Credit score (United States)

Encyclopedia

A credit score in the United States

is a number representing the creditworthiness of a person, the likelihood that person will pay his or her debt

s.

Lenders, such as bank

s and credit card

companies, use credit scores to evaluate the potential risk posed by lending money to consumers. Widespread use of credit scores has made credit more widely available and cheaper for consumers.

, the FICO score is calculated statistically, with information from a consumer's credit files. The letters stand for Fair Isaac Corporation. .

It provides a snapshot of risk that banks and other institutions use to help make lending decisions. Applicants with higher FICO scores may be offered better interest rates on mortgages or automobile loans.

Credit scores are designed to measure the risk of default by taking into account various factors in a person's financial history. Although the exact formulas for calculating credit scores are secret, FICO has disclosed the following components:

Credit scores are designed to measure the risk of default by taking into account various factors in a person's financial history. Although the exact formulas for calculating credit scores are secret, FICO has disclosed the following components:

Getting a higher credit limit can help your credit score. The higher the credit limit on the credit card, the lower the utilization ratio average for all of your credit card accounts. The utilization ratio is the amount owed divided by the amount extended by the creditor and the higher it is the better your FICO rating, in general. So if you have one credit card with a used balance of $500 and a limit of $1,000 as well as another with a used balance of $700 and $2,000 limit the average ratio is 40 percent ($1,200 total used divided by $3,000 total limits). If the first credit card company raises the limit to $2,000 the ratio lowers to 30 percent, which could boost the FICO rating.

There are other special factors which can weigh on the FICO score.

with 60% of between approximately 650 and 799. According to FICO the median

score is 723.

Each individual actually has three credit scores for the FICO scoring model because the three national credit bureau

s, Experian, Equifax and TransUnion, each has its own database. Data about an individual consumer can vary from bureau to bureau.

company for assessing consumer credit risk

. In 2004, at the time of launch, FICO research showed a 4.4% increase in the number of accounts above cutoff while simultaneously showing a decrease in the number of bad, charge-off and Bankrupt accounts when compared to FICO traditional.

Each of the major credit agencies market this score generated with their data differently:

Prior to the introduction of NextGen, their FICO-based scores were also marketed under different names:

. According to court documents filed in the FICO v. VantageScore federal lawsuit the VantageScore market share is less than 6%. The VantageScore score methodology produces a score range from 501–990.

. This score is sold to lenders and investment banks but is free to consumers. It has a range of 350 to 850.

), each legal U.S. resident is entitled to a free copy of his or her credit report from each credit reporting agency once every twelve months. The law requires all three agencies to provide reports: Equifax

, Experian

, and Transunion

.

. Starting in the 1990s, the national credit reporting agencies that generate credit scores have also been generating more specialized insurance score

s, which insurance companies then use to rate the insurance risk of potential customers. Studies indicate that the majority of insureds pay less in insurance through the use of scores. These studies point out that people with higher scores have fewer claims.

According to a Fitch study, the accuracy of FICO in predicting delinquency has reduced in recent years. In 2001 there was an average 31-point difference in the FICO score between borrowers who had defaulted and those who paid on time. By 2006 the difference was only 10 points.

Some banks have reduced their reliance on FICO scoring. For example, Golden West Financial

(which merged with Wachovia Bank in 2006) abandoned FICO scores for a more costly analysis of a potential borrower's assets and employment before giving a loan.

United States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

is a number representing the creditworthiness of a person, the likelihood that person will pay his or her debt

Debt

A debt is an obligation owed by one party to a second party, the creditor; usually this refers to assets granted by the creditor to the debtor, but the term can also be used metaphorically to cover moral obligations and other interactions not based on economic value.A debt is created when a...

s.

Lenders, such as bank

Bank

A bank is a financial institution that serves as a financial intermediary. The term "bank" may refer to one of several related types of entities:...

s and credit card

Credit card

A credit card is a small plastic card issued to users as a system of payment. It allows its holder to buy goods and services based on the holder's promise to pay for these goods and services...

companies, use credit scores to evaluate the potential risk posed by lending money to consumers. Widespread use of credit scores has made credit more widely available and cheaper for consumers.

FICO score

The best-known and most widely used credit score model in the United StatesUnited States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

, the FICO score is calculated statistically, with information from a consumer's credit files. The letters stand for Fair Isaac Corporation. .

It provides a snapshot of risk that banks and other institutions use to help make lending decisions. Applicants with higher FICO scores may be offered better interest rates on mortgages or automobile loans.

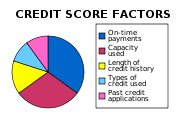

Makeup of the FICO score

- 35%: Payment history—Late payments on bills, such as a mortgage, credit card or automobile loan, can cause a FICO score to drop. Bills paid on time will improve a FICO score.

- 30%: Credit utilization—The ratio of current revolving debtRevolving accountA revolving account is an account created by a lender to represent debts where the outstanding balance does not have to be paid in full every month by the borrower to the lender. The borrower may be required to make a minimum payment, based on the balance amount. The most common example of a...

(such as credit card balances) to the total available revolving credit or credit limit. FICO scores can be improved by paying off debt and lowering the credit utilization ratio. Alternatively, applications for and receiving the credit limit increase will also drive down the utilization ratio. The closing of existing revolving accounts will typically adversely affect this ratio and therefore have a negative impact on a FICO score. - 15%: Length of credit history—As a credit history ages it can have a positive impact on its FICO score.

- 10%: Types of credit used (installmentInstallment creditInstallment credit is a type of credit that has a fixed number of payments, in contrast to revolving credit.-Examples:* Land loan* Home construction loan* Home mortgage* Some equity loans* Home improvement loan* Automobile loan...

, revolvingRevolving creditRevolving credit is a type of credit that does not have a fixed number of payments, in contrast to installment credit. Examples of revolving credits used by consumers include credit cards. Corporate revolving credit facilities are typically used to provide liquidity for a company's day-to-day...

, consumer financeConsumer financeAlternative financial services in the United States refers to a particular type of financial service, namely sub-prime lending by non-bank financial institutions. This branch of the financial services industry is more extensive in the United States than in some other countries, because the major...

, mortgageMortgage loanA mortgage loan is a loan secured by real property through the use of a mortgage note which evidences the existence of the loan and the encumbrance of that realty through the granting of a mortgage which secures the loan...

)—Consumers can benefit by having a history of managing different types of credit. - 10%: Recent searches for credit—Credit inquiries, which occur when consumers are seeking new credit, can hurt scores. Individuals shopping for a mortgage or auto loan over a short period will likely not experience a decrease in their scores as a result of these types of inquiries, however. While all credit inquiries are recorded and displayed on credit reports for a period of time, credit inquiries that were made by the owner (self-check), by an employer (for employee verification) or by companies initiating pre-screened offers of credit or insurance do not have any impact on a credit score.

Getting a higher credit limit can help your credit score. The higher the credit limit on the credit card, the lower the utilization ratio average for all of your credit card accounts. The utilization ratio is the amount owed divided by the amount extended by the creditor and the higher it is the better your FICO rating, in general. So if you have one credit card with a used balance of $500 and a limit of $1,000 as well as another with a used balance of $700 and $2,000 limit the average ratio is 40 percent ($1,200 total used divided by $3,000 total limits). If the first credit card company raises the limit to $2,000 the ratio lowers to 30 percent, which could boost the FICO rating.

There are other special factors which can weigh on the FICO score.

- Any money owed because of a court judgment, tax lien, etc. carry an additional negative penalty, especially when recent.

- Having one or more newly opened consumer financeConsumer financeAlternative financial services in the United States refers to a particular type of financial service, namely sub-prime lending by non-bank financial institutions. This branch of the financial services industry is more extensive in the United States than in some other countries, because the major...

credit accounts may also be a negative.

FICO score range

A FICO score is between 300 and 850, exhibiting a negative skewed distributionSkewness

In probability theory and statistics, skewness is a measure of the asymmetry of the probability distribution of a real-valued random variable. The skewness value can be positive or negative, or even undefined...

with 60% of between approximately 650 and 799. According to FICO the median

Median

In probability theory and statistics, a median is described as the numerical value separating the higher half of a sample, a population, or a probability distribution, from the lower half. The median of a finite list of numbers can be found by arranging all the observations from lowest value to...

score is 723.

Each individual actually has three credit scores for the FICO scoring model because the three national credit bureau

Credit bureau

A credit bureau , or credit reference agency is a company that collects information from various sources and provides consumer credit information on individual consumers for a variety of uses. It is an organization providing information on individuals' borrowing and bill paying habits...

s, Experian, Equifax and TransUnion, each has its own database. Data about an individual consumer can vary from bureau to bureau.

NextGen score

The NextGen Score is a scoring model designed by the FICOFico

Fico may refer to:* Fair Isaac Corporation , an American company* FICO score, a credit score developed by Fair Isaac Corporation * Hurricane Fico, a hurricane in the 1978 Pacific hurricane season...

company for assessing consumer credit risk

Consumer credit risk

The following article is based on UK market, other countries may differ.Consumer Credit Risk is the risk of loss due to a customer's non re-payment on a consumer credit product, such as a mortgage, unsecured personal loan, credit card, overdraft etc .-Consumer Credit Risk...

. In 2004, at the time of launch, FICO research showed a 4.4% increase in the number of accounts above cutoff while simultaneously showing a decrease in the number of bad, charge-off and Bankrupt accounts when compared to FICO traditional.

Each of the major credit agencies market this score generated with their data differently:

- Experian: FICO Advanced Risk Score

- Equifax: Pinnacle

- TransUnion: Precision

Prior to the introduction of NextGen, their FICO-based scores were also marketed under different names:

- Experian: FICO or FICO II

- Equifax: BEACON

- TransUnion: EMPIRICA

VantageScore

In 2006, to try to win business from FICO, the three major credit-reporting agencies introduced VantageScoreVantageScore

VantageScore is the name of a credit rating product that is offered by the three major credit bureaus . The product was unveiled by the three bureaus on 14 March 2006...

. According to court documents filed in the FICO v. VantageScore federal lawsuit the VantageScore market share is less than 6%. The VantageScore score methodology produces a score range from 501–990.

CE Score

CE Score is published by CE Analytics and licensed to sites like Community Empower and QuizzleQuizzle

Quizzle.com, a Detroit-based website, is the first company to give consumers free access to their credit score. Quizzle provides consumers with CE credit score based on an Experian credit report. The CE Score was developed by CE Analytics. Using Quizzle, consumers can update their credit scores...

. This score is sold to lenders and investment banks but is free to consumers. It has a range of 350 to 850.

Free annual credit report

As a result of the FACT Act (Fair and Accurate Credit Transactions ActFair and Accurate Credit Transactions Act

The Fair and Accurate Credit Transactions Act of 2003 is a United States federal law, passed by the United States Congress on November 22, 2003, and signed by President George W. Bush on December 4, 2003, as an amendment to the Fair Credit Reporting Act...

), each legal U.S. resident is entitled to a free copy of his or her credit report from each credit reporting agency once every twelve months. The law requires all three agencies to provide reports: Equifax

Equifax

Equifax Inc. is a consumer credit reporting agency in the United States, considered one of the three largest American credit agencies along with Experian and TransUnion. Founded in 1899, Equifax is the oldest of the three agencies and gathers and maintains information on over 400 million credit...

, Experian

Experian

Experian plc, formerly known as CCN Systems, is a global credit information group with operations in 36 countries. The company employs 15,500 people with corporate headquarters in Dublin, Ireland and operational headquarters in Nottingham, England and Costa Mesa, California, US...

, and Transunion

TransUnion

TransUnion is the third largest credit bureau in the United States, which offers credit-related information to potential creditors. Like major competitors Equifax and Experian, TransUnion markets credit reports directly to consumers.- History :...

.

Non-traditional uses of credit scores

Credit scores are often used in determining prices for auto and homeowner's insuranceInsurance

In law and economics, insurance is a form of risk management primarily used to hedge against the risk of a contingent, uncertain loss. Insurance is defined as the equitable transfer of the risk of a loss, from one entity to another, in exchange for payment. An insurer is a company selling the...

. Starting in the 1990s, the national credit reporting agencies that generate credit scores have also been generating more specialized insurance score

Insurance score

An insurance score - also called an insurance credit score - is a numerical point system based on select credit report characteristics. There is no direct relationship to financial credit scores used in lending decisions, as insurance scores are not intended to measure creditworthiness but rather...

s, which insurance companies then use to rate the insurance risk of potential customers. Studies indicate that the majority of insureds pay less in insurance through the use of scores. These studies point out that people with higher scores have fewer claims.

Criticism

Credit scores are widely used because they are inexpensive and largely reliable, but do have their failings.Easily gamed

Because a significant portion of the FICO score is determined by the ratio of credit used to credit available on credit card accounts, one way to increase the score is to increase the credit limits on one's credit card accounts.Not a good predictor of risk

Some have blamed lenders for inappropriately approving loans for subprime applicants, despite signs that people with poor scores were at high risk for not repaying the loan. By not considering whether the person could afford the payments if they were to increase in the future, many of these loans may have put the borrowers at risk for default.According to a Fitch study, the accuracy of FICO in predicting delinquency has reduced in recent years. In 2001 there was an average 31-point difference in the FICO score between borrowers who had defaulted and those who paid on time. By 2006 the difference was only 10 points.

Some banks have reduced their reliance on FICO scoring. For example, Golden West Financial

Golden West Financial

Golden West Financial was the second largest savings and loan in the United States, operating branches under the name of World Savings Bank.-History:...

(which merged with Wachovia Bank in 2006) abandoned FICO scores for a more costly analysis of a potential borrower's assets and employment before giving a loan.

See also

- Bankruptcy risk scoreBankruptcy risk scoreA bankruptcy risk score is a number that indicates the likelihood of an individual filing for bankruptcy. Although it has been used for over twenty years to assess risk in lending, few consumers know of it. It is related to the better-known credit score, but unlike credit scores, bankruptcy risk...

- Credit scorecardsCredit ScorecardsCredit scorecards are mathematical models which attempt to provide a quantitative estimate of the probability that a customer will display a defined behavior Credit scorecards are mathematical models which attempt to provide a quantitative estimate of the probability that a customer will display a...

- Alternative dataAlternative dataIn economic policy, alternative data refers to the inclusion of non-financial payment reporting data in credit files, such as telecom and energy utility payments. Only 39 of 178 economies have credit bureaus that currently track alternative data....

- Seasoned trade lineSeasoned trade lineAseasoned trade line is a line of credit that the borrowerhas held open in good standing for a long period of time,typically at least 2 years...

External links

- "Credit Scores: What You Should Know About Your Own," by Malgorzata Wozniacka and Snigdha Sen (November 2004) - PBS FRONTLINE