Wells Fargo

Encyclopedia

Financial services

Financial services refer to services provided by the finance industry. The finance industry encompasses a broad range of organizations that deal with the management of money. Among these organizations are credit unions, banks, credit card companies, insurance companies, consumer finance companies,...

company with operations around the world. Wells Fargo is the fourth largest bank in the U.S. by assets and the largest bank by market capitalization

Market capitalization

Market capitalization is a measurement of the value of the ownership interest that shareholders hold in a business enterprise. It is equal to the share price times the number of shares outstanding of a publicly traded company...

. Wells Fargo is the second largest bank in deposits, home mortgage servicing, and debit card. In 2011, Wells Fargo was the 23rd largest company.

In 2007 it was the only bank in the United States to be rated AAA by S&P

Standard & Poor's

Standard & Poor's is a United States-based financial services company. It is a division of The McGraw-Hill Companies that publishes financial research and analysis on stocks and bonds. It is well known for its stock-market indices, the US-based S&P 500, the Australian S&P/ASX 200, the Canadian...

, though its rating has since been lowered to AA- in light of the financial crisis of 2007–2011. The firm's primary U.S. operating subsidiary is national bank

National bank

In banking, the term national bank carries several meanings:* especially in developing countries, a bank owned by the state* an ordinary private bank which operates nationally...

Wells Fargo Bank, N.A., which designates its main office as Sioux Falls, South Dakota

Sioux Falls, South Dakota

Sioux Falls is the largest city in the U.S. state of South Dakota. Sioux Falls is the county seat of Minnehaha County, and also extends into Lincoln County to the south...

.

Wells Fargo in its present form is a result of an acquisition of California-based Wells Fargo & Company by Minneapolis-based Norwest Corporation

Norwest

Norwest Corporation was a banking and financial services company based in Minneapolis, Minnesota, United States. In 1998, it merged with Wells Fargo & Co. and since that time has traded under the Wells Fargo name.-Early formation:...

in 1998 and the subsequent 2008 acquisition of Charlotte, NC-based Wachovia

Wachovia

Wachovia was a diversified financial services company based in Charlotte, North Carolina. Before its acquisition by Wells Fargo in 2008, Wachovia was the fourth-largest bank holding company in the United States based on total assets...

. Although Norwest was technically the surviving entity in the 1998 merger, the new company renamed itself Wells Fargo, capitalizing on the 150-year history of the nationally recognized name and its trademark stagecoach. Following the acquisition, the company transferred its headquarters to Wells Fargo's headquarters in San Francisco and merged its operating subsidiary with Wells Fargo's operating subsidiary in Sioux Falls.

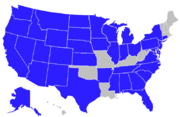

In 2010 Wells Fargo had 6,335 retail branches (called stores by Wells Fargo), 12,000 automated teller machines, 280,000 employees and over 70 million customers.

Wells Fargo is one of the Big Four banks of the United States with Bank of America

Bank of America

Bank of America Corporation, an American multinational banking and financial services corporation, is the second largest bank holding company in the United States by assets, and the fourth largest bank in the U.S. by market capitalization. The bank is headquartered in Charlotte, North Carolina...

, Citigroup

Citigroup

Citigroup Inc. or Citi is an American multinational financial services corporation headquartered in Manhattan, New York City, New York, United States. Citigroup was formed from one of the world's largest mergers in history by combining the banking giant Citicorp and financial conglomerate...

and JP Morgan Chase.

Lines of business

Wells Fargo offers a range of financial services in over 80 different business lines. Wells Fargo delineates three different business segments when reporting results: Community BankingRetail banking

Retail banking is banking in which banking institutions execute transactions directly with consumers, rather than corporations or other banks. Services offered include: savings and transactional accounts, mortgages, personal loans, debit cards, credit cards, and so forth.-Types of...

, Wholesale Banking

Wholesale banking

Wholesale banking is the provision of services by banks to the likes of large corporate clients, mid-sized companies, real estate developers and investors, international trade finance...

, and Wealth, Brokerage and Retirement.

Community banking

The Community Banking segment includes Regional Banking, Diversified Products and the Consumer Deposits groups, as well as Wells Fargo Customer Connection (formerly Wells Fargo Phone Bank, Wachovia Direct Access, the National Business Banking Center and Credit Card Customer Service).Wells Fargo also has around 2,000 stand alone mortgage branches throughout the country. It also does mortgage wholesale lending through independent mortgage broker

Mortgage broker

A mortgage broker acts as an intermediary whose brokers mortgage loans on behalf of individuals or businesses.Traditionally, banks and other lending institutions have sold their own products. However as markets for mortgages have become more competitive, the role of the mortgage broker has become...

s.

Wealth, brokerage, and retirement

Wells Fargo offers investment products through its subsidiaries, Wells Fargo Investments, LLC and Wells Fargo Advisors, as well as through national broker/dealer firms. Mutual funds are offered under the Wells Fargo Advantage Funds brand name. The company also serves high net worth individuals through its private bankPrivate banking

Private banking is banking, investment and other financial services provided by banks to private individuals investing sizable assets. The term "private" refers to the customer service being rendered on a more personal basis than in mass-market retail banking, usually via dedicated bank advisers...

and family wealth

Wealth management

Wealth management is an investment advisory discipline that incorporates financial planning, investment portfolio management and a number of aggregated financial services...

group.

Wells Fargo Advisors is the brokerage and wealth management

Wealth management

Wealth management is an investment advisory discipline that incorporates financial planning, investment portfolio management and a number of aggregated financial services...

subsidiary of Wells Fargo, located in St. Louis, Missouri

St. Louis, Missouri

St. Louis is an independent city on the eastern border of Missouri, United States. With a population of 319,294, it was the 58th-largest U.S. city at the 2010 U.S. Census. The Greater St...

. It is the third largest brokerage firm in the United States as of the third quarter of 2010 with $1.1 trillion retail client assets under management.

Wells Fargo Advisors was known as Wachovia Securities

Wachovia Securities

Wells Fargo Advisors, is a subsidiary of Wells Fargo, located in St. Louis, Missouri. It is the second largest brokerage firm in the United States as of October 1, 2007 with $1.17 trillion retail client assets under management....

until May 1, 2009, when it legally changed names following the Wells Fargo's acquisition of Wachovia Corporation.

Internet services

Wells Fargo launched its personal computer banking service in 1989 and was the first bank to introduce access to bankingOnline banking

Online banking allows customers to conduct financial transactions on a secure website operated by their retail or virtual bank, credit union or building society.-Features:...

accounts on the web

World Wide Web

The World Wide Web is a system of interlinked hypertext documents accessed via the Internet...

in May 1995.

Wells Fargo's Business Online Banking gives small business owners all the services available to consumers, plus services designed specifically for businesses.

The new Wells Fargo vSafe service offers online storage of documents.

Wholesale

The Wholesale Banking segment contains products sold to large and middle market commercial companies, as well as to consumers on a wholesale basis. This includes lending, treasury managementTreasury management

Treasury management includes management of an enterprise's holdings, with the ultimate goal of maximizing the firm's liquidity and mitigating its operational, financial and reputational risk. Treasury Management includes a firm's collections, disbursements, concentration, investment and funding...

, mutual fund

Mutual fund

A mutual fund is a professionally managed type of collective investment scheme that pools money from many investors to buy stocks, bonds, short-term money market instruments, and/or other securities.- Overview :...

s, asset-based lending, commercial real estate, corporate and institutional trust services, and capital markets and investment banking

Investment banking

An investment bank is a financial institution that assists individuals, corporations and governments in raising capital by underwriting and/or acting as the client's agent in the issuance of securities...

services through Wells Fargo Securities. Wells Fargo historically has avoided large corporate loans as stand-alone products, instead requiring that borrowers purchase other products along with loans—which the bank sees as a loss leader

Loss leader

A loss leader or leader is a product sold at a low price to stimulate other profitable sales. It is a kind of sales promotion, in other words marketing concentrating on a pricing strategy. A loss leader is often a popular article...

. One area that is very profitable to Wells, however, is asset-based lending

Asset-based lending

In the simplest meaning, asset-based lending is any kind of lending secured by an asset. This means, if the loan is not repaid, the asset is taken. In this sense, a mortgage is an example of an asset-backed loan. More commonly however, the phrase is used to describe lending to business and large...

: lending to large companies using assets as collateral that are not normally used in other loans. This can be compared to subprime lending, but on a corporate level. The main business unit associated with this activity is Wells Fargo Capital Finance. Wells Fargo also owns Eastdil Secured, which is described as a "real estate investment bank" but is essentially one of the largest commercial real estate brokers for very large transactions (such as the purchase and sale of large Class-A office buildings in central business districts throughout the United States).

Wells Fargo Securities

Wells Fargo Securities ("WFS") is the full service investment bankingInvestment banking

An investment bank is a financial institution that assists individuals, corporations and governments in raising capital by underwriting and/or acting as the client's agent in the issuance of securities...

arm of Wells Fargo & Co. It is the 10th largest in the world (as measured by fee revenue) and exists today as an amalgamation of several legacy enterprises, most notably Wachovia Securities

Wachovia Securities

Wells Fargo Advisors, is a subsidiary of Wells Fargo, located in St. Louis, Missouri. It is the second largest brokerage firm in the United States as of October 1, 2007 with $1.17 trillion retail client assets under management....

. The size and financial performance of the group is not disclosed publicly, but analysts believe the investment banking group houses approximately 2,000 employees and generates between $3 and $4 billion per year in investment banking revenue. By comparison, two of Wells Fargo’s largest competitors, Bank of America

Bank of America

Bank of America Corporation, an American multinational banking and financial services corporation, is the second largest bank holding company in the United States by assets, and the fourth largest bank in the U.S. by market capitalization. The bank is headquartered in Charlotte, North Carolina...

and J.P. Morgan generate approximately $5.5 billion and $6 billion respectively (not including sales and trading

Sales and trading

Sales and trading is one of the key functions of an investment bank. The term refers to the various activities relating to the buying and selling of securities or other financial instruments...

revenue). WFS has U.S. offices in New York, Charlotte, San Francisco and Los Angeles, and internationally in London and Hong Kong.

History

Wells Fargo Securities was established in 2009 to house Wells Fargo’s new capital markets group which it obtained during the Wachovia acquisition. Prior to that point, Wells Fargo had little to no participation in investment banking activities, though Wachovia had a well established investment banking practice which it operated under the Wachovia SecuritiesWachovia Securities

Wells Fargo Advisors, is a subsidiary of Wells Fargo, located in St. Louis, Missouri. It is the second largest brokerage firm in the United States as of October 1, 2007 with $1.17 trillion retail client assets under management....

banner.

Wachovia's institutional capital markets and investment banking business arose from the merger of Wachovia and First Union. First Union had bought Bowles Hollowell Connor & Co.

Bowles Hollowell Connor & Co.

Bowles Hollowell Connor & Co. was a leading middle market investment banking firm headquartered in Charlotte, North Carolina. The firm was founded in 1975 by Erskine Bowles and Thomas Hollowell.In April 1998, Bowles Hollowell was acquired by First Union...

on April 30, 1998 adding to its merger and acquisition, high yield, leveraged finance, equity underwriting, private placement

Private placement

Private placement is a funding round of securities which are sold without an initial public offering, usually to a small number of chosen private investors...

, loan syndication, risk management

Risk management

Risk management is the identification, assessment, and prioritization of risks followed by coordinated and economical application of resources to minimize, monitor, and control the probability and/or impact of unfortunate events or to maximize the realization of opportunities...

, and public finance

Public finance

Public finance is the revenue and expenditure of public authoritiesThe purview of public finance is considered to be threefold: governmental effects on efficient allocation of resources, distribution of income, and macroeconomic stabilization.-Overview:The proper role of government provides a...

capabilities.

Legacy components of Wells Fargo Securities include Wachovia Securities

Wachovia Securities

Wells Fargo Advisors, is a subsidiary of Wells Fargo, located in St. Louis, Missouri. It is the second largest brokerage firm in the United States as of October 1, 2007 with $1.17 trillion retail client assets under management....

, Bowles Hollowell Connor & Co.

Bowles Hollowell Connor & Co.

Bowles Hollowell Connor & Co. was a leading middle market investment banking firm headquartered in Charlotte, North Carolina. The firm was founded in 1975 by Erskine Bowles and Thomas Hollowell.In April 1998, Bowles Hollowell was acquired by First Union...

, Barrington Associates, Halsey, Stuart & Co.

Halsey, Stuart & Co.

Halsey, Stuart was a Chicago-based investment bank founded in 1911.In 1952, the firm made headlines when its managing partner, Harold L. Stuart, testified before the U.S. Supreme Court for the government's antitrust case against Morgan Stanley and 16 other major investment banks...

, Leopold Cahn & Co., Bache & Co.

Bache & Co.

Bache & Company was a securities deim that provided stock brokerage and investment banking services. The firm, which was founded in 1879, was based in New York, New York....

and Prudential Securities

Prudential Securities

Prudential Securities was the financial services arm of the insurer, Prudential Financial. In 2003, Prudential Securities was merged into Wachovia Securities, a division of Wachovia Bank.-History:...

. WFS most recently acquired the investment banking arm of Citadel LLC.

Growth plans

In a speech delivered to the Stanford Graduate School of BusinessStanford Graduate School of Business

The Stanford Graduate School of Business is one of the professional schools of Stanford University, in Stanford, California and is broadly regarded as one of the best business schools in the world.The Stanford GSB offers a general management Master of Business Administration degree, the Sloan...

in 2009, then-Wells Fargo CEO Dick Kovacevich stated that he believed Wells Fargo Securities would be among the top five investment banks in the 'next few years.' Regarding Wells Fargo’s traditional aversion to complex institutional capital markets business lines, current CEO John Stumpf said that investment banking had “changed a lot,” that Wells now had fewer competitors and was a bigger company with more clients who need capital market access. According to Jonathan Weiss and Robert Engel, co-heads of investment banking and capital markets, the group intends to grow by 10% to 20% per year for the foreseeable future. Wells Fargo disclosed that investment banking revenue from underwriting and M&A advisory increased 44% in 2010 over the prior year.

Business model

Wells Fargo's stated goal is to encourage customers to buy all financial products through Wells Fargo: "We want to earn 100 percent of our customers' business. The more products customers have with Wells Fargo the better deal they get, the more loyal they are, and the longer they stay with the company, improving retention. Eighty percent of our revenue growth comes from selling more products to existing customers. Our goal: sell at least eight products to every customer."

This is a concept known as "cross-selling

Cross-selling

Cross-selling is the action or practice of selling among or between established clients, markets, traders, etc. or the action or practice of selling an additional product or service to an existing customer. This article deals exclusively with the latter meaning. In practice, businesses define...

", or as Wells Fargo refers to it, "needs-based selling," which is popular in the financial services

Financial services

Financial services refer to services provided by the finance industry. The finance industry encompasses a broad range of organizations that deal with the management of money. Among these organizations are credit unions, banks, credit card companies, insurance companies, consumer finance companies,...

industry. Certain companies, such as Prudential

Prudential Financial

The Prudential Insurance Company of America , also known as Prudential Financial, Inc., is a Fortune Global 500 and Fortune 500 company whose subsidiaries provide insurance, investment management, and other financial products and services to both retail and institutional customers throughout the...

, pioneered the concept of selling a variety of products, the companies acting merely as holding companies

Holding company

A holding company is a company or firm that owns other companies' outstanding stock. It usually refers to a company which does not produce goods or services itself; rather, its purpose is to own shares of other companies. Holding companies allow the reduction of risk for the owners and can allow...

, with each product sold through its own distribution channel

Distribution (business)

Product distribution is one of the four elements of the marketing mix. An organization or set of organizations involved in the process of making a product or service available for use or consumption by a consumer or business user.The other three parts of the marketing mix are product, pricing,...

. However, predecessor Norwest pioneered selling all its products through all its channels, with discounts given to those who purchase a larger variety.

The average "cross-sell ratio" for a financial institution

Financial institution

In financial economics, a financial institution is an institution that provides financial services for its clients or members. Probably the most important financial service provided by financial institutions is acting as financial intermediaries...

is two (based on an average American consumer owning sixteen different financial products from eight different institutions). Wells Fargo stated they had a cross-sell ratio of 5.5 (2007 data) products per Community Banking household (almost one in five have more than eight), 6.1 (2007 data) for Wholesale Banking customers, and the average middle-market commercial banking customer has more than seven products, which is among the highest in the country.

Global presence

Wells Fargo provides comprehensive personal banking services throughout the world. With Main Office in Hong Kong & London Also, as announced on June 9, 2011, Wells Fargo Securities has planned an aggressive expansion of its investment banking practice internationally, adding positions to its existing offices in Asia, Europe, and Latin America.Wells Fargo has a presence in India as well. Wells Fargo India Solutions (WFIS) is a wholly owned subsidiary of Wells Fargo. WFIS is an extended arm of the organization created to support the needs for expansion in technology and business processes. Set up in September 2006 in Hyderabad, India, it is already operating out of two facilities in the city and has people strength of over 1500. Its two Offices are located at Raheja MindSpace, Hitech City, and Divyashree, Raidurg respectively.

Early in 2011, WFIS started its Bangalore office, as an extension of Wells Fargo's presence in India.

History

The current Wells Fargo is a result of a 1998 merger between Minneapolis-based Norwest CorporationNorwest

Norwest Corporation was a banking and financial services company based in Minneapolis, Minnesota, United States. In 1998, it merged with Wells Fargo & Co. and since that time has traded under the Wells Fargo name.-Early formation:...

and the original Wells Fargo

History of Wells Fargo

This article outlines the history of Wells Fargo & Company from its origins to its merger with Norwest and beyond. The new company chose to retain the name of "Wells Fargo" and so this article also includes the history after the merger.-Origins:...

. Although Norwest was the nominal survivor, the new company kept the Wells Fargo name to capitalize on the long history of the nationally recognized Wells Fargo name and its trademark stagecoach

Stagecoach

A stagecoach is a type of covered wagon for passengers and goods, strongly sprung and drawn by four horses, usually four-in-hand. Widely used before the introduction of railway transport, it made regular trips between stages or stations, which were places of rest provided for stagecoach travelers...

(the company's previous slogan, "The Next Stage," is a nod to the company's wagons-west motif). After the acquisition, the parent company moved its headquarters to San Francisco. The company's new Slogan, "Together we'll go Far" also references the stagecoach motif, its customers and the company name.

In-store branches

There are many mini-branches located inside of other buildings, which are almost exclusively grocery stores, that usually contain ATMs, basic teller services, and, space permitting, an office for private meetings with customers.Wachovia acquisition

On October 3, 2008, WachoviaWachovia

Wachovia was a diversified financial services company based in Charlotte, North Carolina. Before its acquisition by Wells Fargo in 2008, Wachovia was the fourth-largest bank holding company in the United States based on total assets...

agreed to be bought by Wells Fargo for about $14.8B in an all-stock transaction. This news came four days after the Federal Deposit Insurance Corporation

Federal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation is a United States government corporation created by the Glass–Steagall Act of 1933. It provides deposit insurance, which guarantees the safety of deposits in member banks, currently up to $250,000 per depositor per bank. , the FDIC insures deposits at...

(FDIC) made moves to have Citigroup

Citigroup

Citigroup Inc. or Citi is an American multinational financial services corporation headquartered in Manhattan, New York City, New York, United States. Citigroup was formed from one of the world's largest mergers in history by combining the banking giant Citicorp and financial conglomerate...

buy Wachovia for $2.1B. Citigroup protested Wachovia's agreement to sell itself to Wells Fargo and threatened legal action over the matter. However the deal with Wells Fargo overwhelmingly won shareholder approval since it valued Wachovia at about 7 times what Citigroup offered. To further ensure shareholder approval, Wachovia issued Wells Fargo with preferred stock holding 39.9% of the voting power in the company.

On October 4, 2008, a New York state judge issued a temporary injunction blocking the transaction from going forward while the situation was sorted out. Citigroup alleged that they had an exclusivity agreement with Wachovia that barred Wachovia from negotiating with other potential buyers. The injunction was overturned late in the evening on October 5, 2008, by New York state appeals court. Citigroup and Wells Fargo then entered into negotiations brokered by the FDIC to reach an amicable solution to the impasse. Those negotiations failed. Sources say that Citigroup was unwilling to take on more risk than the $42 billion that would have been the cap under the previous FDIC-backed deal (with the FDIC incurring all losses over $42 billion). Citigroup did not block the merger, but indicated they would seek damages of $60 billion for breach of an alleged exclusivity agreement with Wachovia.

Predecessors

Wells Fargo operates under Charter #1, the first national bank charter issued in the United States. This charter was issued to First National Bank of Philadelphia on June 20, 1863 by the Office of the Comptroller of the CurrencyOffice of the Comptroller of the Currency

The Office of the Comptroller of the Currency is a US federal agency established by the National Currency Act of 1863 and serves to charter, regulate, and supervise all national banks and the federal branches and agencies of foreign banks in the United States...

. Traditionally, acquiring banks assume the earliest issued charter number. Thus, the first charter passed from First National Bank of Philadelphia to Wells Fargo through its 2008 acquisition of Wachovia, which in turn had inherited it through one of its many acquisitions.

Selected predecessor companies

- Crocker National BankCrocker National BankCrocker National Bank was a United States bank headquartered in San Francisco, California. It was acquired by and merged into Wells Fargo Bank in 1986.-History:The bank traces its history to the Woolworth National Bank in San Francisco...

- First Interstate BancorpFirst Interstate BancorpFirst Interstate Bancorp was a bank holding company based in the United States that was taken over in 1996 by Wells Fargo. Headquartered in Los Angeles, it was the nation's eighth largest banking company....

- First National Bank of PhiladelphiaBank of North AmericaThe Bank of North America was a private business chartered on December 31, 1781 by the Congress of the Confederation and opened on January 7, 1782, at the prodding of Superintendent of Finance Robert Morris. This was thus the nation's first de facto central bank. It was succeeded in its role as...

- First Security CorporationFirst Security CorporationFirst Security Corporation was a multistate bank holding company in the western United States, primarily in Utah, Idaho, New Mexico, Oregon, Nevada, and Wyoming...

- Norwest CorporationNorwestNorwest Corporation was a banking and financial services company based in Minneapolis, Minnesota, United States. In 1998, it merged with Wells Fargo & Co. and since that time has traded under the Wells Fargo name.-Early formation:...

- Wachovia CorporationWachoviaWachovia was a diversified financial services company based in Charlotte, North Carolina. Before its acquisition by Wells Fargo in 2008, Wachovia was the fourth-largest bank holding company in the United States based on total assets...

2008 financial crisis

On October 28, 2008, Wells Fargo and Company was the recipient of $25B of the Emergency Economic Stabilization Act Federal bail-out in the form of a preferred stock purchase. Tests by the Federal government revealed that Wells Fargo needs an additional 13.7 billion dollars in order to remain well capitalized if the economy were to deteriorate further under stress test scenarios. On May 11, 2009 Wells Fargo announced an additional stock offering which was completed on May 13, 2009 raising $8.6 billion in capital. The remaining $4.9 billion in capital is planned to be raised through earnings. On Dec. 23, 2009, Wells Fargo redeemed the $25 billion of series D preferred stock issued to the U.S. Treasury under the Troubled Asset Relief Program’s Capital Purchase Program. As part of the redemption of the preferred stock, Wells Fargo also paid accrued dividends of $131.9 million, bringing the total dividends paid to the U.S. Treasury and U.S. taxpayers to $1.441 billion since the preferred stock was issued in October 2008.Key dates

- 1852: Henry WellsHenry WellsHenry Wells was an American businessman important in the history of both the American Express Company and Wells Fargo & Company.-Early life:...

and William G. FargoWilliam FargoWilliam George Fargo , pioneer American expressman, was born in Pompey, New York. From the age of thirteen he had to support himself, obtaining little schooling, and for several years he was a clerk in grocery stores in Syracuse....

(Mayor of Buffalo, NY from 1862–63 and again from 1864–65), the two founders of American ExpressAmerican ExpressAmerican Express Company or AmEx, is an American multinational financial services corporation headquartered in Three World Financial Center, Manhattan, New York City, New York, United States. Founded in 1850, it is one of the 30 components of the Dow Jones Industrial Average. The company is best...

, form Wells Fargo & Company to provide express and banking services to California. - 1860: Wells Fargo gains control of Butterfield Overland MailButterfield Overland MailThe Butterfield Overland Mail Trail was a stagecoach route in the United States, operating from 1857 to 1861. It was a conduit for the U.S. mail from two eastern termini, Memphis, Tennessee and St. Louis, Missouri, meeting Fort Smith, Arkansas, and continuing through Indian Territory, New Mexico,...

Company, leading to operation of the western portion of the Pony ExpressPony ExpressThe Pony Express was a fast mail service crossing the Great Plains, the Rocky Mountains, and the High Sierra from St. Joseph, Missouri, to Sacramento, California, from April 3, 1860 to October 1861...

. - 1866: 'Grand consolidation' unites Wells Fargo, Holladay, and Overland Mail stage lines under the Wells Fargo name.

- 1904: A.P. GianniniAmadeo GianniniAmadeo Pietro Giannini, also known as Amadeo Peter Giannini or A.P. Giannini , born in San Jose, California, was the American founder of Bank of America.-Biography:...

creates the Bank of Italy in San Francisco. - 1905: Wells Fargo separates its banking and express operations; Wells Fargo's bank is merged with the Nevada National Bank to form the Wells Fargo Nevada National Bank.

- 1918: As a wartime measure, the U.S. government nationalizes Wells Fargo's express franchise into a federal agencyFederal agencyFederal agency may refer to:*United States federal agencies—see List of United States federal agencies*Federal agency -See also:*Government agency*Statutory corporation*Statutory Agency*Crown corporation*Government-owned corporation...

known as the U.S. Railway Express AgencyRailway Express AgencyThe Railway Express Agency was a the national monopoly set up by the Untied States federal government in 1917. Rail express services provided small package and parcel transportation using the extant railroad infrastructure much as UPS functions today using the road system...

(REA). The government takes control of the express company. The bank begins rebuilding but with a focus on commercial markets. After the war, REA is privatized and continues service - 1923: Wells Fargo Nevada merges with the Union Trust Company to form the Wells Fargo Bank & Union Trust Company.

- 1928: Giannini forms Transamerica CorporationTransamerica CorporationTransamerica Corporation is a holding company for various life insurance companies and investment firms doing business primarily in the United States. It was acquired by the Dutch financial services conglomerate AEGON in 1999.-History:...

as a holding company for his banking and other interests. - 1929: Northwest Bancorporation, or Banco, is formed as a banking association.

- 1954: Wells shortens its name to Wells Fargo Bank.

- 1957: Transamerica spins off its banking operations, including 23 banks in 11 western states, as Firstamerica Corporation.

- 1960: Wells Fargo merges with American Trust Company to form the Wells Fargo Bank American Trust Company.

- 1961: First America changes its name to Western Bancorporation.

- 1962: Wells again shortens its name to Wells Fargo Bank.

- 1968: Wells converts to a federal banking charter, becoming Wells Fargo Bank, N.A.

- 1969: Wells Fargo & Company holding company is formed, with Wells Fargo Bank as its main subsidiary.

- 1981: Western Bancorporation changes its name to First Interstate Bancorp.

- 1982: Banco acquires consumer finance firm Dial Finance which is renamed Norwest Financial Service the following year.

- 1983: Banco is renamed Norwest Corporation.

- 1983: Largest U.S. bank heist to date takes place at a Wells Fargo depot in West Hartford, ConnecticutWest Hartford, ConnecticutWest Hartford is a town located in Hartford County, Connecticut, United States. The town was incorporated in 1854. Prior to that date, the town was a parish of Hartford....

. - 1986: Wells Fargo acquires Crocker National CorporationCrocker National BankCrocker National Bank was a United States bank headquartered in San Francisco, California. It was acquired by and merged into Wells Fargo Bank in 1986.-History:The bank traces its history to the Woolworth National Bank in San Francisco...

from Midland BankMidland BankMidland Bank Plc was one of the Big Four banking groups in the United Kingdom for most of the 20th century. It is now part of HSBC. The bank was founded as the Birmingham and Midland Bank in Union Street, Birmingham, England in August 1836...

. - 1987: Wells Fargo acquires the personal trust business of Bank of AmericaBank of AmericaBank of America Corporation, an American multinational banking and financial services corporation, is the second largest bank holding company in the United States by assets, and the fourth largest bank in the U.S. by market capitalization. The bank is headquartered in Charlotte, North Carolina...

. - 1988: Wells Fargo acquires Barclays Bank of California from Barclays plcBarclays plcBarclays PLC is a global banking and financial services company headquartered in London, United Kingdom. As of 2010 it was the world's 10th-largest banking and financial services group and 21st-largest company according to a composite measure by Forbes magazine...

. - 1995: Wells Fargo becomes the first major financial services firm to offer Internet banking.

- 1996: Wells Fargo acquires First Interstate for $17.3 billion.

- 1998: Wells Fargo Bank merges with Norwest Corp. of Minneapolis.

- 1999: Wells Fargo Bank acquires National Bank of Alaska

- 2000: Wells Fargo acquires First Security CorporationFirst Security CorporationFirst Security Corporation was a multistate bank holding company in the western United States, primarily in Utah, Idaho, New Mexico, Oregon, Nevada, and Wyoming...

. - 2001: Wells Fargo acquires H.D. Vest Financial Services.

- 2007: Wells Fargo acquires CIT Construction.

- 2007: Wells Fargo acquires Placer Sierra Bank.

- 2007: Wells Fargo acquires Greater Bay Bancorp.

- 2008: Wells Fargo acquires United Bancorporation of Wyoming

- 2008: Wells Fargo acquires Century BankCentury BankCentury Bank was a bank headquartered in Texarkana, Texas that offered banking, mortgage, lending and trust services. Its holding company, Century Bancshares Inc., was based in Dallas, Texas...

. - 2008: Wells Fargo acquires WachoviaWachoviaWachovia was a diversified financial services company based in Charlotte, North Carolina. Before its acquisition by Wells Fargo in 2008, Wachovia was the fourth-largest bank holding company in the United States based on total assets...

Corporation. - 2009: Wells Fargo acquires North Coast Surety Insurance Services

Historical data

Wells Fargo Bank was the fifth largest bank at the end of 2008 as an individual bank. (Not including subsidiaries)Environmental record

Wells Fargo ranked No.1 among banks and insurance companies – and No.13 overall – in Newsweek magazine’s inaugural “Green Rankings” of the country’s 500-largest companies.So far, Wells Fargo has provided more than $6 billion in financing for environmentally beneficial business opportunities, including supporting 185 commercial-scale solar photovoltaic projects and 27 utility-scale wind projects nationwide.

As a member of the U.S. Environmental Protection Agency's Climate Leaders program, Wells Fargo aims to reduce its absolute greenhouse gas emissions from its U.S. operations by 20% below 2008 levels by 2018.

Wells Fargo has launched what it believes to be the first blog among its industry peers to report on its environmental stewardship and to solicit feedback and ideas from its stakeholders.

Recent controversies

Lisa Madigan

Lisa Madigan has been the 41st Attorney General of the US state of Illinois since 2003, when she became the first female attorney general for Illinois...

filed suit against Wells Fargo on July 31, 2009, alleging that the bank steers African Americans and Latinos into high-cost subprime loans. A Wells Fargo spokesman responded that "The policies, systems, and controls we have in place – including in Illinois – ensure race is not a factor..."

In August 2010, Wells Fargo was fined by U.S. District Judge William Alsup for overdraft practices designed to "gouge" consumers and "profiteer" at their expense, and for misleading consumers about how the bank processed transactions and assessed overdraft fees.

On February 4, 2009, Wells Fargo announced it was canceling a four-day business meeting and employee recognition event in Las Vegas. There had been negative allegations from the media, members of Congress and other public officials that the trip was a "pricey Las Vegas casino junket" and that the company was misusing taxpayers' money, since Wells Fargo had been one of the banks that received "bailout" funds from the government a few months earlier.

Wells Fargo corporate buildings

- Wells Fargo Building in Milwaukee, WI

- Wells Fargo CenterWells Fargo Center (Los Angeles)Wells Fargo Center is a twin tower skyscraper complex in downtown Los Angeles, California, comprising Wells Fargo Tower and KPMG Tower joined by a three-story glass atrium...

in Los Angeles - Wells Fargo CenterWells Fargo Center (Seattle)Wells Fargo Center is a skyscraper in Seattle, Washington. Formerly named First Interstate Center when completed in 1983, the 47 storey, tower is now the ninth tallest building in the city, and has 24 elevators. of rentable space...

in Seattle, WA - Wells Fargo Center in Boise, ID

- Wells Fargo Center in Spokane, WA

- Wells Fargo Center in Albuquerque, NM

- Wells Fargo CenterWells Fargo Center (Minneapolis)The Wells Fargo Center, formerly known as Norwest Center, is the third-tallest building in Minneapolis, Minnesota, after the IDS Center and the Capella Tower. Completed in 1988, it is 774 feet tall. For many years, this was believed to be one foot shorter than Capella, but that structure...

in Minneapolis, MN - Wells Fargo CenterWells Fargo Center (Denver)Wells Fargo Center is a building located in Denver, Colorado, United States. It resembles a cash register or mailbox and is known locally as the "Cash Register Building" or the "Mailbox Building." It is high, the third tallest building in Denver. It is shorter than the Republic Plaza building and...

in Denver, CO - Wells Fargo CenterAmerican Commercial and Savings BankAmerican Commercial and Savings Bank is located at 201-209 Main Street, Davenport, Iowa, United States. It is listed on the National Register of Historic Places. The building is known locally as the Wells Fargo Bank building.-History:...

in Davenport, IA - Wells Fargo Center in West Des Moines, IA

- Wells Fargo Center in Austin, TX

- Wells Fargo Center in Norfolk, VA

- Wells Fargo Center in Las Vegas, NV

- Wells Fargo Center in Portland, OR

- Wells Fargo CenterWells Fargo Center (Salt Lake City)The Wells Fargo Center is a skyscraper located in Salt Lake City, Utah, United States. It was built in 1998 and is the tallest skyscraper in Utah, standing 24 stories above street level and at roof level, at its highest point excluding the antenna.-History:...

in Salt Lake City, UT - Wells Fargo CenterWells Fargo Center (Sacramento)Wells Fargo Center is a office building in downtown Sacramento California. Construction on the skyscraper began in 1990 with completion in 1992, and yet stands as the tallest building in the city. The building occupies a city block, and features a five-story granite and marble walled interior...

in Sacramento, CA - Wells Fargo Headquarters in San Francisco

- Wells Fargo Advisors Headquarters in St. Louis, MO

- Wells Fargo PlaceWells Fargo PlaceWells Fargo Place is an office tower in St. Paul, Minnesota. It stands at 471 ft. tall, and is currently the tallest building in St. Paul. It was built by Winsor/Faricy Architects, Inc., and is 37 stories tall. It is a concrete structure, with a facade of brown-colored granite and glass. It...

in Saint Paul, MN - Wells Fargo PlazaWells Fargo Plaza (El Paso)The Wells Fargo Plaza is a high-rise skyscraper located on 221 North Kansas Street in Downtown El Paso, Texas, United States. It opened as the First National Bank Plaza on October 25, 1971, and was later renamed the State National Plaza. It is 296 feet tall...

in El Paso, TX - Wells Fargo Plaza in Tacoma, WA

- Wells Fargo Plaza in Houston, TX

- Wells Fargo PlazaWells Fargo Plaza (Phoenix)The Wells Fargo Plaza is a high-rise skyscraper located on 100 West Washington Street in Downtown Phoenix, Arizona, United States. It opened as the First National Bank Plaza on October 25, 1971. It is 372 feet tall. It is designed in the Brutalist style, an architectural style spawned from the...

in Phoenix, AZ - Wells Fargo TowerWells Fargo Tower (Colorado Springs)Wells Fargo Tower, part of the Palmer Center complex, is the tallest building in Colorado Springs, Colorado, United States. Before June 2000, the building was known as the Norwest Bank Tower.-References:**...

in Colorado Springs, CO - Wells Fargo Tower in Birmingham, AL

- One Wells Fargo Center in Charlotte, North CarolinaCharlotte, North CarolinaCharlotte is the largest city in the U.S. state of North Carolina and the seat of Mecklenburg County. In 2010, Charlotte's population according to the US Census Bureau was 731,424, making it the 17th largest city in the United States based on population. The Charlotte metropolitan area had a 2009...

- Duke Energy Center (Formerly; Wachovia Corporate Center) in Charlotte – Wells Fargo owns and occupies space in the building

See also

- StagecoachStagecoachA stagecoach is a type of covered wagon for passengers and goods, strongly sprung and drawn by four horses, usually four-in-hand. Widely used before the introduction of railway transport, it made regular trips between stages or stations, which were places of rest provided for stagecoach travelers...

- Butterfield Stage

- Pony ExpressPony ExpressThe Pony Express was a fast mail service crossing the Great Plains, the Rocky Mountains, and the High Sierra from St. Joseph, Missouri, to Sacramento, California, from April 3, 1860 to October 1861...

- Wells Fargo CenterWells Fargo CenterWells Fargo Center may refer to:*Wells Fargo Center , Colorado*Wells Fargo Center , Florida*Wells Fargo Center , Nevada*Wells Fargo Center , California*Wells Fargo Center , Florida...

- Wells Fargo ArenaWells Fargo ArenaWells Fargo Arena is the name of at least two indoor arenas in the United States:*Wells Fargo Arena , an arena on the grounds of the Iowa Events Center...

- History of Wells FargoHistory of Wells FargoThis article outlines the history of Wells Fargo & Company from its origins to its merger with Norwest and beyond. The new company chose to retain the name of "Wells Fargo" and so this article also includes the history after the merger.-Origins:...

- List of Wells Fargo Directors

- List of Wells Fargo Presidents