Wilshire 5000

Encyclopedia

Common stock

Common stock is a form of corporate equity ownership, a type of security. It is called "common" to distinguish it from preferred stock. In the event of bankruptcy, common stock investors receive their funds after preferred stock holders, bondholders, creditors, etc...

actively traded in the United States

United States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

. Currently, the index contains over 4,100 components. The index is intended to measure the performance of most publicly traded companies

Public company

This is not the same as a Government-owned corporation.A public company or publicly traded company is a limited liability company that offers its securities for sale to the general public, typically through a stock exchange, or through market makers operating in over the counter markets...

headquartered in the United States

United States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

, with readily available price data, (Bulletin Board/penny stocks and stocks of extremely small companies are excluded). Hence, the index includes a majority of the common stock

Common stock

Common stock is a form of corporate equity ownership, a type of security. It is called "common" to distinguish it from preferred stock. In the event of bankruptcy, common stock investors receive their funds after preferred stock holders, bondholders, creditors, etc...

s and REIT

Real estate investment trust

A real estate investment trust or REIT is a tax designation for a corporate entity investing in real estate. The purpose of this designation is to reduce or eliminate corporate tax. In return, REITs are required to distribute 90% of their taxable income into the hands of investors...

s traded primarily through New York Stock Exchange

New York Stock Exchange

The New York Stock Exchange is a stock exchange located at 11 Wall Street in Lower Manhattan, New York City, USA. It is by far the world's largest stock exchange by market capitalization of its listed companies at 13.39 trillion as of Dec 2010...

, NASDAQ

NASDAQ

The NASDAQ Stock Market, also known as the NASDAQ, is an American stock exchange. "NASDAQ" originally stood for "National Association of Securities Dealers Automated Quotations". It is the second-largest stock exchange by market capitalization in the world, after the New York Stock Exchange. As of...

, or the American Stock Exchange

American Stock Exchange

NYSE Amex Equities, formerly known as the American Stock Exchange is an American stock exchange situated in New York. AMEX was a mutual organization, owned by its members. Until 1953, it was known as the New York Curb Exchange. On January 17, 2008, NYSE Euronext announced it would acquire the...

. Limited Partnership

Limited partnership

A limited partnership is a form of partnership similar to a general partnership, except that in addition to one or more general partners , there are one or more limited partners . It is a partnership in which only one partner is required to be a general partner.The GPs are, in all major respects,...

s and ADRs are not included. It can be tracked by following the ticker W5000.

History

- The Wilshire 5000 Total Market Index was established by the Wilshire AssociatesWilshire AssociatesWilshire Associates, Inc. is an independent investment management firm that offers consulting services, and analytical products and manages fund of funds investment vehicles for a global client base. Wilshire manages capital for more than 600 institutional investors globally representing more than...

in 1974, naming it for the approximate number of issues it included at the time. It was renamed the "Dow Jones Wilshire 5000" in April 2004, after Dow Jones & CompanyDow Jones & CompanyDow Jones & Company is an American publishing and financial information firm.The company was founded in 1882 by three reporters: Charles Dow, Edward Jones, and Charles Bergstresser. Like The New York Times and the Washington Post, the company was in recent years publicly traded but privately...

assumed responsibility for its calculation and maintenance. On March 31, 2009 the partnership with Dow Jones was concluded and the index returned to Wilshire AssociatesWilshire AssociatesWilshire Associates, Inc. is an independent investment management firm that offers consulting services, and analytical products and manages fund of funds investment vehicles for a global client base. Wilshire manages capital for more than 600 institutional investors globally representing more than...

.

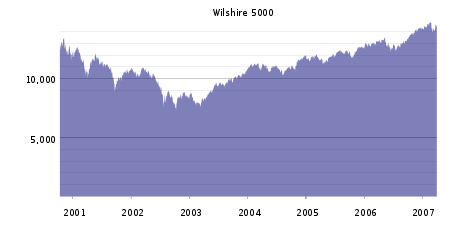

- The base value for the index was 1404.60 points on base date December 31, 1980, when it had a total market capitalization of $1,404.596 billion. On that date, each one-index-point change in the index was equal to $1 billion. However, index divisor adjustments due to corporate actions and index composition changes have changed the relationship over time, so that by 2005 each index point reflected a change of about $1.2 billion in the index’s total market capitalization.

- The index did not close above its March 24, 2000 peak above 14,000 points (record high of the 20th century) until February 20, 2007, and a hypothetical investment in the Wilshire 5000, made at the 2000 peak and with subsequent dividends reinvested, did not become profitable on a closing basis until October 3, 2006.

- On April 20, 2007, the index closed above 15,000 for the first time. On that day, the S&P 500S&P 500The S&P 500 is a free-float capitalization-weighted index published since 1957 of the prices of 500 large-cap common stocks actively traded in the United States. The stocks included in the S&P 500 are those of large publicly held companies that trade on either of the two largest American stock...

was still several percentage points below its March 2000 high, because small cap issues absent from the S&P 500 and included in the Wilshire 5000 outperformed the large cap issues that dominate the S&P 500 during the cyclical bull market.

- The index reached its all-time high on October 9, 2007 at the 15,806.69 point level, right before the onset of the late-2000s recession and the related late-2000s financial crisisLate-2000s financial crisisThe late-2000s financial crisis is considered by many economists to be the worst financial crisis since the Great Depression of the 1930s...

.

- Since late 2007, the expansion of subprime lending difficulties into a wider Financial Crisis, plunged the United States into a renewed bear market that accelerated beginning on September 15, 2008. On October 8, the Wilshire 5000 closed below 10,000 for the first time since 2003.

- The index continued trading downward towards a 13-year low reaching the 6,772 level on March 6, 2009, representing a loss of about $10.9 trillion in market capitalization from its highs in 2007; but has since rallied above the 12,800 level through the beginning of December 2010.

- The Wilshire 5000 gained approximately $2.5 trillion in market value during the first 11 months of 2009 while the index rose 2,105 points. Therefore, as of November 2009, each index point represented about $1.2 billion in market value.

Versions

There are five versions of the index:- Full capitalization total return

- Full capitalization price

- Float-adjusted total return

- Float-adjusted price

- Equal weight

The difference between the total return and price versions of the index is that the total return versions accounts for reinvestment of dividend

Dividend

Dividends are payments made by a corporation to its shareholder members. It is the portion of corporate profits paid out to stockholders. When a corporation earns a profit or surplus, that money can be put to two uses: it can either be re-invested in the business , or it can be distributed to...

s. The difference between the full capitalization, float-adjusted, and equal weight versions is in how the index components are weighted. The full cap index uses the total shares outstanding for each company. The float-adjusted index uses shares adjusted for free float. The equal-weighted index assigns each security

Security (finance)

A security is generally a fungible, negotiable financial instrument representing financial value. Securities are broadly categorized into:* debt securities ,* equity securities, e.g., common stocks; and,...

in the index the same weight.

Calculation

Let:- M = Number of issues included in the index. Hence i ranges from 1 to M;

- Pi = Price of one share of issue i included in the index;

- Ni = Number of shares of issue i for the full capitalization version; or, the float of issue i for the float-adjusted version;

-

= a fixed scaling factor.

= a fixed scaling factor.

The value of the index is then:

At present, one index point corresponds to a little more than US$1 billion of market capitalization.

The list of issues

Security (finance)

A security is generally a fungible, negotiable financial instrument representing financial value. Securities are broadly categorized into:* debt securities ,* equity securities, e.g., common stocks; and,...

included in the index is updated monthly to add new listings resulting from corporate spin-offs and initial public offering

Initial public offering

An initial public offering or stock market launch, is the first sale of stock by a private company to the public. It can be used by either small or large companies to raise expansion capital and become publicly traded enterprises...

s, and to remove issues which move to the pink sheets

Pink Sheets

OTC Markets Group, Inc., informally known as "Pink Sheets", is a private company that provides services to the U.S. over-the-counter securities market including electronic quotations, trading, messaging, and information platforms. According to the U.S. Securities and Exchange Commission, OTC...

or that have ceased trading for at least 10 consecutive days.

See also

- Wilshire AssociatesWilshire AssociatesWilshire Associates, Inc. is an independent investment management firm that offers consulting services, and analytical products and manages fund of funds investment vehicles for a global client base. Wilshire manages capital for more than 600 institutional investors globally representing more than...

- Wilshire 4500Wilshire 4500The Wilshire 4500 Completion Index, more commonly the Wilshire 4500, is a market capitalization-weighted index of all stocks actively traded in the United States with the exception of the stocks included in the S&P 500 index...

- Russell 3000Russell 3000The Russell 3000 Index is a stock market index of US stocks.The ticker symbol is ^RUA.This index measures the performance of 3,000 publicly held US companies based on total market capitalization, which represents approximately 98% of the investable US market.-Annual returns reflected by the Russell...

- Dow Jones & CompanyDow Jones & CompanyDow Jones & Company is an American publishing and financial information firm.The company was founded in 1882 by three reporters: Charles Dow, Edward Jones, and Charles Bergstresser. Like The New York Times and the Washington Post, the company was in recent years publicly traded but privately...

- News CorporationNews CorporationNews Corporation or News Corp. is an American multinational media conglomerate. It is the world's second-largest media conglomerate as of 2011 in terms of revenue, and the world's third largest in entertainment as of 2009, although the BBC remains the world's largest broadcaster...

- NASDAQ OMX

- NYSE Euronext