Bertrand competition

Encyclopedia

Bertrand competition is a model of competition

used in economics

, named after Joseph Louis François Bertrand

(1822-1900). It describes interactions among firms (sellers) that set prices and their customers (buyers) that choose quantities at that price.

The model rests on the following assumptions:

Another way of thinking about it, a simpler way, is to imagine if both firms set equal prices above marginal cost, firms would get half the market at a higher than MC price. However, by lowering prices just slightly, a firm could gain the whole market, so both firms are tempted to lower prices as much as they can. It would be irrational to price below marginal cost, because the firm would make a loss. Therefore, both firms will lower prices until they reach the MC limit.

Bertrand competition versus Cournot competition

Competition

Competition is a contest between individuals, groups, animals, etc. for territory, a niche, or a location of resources. It arises whenever two and only two strive for a goal which cannot be shared. Competition occurs naturally between living organisms which co-exist in the same environment. For...

used in economics

Economics

Economics is the social science that analyzes the production, distribution, and consumption of goods and services. The term economics comes from the Ancient Greek from + , hence "rules of the house"...

, named after Joseph Louis François Bertrand

Joseph Louis François Bertrand

Joseph Louis François Bertrand was a French mathematician who worked in the fields of number theory, differential geometry, probability theory, economics and thermodynamics....

(1822-1900). It describes interactions among firms (sellers) that set prices and their customers (buyers) that choose quantities at that price.

The model rests on the following assumptions:

- There are at least two firms producing homogeneous (undifferentiated) products;

- Firms do not cooperate;

- Firms compete by setting prices simultaneously;

- Consumers buy everything from a firm with a lower price. If all firms charge the same price, consumers randomly select among them.

Calculating the classic Bertrand model

- MC = Marginal cost

- p1 = firm 1’s price level

- p2 = firm 2’s price level

- pM = monopoly price level

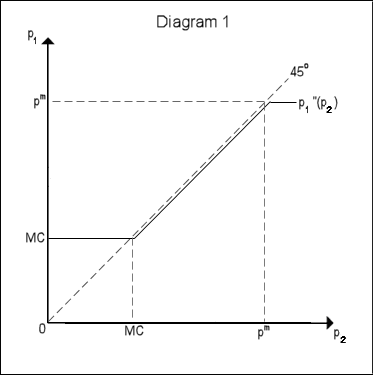

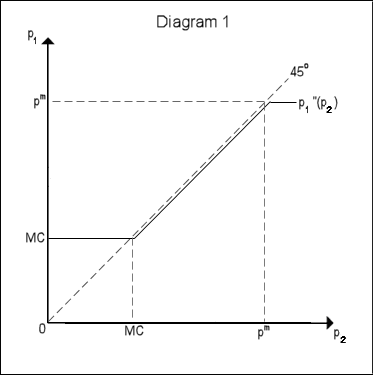

- Firm 1's optimum price depends on where it believes firm 2 will set its prices. Pricing just below the other firm will obtain full market demand (D), though this is not optimal if the other firm is pricing below marginal cost as that would entail negative profits. In general terms, firm 1's best responseBest responseIn game theory, the best response is the strategy which produces the most favorable outcome for a player, taking other players' strategies as given...

function is p1’’(p2), this gives firm 1 optimal price for each price set by firm 2.

- Diagram 1 shows firm 1’s reaction function p1’’(p2), with each firm's strategy on each axis. It shows that when P2 is less than marginal cost (firm 2 pricing below MC) firm 1 prices at marginal cost, p1=MC. When firm 2 prices above MC but below monopoly prices, then firm 1 prices just below firm 2. When firm 2 prices above monopoly prices (PM) firm 1 prices at monopoly level, p1=pM.

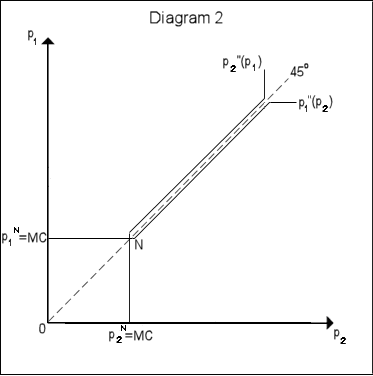

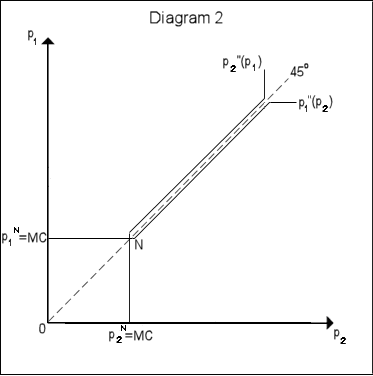

- Because firm 2 has the same marginal cost as firm 1, its reaction function is symmetrical with respect to the 45 degree line. Diagram 2 shows both reaction functions.

- The result of the firms' strategies is a Nash equilibriumNash equilibriumIn game theory, Nash equilibrium is a solution concept of a game involving two or more players, in which each player is assumed to know the equilibrium strategies of the other players, and no player has anything to gain by changing only his own strategy unilaterally...

, that is, a pair of strategies (prices in this case) where neither firm can increase profits by unilaterally changing price. This is given by the intersection of the reaction curves, Point N on the diagram. At this point p1=p1’’(p2), and p2=p2’’(p1). As you can see, point N on the diagram is where both firms are pricing at marginal cost.

Another way of thinking about it, a simpler way, is to imagine if both firms set equal prices above marginal cost, firms would get half the market at a higher than MC price. However, by lowering prices just slightly, a firm could gain the whole market, so both firms are tempted to lower prices as much as they can. It would be irrational to price below marginal cost, because the firm would make a loss. Therefore, both firms will lower prices until they reach the MC limit.

Implications

- Note that colludingCollusionCollusion is an agreement between two or more persons, sometimes illegal and therefore secretive, to limit open competition by deceiving, misleading, or defrauding others of their legal rights, or to obtain an objective forbidden by law typically by defrauding or gaining an unfair advantage...

to charge the monopolyMonopolyA monopoly exists when a specific person or enterprise is the only supplier of a particular commodity...

price and supplying one half of the market each is the best that the firms could do in this set up. However not colluding and charging marginal costMarginal costIn economics and finance, marginal cost is the change in total cost that arises when the quantity produced changes by one unit. That is, it is the cost of producing one more unit of a good...

, which is the non-cooperative outcome is the only Nash equilibriumNash equilibriumIn game theory, Nash equilibrium is a solution concept of a game involving two or more players, in which each player is assumed to know the equilibrium strategies of the other players, and no player has anything to gain by changing only his own strategy unilaterally...

of this model.

- If one firm has lower average cost (a superior production technologyProduction functionIn microeconomics and macroeconomics, a production function is a function that specifies the output of a firm, an industry, or an entire economy for all combinations of inputs...

), it will charge the highest price that is lower than the average cost of the other one (i.e. a price just below the lowest price the other firm can manage) and take all the business. This is known as "limit pricing"Limit priceA limit price is the price set by a monopolist to discourage entry into a market, and is illegal in many countries. The limit price is the price that a potential entrant would face upon entering as long as the incumbent firm did not decrease output. The limit price is often lower than the average...

Bertrand competition versus Cournot competitionCournot competitionCournot competition is an economic model used to describe an industry structure in which companies compete on the amount of output they will produce, which they decide on independently of each other and at the same time. It is named after Antoine Augustin Cournot who was inspired by observing...

- Bertrand predicts a duopoly is enough to push prices down to marginal cost level; a duopoly will result in an outcome exactly equivalent to what prevails under perfect competition.

- Neither model is necessarily "better." The accuracy of the predictions of each model will vary from industry to industry, depending on the closeness of each model to the industry situation.

- If capacity and output can be easily changed, Bertrand is generally a better model of duopoly competition. Or, if output and capacity are difficult to adjust, then Cournot is generally a better model.

- Under some conditions the Cournot model can be recast as a two stage model, where in the first stage firms choose capacities, and in the second they compete in Bertrand fashion.

Critical analysis of the Bertrand model

- The classic Bertrand model assumes firms compete purely on price, ignoring non-price competition. Firms can differentiateProduct differentiationIn economics and marketing, product differentiation is the process of distinguishing a product or offering from others, to make it more attractive to a particular target market. This involves differentiating it from competitors' products as well as a firm's own product offerings...

their products and charge a higher price. For example, would someone travel twice as far to save 1% on the price of their vegetables? The Bertrand model can be extended to include product or location differentiation but then the main result - that price is driven down to marginal cost - no longer holds.

- The model ignores capacity constraints. If a single firm does not have the capacity to supply the whole market then the "price equals marginal cost" result may not hold.

- The classical model only focuses on the pure strategy Nash equilibrium. There are mixed-strategy Nash equilibrium with positive economic profits (see Kaplan & Wettstein, 2000, and Baye & Morgan, 1999).

- The classical model ignores search cost of consumers. If the consumer does not know the price of the product before visiting a firm and each visit is costly (however small), then a Nash equilibrium price will not arise. This creates the possibility that firms will randomly price at some point between marginal cost and the monopoly price.

See also

- Cournot competitionCournot competitionCournot competition is an economic model used to describe an industry structure in which companies compete on the amount of output they will produce, which they decide on independently of each other and at the same time. It is named after Antoine Augustin Cournot who was inspired by observing...

- Differentiated Bertrand competitionDifferentiated Bertrand competitionAs a solution to the Bertrand paradox in economics, it has been suggested that each firm produces a somewhat differentiated product, and consequently faces a demand curve that is downward-sloping for all levels of the firm's price....

- Stackelberg competitionStackelberg competitionThe Stackelberg leadership model is a strategic game in economics in which the leader firm moves first and then the follower firms move sequentially...

- Nash equilibriumNash equilibriumIn game theory, Nash equilibrium is a solution concept of a game involving two or more players, in which each player is assumed to know the equilibrium strategies of the other players, and no player has anything to gain by changing only his own strategy unilaterally...

- Game theoryGame theoryGame theory is a mathematical method for analyzing calculated circumstances, such as in games, where a person’s success is based upon the choices of others...

- Bertrand paradox (economics)Bertrand paradox (economics)In economics and commerce, the Bertrand paradox—named after its creator, Joseph Bertrand—describes a situation in which two players reach a state of Nash equilibrium where both firms charge a price equal to marginal cost. The paradox is that in reality, it usually takes a large number of firms to...