Two-sided markets

Encyclopedia

Two-sided markets, also called two-sided networks, are economic platforms having two distinct user groups that provide each other with network benefits. Example markets include credit cards, composed of cardholders and merchants; HMOs (patients and doctors); operating systems (end-users and developers), travel reservation services (travelers and airlines); yellow pages (advertisers and consumers); video game consoles (gamers and game developers); and communication networks, such as the Internet. Benefits to each group exhibit demand Economies of scale

. Consumers, for example, prefer credit cards honored by more merchants, while merchants prefer cards carried by more consumers. They are particularly useful for analyzing the chicken-and-egg problem of standards battles, such as the competition between VHS and Beta. They are also useful in explaining many free pricing or "freemium" strategies where one user group gets free use of the platform in order to attract the other user group.

Two-sided markets represent a refinement of the concept of network effects

. They were conceived independently by Parker & Van Alstyne

(2000, 2005) to explain behavior in software markets and Rochet & Tirole

(2001) to explain behavior in credit card markets.

Networks with homogenous users are called one-sided to distinguish them from two-sided networks, which have two distinct user groups whose respective members consistently play the same role in transactions.

In a two-sided network, members of each group exhibit a preference regarding the number of users in the other group; these are called cross-side network effects. Each group’s members may also have preferences regarding the number of users in their own group; these are called same-side network effects. Cross-side network effects are usually positive, but can be negative (as with consumer reactions to advertising). Same-side network effects may be either positive (e.g., the benefit from swapping video games with more peers) or negative (e.g., the desire to exclude direct rivals from an online business-to-business marketplace). Figure 1 depicts these relationships.

Figure 1: Cross-Side and Same-Side Network Effects in a Two-Sided Network.

In two-sided networks, users on each side typically require very different functionality from their common platform. In credit card networks, for example, consumers require a unique account, a plastic card, access to phone-based customer service, a monthly bill, etc. Merchants require terminals for authorizing transactions, procedures for submitting charges and receiving payment, “signage” (decals that show the card is accepted), etc. Given these different requirements, platform providers may specialize in serving users on just one side of a two-sided network.

A key feature of two-sided markets is the novel pricing strategies and business models they employ. In order to attract one group of users, the network sponsor may subsidize the other group of users. Historically, for example, Adobe’s portable document format (PDF) did not succeed until Adobe priced the PDF reader at zero, substantially increasing sales of PDF writers. Relative to Apple computer’s initial pricing, Microsoft also steeply discounted systems developer toolkits (SDKs) leading to more rapid development of applications for MS Windows.

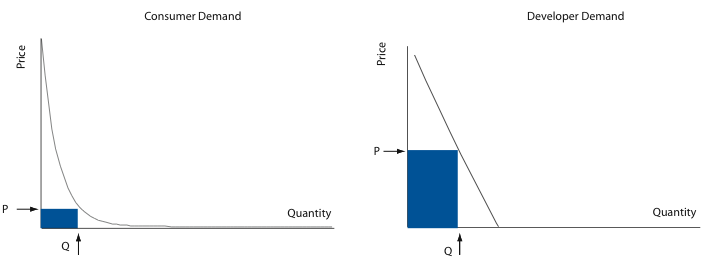

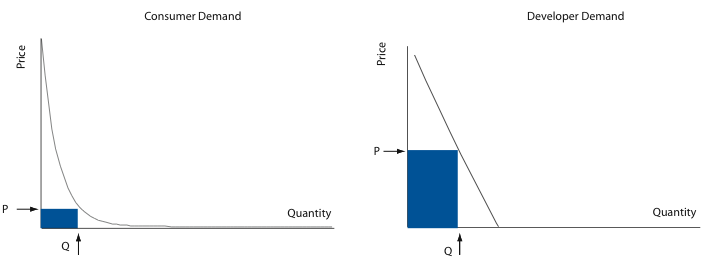

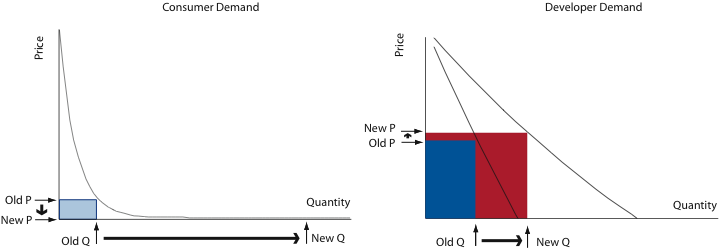

Figure 2–Traditional pricing logic seeks the biggest revenue rectangle (price × quantity) under each demand curve.

In two-sided networks, such pricing logic can be misguided. If firms account for the fact that adoption on one side of the network drives adoption on the other side, they can do better. Demand curves are not fixed: with positive cross-side network effects, demand curves shift outward in response to growth in the user base on the network's other side.

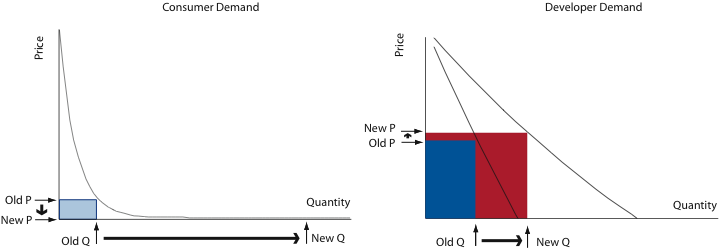

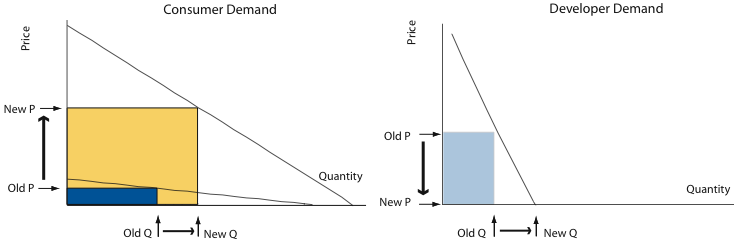

When Adobe changed its pricing strategy and made its reader software freely available, its managers uncovered a key rule of two-sided network pricing. They subsidized the more price sensitive side, and charged the side whose demand increased more strongly in response to growth on the other side. As illustrated in Figure 3, giving consumers a free reader created demand for the document writer, the network's "money side."

Figure 3–So long as the revenue gained (red box) exceeds the revenue lost (light blue box), a discounting strategy is profitable. The subsidy largely changes network size.

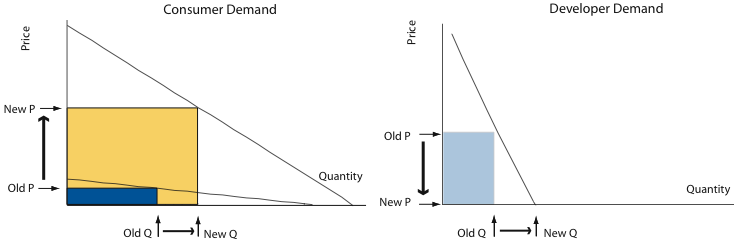

Figure 4–In this market, consumers care more about access to critical features. The main effect of a subsidy is to change network value.

Which market represents the money side and which market represents the subsidy side depends on this critical tradeoff: increasing network size versus growing network value. The size rule lets you increase adoption more while the value rule lets you increase price more.

Although recently developed in terms of economic theory, two-sided networks help to explain many classic battles, for example, Beta vs. VHS

, Mac vs. Windows, CBS vs. RCA in color TV, American Express vs. Visa, and more recently Blu-Ray vs. HD DVD

.

In the case of color TV, CBS and RCA offered rival formats but initially neither gained market traction. Viewers had little reason to buy expensive color TVs in the absence of color programming. Likewise, broadcasters had little reason to develop color programming when households lacked color TVs. RCA won the battle in two ways. It flooded the market with low cost black-and-white TVs incompatible with the CBS format but compatible with its own. Broadcasters then needed to use the RCA format to reach established viewers. RCA also subsidized Walt Disney’s Wonderful World of Color, which gave consumers reason to buy the new technology.

Their significance in industry and antitrust law arises from the fact that the greater the multihoming costs, the greater is the tendency toward market concentration. Higher multihoming costs reduce user willingness to maintain affiliation with competing networks providing similar services.

Economies of scale

Economies of scale, in microeconomics, refers to the cost advantages that an enterprise obtains due to expansion. There are factors that cause a producer’s average cost per unit to fall as the scale of output is increased. "Economies of scale" is a long run concept and refers to reductions in unit...

. Consumers, for example, prefer credit cards honored by more merchants, while merchants prefer cards carried by more consumers. They are particularly useful for analyzing the chicken-and-egg problem of standards battles, such as the competition between VHS and Beta. They are also useful in explaining many free pricing or "freemium" strategies where one user group gets free use of the platform in order to attract the other user group.

Two-sided markets represent a refinement of the concept of network effects

Network effect

In economics and business, a network effect is the effect that one user of a good or service has on the value of that product to other people. When network effect is present, the value of a product or service is dependent on the number of others using it.The classic example is the telephone...

. They were conceived independently by Parker & Van Alstyne

Marshall Van Alstyne

Marshall Van Alstyne is a professor at Boston University and researcher at MIT and the MIT Center for Digital Business. His work focuses on the economics of information....

(2000, 2005) to explain behavior in software markets and Rochet & Tirole

Jean Tirole

Jean Marcel Tirole is a French professor of economics. He works on industrial organization, game theory, banking and finance, and economics and psychology. Tirole is director of the Jean-Jacques Laffont Foundation at the Toulouse School of Economics, and scientific director of the Industrial...

(2001) to explain behavior in credit card markets.

Structural characteristics

In some networks, users are homogeneous, that is, they all perform similar functions. For example, although participants in a telephone network originate and receive calls, these roles are transient. Almost all phone users play both roles at different times. Likewise, almost all instant messaging, FAX, and email users play both roles at different times.Networks with homogenous users are called one-sided to distinguish them from two-sided networks, which have two distinct user groups whose respective members consistently play the same role in transactions.

In a two-sided network, members of each group exhibit a preference regarding the number of users in the other group; these are called cross-side network effects. Each group’s members may also have preferences regarding the number of users in their own group; these are called same-side network effects. Cross-side network effects are usually positive, but can be negative (as with consumer reactions to advertising). Same-side network effects may be either positive (e.g., the benefit from swapping video games with more peers) or negative (e.g., the desire to exclude direct rivals from an online business-to-business marketplace). Figure 1 depicts these relationships.

Figure 1: Cross-Side and Same-Side Network Effects in a Two-Sided Network.

In two-sided networks, users on each side typically require very different functionality from their common platform. In credit card networks, for example, consumers require a unique account, a plastic card, access to phone-based customer service, a monthly bill, etc. Merchants require terminals for authorizing transactions, procedures for submitting charges and receiving payment, “signage” (decals that show the card is accepted), etc. Given these different requirements, platform providers may specialize in serving users on just one side of a two-sided network.

A key feature of two-sided markets is the novel pricing strategies and business models they employ. In order to attract one group of users, the network sponsor may subsidize the other group of users. Historically, for example, Adobe’s portable document format (PDF) did not succeed until Adobe priced the PDF reader at zero, substantially increasing sales of PDF writers. Relative to Apple computer’s initial pricing, Microsoft also steeply discounted systems developer toolkits (SDKs) leading to more rapid development of applications for MS Windows.

Pricing in Two-Sided Networks

Platform managers must choose the right price to charge each group in a two-sided network and ignoring network effects can lead to mistakes. In Figure 2 below, pricing without taking network effects into account means finding prices that maximize the areas of the two blue rectangles. Adobe initially used this approach when it launched PDF and charged for both reader and writer software.

Figure 2–Traditional pricing logic seeks the biggest revenue rectangle (price × quantity) under each demand curve.

In two-sided networks, such pricing logic can be misguided. If firms account for the fact that adoption on one side of the network drives adoption on the other side, they can do better. Demand curves are not fixed: with positive cross-side network effects, demand curves shift outward in response to growth in the user base on the network's other side.

When Adobe changed its pricing strategy and made its reader software freely available, its managers uncovered a key rule of two-sided network pricing. They subsidized the more price sensitive side, and charged the side whose demand increased more strongly in response to growth on the other side. As illustrated in Figure 3, giving consumers a free reader created demand for the document writer, the network's "money side."

Figure 3–So long as the revenue gained (red box) exceeds the revenue lost (light blue box), a discounting strategy is profitable. The subsidy largely changes network size.

Strategic issues

If building a bigger network is one reason to subsidize adoption, then stimulating value adding innovations is the other. Consider, for example, the value of an operating system with no applications. While Apple initially tried to charge both sides of the market, like Adobe did in Figure 2, Microsoft uncovered a second pricing rule: subsidize those who add platform value. In this context, consumers, not developers are the money side.

Figure 4–In this market, consumers care more about access to critical features. The main effect of a subsidy is to change network value.

Which market represents the money side and which market represents the subsidy side depends on this critical tradeoff: increasing network size versus growing network value. The size rule lets you increase adoption more while the value rule lets you increase price more.

Although recently developed in terms of economic theory, two-sided networks help to explain many classic battles, for example, Beta vs. VHS

Videotape format war

The videotape format war was a period of intense competition or "format war" of incompatible models of consumer-level analog video videocassette and video cassette recorders in the late 1970s and the 1980s.- Overview :...

, Mac vs. Windows, CBS vs. RCA in color TV, American Express vs. Visa, and more recently Blu-Ray vs. HD DVD

High definition optical disc format war

A format war took place between the Blu-ray Disc and HD DVD optical disc standards for storing high definition video and audio.These standards emerged between 2000 and 2002 and attracted both the mutual and exclusive support of major consumer electronics manufacturers, personal computer...

.

In the case of color TV, CBS and RCA offered rival formats but initially neither gained market traction. Viewers had little reason to buy expensive color TVs in the absence of color programming. Likewise, broadcasters had little reason to develop color programming when households lacked color TVs. RCA won the battle in two ways. It flooded the market with low cost black-and-white TVs incompatible with the CBS format but compatible with its own. Broadcasters then needed to use the RCA format to reach established viewers. RCA also subsidized Walt Disney’s Wonderful World of Color, which gave consumers reason to buy the new technology.

Multihoming

When two-sided markets contain more than one competing platform, the condition of users affiliating with more than one such platform is called multihoming. Instances arise, for example, when consumers carry credit cards from more than one banking network or they continue using computers based on two different operating systems. These ongoing costs of platform affiliation should be distinguished from switching costs, which refer to the one time costs of terminating one network and adopting another.Their significance in industry and antitrust law arises from the fact that the greater the multihoming costs, the greater is the tendency toward market concentration. Higher multihoming costs reduce user willingness to maintain affiliation with competing networks providing similar services.