Cost-Volume-Profit Analysis

Encyclopedia

Coon-Volume-profit in managerial economics

is a form of cost accounting

. It is a simplified model, useful for elementary instruction and for short-run decisions.

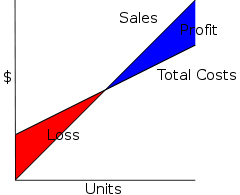

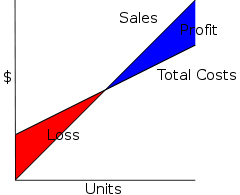

Cost-volume-profit (CVP) analysis expands the use of information provided by breakeven analysis. A critical part of CVP analysis is the point where total revenues equal total costs (both fixed and variable costs). At this breakeven point (BEP

), a company will experience no income or loss. This BEP can be an initial examination that precedes more detailed CVP analysis.

Cost-volume-profit analysis employs the same basic assumptions as in breakeven analysis. The assumptions underlying CVP analysis are:

The behavior of both costs and revenues is linear throughout the relevant range of activity. (This assumption precludes the concept of volume discounts on either purchased materials or sales.)

Costs can be classified accurately as either fixed or variable.

Changes in activity are the only factors that affect costs.

All units produced are sold (there is no ending finished goods inventory).

When a company sells more than one type of product, the sales mix (the ratio of each product to total sales) will remain constant.

The components of Cost-Volume-Profit Analysis are:

These are simplifying, largely linear

izing assumptions, which are often implicitly assumed in elementary discussions of costs and profits. In more advanced treatments and practice, costs and revenue are nonlinear and the analysis is more complicated, but the intuition afforded by linear CVP remains basic and useful.

One of the main Methods of calculating CVP is Profit volume ratio:

which is (contribution /sales)*100 = this gives us profit volume ratio.

Therefore it gives us the profit added per unit of variable costs.

The assumptions of the CVP model yield the following linear equations for total cost

The assumptions of the CVP model yield the following linear equations for total cost

s and total revenue (sales):

)

)

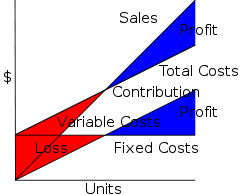

These are linear because of the assumptions of constant costs and prices, and there is no distinction between Units Produced and Units Sold, as these are assumed to be equal. Note that when such a chart is drawn, the linear CVP model is assumed, often implicitly.

In symbols:

where

Profit is computed as TR-TC; it is a profit if positive, a loss if negative.

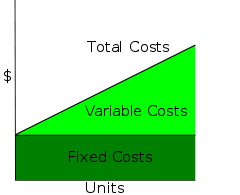

One can decompose Total Costs as Fixed Costs plus Variable Costs:

One can decompose Total Costs as Fixed Costs plus Variable Costs:

Following a matching principle

Following a matching principle

of matching a portion of sales against variable costs, one can decompose Sales as Contribution

plus Variable Costs, where contribution is "what's left after deducting variable costs". One can think of contribution as "the marginal contribution of a unit to the profit", or "contribution towards offsetting fixed costs".

In symbols:

where

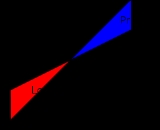

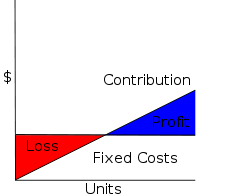

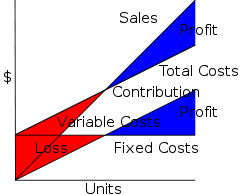

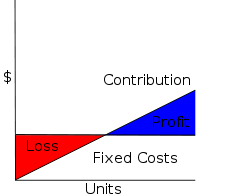

Subtracting Variable Costs from both Costs and Sales yields the simplified diagram and equation for Profit and Loss.

Subtracting Variable Costs from both Costs and Sales yields the simplified diagram and equation for Profit and Loss.

In symbols:

These diagrams can be related by a rather busy diagram, which demonstrates how if one subtracts Variable Costs, the Sales and Total Costs lines shift down to become the Contribution and Fixed Costs lines. Note that the Profit and Loss for any given number of unit sales is the same, and in particular the break-even point is the same, whether one computes by Sales = Total Costs or as Contribution = Fixed Costs. Mathematically, the contribution graph is obtained from the sales graph by a shear, to be precise

These diagrams can be related by a rather busy diagram, which demonstrates how if one subtracts Variable Costs, the Sales and Total Costs lines shift down to become the Contribution and Fixed Costs lines. Note that the Profit and Loss for any given number of unit sales is the same, and in particular the break-even point is the same, whether one computes by Sales = Total Costs or as Contribution = Fixed Costs. Mathematically, the contribution graph is obtained from the sales graph by a shear, to be precise  , where V are Unit Variable Costs.

, where V are Unit Variable Costs.

in break even analysis, and more generally allows simple computation of Target Income Sales. It simplifies analysis of short run trade-offs in operational decisions.

or throughput accounting

.

Managerial economics

Managerial economics as defined by Edwin Mansfield is "concerned with application of economic concepts and economic analysis to the problems of formulating rational managerial decision." It is sometimes referred to as business economics and is a branch of economics that applies microeconomic...

is a form of cost accounting

Cost accounting

Cost accounting information is designed for managers. Since managers are taking decisions only for their own organization, there is no need for the information to be comparable to similar information from other organizations...

. It is a simplified model, useful for elementary instruction and for short-run decisions.

Cost-volume-profit (CVP) analysis expands the use of information provided by breakeven analysis. A critical part of CVP analysis is the point where total revenues equal total costs (both fixed and variable costs). At this breakeven point (BEP

Break Even

Break Even are an Australian hardcore band from Perth, Western Australia.-History:Forming in the suburbs of Perth in 2005, Break Even have released two successful releases and toured with the biggest names in local and international hardcore....

), a company will experience no income or loss. This BEP can be an initial examination that precedes more detailed CVP analysis.

Cost-volume-profit analysis employs the same basic assumptions as in breakeven analysis. The assumptions underlying CVP analysis are:

The behavior of both costs and revenues is linear throughout the relevant range of activity. (This assumption precludes the concept of volume discounts on either purchased materials or sales.)

Costs can be classified accurately as either fixed or variable.

Changes in activity are the only factors that affect costs.

All units produced are sold (there is no ending finished goods inventory).

When a company sells more than one type of product, the sales mix (the ratio of each product to total sales) will remain constant.

The components of Cost-Volume-Profit Analysis are:

- Level or volume of activity

- Unit Selling Prices

- Variable cost per unit

- Total fixed costs

- Sales mix

Assumptions

CVP assumes the following:- Constant sales price;

- Constant variable costVariable costVariable costs are expenses that change in proportion to the activity of a business. Variable cost is the sum of marginal costs over all units produced. It can also be considered normal costs. Fixed costs and variable costs make up the two components of total cost. Direct Costs, however,...

per unit; - Constant total fixed costFixed costIn economics, fixed costs are business expenses that are not dependent on the level of goods or services produced by the business. They tend to be time-related, such as salaries or rents being paid per month, and are often referred to as overhead costs...

; - Constant sales mix;

- Units sold equal units produced.

These are simplifying, largely linear

Linear

In mathematics, a linear map or function f is a function which satisfies the following two properties:* Additivity : f = f + f...

izing assumptions, which are often implicitly assumed in elementary discussions of costs and profits. In more advanced treatments and practice, costs and revenue are nonlinear and the analysis is more complicated, but the intuition afforded by linear CVP remains basic and useful.

One of the main Methods of calculating CVP is Profit volume ratio:

which is (contribution /sales)*100 = this gives us profit volume ratio.

- contribution stands for Sales minus variable costs.

Therefore it gives us the profit added per unit of variable costs.

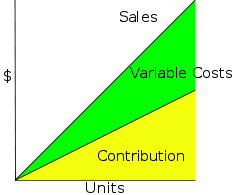

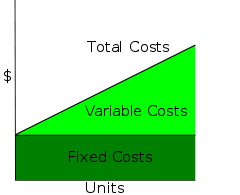

Basic graph

Total cost

In economics, and cost accounting, total cost describes the total economic cost of production and is made up of variable costs, which vary according to the quantity of a good produced and include inputs such as labor and raw materials, plus fixed costs, which are independent of the quantity of a...

s and total revenue (sales):

)

)

These are linear because of the assumptions of constant costs and prices, and there is no distinction between Units Produced and Units Sold, as these are assumed to be equal. Note that when such a chart is drawn, the linear CVP model is assumed, often implicitly.

In symbols:

where

- TC = Total Costs

- TFC = Total Fixed Costs

- V = Unit Variable Cost (Variable Cost per Unit)

- X = Number of Units

- TR = S = Total Revenue = Sales

- P = (Unit) Sales Price

Profit is computed as TR-TC; it is a profit if positive, a loss if negative.

Break down

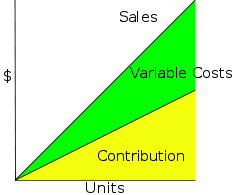

Costs and Sales can be broken down, which provide further insight into operations.

Matching principle

The matching principle is a culmination of accrual accounting and the revenue recognition principle. They both determine the accounting period, in which revenues and expenses are recognized. According to the principle, expenses are recognized when obligations are incurred The matching principle...

of matching a portion of sales against variable costs, one can decompose Sales as Contribution

Contribution margin

In cost-volume-profit analysis, a form of management accounting, contribution margin is the marginal profit per unit sale. It is a useful quantity in carrying out various calculations, and can be used as a measure of operating leverage...

plus Variable Costs, where contribution is "what's left after deducting variable costs". One can think of contribution as "the marginal contribution of a unit to the profit", or "contribution towards offsetting fixed costs".

In symbols:

where

- C = Unit Contribution (Margin)

In symbols:

, where V are Unit Variable Costs.

, where V are Unit Variable Costs.Applications

CVP simplifies the computation of breakevenBreakeven

In economics & business, specifically cost accounting, the break-even point is the point at which cost or expenses and revenue are equal: there is no net loss or gain, and one has "broken even"...

in break even analysis, and more generally allows simple computation of Target Income Sales. It simplifies analysis of short run trade-offs in operational decisions.

Limitations

CVP is a short run, marginal analysis: it assumes that unit variable costs and unit revenues are constant, which is appropriate for small deviations from current production and sales, and assumes a neat division between fixed costs and variable costs, though in the long run all costs are variable. For longer-term analysis that considers the entire life-cycle of a product, one therefore often prefers activity-based costingActivity-based costing

Activity-based costing is a special costing model that identifies activities in an organization and assigns the cost of each activity with resources to all products and services according to the actual consumption by each...

or throughput accounting

Throughput accounting

Throughput Accounting is a principle-based and comprehensive management accounting approach that provides managers with decision support information for enterprise profitability improvement. TA is relatively new in management accounting...

.