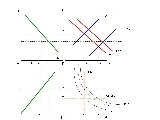

Overshooting Model

Overview

Rudi Dornbusch

Rüdiger "Rudi" Dornbusch was a German economist who worked for most of his career in the United States.-Biography:...

, aims to explain why exchange rate

Exchange rate

In finance, an exchange rate between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency...

s have a high variance. A key element of the model is that expectations of exchange rate changes are "consistent" — that is, rational

Rational expectations

Rational expectations is a hypothesis in economics which states that agents' predictions of the future value of economically relevant variables are not systematically wrong in that all errors are random. An alternative formulation is that rational expectations are model-consistent expectations, in...

— rather than static. The most important insight of the model is that adjustment lags in some parts of the economy can induce compensating volatility in others; specifically, when an exogenous

Exogenous

Exogenous refers to an action or object coming from outside a system. It is the opposite of endogenous, something generated from within the system....

variable changes, the short-run effect on the exchange rate can be greater than the long-run effect, so that in the short run the exchange rate overshoots its new long-run value.

Dornbusch developed this model back when many economists held the view that ideal markets should reach equilibrium and stay there.

Unanswered Questions