Cournot competition

Encyclopedia

Cournot competition is an economic model used to describe an industry structure in which companies compete on the amount of output they will produce, which they decide on independently of each other and at the same time. It is named after Antoine Augustin Cournot

(1801-1877) who was inspired by observing competition in a spring water duopoly

. It has the following features:

An essential assumption of this model is the "not conjecture" that each firm aims to maximize profits, based on the expectation that its own output decision will not have an effect on the decisions of its rivals.

Price is a commonly known decreasing function of total output. All firms know , the total number of firms in the market, and take the output of the others as given. Each firm has a cost function

, the total number of firms in the market, and take the output of the others as given. Each firm has a cost function  . Normally the cost functions are treated as common knowledge. The cost functions may be the same or different among firms. The market price is set at a level such that demand

. Normally the cost functions are treated as common knowledge. The cost functions may be the same or different among firms. The market price is set at a level such that demand

equals the total quantity produced by all firms.

Each firm takes the quantity set by its competitors as a given, evaluates its residual demand, and then behaves as a monopoly

.

.

= firm 1 price,

= firm 1 price,  = firm 2 price

= firm 2 price

= firm 1 quantity,

= firm 1 quantity,  = firm 2 quantity

= firm 2 quantity

= marginal cost

= marginal cost

, identical for both firms

Equilibrium

prices will be:

This implies that firm 1’s profit is given by

and firm i have the cost structure

and firm i have the cost structure  . To calculate the Nash equilibrium, the best response functions

. To calculate the Nash equilibrium, the best response functions

of the firms must first be calculated.

The profit of firm i is revenue minus cost. Revenue is the product of price and quantity and cost is given by the firm's cost function, so profit is (as described above):

. The best response is to find the value of

. The best response is to find the value of  that maximises

that maximises  given

given  , with

, with  , i.e. given some output of the opponent firm, the output that maximises profit is found. Hence, the maximum of

, i.e. given some output of the opponent firm, the output that maximises profit is found. Hence, the maximum of  with respect to

with respect to  is to be found. First take the derivative of

is to be found. First take the derivative of  with respect to

with respect to  :

:

Setting this to zero for maximization:

The values of that satisfy this equation are the best responses. The Nash equilibria are where both

that satisfy this equation are the best responses. The Nash equilibria are where both  and

and  are best responses given those values of

are best responses given those values of  and

and  .

.

The profit of firm i (with cost structure

The profit of firm i (with cost structure  such that

such that  and

and  for ease of computation) is:

for ease of computation) is:

The maximization problem resolves to (from the general case):

Without loss of generality, consider firm 1's problem:

By symmetry:

These are the firms' best response functions. For any value of , firm 1 responds best with any value of

, firm 1 responds best with any value of  that satisfies the above. In Nash equilibria, both firms will be playing best responses so solving the above equations simultaneously. Substituting for

that satisfies the above. In Nash equilibria, both firms will be playing best responses so solving the above equations simultaneously. Substituting for  in firm 1's best response:

in firm 1's best response:

The symmetric Nash equilibrium is at . (See Holt (2005, Chapter 13) for asymmetric examples.) Making suitable assumptions for the partial derivatives (for example, assuming each firm's cost is a linear function of quantity and thus using the slope of that function in the calculation), the equilibrium quantities can be substituted in the assumed industry price structure

. (See Holt (2005, Chapter 13) for asymmetric examples.) Making suitable assumptions for the partial derivatives (for example, assuming each firm's cost is a linear function of quantity and thus using the slope of that function in the calculation), the equilibrium quantities can be substituted in the assumed industry price structure  to obtain the equilibrium market price.

to obtain the equilibrium market price.

edit; we should specify the constants. Given the following results are these;

Market Demand;

Cost Function; , for all i

, for all i

, which is each individual firm's output

, which is each individual firm's output

, which is total industry output

, which is total industry output

, which is the market clearing price

, which is the market clearing price

and

, which is each individual firm's profit.

, which is each individual firm's profit.

The Cournot Theorem then states that, in absence of fixed costs of production, as the number of firms in the market, N, goes to infinity, market output, Nq, goes to the competitive level and the price converges to marginal cost.

Hence with many firms a Cournot market approximates a perfectly competitive market. This result can be generalized to the case of firms with different cost structures (under appropriate restrictions) and non-linear demand.

When the market is characterized by fixed costs of production, however, we can endogenize the number of competitors imagining that firms enter in the market until their profits are zero. In our linear example with firms, when fixed costs for each firm are

firms, when fixed costs for each firm are  , we have the endogenous number of firms:

, we have the endogenous number of firms:

and a production for each firm equal to:

This equilibrium is usually known as Cournot equilibrium with endogenous entry, or Marshall equilibrium .

However, when number of firms goes to infinity, Cournot model gives the same result as in Bertrand model: market price is pushed to marginal cost level.

Antoine Augustin Cournot

Antoine Augustin Cournot was a French philosopher and mathematician.Antoine Augustin Cournot was born at Gray, Haute-Saone. In 1821 he entered one of the most prestigious Grande École, the École Normale Supérieure, and in 1829 he had earned a doctoral degree in mathematics, with mechanics as his...

(1801-1877) who was inspired by observing competition in a spring water duopoly

Duopoly

A true duopoly is a specific type of oligopoly where only two producers exist in one market. In reality, this definition is generally used where only two firms have dominant control over a market...

. It has the following features:

- There is more than one firm and all firms produce a homogeneous productProduct (business)In general, the product is defined as a "thing produced by labor or effort" or the "result of an act or a process", and stems from the verb produce, from the Latin prōdūce ' lead or bring forth'. Since 1575, the word "product" has referred to anything produced...

, i.e. there is no product differentiationProduct differentiationIn economics and marketing, product differentiation is the process of distinguishing a product or offering from others, to make it more attractive to a particular target market. This involves differentiating it from competitors' products as well as a firm's own product offerings...

; - Firms do not cooperate, i.e. there is no collusionCollusionCollusion is an agreement between two or more persons, sometimes illegal and therefore secretive, to limit open competition by deceiving, misleading, or defrauding others of their legal rights, or to obtain an objective forbidden by law typically by defrauding or gaining an unfair advantage...

; - Firms have market powerMarket powerIn economics, market power is the ability of a firm to alter the market price of a good or service. In perfectly competitive markets, market participants have no market power. A firm with market power can raise prices without losing its customers to competitors...

, i.e. each firm's output decision affects the good's price; - The number of firms is fixed;

- Firms compete in quantities, and choose quantities simultaneously;

- The firms are economically rational and act strategicallyGame theoryGame theory is a mathematical method for analyzing calculated circumstances, such as in games, where a person’s success is based upon the choices of others...

, usually seeking to maximize profit given their competitors' decisions.

An essential assumption of this model is the "not conjecture" that each firm aims to maximize profits, based on the expectation that its own output decision will not have an effect on the decisions of its rivals.

Price is a commonly known decreasing function of total output. All firms know

, the total number of firms in the market, and take the output of the others as given. Each firm has a cost function

, the total number of firms in the market, and take the output of the others as given. Each firm has a cost function  . Normally the cost functions are treated as common knowledge. The cost functions may be the same or different among firms. The market price is set at a level such that demand

. Normally the cost functions are treated as common knowledge. The cost functions may be the same or different among firms. The market price is set at a level such that demandSupply and demand

Supply and demand is an economic model of price determination in a market. It concludes that in a competitive market, the unit price for a particular good will vary until it settles at a point where the quantity demanded by consumers will equal the quantity supplied by producers , resulting in an...

equals the total quantity produced by all firms.

Each firm takes the quantity set by its competitors as a given, evaluates its residual demand, and then behaves as a monopoly

Monopoly

A monopoly exists when a specific person or enterprise is the only supplier of a particular commodity...

.

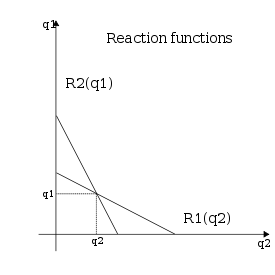

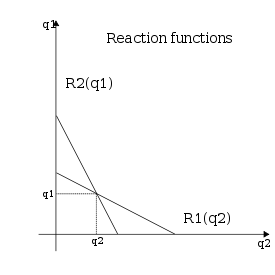

Graphically finding the Cournot duopoly equilibrium

This section presents an analysis of the model with 2 firms and constant marginal costMarginal cost

In economics and finance, marginal cost is the change in total cost that arises when the quantity produced changes by one unit. That is, it is the cost of producing one more unit of a good...

.

= firm 1 price,

= firm 1 price,  = firm 2 price

= firm 2 price = firm 1 quantity,

= firm 1 quantity,  = firm 2 quantity

= firm 2 quantity = marginal cost

= marginal costMarginal cost

In economics and finance, marginal cost is the change in total cost that arises when the quantity produced changes by one unit. That is, it is the cost of producing one more unit of a good...

, identical for both firms

Equilibrium

Economic equilibrium

In economics, economic equilibrium is a state of the world where economic forces are balanced and in the absence of external influences the values of economic variables will not change. It is the point at which quantity demanded and quantity supplied are equal...

prices will be:

This implies that firm 1’s profit is given by

- Calculate firm 1’s residual demand: Suppose firm 1 believes firm 2 is producing quantity

. What is firm 1's optimal quantity? Consider the diagram 1. If firm 1 decides not to produce anything, then price is given by

. What is firm 1's optimal quantity? Consider the diagram 1. If firm 1 decides not to produce anything, then price is given by  . If firm 1 produces

. If firm 1 produces  then price is given by

then price is given by  . More generally, for each quantity that firm 1 might decide to set, price is given by the curve

. More generally, for each quantity that firm 1 might decide to set, price is given by the curve  . The curve

. The curve  is called firm 1’s residual demand; it gives all possible combinations of firm 1’s quantity and price for a given value of

is called firm 1’s residual demand; it gives all possible combinations of firm 1’s quantity and price for a given value of  .

.

- Determine firm 1’s optimum output: To do this we must find where marginal revenue equals marginal cost. Marginal cost (c) is assumed to be constant. Marginal revenue is a curve -

- with twice the slope of

- with twice the slope of  and with the same vertical intercept. The point at which the two curves (

and with the same vertical intercept. The point at which the two curves ( and

and  ) intersect corresponds to quantity

) intersect corresponds to quantity  . Firm 1’s optimum

. Firm 1’s optimum  , depends on what it believes firm 2 is doing. To find an equilibrium, we derive firm 1’s optimum for other possible values of

, depends on what it believes firm 2 is doing. To find an equilibrium, we derive firm 1’s optimum for other possible values of  . Diagram 2 considers two possible values of

. Diagram 2 considers two possible values of  . If

. If  , then the first firm's residual demand is effectively the market demand,

, then the first firm's residual demand is effectively the market demand,  . The optimal solution is for firm 1 to choose the monopolyMonopolyA monopoly exists when a specific person or enterprise is the only supplier of a particular commodity...

. The optimal solution is for firm 1 to choose the monopolyMonopolyA monopoly exists when a specific person or enterprise is the only supplier of a particular commodity...

quantity; (

( is monopoly quantity). If firm 2 were to choose the quantity corresponding to perfect competitionPerfect competitionIn economic theory, perfect competition describes markets such that no participants are large enough to have the market power to set the price of a homogeneous product. Because the conditions for perfect competition are strict, there are few if any perfectly competitive markets...

is monopoly quantity). If firm 2 were to choose the quantity corresponding to perfect competitionPerfect competitionIn economic theory, perfect competition describes markets such that no participants are large enough to have the market power to set the price of a homogeneous product. Because the conditions for perfect competition are strict, there are few if any perfectly competitive markets...

, such that

such that  , then firm 1’s optimum would be to produce nil:

, then firm 1’s optimum would be to produce nil:  . This is the point at which marginal cost intercepts the marginal revenue corresponding to

. This is the point at which marginal cost intercepts the marginal revenue corresponding to  .

.

- It can be shown that, given the linear demand and constant marginal cost, the function

is also linear. Because we have two points, we can draw the entire function

is also linear. Because we have two points, we can draw the entire function  , see diagram 3. Note the axis of the graphs has changed, The function

, see diagram 3. Note the axis of the graphs has changed, The function  is firm 1’s reaction function, it gives firm 1’s optimal choice for each possible choice by firm 2. In other words, it gives firm 1’s choice given what it believes firm 2 is doing.

is firm 1’s reaction function, it gives firm 1’s optimal choice for each possible choice by firm 2. In other words, it gives firm 1’s choice given what it believes firm 2 is doing.

- The last stage in finding the Cournot equilibrium is to find firm 2’s reaction function. In this case it is symmetrical to firm 1’s as they have the same cost function. The equilibrium is the intersection point of the reaction curves. See diagram 4.

- The prediction of the model is that the firms will choose Nash equilibriumNash equilibriumIn game theory, Nash equilibrium is a solution concept of a game involving two or more players, in which each player is assumed to know the equilibrium strategies of the other players, and no player has anything to gain by changing only his own strategy unilaterally...

output levels.

Calculating the equilibrium

In very general terms, let the price function for the (duopoly) industry be and firm i have the cost structure

and firm i have the cost structure  . To calculate the Nash equilibrium, the best response functions

. To calculate the Nash equilibrium, the best response functionsBest response

In game theory, the best response is the strategy which produces the most favorable outcome for a player, taking other players' strategies as given...

of the firms must first be calculated.

The profit of firm i is revenue minus cost. Revenue is the product of price and quantity and cost is given by the firm's cost function, so profit is (as described above):

. The best response is to find the value of

. The best response is to find the value of  that maximises

that maximises  given

given  , with

, with  , i.e. given some output of the opponent firm, the output that maximises profit is found. Hence, the maximum of

, i.e. given some output of the opponent firm, the output that maximises profit is found. Hence, the maximum of  with respect to

with respect to  is to be found. First take the derivative of

is to be found. First take the derivative of  with respect to

with respect to  :

:

Setting this to zero for maximization:

The values of

that satisfy this equation are the best responses. The Nash equilibria are where both

that satisfy this equation are the best responses. The Nash equilibria are where both  and

and  are best responses given those values of

are best responses given those values of  and

and  .

.An example

Suppose the industry has the following price structure: The profit of firm i (with cost structure

The profit of firm i (with cost structure  such that

such that  and

and  for ease of computation) is:

for ease of computation) is:

The maximization problem resolves to (from the general case):

Without loss of generality, consider firm 1's problem:

By symmetry:

These are the firms' best response functions. For any value of

, firm 1 responds best with any value of

, firm 1 responds best with any value of  that satisfies the above. In Nash equilibria, both firms will be playing best responses so solving the above equations simultaneously. Substituting for

that satisfies the above. In Nash equilibria, both firms will be playing best responses so solving the above equations simultaneously. Substituting for  in firm 1's best response:

in firm 1's best response:

The symmetric Nash equilibrium is at

. (See Holt (2005, Chapter 13) for asymmetric examples.) Making suitable assumptions for the partial derivatives (for example, assuming each firm's cost is a linear function of quantity and thus using the slope of that function in the calculation), the equilibrium quantities can be substituted in the assumed industry price structure

. (See Holt (2005, Chapter 13) for asymmetric examples.) Making suitable assumptions for the partial derivatives (for example, assuming each firm's cost is a linear function of quantity and thus using the slope of that function in the calculation), the equilibrium quantities can be substituted in the assumed industry price structure  to obtain the equilibrium market price.

to obtain the equilibrium market price.Cournot competition with many firms and the Cournot Theorem

For an arbitrary number of firms, N>1, the quantities and price can be derived in a manner analogous to that given above. With linear demand and identical, constant marginal cost the equilibrium values are as follows:edit; we should specify the constants. Given the following results are these;

Market Demand;

Cost Function;

, for all i

, for all i , which is each individual firm's output

, which is each individual firm's output , which is total industry output

, which is total industry output , which is the market clearing price

, which is the market clearing priceand

, which is each individual firm's profit.

, which is each individual firm's profit.The Cournot Theorem then states that, in absence of fixed costs of production, as the number of firms in the market, N, goes to infinity, market output, Nq, goes to the competitive level and the price converges to marginal cost.

Hence with many firms a Cournot market approximates a perfectly competitive market. This result can be generalized to the case of firms with different cost structures (under appropriate restrictions) and non-linear demand.

When the market is characterized by fixed costs of production, however, we can endogenize the number of competitors imagining that firms enter in the market until their profits are zero. In our linear example with

firms, when fixed costs for each firm are

firms, when fixed costs for each firm are  , we have the endogenous number of firms:

, we have the endogenous number of firms:

and a production for each firm equal to:

This equilibrium is usually known as Cournot equilibrium with endogenous entry, or Marshall equilibrium .

Implications

- Output is greater with Cournot duopoly than monopoly, but lower than perfect competition.

- Price is lower with Cournot duopoly than monopoly, but not as low as with perfect competition.

- According to this model the firms have an incentive to form a cartel, effectively turning the Cournot model into a Monopoly. Cartels are usually illegal, so firms might instead tacitly collude using self-imposing strategies to reduce output which, ceteris paribusCeteris paribusor is a Latin phrase, literally translated as "with other things the same," or "all other things being equal or held constant." It is an example of an ablative absolute and is commonly rendered in English as "all other things being equal." A prediction, or a statement about causal or logical...

will raise the price and thus increase profits for all firms involved.

Bertrand versus Cournot

Although both models have similar assumptions, they have very different implications:- Since the Bertrand model assumes that firms compete on price and not output quantity, it predicts that a duopolyDuopolyA true duopoly is a specific type of oligopoly where only two producers exist in one market. In reality, this definition is generally used where only two firms have dominant control over a market...

is enough to push prices down to marginal cost level, meaning that a duopoly will result in perfect competitionPerfect competitionIn economic theory, perfect competition describes markets such that no participants are large enough to have the market power to set the price of a homogeneous product. Because the conditions for perfect competition are strict, there are few if any perfectly competitive markets...

. - Neither model is necessarily "better." The accuracy of the predictions of each model will vary from industry to industry, depending on the closeness of each model to the industry situation.

- If capacity and output can be easily changed, BertrandBertrand competitionBertrand competition is a model of competition used in economics, named after Joseph Louis François Bertrand . It describes interactions among firms that set prices and their customers that choose quantities at that price....

is a better model of duopoly competition. If output and capacity are difficult to adjust, then Cournot is generally a better model. - Under some conditions the Cournot model can be recast as a two stage model, where in the first stage firms choose capacities, and in the second they compete in Bertrand fashion.

However, when number of firms goes to infinity, Cournot model gives the same result as in Bertrand model: market price is pushed to marginal cost level.

See also

- Nash equilibriumNash equilibriumIn game theory, Nash equilibrium is a solution concept of a game involving two or more players, in which each player is assumed to know the equilibrium strategies of the other players, and no player has anything to gain by changing only his own strategy unilaterally...

- Game theoryGame theoryGame theory is a mathematical method for analyzing calculated circumstances, such as in games, where a person’s success is based upon the choices of others...

- Bertrand competitionBertrand competitionBertrand competition is a model of competition used in economics, named after Joseph Louis François Bertrand . It describes interactions among firms that set prices and their customers that choose quantities at that price....

- Stackelberg competitionStackelberg competitionThe Stackelberg leadership model is a strategic game in economics in which the leader firm moves first and then the follower firms move sequentially...

- Tacit collusionTacit collusionTacit collusion occurs when cartels are illegal or overt collusion is absent. Put another way, two firms agree to play a certain strategy without explicitly saying so. Oligopolists usually try not to engage in price cutting, excessive advertising or other forms of competition. Thus, there may be...