Volatility Smile

Encyclopedia

In finance

, the volatility smile is a long-observed pattern in which at-the-money options

tend to have lower implied volatilities

than in- or out-of-the-money options. The pattern displays different characteristics for different markets and results from the probability of extreme moves. Equity options traded in American markets did not show a volatility smile before the Crash of 1987

but began showing one afterwards.

Modelling the volatility smile is an active area of research in quantitative finance. Typically, a quantitative analyst

will calculate the implied volatility from liquid vanilla options and use models of the smile to calculate the price of more complex exotic option

s.

A closely related concept is that of term structure of volatility, which refers to how implied volatility differs for related options with different maturities. An implied volatility surface is a 3-D plot that combines volatility smile and term structure of volatility into a consolidated view of all options for an underlier.

with dividends whose early exercise could be optimal, the price is a strictly increasing function of volatility. This means it is usually possible to compute a unique implied volatility from a given market price for an option. This implied volatility is best regarded as a rescaling of option prices which makes comparisons between different strikes, expirations, and underlyings easier and more intuitive.

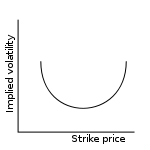

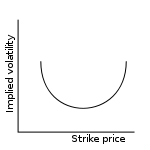

When implied volatility is plotted against strike price, the resulting graph is typically downward sloping for equity markets, or valley-shaped for currency markets. For markets where the graph is downward sloping, such as for equity options, the term "volatility skew" is often used. For other markets, such as FX options or equity index options, where the typical graph turns up at either end, the more familiar term "volatility smile" is used. For example, the implied volatility for upside (i.e. high strike) equity options is typically lower than for at-the-money equity options. However, the implied volatilities of options on foreign exchange contracts tend to rise in both the downside and upside directions. In equity markets, a small tilted smile is often observed near the money as a kink in the general downward sloping implicit volatility graph. Sometimes the term "smirk" is used to describe a skewed smile.

Market practitioners use the term implied-volatility to indicate the volatility parameter for ATM (at-the-money) option. Adjustments to this value is undertaken by incorporating the values of Risk Reversal and Flys (Skews) to determine the actual volatility measure that may be used for options with a delta which is not 50.

Callx = ATM + 0.5 RRx + Flyx

Putx = ATM - 0.5 RRx + Flyx

Risk reversal

s are generally quoted X% delta risk reversal and essentially is Long X% delta call, and short X% delta put.

Butterfly

, on the other hand, is Y% delta fly which mean Long Y% delta call, Long Y% delta put, and short ATM call.

is related to historical volatility, however the two are distinct. Historical volatility is a direct measure of the movement of the underlier’s price (realized volatility) over recent history (e.g. a trailing 21-day period). Implied volatility, in contrast, is set by the market price of the derivative contract itself, and not the underlier. Therefore, different derivative contracts on the same underlier have different implied volatilities. For instance, the IBM call option

, struck at $100 and expiring in 6 months, may have an implied volatility of 18%, while the put option struck at $105 and expiring in 1 month may have an implied volatility of 21%. At the same time, the historical volatility for IBM for the previous 21 day period might be 17% (all volatilities are expressed in annualized percentage moves).

Other option markets show other behavior. For instance, options on commodity futures typically show increased implied volatility just prior to the announcement of harvest forecasts. Options on US Treasury Bill futures show increased implied volatility just prior to meetings of the Federal Reserve Board (when changes in short-term interest rates are announced).

The market incorporates many other types of events into the term structure of volatility. For instance, the impact of upcoming results of a drug trial can cause implied volatility swings for pharmaceutical stocks. The anticipated resolution date of patent litigation can impact technology stocks, etc.

Volatility term structures list the relationship between implied volatilities and time to expiration. The term structures provide another method for traders to gauge cheap or expensive options.

The implied volatility surface simultaneously shows both volatility smile and term structure of volatility. Option traders use an implied volatility plot to quickly determine the shape of the implied volatility surface, and to identify any areas where the slope of the plot (and therefore relative implied volatilities) seems out of line.

The graph shows an implied volatility surface for all the call options on a particular underlying stock price. The Z-axis represents implied volatility in percent, and X and Y axes represent the option delta, and the days to maturity. Note that to maintain put-call parity, a 20 delta put must have the same implied volatility as an 80 delta call. For this surface, we can see that the underlying symbol has both volatility skew (a tilt along the delta axis), as well as a volatility term structure indicating an anticipated event in the near future.

Common heuristics include:

So if spot moves from $100 to $120, sticky strike would predict that the implied volatility of a $120 strike option would be whatever it was before the move (though it has moved from being OTM to ATM), while sticky delta would predict that the implied volatility of the $120 strike option would be whatever the $100 strike option's implied volatility was before the move (as these are both ATM at the time).

models and local volatility

models.

Finance

"Finance" is often defined simply as the management of money or “funds” management Modern finance, however, is a family of business activity that includes the origination, marketing, and management of cash and money surrogates through a variety of capital accounts, instruments, and markets created...

, the volatility smile is a long-observed pattern in which at-the-money options

Option (finance)

In finance, an option is a derivative financial instrument that specifies a contract between two parties for a future transaction on an asset at a reference price. The buyer of the option gains the right, but not the obligation, to engage in that transaction, while the seller incurs the...

tend to have lower implied volatilities

Implied volatility

In financial mathematics, the implied volatility of an option contract is the volatility of the price of the underlying security that is implied by the market price of the option based on an option pricing model. In other words, it is the volatility that, when used in a particular pricing model,...

than in- or out-of-the-money options. The pattern displays different characteristics for different markets and results from the probability of extreme moves. Equity options traded in American markets did not show a volatility smile before the Crash of 1987

Black Monday (1987)

In finance, Black Monday refers to Monday October 19, 1987, when stock markets around the world crashed, shedding a huge value in a very short time. The crash began in Hong Kong and spread west to Europe, hitting the United States after other markets had already declined by a significant margin...

but began showing one afterwards.

Modelling the volatility smile is an active area of research in quantitative finance. Typically, a quantitative analyst

Quantitative analyst

A quantitative analyst is a person who works in finance using numerical or quantitative techniques. Similar work is done in most other modern industries, but the work is not always called quantitative analysis...

will calculate the implied volatility from liquid vanilla options and use models of the smile to calculate the price of more complex exotic option

Exotic option

In finance, an exotic option is a derivative which has features making it more complex than commonly traded products . These products are usually traded over-the-counter , or are embedded in structured notes....

s.

A closely related concept is that of term structure of volatility, which refers to how implied volatility differs for related options with different maturities. An implied volatility surface is a 3-D plot that combines volatility smile and term structure of volatility into a consolidated view of all options for an underlier.

Volatility smiles and implied volatility

In the Black–Scholes model, the theoretical value of a vanilla option is a monotonic increasing function of the Black–Scholes volatility. Furthermore, except in the case of American optionsOption style

In finance, the style or family of an option is a general term denoting the class into which the option falls, usually defined by the dates on which the option may be exercised. The vast majority of options are either European or American options. These options - as well as others where the...

with dividends whose early exercise could be optimal, the price is a strictly increasing function of volatility. This means it is usually possible to compute a unique implied volatility from a given market price for an option. This implied volatility is best regarded as a rescaling of option prices which makes comparisons between different strikes, expirations, and underlyings easier and more intuitive.

When implied volatility is plotted against strike price, the resulting graph is typically downward sloping for equity markets, or valley-shaped for currency markets. For markets where the graph is downward sloping, such as for equity options, the term "volatility skew" is often used. For other markets, such as FX options or equity index options, where the typical graph turns up at either end, the more familiar term "volatility smile" is used. For example, the implied volatility for upside (i.e. high strike) equity options is typically lower than for at-the-money equity options. However, the implied volatilities of options on foreign exchange contracts tend to rise in both the downside and upside directions. In equity markets, a small tilted smile is often observed near the money as a kink in the general downward sloping implicit volatility graph. Sometimes the term "smirk" is used to describe a skewed smile.

Market practitioners use the term implied-volatility to indicate the volatility parameter for ATM (at-the-money) option. Adjustments to this value is undertaken by incorporating the values of Risk Reversal and Flys (Skews) to determine the actual volatility measure that may be used for options with a delta which is not 50.

Callx = ATM + 0.5 RRx + Flyx

Putx = ATM - 0.5 RRx + Flyx

Risk reversal

Risk reversal

-Risk Reversal investment strategy:A risk-reversal consists of being long an out of the money call and being short an out of the money put, both with the same maturity....

s are generally quoted X% delta risk reversal and essentially is Long X% delta call, and short X% delta put.

Butterfly

Butterfly (options)

In finance, a butterfly is a limited risk, non-directional options strategy that is designed to have a large probability of earning a small limited profit when the future volatility of the underlying is expected to be different from the implied volatility....

, on the other hand, is Y% delta fly which mean Long Y% delta call, Long Y% delta put, and short ATM call.

Implied volatility and historical volatility

It is helpful to note that implied volatilityImplied volatility

In financial mathematics, the implied volatility of an option contract is the volatility of the price of the underlying security that is implied by the market price of the option based on an option pricing model. In other words, it is the volatility that, when used in a particular pricing model,...

is related to historical volatility, however the two are distinct. Historical volatility is a direct measure of the movement of the underlier’s price (realized volatility) over recent history (e.g. a trailing 21-day period). Implied volatility, in contrast, is set by the market price of the derivative contract itself, and not the underlier. Therefore, different derivative contracts on the same underlier have different implied volatilities. For instance, the IBM call option

Option (finance)

In finance, an option is a derivative financial instrument that specifies a contract between two parties for a future transaction on an asset at a reference price. The buyer of the option gains the right, but not the obligation, to engage in that transaction, while the seller incurs the...

, struck at $100 and expiring in 6 months, may have an implied volatility of 18%, while the put option struck at $105 and expiring in 1 month may have an implied volatility of 21%. At the same time, the historical volatility for IBM for the previous 21 day period might be 17% (all volatilities are expressed in annualized percentage moves).

Term structure of volatility

For options of different maturities, we also see characteristic differences in implied volatility. However, in this case, the dominant effect is related to the market's implied impact of upcoming events. For instance, it is well-observed that realized volatility for stock prices rises significantly on the day that a company reports its earnings. Correspondingly, we see that implied volatility for options will rise during the period prior to the earnings announcement, and then fall again as soon as the stock price absorbs the new information. Options that mature earlier exhibit a larger swing in implied volatility (sometimes called "vol of vol") than options with longer maturities.Other option markets show other behavior. For instance, options on commodity futures typically show increased implied volatility just prior to the announcement of harvest forecasts. Options on US Treasury Bill futures show increased implied volatility just prior to meetings of the Federal Reserve Board (when changes in short-term interest rates are announced).

The market incorporates many other types of events into the term structure of volatility. For instance, the impact of upcoming results of a drug trial can cause implied volatility swings for pharmaceutical stocks. The anticipated resolution date of patent litigation can impact technology stocks, etc.

Volatility term structures list the relationship between implied volatilities and time to expiration. The term structures provide another method for traders to gauge cheap or expensive options.

Implied volatility surface

It is often useful to plot implied volatility as a function of both strike price and time to maturity. The result is a three-dimensional curved surface whereby the current market implied volatility (Z-axis) for all options on the underlier is plotted against strike price and time to maturity (X & Y-axes).The implied volatility surface simultaneously shows both volatility smile and term structure of volatility. Option traders use an implied volatility plot to quickly determine the shape of the implied volatility surface, and to identify any areas where the slope of the plot (and therefore relative implied volatilities) seems out of line.

The graph shows an implied volatility surface for all the call options on a particular underlying stock price. The Z-axis represents implied volatility in percent, and X and Y axes represent the option delta, and the days to maturity. Note that to maintain put-call parity, a 20 delta put must have the same implied volatility as an 80 delta call. For this surface, we can see that the underlying symbol has both volatility skew (a tilt along the delta axis), as well as a volatility term structure indicating an anticipated event in the near future.

Evolution: Sticky

An implied volatility surface is static: it describes the implied volatilities at a given moment in time. How the surface changes over time (especially as spot changes) is called the evolution of the implied volatility surface.Common heuristics include:

- "sticky strike" (or "sticky-by-strike", or "stick-to-strike"): if spot changes, the implied volatility of an option with a given absolute strike does not change.

- "sticky moneynessMoneynessIn finance, moneyness is a measure of the degree to which a derivative is likely to have positive monetary value at its expiration, in the risk-neutral measure. It can be measured in percentage probability, or in standard deviations....

" (aka, "sticky delta"; see moneynessMoneynessIn finance, moneyness is a measure of the degree to which a derivative is likely to have positive monetary value at its expiration, in the risk-neutral measure. It can be measured in percentage probability, or in standard deviations....

for why these are equivalent terms): if spot changes, the implied volatility of an option with a given moneyness does not change.

So if spot moves from $100 to $120, sticky strike would predict that the implied volatility of a $120 strike option would be whatever it was before the move (though it has moved from being OTM to ATM), while sticky delta would predict that the implied volatility of the $120 strike option would be whatever the $100 strike option's implied volatility was before the move (as these are both ATM at the time).

Modeling volatility

Methods of modelling the volatility smile include stochastic volatilityStochastic volatility

Stochastic volatility models are used in the field of mathematical finance to evaluate derivative securities, such as options. The name derives from the models' treatment of the underlying security's volatility as a random process, governed by state variables such as the price level of the...

models and local volatility

Local volatility

A local volatility model, in mathematical finance and financial engineering, is one which treats volatility as a function of the current asset level S_t and of time t .-Formulation:...

models.

See also

- Volatility (finance)Volatility (finance)In finance, volatility is a measure for variation of price of a financial instrument over time. Historic volatility is derived from time series of past market prices...

- Stochastic volatilityStochastic volatilityStochastic volatility models are used in the field of mathematical finance to evaluate derivative securities, such as options. The name derives from the models' treatment of the underlying security's volatility as a random process, governed by state variables such as the price level of the...

- SABR Volatility ModelSABR Volatility ModelIn mathematical finance, the SABR model is a stochastic volatility model, which attempts to capture the volatility smile in derivatives markets. The name stands for "Stochastic Alpha, Beta, Rho", referring to the parameters of the model. The SABR model is widely used by practitioners in the...

- Vanna Volga methodVanna VolgaThe Vanna-Volga method is a technique for pricing first-generation exotic options in FX derivatives.It consists in adjusting the Black–Scholes theoretical value by the cost of a portfolio which hedges three main risks...

External links

- Emanuel Derman, The Volatility Smile and Its Implied Tree (RISK, 7-2 Feb.1994, pp. 139-145, pp. 32-39) (PDF)

- Mark Rubinstein, Implied Binomial Trees (PDF)

- Damiano Brigo, Fabio Mercurio, Francesco Rapisarda and Giulio Sartorelli, Volatility Smile Modeling with Mixture Stochastic Differential Equations (PDF)

- Visualization of the volatility smile

- C. Grunspan, "Asymptotics Expansions for the Implied Lognormal Volatility : a Model Free Approach"