Land value tax in the United States

Encyclopedia

Land value tax

ation in the United States

has a long history dating back from Physiocrat influence on Thomas Jefferson

and Benjamin Franklin

, and continues to be used today, particularly in Pennsylvania

.

came by Benjamin Franklin

and Thomas Jefferson

as Ambassadors to France, and Jefferson brought his friend Pierre du Pont

to the United States

to promote the idea. A statement in the 36th Federalist Paper

reflects that influence, "A small land tax will answer the purpose of the States, and will be their most simple and most fit resource."

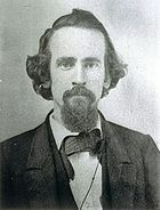

Henry George

Henry George

(September 2, 1839 – October 29, 1897) was perhaps the most famous advocate of land rents. An American

political economist, he advocated a "Single Tax" on land

that would eliminate the need for all other taxes. In 1879 he authored Progress and Poverty

, which significantly influenced land taxation in the United States.

(the highest state appellate court) ruled that the use of land value taxation in Hyattsville was unconstitutional. Shortly thereafter, an amendment to the Maryland

Declaration of Rights specifically allowed for land value taxation where authorized by the State Legislature. However, the uniformity clause in Pennsylvania

has been broadly construed, and land value taxation has been used since 1913.

Each state will have its own legal stance or lack of any stance on LVT; some uniformity clauses explicitly allow some types of classifications of property, some have no uniformity clause, and some do not specifically discuss land qua land at all. Except for the pre-1900 Maryland case of Hyattsville (later overturned by state constitutional amendment and statutory provisions), no state courts have actually struck down an attempt to implement land value taxation on the basis of a state uniformity clause. Nor have any courts even squarely ruled that land and improvements are actually "classes" of property such that uniformity clauses are applicable. Consequently, as a general rule, as long as each type of property (land, improvements, personal) is taxed uniformly there is no constitutional obstacle.

Even in rather strict uniformity clause states, it is unclear whether the uniformity clause actually prohibits separate land value taxation. Some states have other constitutional provisions - for example in New Jersey, which gives localities maximum home rule

authority, and have not adopted Dillon's Rule. While the uniformity clauses might be interpreted to prohibit state-wide action, local action may be legitimate.

remains a real obstacle, requiring the need for local enabling authority or the abrogation of Dillon's Rule. The theory of state preeminence over local governments was expressed as Dillon's Rule in a 1868 case, where it was stated that "[m]unicipal corporations owe their origin to, and derive their powers and rights wholly from, the legislature. It breathes into them the breath of life, without which they cannot exist. As it creates, so may it destroy. If it may destroy, it may abridge and control." As opposed to Dillon's Rule, the Cooley Doctrine expressed the theory of an inherent right to local self determination. In a concurring opinion, Michigan Supreme Court Judge Thomas Cooley

in 1871 stated: "[L]ocal government is a matter of absolute right; and the state cannot take it away." In Maryland, for example, municipal corporations have the right to implement land value taxation, but the counties, including Baltimore City which is treated as a county in Maryland for certain purposes, do not. However, Dillon's Rule has been abandoned in some states, whether in whole by state constitution or state legislation or piecemeal by home rule legislation passed by the State Legislature. For example, the Virginia Legislature has granted land value tax authority to Fairfax and Roanoke.

has some form of property tax on real estate and hence, in part, a tax on land value. There are several cities that use LVT to varying degrees, but LVT in its purest form is not used on state or national levels. Land value taxation was tried in the South

during Reconstruction as a way to promote land reform

. There have also been several attempts throughout history to introduce land value taxation on a national level. In Hylton v. United States

, the Supreme Court directly acknowledged that a Land Tax was constitutional, so long as it was apportioned equally among the states. Two of the associate justice

s explained in their summaries, stating:

There have also been attempts since then to introduce land value tax legislation, such as the Federal Property Tax Act of 1798, and

HR 6026, a bill introduced to the United States House of Representatives

on February 20, 1935 by Theodore L. Moritz

of Pennsylvania. HR 6026 would have imposed a national 1% tax on the value of land in excess of $3,000.

in 1898, through the efforts of Judge Jackson H. Ralston. The Maryland Courts subsequently found it to be barred by the Maryland Constitution

. Judge Ralston and his supporters commenced a campaign to amend the state Constitution which culminated in the Art. 15 of the Declaration of Rights (which remains today part of the Maryland State Constitution). In addition, he helped see that enabling legislation for towns be passed in 1916, which also remains in effect today. The towns of Fairhope, Alabama

and Arden, Delaware

were later founded as model Georgist communities or "single tax colonies".

Nearly 20 Pennsylvania cities in the USA

Nearly 20 Pennsylvania cities in the USA

employ a two-rate or split-rate property tax: taxing the value of land at a higher rate and the value of the buildings and improvements at a lower one. This can be seen as a compromise between pure LVT and an ordinary property tax falling on real estate (land value plus improvement value). Alternatively, two-rate taxation may be seen as a form that allows gradual transformation of the traditional real estate property tax into a pure land value tax.

Nearly two dozen local Pennsylvania jurisdictions (such as Harrisburg

) use two-rate property taxation in which the tax on land value is higher and the tax on improvement value is lower. Pittsburgh

used the two-rate system from 1913 to 2001 when a countywide property reassessment led to a drastic increase in assessed land values during 2001 after years of underassessment, and the system was abandoned in favor of the traditional single-rate property tax. The tax on land in Pittsburgh was about 5.77 times the tax on improvements. Notwithstanding the change in 2001, the Pittsburgh Improvement District still employs a pure land value taxation as a surcharge on the regular property tax. In 2000, Florenz Plassmann and Nicolaus Tideman

wrote that when comparing Pennsylvania

cities using a higher tax rate on land value and a lower rate on improvements with similar sized Pennsylvania cities using the same rate on land and improvements, the higher land value taxation leads to increased construction within the jurisdiction.

Connecticut introduced an enabling bill in 2009.

Land value tax

A land value tax is a levy on the unimproved value of land. It is an ad valorem tax on land that disregards the value of buildings, personal property and other improvements...

ation in the United States

United States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

has a long history dating back from Physiocrat influence on Thomas Jefferson

Thomas Jefferson

Thomas Jefferson was the principal author of the United States Declaration of Independence and the Statute of Virginia for Religious Freedom , the third President of the United States and founder of the University of Virginia...

and Benjamin Franklin

Benjamin Franklin

Dr. Benjamin Franklin was one of the Founding Fathers of the United States. A noted polymath, Franklin was a leading author, printer, political theorist, politician, postmaster, scientist, musician, inventor, satirist, civic activist, statesman, and diplomat...

, and continues to be used today, particularly in Pennsylvania

Pennsylvania

The Commonwealth of Pennsylvania is a U.S. state that is located in the Northeastern and Mid-Atlantic regions of the United States. The state borders Delaware and Maryland to the south, West Virginia to the southwest, Ohio to the west, New York and Ontario, Canada, to the north, and New Jersey to...

.

History

Physiocrat influence in the United StatesUnited States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

came by Benjamin Franklin

Benjamin Franklin

Dr. Benjamin Franklin was one of the Founding Fathers of the United States. A noted polymath, Franklin was a leading author, printer, political theorist, politician, postmaster, scientist, musician, inventor, satirist, civic activist, statesman, and diplomat...

and Thomas Jefferson

Thomas Jefferson

Thomas Jefferson was the principal author of the United States Declaration of Independence and the Statute of Virginia for Religious Freedom , the third President of the United States and founder of the University of Virginia...

as Ambassadors to France, and Jefferson brought his friend Pierre du Pont

Pierre Samuel du Pont de Nemours

Pierre Samuel du Pont de Nemours was a French nobleman, writer, economist, and government official, who was the father of Eleuthère Irénée du Pont, the founder of E.I...

to the United States

United States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

to promote the idea. A statement in the 36th Federalist Paper

Federalist No. 36

Federalist No. 36 is an essay by Alexander Hamilton, the thirty-sixth of the Federalist Papers. It was published on January 8, 1788 under the pseudonym Publius, the name under which all the Federalist Papers were published. This is the last of seven essays by Hamilton on the then-controversial...

reflects that influence, "A small land tax will answer the purpose of the States, and will be their most simple and most fit resource."

Henry George

Henry George

Henry George was an American writer, politician and political economist, who was the most influential proponent of the land value tax, also known as the "single tax" on land...

(September 2, 1839 – October 29, 1897) was perhaps the most famous advocate of land rents. An American

United States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

political economist, he advocated a "Single Tax" on land

Land (economics)

In economics, land comprises all naturally occurring resources whose supply is inherently fixed. Examples are any and all particular geographical locations, mineral deposits, and even geostationary orbit locations and portions of the electromagnetic spectrum. Natural resources are fundamental to...

that would eliminate the need for all other taxes. In 1879 he authored Progress and Poverty

Progress and Poverty

Progress and Poverty: An Inquiry into the Cause of Industrial Depressions and of Increase of Want with Increase of Wealth: The Remedy was written by Henry George in 1879...

, which significantly influenced land taxation in the United States.

Legality

There are two potential legal obstacles unique to land value taxation in the United States: uniformity clauses and Dillon's Rule. At the federal level, land value taxation is legal so long as it is apportioned among the states.Uniformity clauses

The United States legal system includes "uniformity clauses" found in individual State Constitutions as well as the federal Constitution. Broadly speaking, these clauses require taxation to be applied evenly or uniformly within a jurisdiction. However, the exact wording and meaning of these clauses differs from constitution to constitution. Although the federal Uniformity Clause has never been an issue, the wording and interpretation of many state constitutions has created issues peculiar to each state. For example in 1898, the Maryland Court of AppealsMaryland Court of Appeals

The Court of Appeals of Maryland is the supreme court of the U.S. state of Maryland. The court, which is composed of one chief judge and six associate judges, meets in the Robert C. Murphy Courts of Appeal Building in the state capital, Annapolis...

(the highest state appellate court) ruled that the use of land value taxation in Hyattsville was unconstitutional. Shortly thereafter, an amendment to the Maryland

Maryland

Maryland is a U.S. state located in the Mid Atlantic region of the United States, bordering Virginia, West Virginia, and the District of Columbia to its south and west; Pennsylvania to its north; and Delaware to its east...

Declaration of Rights specifically allowed for land value taxation where authorized by the State Legislature. However, the uniformity clause in Pennsylvania

Pennsylvania

The Commonwealth of Pennsylvania is a U.S. state that is located in the Northeastern and Mid-Atlantic regions of the United States. The state borders Delaware and Maryland to the south, West Virginia to the southwest, Ohio to the west, New York and Ontario, Canada, to the north, and New Jersey to...

has been broadly construed, and land value taxation has been used since 1913.

Each state will have its own legal stance or lack of any stance on LVT; some uniformity clauses explicitly allow some types of classifications of property, some have no uniformity clause, and some do not specifically discuss land qua land at all. Except for the pre-1900 Maryland case of Hyattsville (later overturned by state constitutional amendment and statutory provisions), no state courts have actually struck down an attempt to implement land value taxation on the basis of a state uniformity clause. Nor have any courts even squarely ruled that land and improvements are actually "classes" of property such that uniformity clauses are applicable. Consequently, as a general rule, as long as each type of property (land, improvements, personal) is taxed uniformly there is no constitutional obstacle.

Even in rather strict uniformity clause states, it is unclear whether the uniformity clause actually prohibits separate land value taxation. Some states have other constitutional provisions - for example in New Jersey, which gives localities maximum home rule

Home rule

Home rule is the power of a constituent part of a state to exercise such of the state's powers of governance within its own administrative area that have been devolved to it by the central government....

authority, and have not adopted Dillon's Rule. While the uniformity clauses might be interpreted to prohibit state-wide action, local action may be legitimate.

Local authorization

Although uniformity clauses do not seem to be a major obstacle in most jurisdictions to land value taxation, control of local authority by the state legislatureLegislature

A legislature is a kind of deliberative assembly with the power to pass, amend, and repeal laws. The law created by a legislature is called legislation or statutory law. In addition to enacting laws, legislatures usually have exclusive authority to raise or lower taxes and adopt the budget and...

remains a real obstacle, requiring the need for local enabling authority or the abrogation of Dillon's Rule. The theory of state preeminence over local governments was expressed as Dillon's Rule in a 1868 case, where it was stated that "[m]unicipal corporations owe their origin to, and derive their powers and rights wholly from, the legislature. It breathes into them the breath of life, without which they cannot exist. As it creates, so may it destroy. If it may destroy, it may abridge and control." As opposed to Dillon's Rule, the Cooley Doctrine expressed the theory of an inherent right to local self determination. In a concurring opinion, Michigan Supreme Court Judge Thomas Cooley

Thomas M. Cooley

Thomas McIntyre Cooley, LL.D., was the 25th Justice and a Chief Justice of the Michigan Supreme Court, between 1864 and 1885. Born in Attica, New York, he was father to Charles Cooley, a distinguished American sociologist...

in 1871 stated: "[L]ocal government is a matter of absolute right; and the state cannot take it away." In Maryland, for example, municipal corporations have the right to implement land value taxation, but the counties, including Baltimore City which is treated as a county in Maryland for certain purposes, do not. However, Dillon's Rule has been abandoned in some states, whether in whole by state constitution or state legislation or piecemeal by home rule legislation passed by the State Legislature. For example, the Virginia Legislature has granted land value tax authority to Fairfax and Roanoke.

Usage

Every single state in the United StatesUnited States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

has some form of property tax on real estate and hence, in part, a tax on land value. There are several cities that use LVT to varying degrees, but LVT in its purest form is not used on state or national levels. Land value taxation was tried in the South

Southern United States

The Southern United States—commonly referred to as the American South, Dixie, or simply the South—constitutes a large distinctive area in the southeastern and south-central United States...

during Reconstruction as a way to promote land reform

Land reform

[Image:Jakarta farmers protest23.jpg|300px|thumb|right|Farmers protesting for Land Reform in Indonesia]Land reform involves the changing of laws, regulations or customs regarding land ownership. Land reform may consist of a government-initiated or government-backed property redistribution,...

. There have also been several attempts throughout history to introduce land value taxation on a national level. In Hylton v. United States

Hylton v. United States

Hylton v. United States, , was an early United States Supreme Court case in which the Court held that a tax on carriages did not violate the Article I, Section 9 requirement for the apportioning of direct taxes. It found the carriage tax was an "excise" instead of a "direct tax" requiring...

, the Supreme Court directly acknowledged that a Land Tax was constitutional, so long as it was apportioned equally among the states. Two of the associate justice

Associate Justice

Associate Justice or Associate Judge is the title for a member of a judicial panel who is not the Chief Justice in some jurisdictions. The title "Associate Justice" is used for members of the United States Supreme Court and some state supreme courts, and for some other courts in Commonwealth...

s explained in their summaries, stating:

There have also been attempts since then to introduce land value tax legislation, such as the Federal Property Tax Act of 1798, and

HR 6026, a bill introduced to the United States House of Representatives

United States House of Representatives

The United States House of Representatives is one of the two Houses of the United States Congress, the bicameral legislature which also includes the Senate.The composition and powers of the House are established in Article One of the Constitution...

on February 20, 1935 by Theodore L. Moritz

Theodore L. Moritz

Theodore Leo Moritz was a Democratic member of the U.S. House of Representatives from Pennsylvania.Theodore L. Moritz was born in Toledo, Ohio. He graduated from St. Mary’s Institute in Dayton, Ohio, in 1913, and the University of Dayton in 1919...

of Pennsylvania. HR 6026 would have imposed a national 1% tax on the value of land in excess of $3,000.

Single tax

The first city in the United States to enact land value taxation was Hyattsville, MarylandHyattsville, Maryland

Hyattsville is a city in Prince George's County, Maryland, United States. The population was 17,557 at the 2000 census.- History :The city was named for its founder, Christopher Clark Hyatt. He purchased his first parcel of land in the area in March 1845...

in 1898, through the efforts of Judge Jackson H. Ralston. The Maryland Courts subsequently found it to be barred by the Maryland Constitution

Maryland Constitution

The current Constitution of the State of Maryland, which was ratified by the people of the state on September 18, 1867, forms the basic law for the U.S. state of Maryland. It replaced the short-lived Maryland Constitution of 1864 and is the fourth constitution under which the state has been...

. Judge Ralston and his supporters commenced a campaign to amend the state Constitution which culminated in the Art. 15 of the Declaration of Rights (which remains today part of the Maryland State Constitution). In addition, he helped see that enabling legislation for towns be passed in 1916, which also remains in effect today. The towns of Fairhope, Alabama

Fairhope, Alabama

Fairhope is a city in Baldwin County, Alabama, on a sloping plateau, along the cliffs and shoreline of Mobile Bay. The 2010 census lists the population of the city as 16,176....

and Arden, Delaware

Arden, Delaware

Arden is a village and art colony in New Castle County, Delaware, in the United States, founded in 1900 as a radical Georgist single-tax community by sculptor Frank Stephens and architect Will Price. The village occupies about 160 acres, with half kept as open land. According to the 2010 Census,...

were later founded as model Georgist communities or "single tax colonies".

Two-rate taxation

United States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

employ a two-rate or split-rate property tax: taxing the value of land at a higher rate and the value of the buildings and improvements at a lower one. This can be seen as a compromise between pure LVT and an ordinary property tax falling on real estate (land value plus improvement value). Alternatively, two-rate taxation may be seen as a form that allows gradual transformation of the traditional real estate property tax into a pure land value tax.

Nearly two dozen local Pennsylvania jurisdictions (such as Harrisburg

Harrisburg, Pennsylvania

Harrisburg is the capital of Pennsylvania. As of the 2010 census, the city had a population of 49,528, making it the ninth largest city in Pennsylvania...

) use two-rate property taxation in which the tax on land value is higher and the tax on improvement value is lower. Pittsburgh

Pittsburgh, Pennsylvania

Pittsburgh is the second-largest city in the US Commonwealth of Pennsylvania and the county seat of Allegheny County. Regionally, it anchors the largest urban area of Appalachia and the Ohio River Valley, and nationally, it is the 22nd-largest urban area in the United States...

used the two-rate system from 1913 to 2001 when a countywide property reassessment led to a drastic increase in assessed land values during 2001 after years of underassessment, and the system was abandoned in favor of the traditional single-rate property tax. The tax on land in Pittsburgh was about 5.77 times the tax on improvements. Notwithstanding the change in 2001, the Pittsburgh Improvement District still employs a pure land value taxation as a surcharge on the regular property tax. In 2000, Florenz Plassmann and Nicolaus Tideman

Nicolaus Tideman

T. Nicolaus Tideman is a Professor of Economics at Virginia Polytechnic Institute and State University. He received his Bachelor of Arts in economics and mathematics from Reed College in 1965 and his PhD in economics from the University of Chicago in 1969...

wrote that when comparing Pennsylvania

Pennsylvania

The Commonwealth of Pennsylvania is a U.S. state that is located in the Northeastern and Mid-Atlantic regions of the United States. The state borders Delaware and Maryland to the south, West Virginia to the southwest, Ohio to the west, New York and Ontario, Canada, to the north, and New Jersey to...

cities using a higher tax rate on land value and a lower rate on improvements with similar sized Pennsylvania cities using the same rate on land and improvements, the higher land value taxation leads to increased construction within the jurisdiction.

Connecticut introduced an enabling bill in 2009.