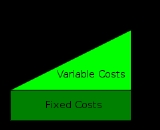

Fixed cost

Overview

In management accounting

Management accounting

Management accounting or managerial accounting is concerned with the provisions and use of accounting information to managers within organizations, to provide them with the basis to make informed business decisions that will allow them to be better equipped in their management and control...

, fixed costs are defined as expenses that do not change as a function of the activity of a business, within the relevant period.

Discussions