and Aaron Brown

debated VaR in Global Association of Risk Professionals Review Einhorn compared VaR to “an airbag that works all the time, except when you have a car accident.” He further charged that VaR:

New York Times

reporter Joe Nocera

wrote an extensive piece Risk Mismanagement on January 4, 2009 discussing the role VaR played in the Financial crisis of 2007-2008. After interviewing risk managers (including several of the ones cited above) the article suggests that VaR was very useful to risk experts, but nevertheless exacerbated the crisis by giving false security to bank executives and regulators. A powerful tool for professional risk managers, VaR is portrayed as both easy to misunderstand, and dangerous when misunderstood.

A common complaint among academics is that VaR is not subadditive. That means the VaR of a combined portfolio can be larger than the sum of the VaRs of its components. To a practising risk manager this makes sense. For example, the average bank branch in the United States is robbed about once every ten years. A single-branch bank has about 0.0004% chance of being robbed on a specific day, so the risk of robbery would not figure into one-day 1% VaR. It would not even be within an order of magnitude of that, so it is in the range where the institution should not worry about it, it should insure against it and take advice from insurers on precautions. The whole point of insurance is to aggregate risks that are beyond individual VaR limits, and bring them into a large enough portfolio to get statistical predictability. It does not pay for a one-branch bank to have a security expert on staff.

As institutions get more branches, the risk of a robbery on a specific day rises to within an order of magnitude of VaR. At that point it makes sense for the institution to run internal stress tests and analyze the risk itself. It will spend less on insurance and more on in-house expertise. For a very large banking institution, robberies are a routine daily occurrence. Losses are part of the daily VaR calculation, and tracked statistically rather than case-by-case. A sizable in-house security department is in charge of prevention and control, the general risk manager just tracks the loss like any other cost of doing business.

As portfolios or institutions get larger, specific risks change from low-probability/low-predictability/high-impact to statistically predictable losses of low individual impact. That means they move from the range of far outside VaR, to be insured, to near outside VaR, to be analyzed case-by-case, to inside VaR, to be treated statistically.

Even VaR supporters generally agree there are common abuses of VaR:

Tools

Financial risk management

Financial risk management is the practice of creating economic value in a firm by using financial instruments to manage exposure to risk, particularly credit risk and market risk. Other types include Foreign exchange, Shape, Volatility, Sector, Liquidity, Inflation risks, etc...

, Value at Risk (VaR) is a widely used risk measure

Risk measure

A Risk measure is used to determine the amount of an asset or set of assets to be kept in reserve. The purpose of this reserve is to make the risks taken by financial institutions, such as banks and insurance companies, acceptable to the regulator...

of the risk of loss

Market risk

Market risk is the risk that the value of a portfolio, either an investment portfolio or a trading portfolio, will decrease due to the change in value of the market risk factors. The four standard market risk factors are stock prices, interest rates, foreign exchange rates, and commodity prices...

on a specific portfolio

Portfolio (finance)

Portfolio is a financial term denoting a collection of investments held by an investment company, hedge fund, financial institution or individual.-Definition:The term portfolio refers to any collection of financial assets such as stocks, bonds and cash...

of financial assets. For a given portfolio, probability

Probability

Probability is ordinarily used to describe an attitude of mind towards some proposition of whose truth we arenot certain. The proposition of interest is usually of the form "Will a specific event occur?" The attitude of mind is of the form "How certain are we that the event will occur?" The...

and time horizon, VaR is defined as a threshold value such that the probability that the mark-to-market loss on the portfolio over the given time horizon exceeds this value (assuming normal markets and no trading in the portfolio) is the given probability level.

For example, if a portfolio of stocks has a one-day 5% VaR of $1 million, there is a 0.05 probability that the portfolio will fall in value by more than $1 million over a one day period if there is no trading. Informally, a loss of $1 million or more on this portfolio is expected on 1 day in 20. A loss which exceeds the VaR threshold is termed a “VaR break.” Thus, VaR is a piece of jargon favored in the financial world for a percentile

Percentile

In statistics, a percentile is the value of a variable below which a certain percent of observations fall. For example, the 20th percentile is the value below which 20 percent of the observations may be found...

of the predictive probability distribution

Probability distribution

In probability theory, a probability mass, probability density, or probability distribution is a function that describes the probability of a random variable taking certain values....

for the size of a future financial loss.

VaR has five main uses in finance

Finance

"Finance" is often defined simply as the management of money or “funds” management Modern finance, however, is a family of business activity that includes the origination, marketing, and management of cash and money surrogates through a variety of capital accounts, instruments, and markets created...

: risk management

Risk management

Risk management is the identification, assessment, and prioritization of risks followed by coordinated and economical application of resources to minimize, monitor, and control the probability and/or impact of unfortunate events or to maximize the realization of opportunities...

, risk measurement, financial control

Comptroller

A comptroller is a management level position responsible for supervising the quality of accounting and financial reporting of an organization.In British government, the Comptroller General or Comptroller and Auditor General is in most countries the external auditor of the budget execution of the...

, financial reporting

Financial statements

A financial statement is a formal record of the financial activities of a business, person, or other entity. In British English—including United Kingdom company law—a financial statement is often referred to as an account, although the term financial statement is also used, particularly by...

and computing regulatory capital

Capital requirement

Capital requirement refers to -The standardized requirements in place for banks and other depository institutions, which determines how much capital is required to be held for a certain level of assets through regulatory agencies such as the Bank for International Settlements, Federal Deposit...

. VaR is sometimes used in non-financial applications as well.

Important related ideas are economic capital

Economic capital

-Finance and Economics:In financial services firms, economic capital can be thought of as the capital level shareholders would choose in absence of capital regulation....

, backtesting

Backtesting

Backtesting is the process of evaluating a strategy, theory, or model by applying it to historical data. Backtesting can be used in situations like studying how a trading method would have performed in past stock markets or how a model of climate and weather patterns would have matched past...

, stress testing

Stress testing

Stress testing is a form of testing that is used to determine the stability of a given system or entity. It involves testing beyond normal operational capacity, often to a breaking point, in order to observe the results...

, expected shortfall

Expected shortfall

Expected shortfall is a risk measure, a concept used in finance to evaluate the market risk or credit risk of a portfolio. It is an alternative to value at risk that is more sensitive to the shape of the loss distribution in the tail of the distribution...

, and tail conditional expectation.

Details

Common parameters for VaR are 1% and 5% probabilities and one day and two week horizons, although other combinations are in use.The reason for assuming normal markets and no trading, and to restricting loss to things measured in daily accounts

Financial statements

A financial statement is a formal record of the financial activities of a business, person, or other entity. In British English—including United Kingdom company law—a financial statement is often referred to as an account, although the term financial statement is also used, particularly by...

, is to make the loss observable

Observability

Observability, in control theory, is a measure for how well internal states of a system can be inferred by knowledge of its external outputs. The observability and controllability of a system are mathematical duals. The concept of observability was introduced by American-Hungarian scientist Rudolf E...

. In some extreme financial events it can be impossible to determine losses, either because market prices are unavailable or because the loss-bearing institution breaks up. Some longer-term consequences of disasters, such as lawsuits, loss of market confidence and employee morale and impairment of brand names can take a long time to play out, and may be hard to allocate among specific prior decisions. VaR marks the boundary between normal days and extreme events. Institutions can lose far more than the VaR amount; all that can be said is that they will not do so very often.

The probability level is about equally often specified as one minus the probability of a VaR break, so that the VaR in the example above would be called a one-day 95% VaR instead of one-day 5% VaR. This generally does not lead to confusion because the probability of VaR breaks is almost always small, certainly less than 0.5.

Although it virtually always represents a loss, VaR is conventionally reported as a positive number. A negative VaR would imply the portfolio has a high probability of making a profit, for example a one-day 5% VaR of negative $1 million implies the portfolio has a 5% chance of making more than $1 million over the next day.

Another inconsistency is VaR is sometimes taken to refer to profit-and-loss at the end of the period, and sometimes as the maximum loss at any point during the period. The original definition was the latter, but in the early 1990s when VaR was aggregated across trading desks and time zones, end-of-day valuation was the only reliable number so the former became the de facto definition. As people began using multiday VaRs in the second half of the 1990s they almost always estimated the distribution at the end of the period only. It is also easier theoretically to deal with a point-in-time estimate versus a maximum over an interval. Therefore the end-of-period definition is the most common both in theory and practice today.

Varieties of VaR

The definition of VaR is nonconstructiveConstructive proof

In mathematics, a constructive proof is a method of proof that demonstrates the existence of a mathematical object with certain properties by creating or providing a method for creating such an object...

; it specifies a property

Property (philosophy)

In modern philosophy, logic, and mathematics a property is an attribute of an object; a red object is said to have the property of redness. The property may be considered a form of object in its own right, able to possess other properties. A property however differs from individual objects in that...

VaR must have, but not how to compute VaR. Moreover, there is wide scope for interpretation in the definition. This has led to two broad types of VaR, one used primarily in risk management

Risk management

Risk management is the identification, assessment, and prioritization of risks followed by coordinated and economical application of resources to minimize, monitor, and control the probability and/or impact of unfortunate events or to maximize the realization of opportunities...

and the other primarily for risk measurement. The distinction is not sharp, however, and hybrid versions are typically used in financial control

Comptroller

A comptroller is a management level position responsible for supervising the quality of accounting and financial reporting of an organization.In British government, the Comptroller General or Comptroller and Auditor General is in most countries the external auditor of the budget execution of the...

, financial reporting

Financial statements

A financial statement is a formal record of the financial activities of a business, person, or other entity. In British English—including United Kingdom company law—a financial statement is often referred to as an account, although the term financial statement is also used, particularly by...

and computing regulatory capital

Capital requirement

Capital requirement refers to -The standardized requirements in place for banks and other depository institutions, which determines how much capital is required to be held for a certain level of assets through regulatory agencies such as the Bank for International Settlements, Federal Deposit...

.

To a risk manager, VaR is a system, not a number. The system is run periodically (usually daily) and the published number is compared to the computed price movement in opening positions over the time horizon. There is never any subsequent adjustment to the published VaR, and there is no distinction between VaR breaks caused by input errors (including Information Technology

Information technology

Information technology is the acquisition, processing, storage and dissemination of vocal, pictorial, textual and numerical information by a microelectronics-based combination of computing and telecommunications...

breakdowns, fraud

Fraud

In criminal law, a fraud is an intentional deception made for personal gain or to damage another individual; the related adjective is fraudulent. The specific legal definition varies by legal jurisdiction. Fraud is a crime, and also a civil law violation...

and rogue trading

Rogue trader

A rogue trader is an authorised employee making unauthorised trades on behalf of their employer. It is most often applicable to financial trading, and as such is a term used to describe persons - professional traders - making unapproved financial transactions....

), computation errors (including failure to produce a VaR on time) and market movements.

A frequentist

Frequency probability

Frequency probability is the interpretation of probability that defines an event's probability as the limit of its relative frequency in a large number of trials. The development of the frequentist account was motivated by the problems and paradoxes of the previously dominant viewpoint, the...

claim is made, that the long-term frequency of VaR breaks will equal the specified probability, within the limits of sampling error, and that the VaR breaks will be independent

Statistical independence

In probability theory, to say that two events are independent intuitively means that the occurrence of one event makes it neither more nor less probable that the other occurs...

in time and independent

Statistical independence

In probability theory, to say that two events are independent intuitively means that the occurrence of one event makes it neither more nor less probable that the other occurs...

of the level of VaR. This claim is validated by a backtest

Backtesting

Backtesting is the process of evaluating a strategy, theory, or model by applying it to historical data. Backtesting can be used in situations like studying how a trading method would have performed in past stock markets or how a model of climate and weather patterns would have matched past...

, a comparison of published VaRs to actual price movements. In this interpretation, many different systems could produce VaRs with equally good backtests

Backtesting

Backtesting is the process of evaluating a strategy, theory, or model by applying it to historical data. Backtesting can be used in situations like studying how a trading method would have performed in past stock markets or how a model of climate and weather patterns would have matched past...

, but wide disagreements on daily VaR values.

For risk measurement a number is needed, not a system. A Bayesian probability

Bayesian probability

Bayesian probability is one of the different interpretations of the concept of probability and belongs to the category of evidential probabilities. The Bayesian interpretation of probability can be seen as an extension of logic that enables reasoning with propositions, whose truth or falsity is...

claim is made, that given the information and beliefs at the time, the subjective probability

Bayesian probability

Bayesian probability is one of the different interpretations of the concept of probability and belongs to the category of evidential probabilities. The Bayesian interpretation of probability can be seen as an extension of logic that enables reasoning with propositions, whose truth or falsity is...

of a VaR break was the specified level. VaR is adjusted after the fact to correct errors in inputs and computation, but not to incorporate information unavailable at the time of computation. In this context, “backtest

Backtesting

Backtesting is the process of evaluating a strategy, theory, or model by applying it to historical data. Backtesting can be used in situations like studying how a trading method would have performed in past stock markets or how a model of climate and weather patterns would have matched past...

” has a different meaning. Rather than comparing published VaRs to actual market movements over the period of time the system has been in operation, VaR is retroactively computed on scrubbed data over as long a period as data are available and deemed relevant. The same position data and pricing models are used for computing the VaR as determining the price movements.

Although some of the sources listed here treat only one kind of VaR as legitimate, most of the recent ones seem to agree that risk management VaR is superior for making short-term and tactical decisions today, while risk measurement VaR should be used for understanding the past, and making medium term and strategic decisions for the future. When VaR is used for financial control

Comptroller

A comptroller is a management level position responsible for supervising the quality of accounting and financial reporting of an organization.In British government, the Comptroller General or Comptroller and Auditor General is in most countries the external auditor of the budget execution of the...

or financial reporting

Financial statements

A financial statement is a formal record of the financial activities of a business, person, or other entity. In British English—including United Kingdom company law—a financial statement is often referred to as an account, although the term financial statement is also used, particularly by...

it should incorporate elements of both. For example, if a trading desk

Trader (finance)

A trader is someone in finance who buys and sells financial instruments such as stocks, bonds, commodities and derivatives. A broker who simply fills buy or sell orders is not a trader, as they are merely executing instructions given to them. According to the Wall Street Journal in 2004, a managing...

is held to a VaR limit, that is both a risk-management rule for deciding what risks to allow today, and an input into the risk measurement computation of the desk’s

Trader (finance)

A trader is someone in finance who buys and sells financial instruments such as stocks, bonds, commodities and derivatives. A broker who simply fills buy or sell orders is not a trader, as they are merely executing instructions given to them. According to the Wall Street Journal in 2004, a managing...

risk-adjusted return at the end of the reporting period.

VAR in Governance

An interesting takeoff on VaR is its application in Governance for endowments, trusts, and pension plans. Essentially trustees adopt portfolio Values-at-Risk metrics for the entire pooled account and the diversified parts individually managed. Instead of probability estimates they simply define maximum levels of acceptable loss for each. Doing so provides an easy metric for oversight and adds accountability as managers are then directed to manage, but with the additional constraint to avoid losses within a defined risk parameter. VaR utilized in this manner adds relevance as well as an easy to monitor risk measurement control far more intuitive than Standard Deviation of Return. Use of VaR in this context, as well as a worthwhile critique on board governance practices as it relates to investment management oversight in general can be found in 'Best Practices in Governance".Mathematical definition

"Given some confidence level the VaR of the portfolio at the confidence level

the VaR of the portfolio at the confidence level  is given by the smallest number

is given by the smallest number  such that the probability that the loss

such that the probability that the loss  exceeds

exceeds  is not larger than

is not larger than  "

"

The left equality is a definition of VaR. The right equality assumes an underlying probability distribution, which makes it true only for parametric VaR. Risk managers typically assume that some fraction of the bad events will have undefined losses, either because markets are closed or illiquid, or because the entity bearing the loss breaks apart or loses the ability to compute accounts. Therefore, they do not accept results based on the assumption of a well-defined probability distribution. Nassim Taleb

Nassim Taleb

Nassim Nicholas Taleb is a Lebanese American essayist whose work focuses on problems of randomness and probability. His 2007 book The Black Swan was described in a review by Sunday Times as one of the twelve most influential books since World War II....

has labeled this assumption, "charlatanism." On the other hand, many academics prefer to assume a well-defined distribution, albeit usually one with fat tails

Kurtosis

In probability theory and statistics, kurtosis is any measure of the "peakedness" of the probability distribution of a real-valued random variable...

. This point has probably caused more contention among VaR theorists than any other.

Risk measure and risk metric

The term “VaR” is used both for a risk measureMeasure (mathematics)

In mathematical analysis, a measure on a set is a systematic way to assign to each suitable subset a number, intuitively interpreted as the size of the subset. In this sense, a measure is a generalization of the concepts of length, area, and volume...

and a risk metric. This sometimes leads to confusion. Sources earlier than 1995 usually emphasize the risk measure, later sources are more likely to emphasize the metric.

The VaR risk measure defines risk as mark-to-market loss on a fixed portfolio over a fixed time horizon, assuming normal markets. There are many alternative risk measures in finance. Instead of mark-to-market, which uses market prices to define loss, loss is often defined as change in fundamental value

Intrinsic value (finance)

In finance, intrinsic value refers to the value of a security which is intrinsic to or contained in the security itself. It is also frequently called fundamental value. It is ordinarily calculated by summing the future income generated by the asset, and discounting it to the present value...

. For example, if an institution holds a loan

Loan

A loan is a type of debt. Like all debt instruments, a loan entails the redistribution of financial assets over time, between the lender and the borrower....

that declines in market price because interest

Interest

Interest is a fee paid by a borrower of assets to the owner as a form of compensation for the use of the assets. It is most commonly the price paid for the use of borrowed money, or money earned by deposited funds....

rates go up, but has no change in cash flows or credit quality, some systems do not recognize a loss. Or we could try to incorporate the economic

Economics

Economics is the social science that analyzes the production, distribution, and consumption of goods and services. The term economics comes from the Ancient Greek from + , hence "rules of the house"...

cost of things not measured in daily financial statements

Financial statements

A financial statement is a formal record of the financial activities of a business, person, or other entity. In British English—including United Kingdom company law—a financial statement is often referred to as an account, although the term financial statement is also used, particularly by...

, such as loss of market confidence or employee morale, impairment of brand names or lawsuits.

Rather than assuming a fixed portfolio over a fixed time horizon, some risk measures incorporate the effect of expected trading (such as a stop loss order

Order (exchange)

An order in a market such as a stock market, bond market, commodity market or financial derivative market is an instruction from customers to brokers to buy or sell on the exchange.These instructions can be simple or complicated...

) and consider the expected holding period of positions. Finally, some risk measures adjust for the possible effects of abnormal markets, rather than excluding them from the computation.

The VaR risk metric summarizes the distribution

Probability distribution

In probability theory, a probability mass, probability density, or probability distribution is a function that describes the probability of a random variable taking certain values....

of possible losses by a quantile

Quantile function

In probability and statistics, the quantile function of the probability distribution of a random variable specifies, for a given probability, the value which the random variable will be at, or below, with that probability...

, a point with a specified probability of greater losses. Common alternative metrics are standard deviation

Standard deviation

Standard deviation is a widely used measure of variability or diversity used in statistics and probability theory. It shows how much variation or "dispersion" there is from the average...

, mean absolute deviation

Absolute deviation

In statistics, the absolute deviation of an element of a data set is the absolute difference between that element and a given point. Typically the point from which the deviation is measured is a measure of central tendency, most often the median or sometimes the mean of the data set.D_i = |x_i-m|...

, expected shortfall

Expected shortfall

Expected shortfall is a risk measure, a concept used in finance to evaluate the market risk or credit risk of a portfolio. It is an alternative to value at risk that is more sensitive to the shape of the loss distribution in the tail of the distribution...

and downside risk

Sortino ratio

The Sortino ratio measures the risk-adjusted return of an investment asset, portfolio or strategy. It is a modification of the Sharpe ratio but penalizes only those returns falling below a user-specified target, or required rate of return, while the Sharpe ratio penalizes both upside and downside...

.

VaR risk management

Supporters of VaR-based risk management claim the first and possibly greatest benefit of VaR is the improvement in systems and modeling it forces on an institution. In 1997, Philippe Jorion wrote:[T]he greatest benefit of VAR lies in the imposition of a structured methodology for critically thinking about risk. Institutions that go through the process of computing their VAR are forced to confront their exposure to financial risks and to set up a proper risk management function. Thus the process of getting to VAR may be as important as the number itself.

Publishing a daily number, on-time and with specified statistical

Statistics

Statistics is the study of the collection, organization, analysis, and interpretation of data. It deals with all aspects of this, including the planning of data collection in terms of the design of surveys and experiments....

properties holds every part of a trading organization to a high objective standard. Robust backup systems and default assumptions must be implemented. Positions that are reported, modeled or priced incorrectly stand out, as do data feeds that are inaccurate or late and systems that are too-frequently down. Anything that affects profit and loss that is left out of other reports will show up either in inflated VaR or excessive VaR breaks. “A risk-taking institution that does not compute VaR might escape disaster, but an institution that cannot compute VaR will not.”

The second claimed benefit of VaR is that it separates risk into two regime

Regime

The word regime refers to a set of conditions, most often of a political nature.-Politics:...

s. Inside the VaR limit, conventional statistical methods are reliable. Relatively short-term and specific data can be used for analysis. Probability estimates are meaningful, because there are enough data to test them. In a sense, there is no true risk because you have a sum of many independent

Statistical independence

In probability theory, to say that two events are independent intuitively means that the occurrence of one event makes it neither more nor less probable that the other occurs...

observations with a left bound on the outcome. A casino doesn't worry about whether red or black will come up on the next roulette spin. Risk managers encourage productive risk-taking in this regime, because there is little true cost. People tend to worry too much about these risks, because they happen frequently, and not enough about what might happen on the worst days.

Outside the VaR limit, all bets are off. Risk should be analyzed with stress testing

Stress testing

Stress testing is a form of testing that is used to determine the stability of a given system or entity. It involves testing beyond normal operational capacity, often to a breaking point, in order to observe the results...

based on long-term and broad market data. Probability statements are no longer meaningful. Knowing the distribution of losses beyond the VaR point is both impossible and useless. The risk manager should concentrate instead on making sure good plans are in place to limit the loss if possible, and to survive the loss if not.

One specific system uses three regimes.

- One to three times VaR are normal occurrences. You expect periodic VaR breaks. The loss distribution typically has fat tailsKurtosisIn probability theory and statistics, kurtosis is any measure of the "peakedness" of the probability distribution of a real-valued random variable...

, and you might get more than one break in a short period of time. Moreover, markets may be abnormal and trading may exacerbate losses, and you may take losses not measured in daily marksFinancial statementsA financial statement is a formal record of the financial activities of a business, person, or other entity. In British English—including United Kingdom company law—a financial statement is often referred to as an account, although the term financial statement is also used, particularly by...

such as lawsuits, loss of employee morale and market confidence and impairment of brand names. So an institution that can't deal with three times VaR losses as routine events probably won't survive long enough to put a VaR system in place. - Three to ten times VaR is the range for stress testingStress testingStress testing is a form of testing that is used to determine the stability of a given system or entity. It involves testing beyond normal operational capacity, often to a breaking point, in order to observe the results...

. Institutions should be confident they have examined all the foreseeable events that will cause losses in this range, and are prepared to survive them. These events are too rare to estimate probabilities reliably, so risk/return calculations are useless. - Foreseeable events should not cause losses beyond ten times VaR. If they do they should be hedgedHedge (finance)A hedge is an investment position intended to offset potential losses that may be incurred by a companion investment.A hedge can be constructed from many types of financial instruments, including stocks, exchange-traded funds, insurance, forward contracts, swaps, options, many types of...

or insured, or the business plan should be changed to avoid them, or VaR should be increased. It's hard to run a business if foreseeable losses are orders of magnitude larger than very large everyday losses. It's hard to plan for these events, because they are out of scale with daily experience. Of course there will be unforeseeable losses more than ten times VaR, but it's pointless to anticipate them, you can't know much about them and it results in needless worrying. Better to hope that the discipline of preparing for all foreseeable three-to-ten times VaR losses will improve chances for surviving the unforeseen and larger losses that inevitably occur.

"A risk manager has two jobs: make people take more risk the 99% of the time it is safe to do so, and survive the other 1% of the time. VaR is the border."

VaR risk measurement

The VaR risk measure is a popular way to aggregate risk across an institution. Individual business units have risk measures such as durationBond duration

In finance, the duration of a financial asset that consists of fixed cash flows, for example a bond, is the weighted average of the times until those fixed cash flows are received....

for a fixed income

Fixed income

Fixed income refers to any type of investment that is not equity, which obligates the borrower/issuer to make payments on a fixed schedule, even if the number of the payments may be variable....

portfolio

Portfolio (finance)

Portfolio is a financial term denoting a collection of investments held by an investment company, hedge fund, financial institution or individual.-Definition:The term portfolio refers to any collection of financial assets such as stocks, bonds and cash...

or beta for an equity

Stock

The capital stock of a business entity represents the original capital paid into or invested in the business by its founders. It serves as a security for the creditors of a business since it cannot be withdrawn to the detriment of the creditors...

business. These cannot be combined in a meaningful way. It is also difficult to aggregate results available at different times, such as positions marked in different time zone

Time zone

A time zone is a region on Earth that has a uniform standard time for legal, commercial, and social purposes. In order for the same clock time to always correspond to the same portion of the day as the Earth rotates , different places on the Earth need to have different clock times...

s, or a high frequency trading desk with a business holding relatively illiquid

Market liquidity

In business, economics or investment, market liquidity is an asset's ability to be sold without causing a significant movement in the price and with minimum loss of value...

positions. But since every business contributes to profit and loss in an additive

Additive function

In mathematics the term additive function has two different definitions, depending on the specific field of application.In algebra an additive function is a function that preserves the addition operation:for any two elements x and y in the domain. For example, any linear map is additive...

fashion, and many financial

Finance

"Finance" is often defined simply as the management of money or “funds” management Modern finance, however, is a family of business activity that includes the origination, marketing, and management of cash and money surrogates through a variety of capital accounts, instruments, and markets created...

businesses mark-to-market daily, it is natural to define firm-wide risk using the distribution of possible losses at a fixed point in the future.

In risk measurement, VaR is usually reported alongside other risk metrics such as standard deviation

Standard deviation

Standard deviation is a widely used measure of variability or diversity used in statistics and probability theory. It shows how much variation or "dispersion" there is from the average...

, expected shortfall

Expected shortfall

Expected shortfall is a risk measure, a concept used in finance to evaluate the market risk or credit risk of a portfolio. It is an alternative to value at risk that is more sensitive to the shape of the loss distribution in the tail of the distribution...

and “greeks

Greeks (finance)

In mathematical finance, the Greeks are the quantities representing the sensitivities of the price of derivatives such as options to a change in underlying parameters on which the value of an instrument or portfolio of financial instruments is dependent. The name is used because the most common of...

” (partial derivative

Partial derivative

In mathematics, a partial derivative of a function of several variables is its derivative with respect to one of those variables, with the others held constant...

s of portfolio value with respect to market factors). VaR is a distribution-free

Non-parametric statistics

In statistics, the term non-parametric statistics has at least two different meanings:The first meaning of non-parametric covers techniques that do not rely on data belonging to any particular distribution. These include, among others:...

metric, that is it does not depend on assumptions about the probability distribution of future gains and losses. The probability level is chosen deep enough in the left tail of the loss distribution to be relevant for risk decisions, but not so deep as to be difficult to estimate with accuracy.

VaR can be estimated either parametrically (for example, variance

Variance

In probability theory and statistics, the variance is a measure of how far a set of numbers is spread out. It is one of several descriptors of a probability distribution, describing how far the numbers lie from the mean . In particular, the variance is one of the moments of a distribution...

-covariance

Covariance

In probability theory and statistics, covariance is a measure of how much two variables change together. Variance is a special case of the covariance when the two variables are identical.- Definition :...

VaR or delta-gamma VaR) or nonparametrically (for examples, historical simulation

Simulation

Simulation is the imitation of some real thing available, state of affairs, or process. The act of simulating something generally entails representing certain key characteristics or behaviours of a selected physical or abstract system....

VaR or resampled

Resampling

Resampling may refer to:* Resampling , several related audio processes* Resampling , resampling methods in statistics* Resampling , scaling of bitmap images* Sample rate conversion-See also:* Downsampling* Upsampling...

VaR). Nonparametric methods of VaR estimation are discussed in Markovich and Novak .

History of VaR

The problem of risk measurement is an old one in statisticsStatistics

Statistics is the study of the collection, organization, analysis, and interpretation of data. It deals with all aspects of this, including the planning of data collection in terms of the design of surveys and experiments....

, economics

Economics

Economics is the social science that analyzes the production, distribution, and consumption of goods and services. The term economics comes from the Ancient Greek from + , hence "rules of the house"...

and finance

Finance

"Finance" is often defined simply as the management of money or “funds” management Modern finance, however, is a family of business activity that includes the origination, marketing, and management of cash and money surrogates through a variety of capital accounts, instruments, and markets created...

. Financial risk management has been a concern of regulators and financial executives for a long time as well. Retrospective analysis has found some VaR-like concepts in this history. But VaR did not emerge as a distinct concept until the late 1980s. The triggering event was the stock market crash of 1987

Black Monday (1987)

In finance, Black Monday refers to Monday October 19, 1987, when stock markets around the world crashed, shedding a huge value in a very short time. The crash began in Hong Kong and spread west to Europe, hitting the United States after other markets had already declined by a significant margin...

. This was the first major financial crisis in which a lot of academically-trained quants

Quantitative analyst

A quantitative analyst is a person who works in finance using numerical or quantitative techniques. Similar work is done in most other modern industries, but the work is not always called quantitative analysis...

were in high enough positions to worry about firm-wide survival.

The crash was so unlikely given standard statistical models, that it called the entire basis of quant

Quantitative analyst

A quantitative analyst is a person who works in finance using numerical or quantitative techniques. Similar work is done in most other modern industries, but the work is not always called quantitative analysis...

finance into question. A reconsideration of history led some quants to decide there were recurring crises, about one or two per decade, that overwhelmed the statistical assumptions embedded in models used for trading

Trader (finance)

A trader is someone in finance who buys and sells financial instruments such as stocks, bonds, commodities and derivatives. A broker who simply fills buy or sell orders is not a trader, as they are merely executing instructions given to them. According to the Wall Street Journal in 2004, a managing...

, investment management

Investment management

Investment management is the professional management of various securities and assets in order to meet specified investment goals for the benefit of the investors...

and derivative

Derivative (finance)

A derivative instrument is a contract between two parties that specifies conditions—in particular, dates and the resulting values of the underlying variables—under which payments, or payoffs, are to be made between the parties.Under U.S...

pricing. These affected many markets at once, including ones that were usually not correlated

Correlation

In statistics, dependence refers to any statistical relationship between two random variables or two sets of data. Correlation refers to any of a broad class of statistical relationships involving dependence....

, and seldom had discernible economic cause or warning (although after-the-fact explanations were plentiful). Much later, they were named "Black Swans

Black swan theory

The black swan theory or theory of black swan events is a metaphor that encapsulates the concept that The event is a surprise and has a major impact...

" by Nassim Taleb and the concept extended far beyond finance

Finance

"Finance" is often defined simply as the management of money or “funds” management Modern finance, however, is a family of business activity that includes the origination, marketing, and management of cash and money surrogates through a variety of capital accounts, instruments, and markets created...

.

If these events were included in quantitative analysis they dominated results and led to strategies that did not work day to day. If these events were excluded, the profits made in between "Black Swans" could be much smaller than the losses suffered in the crisis. Institutions could fail as a result.

VaR was developed as a systematic way to segregate extreme events, which are studied qualitatively over long-term history and broad market events, from everyday price movements, which are studied quantitatively using short-term data in specific markets. It was hoped that "Black Swans" would be preceded by increases in estimated VaR or increased frequency of VaR breaks, in at least some markets. The extent to which this has proven to be true is controversial.

Abnormal markets and trading were excluded from the VaR estimate in order to make it observable. It is not always possible to define loss if, for example, markets are closed as after 9/11, or severely illiquid, as happened several times in 2008. Losses can also be hard to define if the risk-bearing institution fails or breaks up. A measure that depends on traders taking certain actions, and avoiding other actions, can lead to self reference.

This is risk management VaR. It was well established in quantative trading

Quantitative analyst

A quantitative analyst is a person who works in finance using numerical or quantitative techniques. Similar work is done in most other modern industries, but the work is not always called quantitative analysis...

groups at several financial institutions, notably Bankers Trust

Bankers Trust

Bankers Trust was an historic American banking organization. The bank merged with Alex. Brown & Sons before being acquired by Deutsche Bank in 1998.-History:A consortium of banks created Bankers Trust to perform trust company services for their clients....

, before 1990, although neither the name nor the definition had been standardized. There was no effort to aggregate VaRs across trading desks.

The financial events of the early 1990s found many firms in trouble because the same underlying bet had been made at many places in the firm, in non-obvious ways. Since many trading desks already computed risk management VaR, and it was the only common risk measure that could be both defined for all businesses and aggregated without strong assumptions, it was the natural choice for reporting firmwide risk. J. P. Morgan CEO Dennis Weatherstone

Dennis Weatherstone

Sir Dennis Weatherstone KBE was the former CEO and Chairman of J. P. Morgan & Co.. He attended the Northwest Polytechnic...

famously called for a “4:15 report” that combined all firm risk

Risk

Risk is the potential that a chosen action or activity will lead to a loss . The notion implies that a choice having an influence on the outcome exists . Potential losses themselves may also be called "risks"...

on one page, available within 15 minutes of the market close.

Risk measurement VaR was developed for this purpose. Development was most extensive at J. P. Morgan, which published the methodology and gave free access to estimates of the necessary underlying parameters in 1994. This was the first time VaR had been exposed beyond a relatively small group of quants. Two years later, the methodology was spun off into an independent for-profit business now part of RiskMetrics Group.

In 1997, the U.S. Securities and Exchange Commission ruled that public corporations must disclose quantitative information about their derivatives

Derivative (finance)

A derivative instrument is a contract between two parties that specifies conditions—in particular, dates and the resulting values of the underlying variables—under which payments, or payoffs, are to be made between the parties.Under U.S...

activity. Major bank

Bank

A bank is a financial institution that serves as a financial intermediary. The term "bank" may refer to one of several related types of entities:...

s and dealers chose to implement the rule by including VaR information in the notes to their financial statements

Financial statements

A financial statement is a formal record of the financial activities of a business, person, or other entity. In British English—including United Kingdom company law—a financial statement is often referred to as an account, although the term financial statement is also used, particularly by...

.

Worldwide adoption of the Basel II Accord, beginning in 1999 and nearing completion today, gave further impetus to the use of VaR. VaR is the preferred measure

Measure (mathematics)

In mathematical analysis, a measure on a set is a systematic way to assign to each suitable subset a number, intuitively interpreted as the size of the subset. In this sense, a measure is a generalization of the concepts of length, area, and volume...

of market risk

Market risk

Market risk is the risk that the value of a portfolio, either an investment portfolio or a trading portfolio, will decrease due to the change in value of the market risk factors. The four standard market risk factors are stock prices, interest rates, foreign exchange rates, and commodity prices...

, and concepts similar to VaR are used in other parts of the accord.

Criticism

VaR has been controversial since it moved from trading desks into the public eye in 1994. A famous 1997 debate between Nassim Taleb and Philippe Jorion set out some of the major points of contention. Taleb claimed VaR:- Ignored 2,500 years of experience in favor of untested models built by non-traders

- Was charlatanism because it claimed to estimate the risks of rare events, which is impossible

- Gave false confidence

- Would be exploited by traders

More recently David Einhorn and Aaron Brown

Aaron C. Brown

Aaron C. Brown is an American finance professor, author and quant. He wrote Red-Blooded Risk: The Secret History of Wall Street, The Poker Face of Wall Street and A World of Chance...

debated VaR in Global Association of Risk Professionals Review Einhorn compared VaR to “an airbag that works all the time, except when you have a car accident.” He further charged that VaR:

- Led to excessive risk-taking and leverage at financial institutions

- Focused on the manageable risks near the center of the distribution and ignored the tails

- Created an incentive to take “excessive but remote risks”

- Was “potentially catastrophic when its use creates a false sense of security among senior executives and watchdogs.”

New York Times

The New York Times

The New York Times is an American daily newspaper founded and continuously published in New York City since 1851. The New York Times has won 106 Pulitzer Prizes, the most of any news organization...

reporter Joe Nocera

Joseph Nocera

Joseph "Joe" Nocera is an American business journalist and author. He became a business columnist for The New York Times in April 2005. In March 2011, Nocera became a regular opinion columnist for The Times' Op-Ed page, writing on Tuesdays and Saturdays...

wrote an extensive piece Risk Mismanagement on January 4, 2009 discussing the role VaR played in the Financial crisis of 2007-2008. After interviewing risk managers (including several of the ones cited above) the article suggests that VaR was very useful to risk experts, but nevertheless exacerbated the crisis by giving false security to bank executives and regulators. A powerful tool for professional risk managers, VaR is portrayed as both easy to misunderstand, and dangerous when misunderstood.

A common complaint among academics is that VaR is not subadditive. That means the VaR of a combined portfolio can be larger than the sum of the VaRs of its components. To a practising risk manager this makes sense. For example, the average bank branch in the United States is robbed about once every ten years. A single-branch bank has about 0.0004% chance of being robbed on a specific day, so the risk of robbery would not figure into one-day 1% VaR. It would not even be within an order of magnitude of that, so it is in the range where the institution should not worry about it, it should insure against it and take advice from insurers on precautions. The whole point of insurance is to aggregate risks that are beyond individual VaR limits, and bring them into a large enough portfolio to get statistical predictability. It does not pay for a one-branch bank to have a security expert on staff.

As institutions get more branches, the risk of a robbery on a specific day rises to within an order of magnitude of VaR. At that point it makes sense for the institution to run internal stress tests and analyze the risk itself. It will spend less on insurance and more on in-house expertise. For a very large banking institution, robberies are a routine daily occurrence. Losses are part of the daily VaR calculation, and tracked statistically rather than case-by-case. A sizable in-house security department is in charge of prevention and control, the general risk manager just tracks the loss like any other cost of doing business.

As portfolios or institutions get larger, specific risks change from low-probability/low-predictability/high-impact to statistically predictable losses of low individual impact. That means they move from the range of far outside VaR, to be insured, to near outside VaR, to be analyzed case-by-case, to inside VaR, to be treated statistically.

Even VaR supporters generally agree there are common abuses of VaR:

- Referring to VaR as a "worst-case" or "maximum tolerable" loss. In fact, you expect two or three losses per year that exceed one-day 1% VaR.

- Making VaR control or VaR reduction the central concern of risk management. It is far more important to worry about what happens when losses exceed VaR.

- Assuming plausible losses will be less than some multiple, often three, of VaR. The entire point of VaR is that losses can be extremely large, and sometimes impossible to define, once you get beyond the VaR point. To a risk manager, VaR is the level of losses at which you stop trying to guess what will happen next, and start preparing for anything.

- Reporting a VaR that has not passed a backtestBacktestingBacktesting is the process of evaluating a strategy, theory, or model by applying it to historical data. Backtesting can be used in situations like studying how a trading method would have performed in past stock markets or how a model of climate and weather patterns would have matched past...

. Regardless of how VaR is computed, it should have produced the correct number of breaks (within sampling errorSampling error-Random sampling:In statistics, sampling error or estimation error is the error caused by observing a sample instead of the whole population. The sampling error can be found by subtracting the value of a parameter from the value of a statistic...

) in the past. A common specific violation of this is to report a VaR based on the unverified assumption that everything follows a multivariate normal distribution.

External links

Discussion- “Perfect Storms” – Beautiful & True Lies In Risk Management, Satyajit Das

- “Gloria Mundi” – All About Value at Risk, Barry Schachter

- Risk Management, Joe Nocera NYTimes article.

Tools

- Online real-time VaR calculator, Razvan Pascalau, University of AlabamaUniversity of AlabamaThe University of Alabama is a public coeducational university located in Tuscaloosa, Alabama, United States....

- Value-at-Risk (VaR), Simon Benninga and Zvi Wiener. (Mathematica in Education and Research Vol. 7 No. 4 1998.)