GersonH

On Thursday the 1st of November, trading on the euro closed up 0.85% (+96 pips). The price kept this momentum during for three sessions. The euro rose against the US dollar amid partial profit taking in tandem with the British pound, as well as a significant weakening of the US dollar across the entire spectrum of the market due to falling bond yields and weak data on activity in the US manufacturing sector. Initially, the New Zealander and the pound caused the dollar to weaken. The remaining currencies have already followed suit.

The Bank of England noted that next year the rate could grow even faster if a trade agreement is reached on Brexit. According to BOE head Carney, a trade agreement is likely.

The ISM business activity index was 57.7 (forecast: 59.0; previous 59.8) for October. It increased pressure on the dollar, which grew during the Asian session.

Day's news (GMT+3):

11:15 Switzerland: real retail sales (Sep).

11:45 France: Markit Manufacturing PMI (Oct).

11:55 Germany: Markit Manufacturing PMI (Oct).

12:00 Eurozone: Markit Manufacturing PMI (Oct).

12:30 UK: PMI construction (Oct).

15:30 Canada: unemployment rate (Oct), participation rate (Oct), net change in employment (Oct).

15:30 US: average hourly earnings (Oct), nonfarm payrolls (Oct), unemployment rate (Oct), labor force participation rate (Oct).

17:00 US: factory orders (Sep).

20:00 US: Baker Hughes US oil rig count.

Current situation:

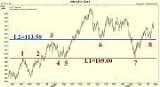

Buyers got off to a good start to the month. There was a breakout of the trend line which pushed the price up from the A-A and B-B channels.

Today is nonfarm payrolls day. I won't be making an intraday forecast today as the NFP indicator is unpredictable. If anyone is looking to trade before the report is released, then keep your eye on 1.1433 (112th degree) if you're thinking of selling euros. If the price goes down immediately, then you can forget about the short position and quietly wait for the release of the US labor market report. I'm not expecting any growth since we are at around the 112th-135th degrees, which for me is a reversal zone.

The daily trend line is passing through 1.1457. Be on the lookout today. If the NFP report turns out to be higher than expected, the euro/dollar could fall to 1.1350 (67th degree) without even reaching the trend line. We need to learn currency trading in India more in https://alpari.com/en/school/

The Bank of England noted that next year the rate could grow even faster if a trade agreement is reached on Brexit. According to BOE head Carney, a trade agreement is likely.

The ISM business activity index was 57.7 (forecast: 59.0; previous 59.8) for October. It increased pressure on the dollar, which grew during the Asian session.

Day's news (GMT+3):

11:15 Switzerland: real retail sales (Sep).

11:45 France: Markit Manufacturing PMI (Oct).

11:55 Germany: Markit Manufacturing PMI (Oct).

12:00 Eurozone: Markit Manufacturing PMI (Oct).

12:30 UK: PMI construction (Oct).

15:30 Canada: unemployment rate (Oct), participation rate (Oct), net change in employment (Oct).

15:30 US: average hourly earnings (Oct), nonfarm payrolls (Oct), unemployment rate (Oct), labor force participation rate (Oct).

17:00 US: factory orders (Sep).

20:00 US: Baker Hughes US oil rig count.

Current situation:

Buyers got off to a good start to the month. There was a breakout of the trend line which pushed the price up from the A-A and B-B channels.

Today is nonfarm payrolls day. I won't be making an intraday forecast today as the NFP indicator is unpredictable. If anyone is looking to trade before the report is released, then keep your eye on 1.1433 (112th degree) if you're thinking of selling euros. If the price goes down immediately, then you can forget about the short position and quietly wait for the release of the US labor market report. I'm not expecting any growth since we are at around the 112th-135th degrees, which for me is a reversal zone.

The daily trend line is passing through 1.1457. Be on the lookout today. If the NFP report turns out to be higher than expected, the euro/dollar could fall to 1.1350 (67th degree) without even reaching the trend line. We need to learn currency trading in India more in https://alpari.com/en/school/