Allied Bank Limited

Encyclopedia

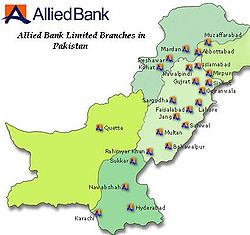

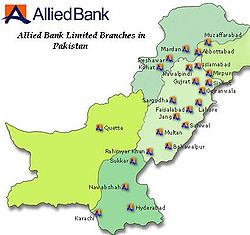

Allied Bank with its Registered Offices in Karachi and Lahore is one of the largest banks within the country with 805 Branches connected to an online network. It was the first Muslim Bank Established in Pakistan before Partition (1942) with the name of Australasia Bank. It was Named as Allied Bank of Pakistan from Australasia Bank Limited in 1974, and Sarhad Bank Ltd, Lahore Commercial Bank Ltd and Pak Bank Ltd were also merged in it. In August 2004 the Bank was restructured and the ownership was transferred to Ibrahim Group.

0.12 million under the Chairmanship of Khawaja Bashir Bux, and his business associates, including Abdul Rahman Malik who was amongst the original Board of Directors, the bank had attracted deposits, equivalent to PKR 0.431 million in its first eighteen months of business. Total assets then amounted to PKR 0.572 million. Today Allied Bank's paid up Capital & Reserves amount to Rs. 10.5 billion, deposit exceeded Rs. 143 billion and total assets equal Rs. 170 billion. The Allied Bank's story is one of dedication, commitment to professionalism, adaptation to changing environmental challenges resulting into all round growth and stability, envied and aspired by many.

It was particularly galling for Khawaja Bashir Bux and Abdul Rahman Malik to hear the gibe that Muslims could not be successful bankers. They decided to respond to the challenge and took lead in establishing this first Muslim bank on the soil of Punjab that was to become Pakistan in December 1942; by the name of Australasia Bank Limited.

The initial equity of the Bank amounted to Rs 0.12 million, which was raised to Rs 0.5 million by the end of first full year of operation, and by the end of 30 June 1947 capital increased to Rs. 0.673 million and deposits raised to Rs 7.728 million.

It had been severely hit by the riots in East Punjab. The bank was identified with the Pakistan Movement. At the time of independence all the branches in India, (Amritsar, Batala, Jalandhar, Ludhaina, Delhi and Angra (Agra)) were closed down. New Branches were opened in Karachi, Rawalpindi, Peshawar, Sialkot, Sargodha, Jhang, Gujranwala and Kasur. Later it network spread to Multan & Quetta. The Bank financed trade in cloth and food grains and thus played an important role in maintaining consumer supplies during riot affected early months of 1948. Despite the difficult conditions prevailing and the substantial setback in the Bank’s business in India, Australasia Bank made a profit of Rs 50,000 during 1947-48.

By the end of 1970 it had 101 branches. Unfortunately it lost 51 branches in the separation of East Pakistan which became Bengladesh. The bank did well in despite losing lot of its assets. By the end of 1973 the bank had 186 branches in West Pakistan.

.

After privatization, Allied Bank registered an unprecedented growth to become one of the premier financial institutions of Pakistan. Allied Bank’s capital and reserves were Rs. 1.525 (Billion) and assets amounted to Rs. 87.536 (Billion) and deposits were Rs. 76.038 (Billion). Allied Bank enjoyed an enviable position in the financial sector of Pakistan and was recognized as one of the best amongst the major banks of the country.

In August 2004 as a result of capital reconstruction, the Bank’s ownership was transferred to a consortium comprising Ibrahim Leasing Limited and Ibrahim Group.

Today the Bank stands on a solid foundation of over 63 years of its existence having a strong equity, assets and deposits base offering universal banking services with higher focus on retail banking. The bank has the largest network of on-line branches in Pakistan and offers various technology based products and services to its diversified clientele through its network of more than 700 branches.

to and vested in with and into Allied Bank Limited. ILL shareholders were issued ABL shares in lieu of the ILL shares held by them. Application for the listing of ABL shares in all the Stock Exchange Companies of Pakistan was made. ABL was formally listed and trading of the shares of the Bank commenced w.e.f. the following dates.

And it is also traded on trading floors in Faisalabad.

History

Allied Bank of Pakistan Limited was formed in 1974 by the merger of Sarhad Bank Ltd, Lahore Commercial Bank Ltd and Pak Bank Ltd into Australasia Bank Limited and renamed by the government.Australasia Bank

Established in December 1942 as the Australasia Bank at Lahore with a paid-up share capital of PKRPakistani rupee

The rupee is the currency of Pakistan. The issuance of the currency is controlled by the State Bank of Pakistan, the central bank of the country. The most commonly used symbol for the rupee is Rs, used on receipts when purchasing goods and services. In Pakistan, the rupee is referred to as the...

0.12 million under the Chairmanship of Khawaja Bashir Bux, and his business associates, including Abdul Rahman Malik who was amongst the original Board of Directors, the bank had attracted deposits, equivalent to PKR 0.431 million in its first eighteen months of business. Total assets then amounted to PKR 0.572 million. Today Allied Bank's paid up Capital & Reserves amount to Rs. 10.5 billion, deposit exceeded Rs. 143 billion and total assets equal Rs. 170 billion. The Allied Bank's story is one of dedication, commitment to professionalism, adaptation to changing environmental challenges resulting into all round growth and stability, envied and aspired by many.

1942 - 1947: Pre Independence

In the early 1940s the Muslim community was beginning to realize the need for the active participation in the field of trade and industry. The Hindus had since the late 1880s established a commanding presence in these areas and industry, trade and commerce in the undivided Sub-continent was completely dominated by them. Banking, in particular, was an exclusive enclave of the Hindus and it was widely believed, and wrongly so, that Muslims were temperamentally unsuited for this profession.It was particularly galling for Khawaja Bashir Bux and Abdul Rahman Malik to hear the gibe that Muslims could not be successful bankers. They decided to respond to the challenge and took lead in establishing this first Muslim bank on the soil of Punjab that was to become Pakistan in December 1942; by the name of Australasia Bank Limited.

The initial equity of the Bank amounted to Rs 0.12 million, which was raised to Rs 0.5 million by the end of first full year of operation, and by the end of 30 June 1947 capital increased to Rs. 0.673 million and deposits raised to Rs 7.728 million.

1947 to 1974

Australasia Bank was the only fully functional Muslim Bank on Pakistan territory on August the 14th, .It had been severely hit by the riots in East Punjab. The bank was identified with the Pakistan Movement. At the time of independence all the branches in India, (Amritsar, Batala, Jalandhar, Ludhaina, Delhi and Angra (Agra)) were closed down. New Branches were opened in Karachi, Rawalpindi, Peshawar, Sialkot, Sargodha, Jhang, Gujranwala and Kasur. Later it network spread to Multan & Quetta. The Bank financed trade in cloth and food grains and thus played an important role in maintaining consumer supplies during riot affected early months of 1948. Despite the difficult conditions prevailing and the substantial setback in the Bank’s business in India, Australasia Bank made a profit of Rs 50,000 during 1947-48.

By the end of 1970 it had 101 branches. Unfortunately it lost 51 branches in the separation of East Pakistan which became Bengladesh. The bank did well in despite losing lot of its assets. By the end of 1973 the bank had 186 branches in West Pakistan.

1974 to 1991: Public

In 1974, the Board of Directors of Australasia Bank was dissolved and the bank was renamed as Allied Bank. The first year was highly successful one: profit exceeded the Rs 10 million mark; deposits rose by over 50 percent and approached Rs 1460 million. Investments rose by 72 percent and advances exceeded Rs 1080 million for the first time in bank history. 116 new branches were opened during 1974 and the Bank started participation in the spot procurement agriculture program of the Government. Those seventeen years of the Bank saw a rapid growth. Branches increased from 353 in 1974 to 748 in 1991. Deposits rose from Rs 1.46 billion, and Advances and investments from Rs 1.34 billion to Rs 22 billion during this period. It also opened three branches in the UKUnited Kingdom

The United Kingdom of Great Britain and Northern IrelandIn the United Kingdom and Dependencies, other languages have been officially recognised as legitimate autochthonous languages under the European Charter for Regional or Minority Languages...

.

1991 to 2004: Privatization

As a result of privatization in September 1991, Allied Bank entered in a new phase of its history, as the world’s first bank to be owned and managed by its employees. In 1993 the First Allied Bank Modaraba (FABM) was floated.After privatization, Allied Bank registered an unprecedented growth to become one of the premier financial institutions of Pakistan. Allied Bank’s capital and reserves were Rs. 1.525 (Billion) and assets amounted to Rs. 87.536 (Billion) and deposits were Rs. 76.038 (Billion). Allied Bank enjoyed an enviable position in the financial sector of Pakistan and was recognized as one of the best amongst the major banks of the country.

In August 2004 as a result of capital reconstruction, the Bank’s ownership was transferred to a consortium comprising Ibrahim Leasing Limited and Ibrahim Group.

Today the Bank stands on a solid foundation of over 63 years of its existence having a strong equity, assets and deposits base offering universal banking services with higher focus on retail banking. The bank has the largest network of on-line branches in Pakistan and offers various technology based products and services to its diversified clientele through its network of more than 700 branches.

2005-today

In May 2005 Ibrahim Leasing Limited was amalgamated by transferTransfer

Transfer may refer to:* Transfer * Transfer * Transfer DNA, the transferred DNA of the tumor-inducing plasmid of some species of bacteria such as Agrobacterium tumefaciens* Transfer...

to and vested in with and into Allied Bank Limited. ILL shareholders were issued ABL shares in lieu of the ILL shares held by them. Application for the listing of ABL shares in all the Stock Exchange Companies of Pakistan was made. ABL was formally listed and trading of the shares of the Bank commenced w.e.f. the following dates.

- Islamabad Stock ExchangeIslamabad Stock ExchangeIslamabad Stock Exchange or ISE is one and youngest of the three stock exchanges of Pakistan and is located in the capital of Islamabad. Islamabad stock exchange was incorporated as a guarantee limited company on 25 October 1989 in Islamabad capital territory with the main object of setting up of...

- 8 August 2005 - Lahore Stock ExchangeLahore Stock ExchangeLahore Stock Exchange Limited is Pakistan's second largest stock exchange after the Karachi Stock Exchange. It is located in Lahore, Pakistan.- History :...

- 10 August 2005 - Karachi Stock ExchangeKarachi Stock ExchangeThe Karachi Stock Exchange or KSE is a stock exchange located in Karachi, Sindh, Pakistan. It is Pakistan's largest and oldest stock exchange, with many Pakistani as well as overseas listings. Currently located in Stock Exchange Building on Stock Exchange Road, in the heart of Karachi's Business...

- 17 2005 August

And it is also traded on trading floors in Faisalabad.

Functions

Services

Allied Bank offers the following services to its customers:- Home Remittances

- Remittances

- Hajj Services

- Utility Bills

- Lockers

- Commodity Operation

Internet Banking

Online Banking facilities are available to customers maintaining accounts at all online branches across the country. The following facilities are available:- Cash Deposit for immediate credit to remote branch.

- Remote Cheque Encashment from any online branch.

- Instant Funds Transfer between any 2 online branches.

- Remote Balance Enquiry and Statement of Account.

Board of directors

- Khalid A Sherwani - Director/President & CEO

- Mohammad Naeem Mukhtar - Chairman

- Sheikh Mukhtar Ahmed - Director

- Muhammad Waseem Mukhtar - Director

- Abdul Aziz Khan - Director

- Sheikh Jalees Ahmed - Director

- Mubashir A Akhtar - Director

- Pervaiz Iqbal Butt - Director

External links

- www.abl.com - Allied Bank Limited