Iowa Electronic Markets

Encyclopedia

Prediction market

Prediction markets are speculative markets created for the purpose of making predictions...

s/futures markets operated by the University of Iowa

University of Iowa

The University of Iowa is a public state-supported research university located in Iowa City, Iowa, United States. It is the oldest public university in the state. The university is organized into eleven colleges granting undergraduate, graduate, and professional degrees...

Tippie College of Business

Tippie College of Business

The Tippie College of Business at The University of Iowa, established as the College of Commerce in 1921, is one of the oldest and top ranked business schools in the United States. The College was the first academic division at the University of Iowa to be named for an alumnus, Henry B. Tippie, a...

. Unlike normal futures markets, the IEM is not-for-profit; the markets are run for educational and research purposes.

The IEM allows traders to buy and sell contract

Contract

A contract is an agreement entered into by two parties or more with the intention of creating a legal obligation, which may have elements in writing. Contracts can be made orally. The remedy for breach of contract can be "damages" or compensation of money. In equity, the remedy can be specific...

s based on, among other things, political election results and economic indicators. Some markets are only available to academic traders.

The political election results have been highly accurate, especially when compared with traditional polling. This may be because it uses a free market

Free market

A free market is a competitive market where prices are determined by supply and demand. However, the term is also commonly used for markets in which economic intervention and regulation by the state is limited to tax collection, and enforcement of private ownership and contracts...

model to predict an outcome, instead of the aggregation of many individuals' opinions. The speculator is more interested in a correct outcome than in his or her desired outcome.

A precursor to the IEM was the Iowa Political Stock Market (IPSM), invented by George Neumann, and was developed by Robert E. Forsythe

Robert E. Forsythe

Robert E. Forsythe is an American economist. He is currently professor and senior associate dean at the Henry B. Tippie College of Business at the University of Iowa...

, Forrest Nelson, and George Neumann.

How it works

Here are examples of contracts that the IEM traded, beginning June 6, 2006, concerning the 2008 US Presidential Election Winner-Takes-All Market. (The contract descriptions came from the IEM site.)DEM08_WTA

- $1 if the Democratic Party nominee receives the majority of popular votes cast for the two major parties in the 2008 U.S. Presidential election, $0 otherwise

REP08_WTA

- $1 if the Republican Party nominee receives the majority of popular votes cast for the two major parties in the 2008 U.S. Presidential election, $0 otherwise

On the first trading day in January, 2007, the DEM08_WTA contract sold for 52.2 cents.

At this point, a speculator has a number of options.

- He can simply buy a number of DEM08_WTA shares and wait for the results of the election. If the Democratic Party nominee receives the majority of popular votes in the 2008 Presidential Election, the speculator would have his contract liquidated and receive $1, for a profit of 48¢. If the Democratic Party nominee did not receive the majority of popular votes in the Presidential Election, then the speculator would receive nothing.

- Alternatively, he could have bought shares intending to sell them later (before the election and the resolution of the share values) for a greater amount.

- Another option would be to essentially short sell DEM08_WTA shares - if one considers the price of DEM08_WTA to be too high and incommensurate with the true probability of the popular vote going to the Democratic nominee, one can buy a "bundle" for $1. In this case, the bundle would be 1 DEM08_WTA and 1 REP08_WTA; the value of these two shares is guaranteed to be 1$ (as they will be cashed out as either worth $1 and $0, or $0 and $1). Hence to short sell, one would buy one bundle and then sell the overvalued items.

- It is possible that a given market is simply irrationally priced. If the price of all the different shares is greater than or less than $1, then there is at least one share which is not correctly priced and so can either be shorted or gone long on. The price can be seen as the probability, and it doesn't make sense to have a total probability of greater than 100, and the markets are designed to cover all possibilities, so less than 100% doesn't make sense either. This is not necessarily true of all markets; in the Winner takes all markets this is true, but it is possible for the total value of 1 of every contract, which in 08_WTA is guaranteed to be $1, to exceed $1, such as in the markets dealing with share prices.

At the IEM site mentioned above, there is another bet on the 2008 US Presidential Election, based on vote share, which, because its payoffs are between $0 and $1, has prices that are, on average, closer together. (See "Graphs" below in External links.)

UDEM08_VS

- $1.00 times two-party vote share of unnamed Democratic nominee in 2008 election

UREP08_VS

- $1.00 times two-party vote share of unnamed Republican nominee in 2008 election

The IEM also trades futures based on financial markets, such as whether the Fed Funds rate will be raised at the following meeting.

Rules and limits

The IEM is not regulated by the CFTC (Commodity Futures Trading CommissionCommodity Futures Trading Commission

The U.S. Commodity Futures Trading Commission is an independent agency of the United States government that regulates futures and option markets....

) or any other agency. Because of the small sums wagered and the academic focus, the IEM has received two no-action letters that extend no-action relief. A speculator may put at risk in the IEM only between 5 and 500 USD. In contrast, other future markets like HedgeStreet

HedgeStreet

Nadex , formerly known as HedgeStreet, is an electronic exchange that allow trading in a number of financial derivatives...

are regulated by the CFTC and allow speculators to take on or offset financially significant amounts of risk regarding economic events or the prices of commodities.

See also

- Prediction marketPrediction marketPrediction markets are speculative markets created for the purpose of making predictions...

- The Wisdom of CrowdsThe Wisdom of CrowdsThe Wisdom of Crowds: Why the Many Are Smarter Than the Few and How Collective Wisdom Shapes Business, Economies, Societies and Nations, published in 2004, is a book written by James Surowiecki about the aggregation of information in groups, resulting in decisions that, he argues, are often better...

- HedgeStreetHedgeStreetNadex , formerly known as HedgeStreet, is an electronic exchange that allow trading in a number of financial derivatives...

- NewsFuturesNewsFuturesPrediction markets company NewsFutures has evolved into , "a consulting firm that specializes in developing and customizing online systems for large organizations to use to gather so-called Collective Intelligence from their employees."...

- IntradeIntradeIntrade is an online trading exchange website. The website's members speculate on the outcomes of non-sports-related future events. Intrade was founded by John Delaney in 2001 and acquired by Tradesports in 2003. Dublin-based owner Trade Exchange Network Limited also operated TradeBetX.com, which...

- TradeSportsTradeSportsTradesports was an online trading exchange website whose members speculate on the outcomes of future sports events. Founded by John Delaney in 2000, and located in Dublin, Ireland, by 2005 it reported 50,000 members and an average monthly volume of four million trades.Tradesports' sister website,...

Further reading

- Surowiecki, JamesJames SurowieckiJames Michael Surowiecki is an American journalist. He is a staff writer at The New Yorker, where he writes a regular column on business and finance called "The Financial Page".-Background:...

(2004). The Wisdom of Crowds: Why the Many Are Smarter Than the Few and How Collective Wisdom Shapes Business, Economies, Societies and Nations Little, Brown ISBN 0-316-86173-1

External links

- The Iowa Electronic Markets website

- Federal Reserve Monetary Policy Market

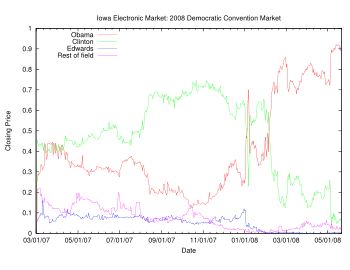

- Graphs for 2008 US Presidential Election Markets

- A Market for Playing the 2 Candidates, (about the IPSM) The New York TimesThe New York TimesThe New York Times is an American daily newspaper founded and continuously published in New York City since 1851. The New York Times has won 106 Pulitzer Prizes, the most of any news organization...

, 1992 - The "Election Futures Market": More Accurate Than Polls?, BusinessweekBusinessWeekBloomberg Businessweek, commonly and formerly known as BusinessWeek, is a weekly business magazine published by Bloomberg L.P. It is currently headquartered in New York City.- History :...

, 1996 - Porkbellies and Politics, TheStreet.comTheStreet.com-History:TheStreet.com, Inc., was co-founded in 1996 by Jim Cramer and Martin Peretz. It is traded on the NASDAQ Global Market. The company is headquartered at 14 Wall Street in New York City. Its stock was made public in May 1999 under the direction of past Chairman and Chief Executive Officer...

, 2000 - Bookies seen outbidding election polls: Betting sites better at predicting winner, economists claim, MSNBCMSNBCMSNBC is a cable news channel based in the United States available in the US, Germany , South Africa, the Middle East and Canada...

, 2004 - The Iowa Electronic Markets are still going for Bush, Salon.comSalon.comSalon.com, part of Salon Media Group , often just called Salon, is an online liberal magazine, with content updated each weekday. Salon was founded by David Talbot and launched on November 20, 1995. It was the internet's first online-only commercial publication. The magazine focuses on U.S...

, 2004 - Iowa 'futures' show Republican weakness, CNNCNNCable News Network is a U.S. cable news channel founded in 1980 by Ted Turner. Upon its launch, CNN was the first channel to provide 24-hour television news coverage, and the first all-news television channel in the United States...

, 2006 - PollyVote - Forecasting the U.S. Presidential Election