Seed money

Encyclopedia

Seed money, sometimes known as seed funding, friends and family funding or angel funding (and some times also as venture capital

), is a securities offering

whereby one or more parties that have some connection to a new enterprise invest the funds necessary to start the business so that it has enough funds to sustain itself for a period of development until it reaches either a state where it is able to continue funding itself, or has created something in value so that it is worthy of future rounds of funding. Seed money refers to the money

invested.

New seed money options are also emerging from crowd funding

.

Seed money is typically used to pay for such preliminary operations as market research

Seed money is typically used to pay for such preliminary operations as market research

and product development. Investors are often the business founders themselves, using savings, mortgage loan

proceeds, or funds borrowed from family and friends. They may also be outside angel investor

s, venture capitalists or accredited investor

s who are acquainted in some way with the founders. Seed capital is not necessarily a large amount of money. Many people start up new business ventures with $50,000 or less.

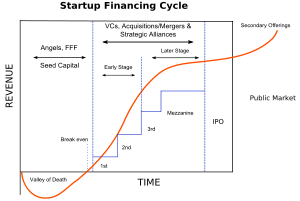

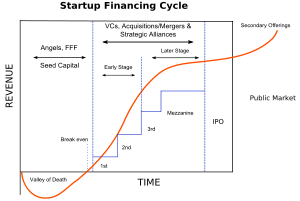

Seed capital can be distinguished from venture capital

in that venture capital investments tend to involve significantly more money, an arm's length transaction, and much greater complexity in the contracts and corporate structure that accompany the investment. Seed funding involves a higher risk

than normal venture capital funding since the investor

does not see any existing project to evaluate for funding. Hence the investments made are usually lower (in the tens of thousands to the hundreds of thousands of dollars range) as against normal venture capital investment (in the hundreds of thousands to the millions of dollars range), for similar levels of stake in the company.

Seed money may also come from crowd funding

or from financial bootstrapping rather than an offering. Bootstrapping in this context means making use of the cash flow

of an existing enterprise.

Investors make their decision whether to fund a project based on the perceived strength of the idea and the capabilities, skills and past history of the founders.

Venture capital

Venture capital is financial capital provided to early-stage, high-potential, high risk, growth startup companies. The venture capital fund makes money by owning equity in the companies it invests in, which usually have a novel technology or business model in high technology industries, such as...

), is a securities offering

Securities offering

A securities offering is a discrete round of investment, by which a business or other enterprise raises money to fund operations, expansion, a capital project, an acquisition, or some other business purpose....

whereby one or more parties that have some connection to a new enterprise invest the funds necessary to start the business so that it has enough funds to sustain itself for a period of development until it reaches either a state where it is able to continue funding itself, or has created something in value so that it is worthy of future rounds of funding. Seed money refers to the money

Money

Money is any object or record that is generally accepted as payment for goods and services and repayment of debts in a given country or socio-economic context. The main functions of money are distinguished as: a medium of exchange; a unit of account; a store of value; and, occasionally in the past,...

invested.

New seed money options are also emerging from crowd funding

Crowd funding

Crowd funding describes the collective cooperation, attention and trust by people who network and pool their money and other resources together, usually via the Internet, to support efforts initiated by other people or organizations...

.

Usage

Market research

Market research is any organized effort to gather information about markets or customers. It is a very important component of business strategy...

and product development. Investors are often the business founders themselves, using savings, mortgage loan

Mortgage loan

A mortgage loan is a loan secured by real property through the use of a mortgage note which evidences the existence of the loan and the encumbrance of that realty through the granting of a mortgage which secures the loan...

proceeds, or funds borrowed from family and friends. They may also be outside angel investor

Angel investor

An angel investor or angel is an affluent individual who provides capital for a business start-up, usually in exchange for convertible debt or ownership equity...

s, venture capitalists or accredited investor

Accredited investor

Accredited investor is a term defined by various securities laws that delineates investors permitted to invest in certain types of higher risk investments including seed money, limited partnerships, hedge funds, and angel investor networks...

s who are acquainted in some way with the founders. Seed capital is not necessarily a large amount of money. Many people start up new business ventures with $50,000 or less.

Seed capital can be distinguished from venture capital

Venture capital

Venture capital is financial capital provided to early-stage, high-potential, high risk, growth startup companies. The venture capital fund makes money by owning equity in the companies it invests in, which usually have a novel technology or business model in high technology industries, such as...

in that venture capital investments tend to involve significantly more money, an arm's length transaction, and much greater complexity in the contracts and corporate structure that accompany the investment. Seed funding involves a higher risk

Risk

Risk is the potential that a chosen action or activity will lead to a loss . The notion implies that a choice having an influence on the outcome exists . Potential losses themselves may also be called "risks"...

than normal venture capital funding since the investor

Investor

An investor is a party that makes an investment into one or more categories of assets --- equity, debt securities, real estate, currency, commodity, derivatives such as put and call options, etc...

does not see any existing project to evaluate for funding. Hence the investments made are usually lower (in the tens of thousands to the hundreds of thousands of dollars range) as against normal venture capital investment (in the hundreds of thousands to the millions of dollars range), for similar levels of stake in the company.

Seed money may also come from crowd funding

Crowd funding

Crowd funding describes the collective cooperation, attention and trust by people who network and pool their money and other resources together, usually via the Internet, to support efforts initiated by other people or organizations...

or from financial bootstrapping rather than an offering. Bootstrapping in this context means making use of the cash flow

Cash flow

Cash flow is the movement of money into or out of a business, project, or financial product. It is usually measured during a specified, finite period of time. Measurement of cash flow can be used for calculating other parameters that give information on a company's value and situation.Cash flow...

of an existing enterprise.

Investors make their decision whether to fund a project based on the perceived strength of the idea and the capabilities, skills and past history of the founders.

See also

- Financial capitalFinancial capitalFinancial capital can refer to money used by entrepreneurs and businesses to buy what they need to make their products or provide their services or to that sector of the economy based on its operation, i.e. retail, corporate, investment banking, etc....

- Private equityPrivate equityPrivate equity, in finance, is an asset class consisting of equity securities in operating companies that are not publicly traded on a stock exchange....

- InvestmentInvestmentInvestment has different meanings in finance and economics. Finance investment is putting money into something with the expectation of gain, that upon thorough analysis, has a high degree of security for the principal amount, as well as security of return, within an expected period of time...

- Corporate financeCorporate financeCorporate finance is the area of finance dealing with monetary decisions that business enterprises make and the tools and analysis used to make these decisions. The primary goal of corporate finance is to maximize shareholder value while managing the firm's financial risks...

- List of finance topics

- Angel investorAngel investorAn angel investor or angel is an affluent individual who provides capital for a business start-up, usually in exchange for convertible debt or ownership equity...

- Crowd fundingCrowd fundingCrowd funding describes the collective cooperation, attention and trust by people who network and pool their money and other resources together, usually via the Internet, to support efforts initiated by other people or organizations...