Trade-off theory of capital structure

Encyclopedia

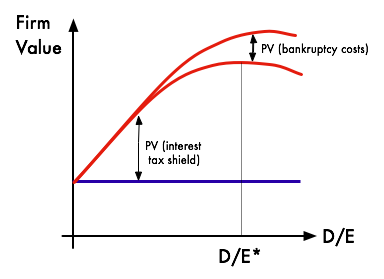

An important purpose of the theory is to explain the fact that corporations usually are financed partly with debt

Debt

A debt is an obligation owed by one party to a second party, the creditor; usually this refers to assets granted by the creditor to the debtor, but the term can also be used metaphorically to cover moral obligations and other interactions not based on economic value.A debt is created when a...

and partly with equity

Ownership equity

In accounting and finance, equity is the residual claim or interest of the most junior class of investors in assets, after all liabilities are paid. If liability exceeds assets, negative equity exists...

. It states that there is an advantage to financing with debt, the tax benefits of debt

Tax benefits of debt

In the context of corporate finance, the tax benefits of debt or tax advantage of debt refers to the fact that from a tax perspective it is cheaper for firms and investors to finance with debt than with equity. Under a majority of taxation systems around the world, and until recently under the U.S...

and there is a cost of financing with debt, the costs of financial distress including bankruptcy costs of debt

Bankruptcy Costs of debt

Within the theory of corporate finance, bankruptcy costs of debt are the increased costs of financing with debt instead of equity that result from a higher probability of bankruptcy. The fact that bankruptcy is generally a costly process in itself and not only a transfer of ownership implies that...

and non-bankruptcy costs (e.g. staff leaving, suppliers demanding disadvantageous payment terms, bondholder/stockholder infighting, etc). The marginal benefit of further increases in debt declines as debt increases, while the marginal cost

Marginal cost

In economics and finance, marginal cost is the change in total cost that arises when the quantity produced changes by one unit. That is, it is the cost of producing one more unit of a good...

increases, so that a firm that is optimizing

Optimization (mathematics)

In mathematics, computational science, or management science, mathematical optimization refers to the selection of a best element from some set of available alternatives....

its overall value will focus on this trade-off when choosing how much debt and equity to use for financing.

Evidence

The empirical relevance of the Trade-Off Theory has often been questioned. Miller for example compared this balancing as akin to the balance between horse and rabbit content in a stew of one horse and one rabbit. Taxes are large and they are sure, while bankruptcy is rare and, according to Miller, it has low dead-weight costs. Accordingly he suggested that if the Trade-Off Theory were true, then firms ought to have much higher debt levels than we observe in reality. Myers was a particularly fierce critic in his Presidential address to the American Finance Association meetings in which he proposed what he called "The Pecking Order Theory".Fama and French criticized both the Trade-Off Theory and the Pecking Order Theory in different ways. Welch has argued that firms do not undo the impact of stock price shocks as they should under the basic Trade-Off Theory and so the mechanical change in asset prices that makes up for most of the variation in capital structure

Capital structure

In finance, capital structure refers to the way a corporation finances its assets through some combination of equity, debt, or hybrid securities. A firm's capital structure is then the composition or 'structure' of its liabilities. For example, a firm that sells $20 billion in equity and $80...

.

Despite such criticisms, the Trade-Off Theory remains the dominant theory of corporate capital structure as taught in the main corporate finance textbooks. Dynamic version of the model generally seem to offer enough flexibility in matching the data so, contrary to Miller's verbal argument, dynamic trade-off models are very hard to reject empirically.

See also

- Capital structureCapital structureIn finance, capital structure refers to the way a corporation finances its assets through some combination of equity, debt, or hybrid securities. A firm's capital structure is then the composition or 'structure' of its liabilities. For example, a firm that sells $20 billion in equity and $80...

- Capital structure substitution theoryCapital structure substitution theoryIn finance, the capital structure substitution theory describes the relationship between earnings, stock price and capital structure of public companies. The CSS theory hypothesizes that managements of public companies manipulate capital structure such that earnings per share are maximized...

- Cost of capitalCost of capitalThe cost of capital is a term used in the field of financial investment to refer to the cost of a company's funds , or, from an investor's point of view "the shareholder's required return on a portfolio of all the company's existing securities"...

- Corporate financeCorporate financeCorporate finance is the area of finance dealing with monetary decisions that business enterprises make and the tools and analysis used to make these decisions. The primary goal of corporate finance is to maximize shareholder value while managing the firm's financial risks...

- Market timing hypothesisMarket timing hypothesisThe market timing hypothesis is a theory of how firms and corporations in the economy decide whether to finance their investment with equity or with debt instruments. It is one of many such corporate finance theories, and is often contrasted with the pecking order theory and the trade-off theory,...

- Pecking Order TheoryPecking Order TheoryIn the theory of firm's capital structure and financing decisions, the Pecking Order Theory or Pecking Order Model was first suggested by Donaldson in 1961 and it was modified by Stewart C. Myers and Nicolas Majluf in 1984...