Financialization

Encyclopedia

Financial capitalism

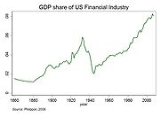

Financial capitalism is a form of capitalism where the intermediation of savings to investment becomes a dominant function in the economy, with implications for the political process and social evolution...

which developed over several decades leading up to the 2007-2010 financial crisis, and in which financial leverage tended to override capital (equity

Ownership equity

In accounting and finance, equity is the residual claim or interest of the most junior class of investors in assets, after all liabilities are paid. If liability exceeds assets, negative equity exists...

) and financial markets tended to dominate over the traditional industrial economy and agricultural economics

Agricultural economics

Agricultural economics originally applied the principles of economics to the production of crops and livestock — a discipline known as agronomics. Agronomics was a branch of economics that specifically dealt with land usage. It focused on maximizing the crop yield while maintaining a good soil...

.

Financialization is a term that describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible, intangible, future or present promises, etc.) either into a financial instrument or a derivative of a financial instrument. The original intent of financialization is to be able to reduce any work-product or service to an exchangeable financial instrument, like currency

Currency

In economics, currency refers to a generally accepted medium of exchange. These are usually the coins and banknotes of a particular government, which comprise the physical aspects of a nation's money supply...

, and thus make it easier for people to trade these financial instruments.

Workers, through a financial instrument such as a mortgage

Mortgage loan

A mortgage loan is a loan secured by real property through the use of a mortgage note which evidences the existence of the loan and the encumbrance of that realty through the granting of a mortgage which secures the loan...

, could trade their promise of future work/wages for a home. Financialization of risk-sharing makes all insurance

Insurance

In law and economics, insurance is a form of risk management primarily used to hedge against the risk of a contingent, uncertain loss. Insurance is defined as the equitable transfer of the risk of a loss, from one entity to another, in exchange for payment. An insurer is a company selling the...

possible, the financialization of the U.S. Government's promises (bonds

Bond (finance)

In finance, a bond is a debt security, in which the authorized issuer owes the holders a debt and, depending on the terms of the bond, is obliged to pay interest to use and/or to repay the principal at a later date, termed maturity...

) makes all deficit spending possible. Financialization also makes economic rent

Economic rent

Economic rent is typically defined by economists as payment for goods and services beyond the amount needed to bring the required factors of production into a production process and sustain supply. A recipient of economic rent is a rentier....

s possible.

Specific academic approaches

Actually, various definitions, focusing on specific aspects and interpretations, have been used:- Greta Krippner of the University of California, Los AngelesUniversity of California, Los AngelesThe University of California, Los Angeles is a public research university located in the Westwood neighborhood of Los Angeles, California, USA. It was founded in 1919 as the "Southern Branch" of the University of California and is the second oldest of the ten campuses...

has written that financialization refers to a “pattern of accumulation in which profit making occurs increasingly through financial channels rather than through trade and commodity production.” In the introduction to the 2005 book Financialization and the World Economy, editor Gerald A. Epstein wrote that some scholars have insisted on a much more narrow use of the term: the ascendancy of "shareholder valueShareholder valueShareholder value is a business term, sometimes phrased as shareholder value maximization or as the shareholder value model, which implies that the ultimate measure of a company's success is the extent to which it enriches shareholders...

" as a mode of corporate governanceCorporate governanceCorporate governance is a number of processes, customs, policies, laws, and institutions which have impact on the way a company is controlled...

; or the growing dominance of capital marketCapital marketA capital market is a market for securities , where business enterprises and governments can raise long-term funds. It is defined as a market in which money is provided for periods longer than a year, as the raising of short-term funds takes place on other markets...

financial systems over bank-based financial systems.

- Financialization may be defined as: "the increasing dominance of the finance industry in the sum total of economic activity, of financial controllers in the management of corporations, of financial assets among total assets, of marketised securities and particularly equities among financial assets, of the stock market as a market for corporate control in determining corporate strategies, and of fluctuations in the stock market as a determinant of business cycles" (Dore 2002)

- More popularly, however, financialization is understood to mean the vastly expanded role of financial motives, financial markets, financial actors and financial institutionFinancial institutionIn financial economics, a financial institution is an institution that provides financial services for its clients or members. Probably the most important financial service provided by financial institutions is acting as financial intermediaries...

s in the operation of domestic and international economies.

- Sociological and political interpretation have also been made. In his 2006 book, American Theocracy: The Peril and Politics of Radical Religion, Oil, and Borrowed Money in the 21st Century, American writer and commentator Kevin PhillipsKevin Phillips (political commentator)Kevin Price Phillips is an American writer and commentator on politics, economics, and history. Formerly a Republican Party strategist, Phillips has become disaffected with his former party over the last two decades, and is now one of its most scathing critics...

presented financialization as “a process whereby financial services, broadly construed, take over the dominant economic, cultural, and political role in a national economy.” (page 268). Philips considers that the financialization of the U.S. economy follows the same pattern that marked the beginning of the decline of Habsburg SpainHabsburg SpainHabsburg Spain refers to the history of Spain over the 16th and 17th centuries , when Spain was ruled by the major branch of the Habsburg dynasty...

in the 16th century, the Dutch trading empire in the 18th century, and the British EmpireBritish EmpireThe British Empire comprised the dominions, colonies, protectorates, mandates and other territories ruled or administered by the United Kingdom. It originated with the overseas colonies and trading posts established by England in the late 16th and early 17th centuries. At its height, it was the...

in the 19th century: (It is also worth pointing out that the true final step in each of these historical economies is; collapse)

-

- ... the leading economic powers have followed an evolutionary progression: first, agriculture, fishing, and the like, next commerce and industry, and finally finance. Several historians have elaborated this point. Brooks Adams contended that “as societies consolidate, they pass through a profound intellectual change. Energy ceases to vent through the imagination and takes the form of capital.”

- Nassim TalebNassim TalebNassim Nicholas Taleb is a Lebanese American essayist whose work focuses on problems of randomness and probability. His 2007 book The Black Swan was described in a review by Sunday Times as one of the twelve most influential books since World War II....

discusses the role mis-estimated financialization methods and processes can be the cause of disaster. In his book The Black Swan Taleb points out how financialization can misrepresent reality and lead to large errors. Relative to the 2007-2009 financial crisis it became clear that many mortgages did not accurately represent the risk to the lendor or the promise of future income from the borrower. Credit Default SwapCredit default swapA credit default swap is similar to a traditional insurance policy, in as much as it obliges the seller of the CDS to compensate the buyer in the event of loan default...

s transactions initially overwhelmed the marketplace as many rushed to correct the error caused by the mis-financialization of borrowers' promises, i.e., mortgages. Nassim Taleb in a 2001 work titled "Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets" foretold many of the errors in Financialization that were being made at the time, those errors in Financialization ultimately proved to be the major causes of the 2007-2009 financial crisis. Taleb suggests that mis-financializations are the root causes of most systemic economic problems in modern economies.

Roots

In the American experience, the roots of financialization can be traced to the rise of NeoliberalismNeoliberalism

Neoliberalism is a market-driven approach to economic and social policy based on neoclassical theories of economics that emphasizes the efficiency of private enterprise, liberalized trade and relatively open markets, and therefore seeks to maximize the role of the private sector in determining the...

and the free-market doctrines of Milton Friedman

Milton Friedman

Milton Friedman was an American economist, statistician, academic, and author who taught at the University of Chicago for more than three decades...

and the Chicago School of Economics, which provided the ideological and theoretical basis for the increasing deregulation

Deregulation

Deregulation is the removal or simplification of government rules and regulations that constrain the operation of market forces.Deregulation is the removal or simplification of government rules and regulations that constrain the operation of market forces.Deregulation is the removal or...

of financial systems and banking beginning in the 1970s. Notre Dame heterodox economist David Ruccio has summarized the politico-economic philosophy of Friedman and the Chicago School as one in which “markets, private property and minimal government will achieve maximum welfare.”

One of the most important impetuses to the rise of financialization was the end of the post-World War Two Bretton Woods system

Bretton Woods system

The Bretton Woods system of monetary management established the rules for commercial and financial relations among the world's major industrial states in the mid 20th century...

of fixed international exchange rate

Exchange rate

In finance, an exchange rate between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency...

s and the dollar peg to gold in August 1971.

Foreign exchange trading

The demise of fixed exchange rates initiated a rapid rise in the level of foreign exchange trading (forex). In the United States, forex leaped from $110.8 billion in 1970, 10.7 percent of U.S. Gross Domestic ProductGross domestic product

Gross domestic product refers to the market value of all final goods and services produced within a country in a given period. GDP per capita is often considered an indicator of a country's standard of living....

, to $5.449 trillion in 1980, 195.3 percent of U.S. GDP. These figures are estimates, but in April 1977, the U.S. Federal Reserve Bank of New York

Federal Reserve Bank of New York

The Federal Reserve Bank of New York is one of the 12 Federal Reserve Banks of the United States. It is located at 33 Liberty Street, New York, NY. It is responsible for the Second District of the Federal Reserve System, which encompasses New York state, the 12 northern counties of New Jersey,...

undertook to measure the actual amount of forex in the United States, surveying forex trading at 44 large money center banks, which the Fed believed probably represented 98 percent of all forex in the United States at that time. This April 1977 study found there was $4.8 billion in daily forex trading, or around $1.2 trillion a year. However, this study did not include all the trading in futures trading for various currencies. Currency futures were first created at the Chicago Mercantile Exchange

Chicago Mercantile Exchange

The Chicago Mercantile Exchange is an American financial and commodity derivative exchange based in Chicago. The CME was founded in 1898 as the Chicago Butter and Egg Board. Originally, the exchange was a non-profit organization...

(CME) in 1972, the year after fixed exchange rates were abandoned.

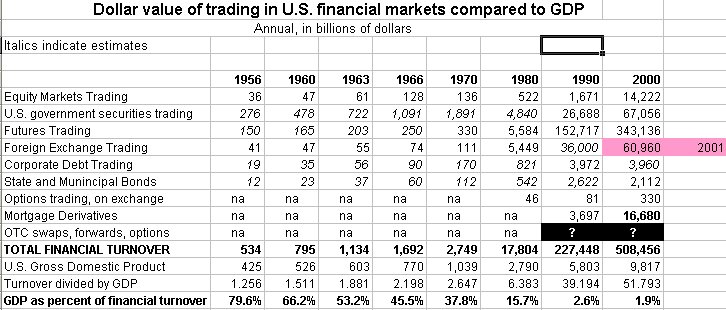

Financial turnover compared to gross domestic product

Other financial markets exhibited similarly explosive growth. Trading in U.S. equity (stock) markets grew from $136.0 billion or 13.1 percent of U.S. GDP in 1970, to $1.671 trillion or 28.8 percent of U.S. GDP in 1990. In 2000, trading in U.S. equity markets was $14.222 trillion, or 144.9 percent of GDP. Most of the growth in stock trading has been directly attributed to the introduction and spread of program tradingProgram trading

Program trading is a generic term used to describe a type of trading in securities, usually consisting of baskets of fifteen stocks or more that are executed by a computer program simultaneously based on predetermined conditions...

.

According to the March 2007 Quarterly Report from the Bank for International Settlements (see page 24.):

Trading on the international derivatives exchanges slowed in the fourth quarter of 2006. Combined turnover of interest rate, currency and stock index derivatives fell by 7% to $431 trillion between October and December 2006.

Thus, derivatives trading – mostly futures contracts on interest rates, foreign currencies, Treasury bonds, etc. had reached a level of $1,200 trillion, $1.2 quadrillion, a year. By comparison, U.S. GDP in 2006 was $12.456 trillion.

The table below provides data for the annual amount of financial trading in U.S. financial markets, compared to GDP.

Sources for table above:

- Equity Markets Trading, Statistical Abstract of the United States. For example 1990 and 2000 taken from Table 1201, Sales of Stocks on Registered Exchanges, 1990 to 2003, "Market Value of all Sales" minus "CBOE" Statistical Abstract of the United States, 2004-2005.

- U.S. government securities trading, Statistical Abstract of the United States. For example 1990 and 2000 taken from Table 1190, Volume of Debt Markets by Type of Security, 1990 to 2003, Statistical Abstract of the United States 2004-2005.

- Futures Trading, are estimates based on the average value of types of futures contracts, multiplied by the number of contracts traded, reported by the Futures Industries Association.

- Corporate Debt Trading and State and Municipal Bonds, the Bond Market Association reports average daily volume, multiplied by 240 business days.

- Options trading, on exchange, Statistical Abstract of the United States. For example 1990 and 2000 taken from Table 1201, Sales of Stocks on Registered Exchanges, 1990 to 2003, line for "CBOE" only, Statistical Abstract of the United States, 2004-2005.

- Mortgage Derivatives, 2000 taken from Table 1190, Volume of Debt Markets by Type of Security, 1990 to 2003, Statistical Abstract of the United States 2004-2005.

- OTC swaps, forwards, options is reported by the U.S. Federal Reserve Bank of New York, and the Bank for International Settlements, but I have not been able to determine what percentage of nominal values of these types of financial derivatives are actually traded.

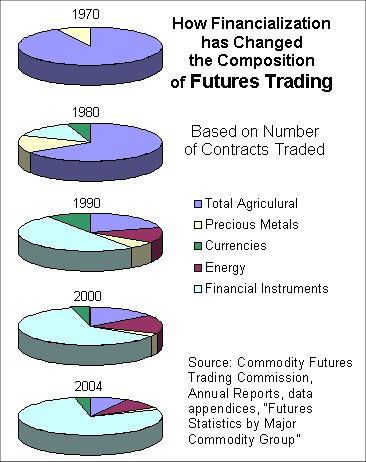

Futures markets

The data for turnover in the futures markets in 1970, 1980, and 1990, is based on the number of contracts traded, which is reported by the organized exchanges, such as the Chicago Board of Trade, the Chicago Mercantile Exchange and the New York Commodity Exchange, and compiled in data appendices of the Annual Reports of the U.S. Commodity Futures Trading Commission. The pie charts below show the dramatic shift in types of futures contracts traded from 1970 to 2004. For a century after organized futures exchanges were founded in the mid-19th century, all futures trading was solely based on agricultural commodities.But after the end of dollar gold-backed fixed-exchange rate system in 1971, contracts based on foreign currencies began to be traded. After the deregulation of interest rates by the Bank of England, then the U.S. Federal Reserve, in the late 1970s, futures contracts based on various bonds / interest rates began to be traded. The result was that financial futures contracts - based on such things as interest rates, currencies, or equity indices - came to dominate the futures markets.

The dollar value of turnover in the futures markets is found by multiplying the number of contracts traded by the average value per contract for 1978 to 1980, which was calculated by ACLI Research in 1981. The figures for earlier years were estimated on computer-generated exponential fit of data from 1960 to 1970, with 1960 set at $165 billion, half the 1970 figure, on the basis of a graph accompanying the ACLI data, which showed that the number of futures contracts traded in 1961 and earlier years was about half the number traded in 1970.

According to the ALCI data, the average value for interest rate contracts is around ten times that of agricultural and other commodities, while the average value of currency contracts is twice that of agricultural and other commodities. (Beginning in mid-1993, the Chicago Mercantile Exchange itself began to release figures of the nominal value of contracts traded at the CME each month. In November 1993, the CME boasted it had set a new monthly record of 13.466 million contracts traded, representing a dollar value of $8.8 trillion. By late 1994, this monthly value had doubled. On. Jan. 3, 1995, the CME boasted that its total volume for 1994 had jumped 54%, to 226.3 million contracts traded, worth nearly $200 trillion. Soon thereafter, the CME ceased to provide a figure for the dollar value of contracts traded.)

Economic effects

Financial servicesFinancial services

Financial services refer to services provided by the finance industry. The finance industry encompasses a broad range of organizations that deal with the management of money. Among these organizations are credit unions, banks, credit card companies, insurance companies, consumer finance companies,...

(banking, insurance, investment...) has become a key industry in developed economies in which it represents a sizeable share of the GDP and an important source of employment. Those activities also played a key facilitator role to foster economic globalization

Economic globalization

Economic globalization refers to increasing economic interdependence of national economies across the world through a rapid increase in cross-border movement of goods, service, technology and capital...

. In the wake of the 2007-2010 financial crisis, a number of economists and others began to argue that Financial services

Financial services

Financial services refer to services provided by the finance industry. The finance industry encompasses a broad range of organizations that deal with the management of money. Among these organizations are credit unions, banks, credit card companies, insurance companies, consumer finance companies,...

had become too large a sector in the U.S. economy, with no real benefit to society accruing from the activities of increased financialization. Some, such as former International Monetary Fund

International Monetary Fund

The International Monetary Fund is an organization of 187 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world...

chief economist Simon Johnson

Simon Johnson

Simon Johnson may refer to:*Simon Johnson , former chief economist of the IMF and professor at MIT's Sloan School of Management.*Simon Johnson , footballer who began his career at Leeds United...

even went so far as to argue that the increased power and influence of the financial services sector had fundamentally transformed the American polity, endangering representative democracy itself.

In February 2009, white-collar criminologist and former senior financial regulator William K. Black

William K. Black

William Kurt Black is an American lawyer, academic, author, and a former bank regulator. Black's expertise is in white-collar crime, public finance, regulation, and other topics in law and economics...

listed the ways in which the financial sector harms the real economy. Black wrote, “The financial sector functions as the sharp canines that the predator state uses to rend the nation. In addition to siphoning off capital for its own benefit, the finance sector misallocates the remaining capital in ways that harm the real economy in order to reward already-rich financial elites harming the nation.”

In testimony before the U.S. Congress in March 2009, former Federal Reserve Chairman Emerging countries try also to develop their financial sector, as an engine of economic development

Economic development

Economic development generally refers to the sustained, concerted actions of policymakers and communities that promote the standard of living and economic health of a specific area...

. A typical aspect is the growth of microfinance

Microfinance

Microfinance is the provision of financial services to low-income clients or solidarity lending groups including consumers and the self-employed, who traditionally lack access to banking and related services....

/microcredit

Microcredit

Microcredit is the extension of very small loans to those in poverty designed to spur entrepreneurship. These individuals lack collateral, steady employment and a verifiable credit history and therefore cannot meet even the most minimal qualifications to gain access to traditional credit...

.

On 15 February 2010, Adair Turner, head of Britain’s Financial Services Authority

Financial Services Authority

The Financial Services Authority is a quasi-judicial body responsible for the regulation of the financial services industry in the United Kingdom. Its board is appointed by the Treasury and the organisation is structured as a company limited by guarantee and owned by the UK government. Its main...

directly blamed financialization as a primary cause of the 2007–2010 financial crisis. In a speech before the Reserve Bank of India

Reserve Bank of India

The Reserve Bank of India is the central banking institution of India and controls the monetary policy of the rupee as well as US$300.21 billion of currency reserves. The institution was established on 1 April 1935 during the British Raj in accordance with the provisions of the Reserve Bank of...

, Turner said that the Asian financial crisis of 1997-98 was similar to the 2008-2009 crisis in that “...both were rooted in, or at least followed after, sustained increases in the relative importance of financial activity relative to real non-financial economic activity, an increasing “financialisation” of the economy.”

Criticism of financialization

This recognized success brought also some negative reactions. In the Introduction to the 2005 book Financialization and the World Economy, editor Gerald A. Epstein wrote that

in the mid- to late 1970s or early 1980s, structural shifts of dramatic proportions took place in a number of countries that led to significant increases in financial transactions, real interest rates, the profitability of financial firms, and the shares of national income accruing to the holders of financial assets. This set of phenomena reflects the processes of financialization in the world economy....

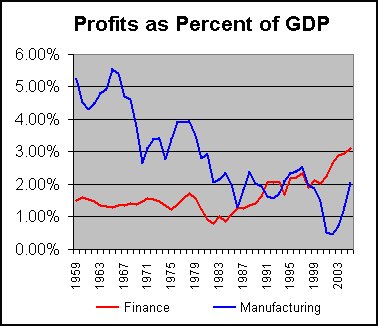

... finance benefits handsomely from the same processes that create economic crises and injure so many others. Hence the costs of financial crises are paid by the bulk of the population, while large benefits accrue to finance. Duménil and Lévy provide new and valuable data documenting these trends in the case of France and the USA....

Using the case of the US economy, Crotty argues that financialization has had a profound and largely negative impact on the operations of US nonfinancial corporations. This is partly reflected in the increasing incomes extracted by financial markets from these corporations; trends identified also by Duménil and Lévy and Epstein and Jayadev. For example, Crotty shows that the payments US NFCs paid out to financial markets more than doubled as a share of their cash flow between the 1960s and the 1970s, on one hand, and the 1980s and 1990s on the other...

Financial markets’ demands for more income and more rapidly growing stock prices occurred at the same time as stagnant economic growth and increased product market competition made it increasingly difficult to earn profits. Crotty calls this the ‘neoliberal’ paradox. Non-financial corporations responded to this pressure in three ways, none of them healthy for the average citizen: 1) they cut wages and benefits to workers; 2) they engaged in fraud and deception to increase apparent profits and 3) they moved into financial operations to increase profits. Hence, Crotty argues that financialization in conjunction with neoliberalism and globalization has had a significantly negative impact on the prospects for economic prosperity.

The graph below shows profits of the U.S. financial sector and of the U.S. manufacturing sector, as a percent of GDP

Source for graph above: Economic Report of the President: 2007 Report Spreadsheet Tables, Tables B-1 and B-91.

The development of leverage and of financial derivatives

One of the most notable features of financialization has been the development of overleverageLeverage (finance)

In finance, leverage is a general term for any technique to multiply gains and losses. Common ways to attain leverage are borrowing money, buying fixed assets and using derivatives. Important examples are:* A public corporation may leverage its equity by borrowing money...

(more borrowed capital and less own capital) and, as a related tool, financial derivatives – financial instruments, the price or value of which is derived from the price or value of another, underlying financial instrument. Those instruments, which initial purpose was hedging and risk management, has become widely traded financial assets in their own. The most common types of derivatives are futures contracts, swaps, and options. In the early 1990s, a number of central banks around the world began to survey the amount of derivative market activity, and report the results to the Bank for International Settlements.

In the past few years, the number and types of financial derivatives have grown enormously. In November 2007, commenting on the financial crisis sparked by the sub-prime mortgage collapse in the United States, Doug Noland’s Credit Bubble Bulletin, on Asia Times Online, noted,

The scale of the Credit "insurance" problem is astounding. According to the Bank of International Settlements, the OTC market for Credit default swaps (CDS) jumped from $4.7 TN at the end of 2004 to $22.6 TN to end 2006. From the International Swaps and Derivatives AssociationInternational Swaps and Derivatives AssociationThe International Swaps and Derivatives Association is a trade organization of participants in the market for over-the-counter derivatives....

we know that the total notional volume of credit derivatives jumped about 30% during the first half to $45.5 TN. And from the Comptroller of the Currency, total U.S. commercial bank Credit derivative positions ballooned from $492bn to begin 2003 to $11.8 TN as of this past June....

A major unknown regarding derivatives is the actual amount of cash behind a transaction. A derivatives contract with a notional value of millions of dollars may actually only cost a few thousand dollars. For example, an interest rate swap might be based on exchanging the interest payments on $100 million in U.S. Treasury bonds at a fixed interest of 4.5 percent, for the floating interest rate of $100 million in credit card receivables. This contract would involve at least $4.5 million in interest payments, though the notional value may be reported as $100 million. However, the actual “cost” of the swap contract would be some small fraction of the minimal $4.5 million in interest payments. The difficulty of determining exactly how much this swap contract is worth when accounted for on a financial institution’s books, is typical of the worries many experts and regulators have over the explosive growth of these types of instruments.

Contrary to common belief in the United States, the largest financial center for derivatives - and also for forex - is London. According to MarketWatch on December 7, 2006,

The global foreign exchange market, easily the largest financial market, is dominated by London. More than half of the trades in the derivatives market are handled in London, which straddles the time zones between Asia and the U.S. And the trading rooms in the Square Mile, as the City of London financial district is known, are responsible for almost three-quarters of the trades in the secondary fixed-income markets.

See also

|

FIRE economy A 'FIRE economy is any economy based primarily on the paper-intensive sectors of Finance, Insurance, and Real Estate . The origins of the term are unclear. Barry Popik describes some early uses as far back as 1982... Late capitalism "Late capitalism" is a term used by neo-Marxists to refer to capitalism from about 1945 onwards, with the implication that it is a historically limited stage rather than an eternal feature of all future human society. Postwar German sociologists needed a term to describe contemporary society... Shadow banking system The shadow banking system is the infrastructure and practices which support financial transactions that occur beyond the reach of existing state sanctioned monitoring and regulation. It includes entities such as hedge funds, money market funds and Structured investment vehicles... Speculation In finance, speculation is a financial action that does not promise safety of the initial investment along with the return on the principal sum... Usury Usury Originally, when the charging of interest was still banned by Christian churches, usury simply meant the charging of interest at any rate . In countries where the charging of interest became acceptable, the term came to be used for interest above the rate allowed by law... |

Further reading

- Baker, A (2005). IPE, Corporate Governance and the New Politics of Financialisation: Issues Raised by Sarbanes-Oxley

- Orhangazi, O (2008). Financialization and the US Economy, Edward Elgar Publishing. http://books.google.com/books?id=_IBAWevInNIC&printsec=frontcover&source=gbs_v2_summary_r&cad=0#v=onepage&q=&f=false

- Orhangazi, O. 2008. "Financialization and Capital Accumulation in the Nonfinancial Corporate Sector: A Theoretical and Empirical Investigation on the US Economy, 1973-2003" Cambridge Journal of Economics, 32(6): 863-886.

External links

- Financialization and the US Economy, http://books.google.com/books?id=_IBAWevInNIC&printsec=frontcover&source=gbs_v2_summary_r&cad=0#v=onepage&q=&f=false

- John BogleJohn BogleJohn Clifton "Jack" Bogle is the founder and retired CEO of The Vanguard Group. He is known for his 1999 book Common Sense on Mutual Funds: New Imperatives for the Intelligent Investor, which became a bestseller and is considered a classic.-Early life and education:Bogle was born in in Verona, New...

, founder and retired CEO of The Vanguard GroupThe Vanguard GroupThe Vanguard Group is an American investment management company based in Malvern, Pennsylvania, that manages approximately $1.6 trillion in assets. It offers mutual funds and other financial products and services to individual and institutional investors in the United States and abroad. Founder...

of mutual funds, discusses how the financial system has overwhelmed the productive system, on Bill Moyers Journal - Gerald A. Epstein’s Introduction to Financialization and the World Economy

- Thomas I. Palley's November 2007 paper, Financialization: What it is and Why it Matters

- Greta R. Krippner: The financialization of the American economy. Socio-Economic Review 2005 3(2):173-208.

- The Financialization of Capital and the Crisis, Monthly Review, April 2008

- The Financialization of Capitalism, Monthly Review, April 2007

- Monopoly-Finance Capital, Monthly Review, December 2006

- http://www.peri.umass.edu/fileadmin/pdf/working_papers/working_papers_101-150/WP149.pdf, "Financialization and Capital Accumulation"

- Blackburn - Subprime Crisis New Left Review Mar April 2008

- Financialization: A Primer by economist Ramaa Vasudevan in Dollars & SenseDollars & SenseDollars & Sense is a magazine dedicated to providing left-wing perspectives on economics.Published six times a year since 1974, it is edited by a collective of economists, journalists, and activists committed to the ideals of social justice and economic democracy.It was initially sponsored by the...

magazine, Nov/Dec 2008 - Luiz Carlos Bresser-Pereira: The Global Financial Crisis and a New Capitalism? Levy Economics Institute Working Paper No. 592. Mai 2010.