Windfall profits tax

Encyclopedia

A windfall profits tax is a higher tax rate on profits

that ensue from a sudden windfall gain

to a particular company or industry

.

, the Windfall Tax

was a tax levied on privatised utility companies.

enacted the Crude Oil Windfall Profit Tax Act (P.L. 96-223) as part of a compromise between the Carter Administration and the Congress over the decontrol of crude oil prices. The Act was intended to recoup the revenue earned by oil producers as a result of the sharp increase in oil prices brought about by the OPEC oil embargo. According to the Congressional Research Service

, the Act's title was a misnomer

. "Despite its name, the crude oil windfall profit tax... was not a tax on profits. It was an excise tax... imposed on the difference between the market price of oil, which was technically referred to as the removal price, and a statutory 1979 base price that was adjusted quarterly for inflation and state severance tax

es."

was motivated to enact the tax by several factors:

• The Congress was concerned that the domestic oil industry would reap enormous revenues and profits as a result of the deregulation of price controls

to allow domestic oil to reset to world oil price levels. Congress believed that the projected huge redistribution of income from energy consumers to energy producers would not be fair.

• Congress also felt the industry was not paying its fair share of federal taxes. The oil industry’s low effective income tax rates were due to the availability of two oil industry tax deductions: the percentage depletion

allowance, and the provision which permits companies to expense (deduct fully in the initial year) the intangible costs of drilling.

• In addition, Congress was looking for additional sources of revenue. Between 1961 and 1979, the federal budget was in deficit in every year but one (there was a small surplus in FY1969). The Congress's Joint Committee on Taxation projected the tax would generate, from 1980 to 1990, additional gross revenues of approximately $393 billion.

signed P.L. 100-418, The Omnibus Trade and Competitiveness Act of 1988. Reagan had objected to the tax during his 1980 presidential campaign and promised to repeal it. As with the enactment, Congress was motivated by several factors:

• A principal issue in the debate over the Act's repeal was that the original forecast of revenues turned out to have been significantly overestimated, reflecting overestimates of crude oil prices. From 1980 to 1990 the tax generated gross revenue of about $80 billion, or 80% less than the projected amount of $393 billion.

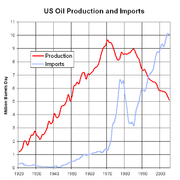

• Congress was also concerned that the tax had increased the nation's dependence on imported oil. The tax was an excise tax on oil produced domestically in the United States; it was not imposed on imported oil. Domestic oil producers could not shift the tax forward as a higher oil selling price because the purchaser would merely substitute imported or tax-exempt crude. The tax caused domestic oil production losses in every year until 1986, when crude prices declined below adjusted base prices resulting in zero windfall profit tax. Over the 1980-1986 period, it is estimated that, depending on the assumed supply curve price elasticity

, the tax reduced domestic oil production from between 320 million barrels (1.2% of domestic production) and 1,268 million barrels (4.8% of domestic production). The effect of reducing domestic oil production was to increase the level of imported oil. The estimated production losses caused by the tax, as a % of the actual level of imported oil, under three assumed supply curve elasticities range from 3.2% of total imports to 12.7% of imports for this period, depending on price elasticity.

• The tax also may have distorted the way resources were allocated within the oil industry. Since the tax was imposed on oil production — i.e., upon its removal and sale — extraction (and other upstream operations) was penalized and other aspects of the business (refining and marketing, the downstream operations) become relatively favored. Thus it created financial incentives to shift resources from exploration and drilling to refining and marketing.

• The tax also appeared to be a complicated tax to comply with and to administer. A 1984 General Accounting Office report called it "perhaps the largest and most complex tax ever levied on a U.S. industry." The windfall profit tax was imposed on oil producers when taxable crude oil was removed from the oil-producing property. Any individual or business with an economic interest in an oil-producing property was considered as a producer and subject to the tax. There were four kinds of producers — independent producers, integrated oil companies, royalty owners (landowners), and tax-exempt parties. There were about one million oil producers (persons, institutions, and businesses) in the United States in 1984. Sometimes there were hundreds of people having a fractional economic interest in a single oil-producing property. Throughout the compliance process, many tax return forms and information forms were required. The process was further complicated due to numerous exceptions to the basic general rules and due to possible interactions between the windfall profit tax rules, the personal and corporate income tax rules, energy regulations, and state and local tax and energy laws. After 1986, the WPT imposed little or no tax liability on oil producers because oil prices were below the threshold base prices that triggered it. Oil producers were obliged to comply with the paperwork requirements of the law, however, and the Internal Revenue Service

(IRS) was compelled to administer the system despite the fact that the tax generated no revenue, reportedly spending about $15 million a year to do so.

Since 1988, no windfall profit tax has been enacted in the U.S., however, when gas prices once again reached record levels there was renewed pressure on the U.S. government to bring back the tax. At least nine bills that purported to tax windfall profits of crude oil producers were introduced in the 110th United States Congress

during 2007-08 (HR 1500, HR 2372, HR 5800, HR 6000, S.1238, S.2761, S.2782, S.2991, S.3044) .

The windfall profit tax of the 1980s is not to be confused with the excess profit taxes of World War I

, World War II

, and the Korean War

eras.

In a February 12, 2008 editorial titled "Record Profits Mean Record Taxes," Investor's Business Daily

In a February 12, 2008 editorial titled "Record Profits Mean Record Taxes," Investor's Business Daily

said that regular income taxes already take into account the high profits, and that there's no need to do anything extra to tax or punish the oil companies. As an example, the editorial states "Consider the magnitude of the contributions from Exxon

alone. On those 'outlandish' 2006 profits, the company paid federal income taxes of $27.9 billion, leaving it with $39.5 billion in after-tax income. That $27.9 billion was more than was collected from half of individual taxpayers in 2004. In that year, 65 million returns — which represent far more than 65 million taxpayers because of joint returns — paid $27.4 billion in federal income taxes."

In an August 4, 2008 editorial titled "What Is a 'Windfall' Profit?" The Wall Street Journal

wrote, "What is a 'windfall' profit anyway? ... Take Exxon Mobil, which on Thursday reported the highest quarterly profit ever and is the main target of any 'windfall' tax surcharge. Yet if its profits are at record highs, its tax bills are already at record highs too... Exxon's profit margin

stood at 10% for 2007... If that's what constitutes windfall profits, most of corporate America would qualify... 51 Senators voted to impose a 25% windfall tax on a U.S.-based oil company whose profits grew by more than 10% in a single year... This suggests that a windfall is defined by profits growing too fast.... But if 10% is the new standard, the tech industry is going to have to rethink its growth arc... General Electric

profits by investing in the alternativeenergy technology that President Obama

says Congress should subsidize even more heavily than it already does. GE's profit margin in 2007 was 10.3%, about the same as profiteering Exxon's." The profit margin listed in the article for General Electric included all of their diversified industries, of which energy technology is only one among many (such as aircraft engine manufacturing and media production), whereas ExxonMobil deals strictly with oil and gas and therefore has profits solely derived from oil and gas.

Due to intense lobbying

by industry, trade offs between government and industry are often set in place so that the effects of windfall taxes are minimized. When the Labour Party

came to power in 1997 it introduced a windfall tax on utility companies. The public affairs team of Centrica

, however, had already begun lobbying the Labour Party while they were in opposition. So although Centrica had to pay the windfall tax, the government agreed to scrap the gas levy. “Even after the windfall tax we came out ahead” their public affairs director was later quoted as saying.

Profit (accounting)

In accounting, profit can be considered to be the difference between the purchase price and the costs of bringing to market whatever it is that is accounted as an enterprise in terms of the component costs of delivered goods and/or services and any operating or other expenses.-Definition:There are...

that ensue from a sudden windfall gain

Windfall gain

-Types of Windfall Gains:The list of windfall gains includes, but is not limited to:*Lottery winnings*Unexpected inheritance*Gains from demutualization-Uses of Windfall Gains:What people do with windfall gains is subject to much debate...

to a particular company or industry

Industry

Industry refers to the production of an economic good or service within an economy.-Industrial sectors:There are four key industrial economic sectors: the primary sector, largely raw material extraction industries such as mining and farming; the secondary sector, involving refining, construction,...

.

United Kingdom

In the United KingdomUnited Kingdom

The United Kingdom of Great Britain and Northern IrelandIn the United Kingdom and Dependencies, other languages have been officially recognised as legitimate autochthonous languages under the European Charter for Regional or Minority Languages...

, the Windfall Tax

Windfall Tax (United Kingdom)

The Windfall Tax was a tax on what were claimed to be "the excess profits of the privatised utilities" , introduced by the Labour government in 1997. It followed from their manifesto commitment made during the 1997 general election campaign to impose a "windfall levy" on the privatised utilities...

was a tax levied on privatised utility companies.

United States

In 1980, the United StatesUnited States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

enacted the Crude Oil Windfall Profit Tax Act (P.L. 96-223) as part of a compromise between the Carter Administration and the Congress over the decontrol of crude oil prices. The Act was intended to recoup the revenue earned by oil producers as a result of the sharp increase in oil prices brought about by the OPEC oil embargo. According to the Congressional Research Service

Congressional Research Service

The Congressional Research Service , known as "Congress's think tank", is the public policy research arm of the United States Congress. As a legislative branch agency within the Library of Congress, CRS works exclusively and directly for Members of Congress, their Committees and staff on a...

, the Act's title was a misnomer

Misnomer

A misnomer is a term which suggests an interpretation that is known to be untrue. Such incorrect terms sometimes derive their names because of the form, action, or origin of the subject becoming named popularly or widely referenced—long before their true natures were known.- Sources of misnomers...

. "Despite its name, the crude oil windfall profit tax... was not a tax on profits. It was an excise tax... imposed on the difference between the market price of oil, which was technically referred to as the removal price, and a statutory 1979 base price that was adjusted quarterly for inflation and state severance tax

Severance tax

Severance taxes are incurred when non-renewable natural resources are separated from a taxing jurisdiction. Industries that typically incur such taxes are oil and gas, coal, mining, and timber industries....

es."

Enactment

The 96th United States Congress96th United States Congress

The Ninety-sixth United States Congress was a meeting of the legislative branch of the United States federal government, composed of the United States Senate and the United States House of Representatives. It met in Washington, DC from January 3, 1979 to January 3, 1981, during the last two years...

was motivated to enact the tax by several factors:

• The Congress was concerned that the domestic oil industry would reap enormous revenues and profits as a result of the deregulation of price controls

Price controls

Price controls are governmental impositions on the prices charged for goods and services in a market, usually intended to maintain the affordability of staple foods and goods, and to prevent price gouging during shortages, or, alternatively, to insure an income for providers of certain goods...

to allow domestic oil to reset to world oil price levels. Congress believed that the projected huge redistribution of income from energy consumers to energy producers would not be fair.

• Congress also felt the industry was not paying its fair share of federal taxes. The oil industry’s low effective income tax rates were due to the availability of two oil industry tax deductions: the percentage depletion

Depletion

Depletion may refer to:*Depletion , an accounting concept*Depletion region, a concept of semiconductor physics*Depletion width, a concept of semiconductor physics*Grain boundary depletion, a mechanism of corrosion...

allowance, and the provision which permits companies to expense (deduct fully in the initial year) the intangible costs of drilling.

• In addition, Congress was looking for additional sources of revenue. Between 1961 and 1979, the federal budget was in deficit in every year but one (there was a small surplus in FY1969). The Congress's Joint Committee on Taxation projected the tax would generate, from 1980 to 1990, additional gross revenues of approximately $393 billion.

Repeal

On August 23, 1988, amid low oil prices, the tax was repealed when President Ronald ReaganRonald Reagan

Ronald Wilson Reagan was the 40th President of the United States , the 33rd Governor of California and, prior to that, a radio, film and television actor....

signed P.L. 100-418, The Omnibus Trade and Competitiveness Act of 1988. Reagan had objected to the tax during his 1980 presidential campaign and promised to repeal it. As with the enactment, Congress was motivated by several factors:

• A principal issue in the debate over the Act's repeal was that the original forecast of revenues turned out to have been significantly overestimated, reflecting overestimates of crude oil prices. From 1980 to 1990 the tax generated gross revenue of about $80 billion, or 80% less than the projected amount of $393 billion.

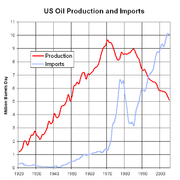

• Congress was also concerned that the tax had increased the nation's dependence on imported oil. The tax was an excise tax on oil produced domestically in the United States; it was not imposed on imported oil. Domestic oil producers could not shift the tax forward as a higher oil selling price because the purchaser would merely substitute imported or tax-exempt crude. The tax caused domestic oil production losses in every year until 1986, when crude prices declined below adjusted base prices resulting in zero windfall profit tax. Over the 1980-1986 period, it is estimated that, depending on the assumed supply curve price elasticity

Elasticity (economics)

In economics, elasticity is the measurement of how changing one economic variable affects others. For example:* "If I lower the price of my product, how much more will I sell?"* "If I raise the price, how much less will I sell?"...

, the tax reduced domestic oil production from between 320 million barrels (1.2% of domestic production) and 1,268 million barrels (4.8% of domestic production). The effect of reducing domestic oil production was to increase the level of imported oil. The estimated production losses caused by the tax, as a % of the actual level of imported oil, under three assumed supply curve elasticities range from 3.2% of total imports to 12.7% of imports for this period, depending on price elasticity.

• The tax also may have distorted the way resources were allocated within the oil industry. Since the tax was imposed on oil production — i.e., upon its removal and sale — extraction (and other upstream operations) was penalized and other aspects of the business (refining and marketing, the downstream operations) become relatively favored. Thus it created financial incentives to shift resources from exploration and drilling to refining and marketing.

• The tax also appeared to be a complicated tax to comply with and to administer. A 1984 General Accounting Office report called it "perhaps the largest and most complex tax ever levied on a U.S. industry." The windfall profit tax was imposed on oil producers when taxable crude oil was removed from the oil-producing property. Any individual or business with an economic interest in an oil-producing property was considered as a producer and subject to the tax. There were four kinds of producers — independent producers, integrated oil companies, royalty owners (landowners), and tax-exempt parties. There were about one million oil producers (persons, institutions, and businesses) in the United States in 1984. Sometimes there were hundreds of people having a fractional economic interest in a single oil-producing property. Throughout the compliance process, many tax return forms and information forms were required. The process was further complicated due to numerous exceptions to the basic general rules and due to possible interactions between the windfall profit tax rules, the personal and corporate income tax rules, energy regulations, and state and local tax and energy laws. After 1986, the WPT imposed little or no tax liability on oil producers because oil prices were below the threshold base prices that triggered it. Oil producers were obliged to comply with the paperwork requirements of the law, however, and the Internal Revenue Service

Internal Revenue Service

The Internal Revenue Service is the revenue service of the United States federal government. The agency is a bureau of the Department of the Treasury, and is under the immediate direction of the Commissioner of Internal Revenue...

(IRS) was compelled to administer the system despite the fact that the tax generated no revenue, reportedly spending about $15 million a year to do so.

Since 1988, no windfall profit tax has been enacted in the U.S., however, when gas prices once again reached record levels there was renewed pressure on the U.S. government to bring back the tax. At least nine bills that purported to tax windfall profits of crude oil producers were introduced in the 110th United States Congress

110th United States Congress

The One Hundred Tenth United States Congress was the meeting of the legislative branch of the United States federal government, between January 3, 2007, and January 3, 2009, during the last two years of the second term of President George W. Bush. It was composed of the Senate and the House of...

during 2007-08 (HR 1500, HR 2372, HR 5800, HR 6000, S.1238, S.2761, S.2782, S.2991, S.3044) .

The windfall profit tax of the 1980s is not to be confused with the excess profit taxes of World War I

World War I

World War I , which was predominantly called the World War or the Great War from its occurrence until 1939, and the First World War or World War I thereafter, was a major war centred in Europe that began on 28 July 1914 and lasted until 11 November 1918...

, World War II

World War II

World War II, or the Second World War , was a global conflict lasting from 1939 to 1945, involving most of the world's nations—including all of the great powers—eventually forming two opposing military alliances: the Allies and the Axis...

, and the Korean War

Korean War

The Korean War was a conventional war between South Korea, supported by the United Nations, and North Korea, supported by the People's Republic of China , with military material aid from the Soviet Union...

eras.

Scandinavia

In Sweden, hydro power is subject to a property tax and nuclear power to a capacity-based tax. Both taxes were raised at the beginning of 2008 due to higher windfall profits. Norway similarly imposed, as of 2009, a ground rent tax on hydro-electric power plants, and Finland announced its intention in 2009 to tax nuclear and hydro power as of 2010 or 2011.Criticism

Investor's Business Daily

Investor's Business Daily is a national newspaper in the United States, published Monday through Friday, that covers international business, finance, and the global economy...

said that regular income taxes already take into account the high profits, and that there's no need to do anything extra to tax or punish the oil companies. As an example, the editorial states "Consider the magnitude of the contributions from Exxon

Exxon

Exxon is a chain of gas stations as well as a brand of motor fuel and related products by ExxonMobil. From 1972 to 1999, Exxon was the corporate name of the company previously known as Standard Oil Company of New Jersey or Jersey Standard....

alone. On those 'outlandish' 2006 profits, the company paid federal income taxes of $27.9 billion, leaving it with $39.5 billion in after-tax income. That $27.9 billion was more than was collected from half of individual taxpayers in 2004. In that year, 65 million returns — which represent far more than 65 million taxpayers because of joint returns — paid $27.4 billion in federal income taxes."

In an August 4, 2008 editorial titled "What Is a 'Windfall' Profit?" The Wall Street Journal

The Wall Street Journal

The Wall Street Journal is an American English-language international daily newspaper. It is published in New York City by Dow Jones & Company, a division of News Corporation, along with the Asian and European editions of the Journal....

wrote, "What is a 'windfall' profit anyway? ... Take Exxon Mobil, which on Thursday reported the highest quarterly profit ever and is the main target of any 'windfall' tax surcharge. Yet if its profits are at record highs, its tax bills are already at record highs too... Exxon's profit margin

Profit margin

Profit margin, net margin, net profit margin or net profit ratio all refer to a measure of profitability. It is calculated by finding the net profit as a percentage of the revenue.Net profit Margin = x100...

stood at 10% for 2007... If that's what constitutes windfall profits, most of corporate America would qualify... 51 Senators voted to impose a 25% windfall tax on a U.S.-based oil company whose profits grew by more than 10% in a single year... This suggests that a windfall is defined by profits growing too fast.... But if 10% is the new standard, the tech industry is going to have to rethink its growth arc... General Electric

General Electric

General Electric Company , or GE, is an American multinational conglomerate corporation incorporated in Schenectady, New York and headquartered in Fairfield, Connecticut, United States...

profits by investing in the alternativeenergy technology that President Obama

Barack Obama

Barack Hussein Obama II is the 44th and current President of the United States. He is the first African American to hold the office. Obama previously served as a United States Senator from Illinois, from January 2005 until he resigned following his victory in the 2008 presidential election.Born in...

says Congress should subsidize even more heavily than it already does. GE's profit margin in 2007 was 10.3%, about the same as profiteering Exxon's." The profit margin listed in the article for General Electric included all of their diversified industries, of which energy technology is only one among many (such as aircraft engine manufacturing and media production), whereas ExxonMobil deals strictly with oil and gas and therefore has profits solely derived from oil and gas.

Due to intense lobbying

Lobbying

Lobbying is the act of attempting to influence decisions made by officials in the government, most often legislators or members of regulatory agencies. Lobbying is done by various people or groups, from private-sector individuals or corporations, fellow legislators or government officials, or...

by industry, trade offs between government and industry are often set in place so that the effects of windfall taxes are minimized. When the Labour Party

Labour Party (UK)

The Labour Party is a centre-left democratic socialist party in the United Kingdom. It surpassed the Liberal Party in general elections during the early 1920s, forming minority governments under Ramsay MacDonald in 1924 and 1929-1931. The party was in a wartime coalition from 1940 to 1945, after...

came to power in 1997 it introduced a windfall tax on utility companies. The public affairs team of Centrica

Centrica

Centrica plc is a multinational utility company, based in the United Kingdom but also with interests in North America. Centrica is the largest supplier of gas to domestic customers in the UK, and one of the largest suppliers of electricity, operating under the trading names "Scottish Gas" in...

, however, had already begun lobbying the Labour Party while they were in opposition. So although Centrica had to pay the windfall tax, the government agreed to scrap the gas levy. “Even after the windfall tax we came out ahead” their public affairs director was later quoted as saying.