World currency

Encyclopedia

In the foreign exchange market

and international finance

, a world currency, supranational currency, or global currency refers to a currency in which the vast majority of international transactions take place and which serves as the world's primary reserve currency

. In March 2009, as a result of the global economic crisis, China pressed for urgent consideration of a global currency. A UN panel of expert economists has proposed replacing the current US dollar-based system by greatly expanding the International Monetary Fund

's Special Drawing Rights

(SDRs).

Currencies have many forms depending on several properties: type of issuance, type of issuer and type of backing. The particular configuration of those properties leads to different types of money. The pros and cons of a currency are strongly influenced by the type proposed. Consider, for example, the properties of a complementary currency

.

In the period following the Bretton Woods Conference of 1944, exchange rate

In the period following the Bretton Woods Conference of 1944, exchange rate

s around the world were pegged

against the United States dollar, which could be exchanged for a fixed amount of gold. This reinforced the dominance of the US dollar as a global currency.

Since the collapse of the fixed exchange rate

regime and the gold standard

and the institution of floating exchange rate

s following the Smithsonian Agreement

in 1971, most currencies around the world have no longer been pegged against the United States dollar. However, as the United States remained the world's preeminent economic superpower, most international transactions continued to be conducted with the United States dollar, and it has remained the de facto

world currency.

Only two serious challengers to the status of the United States dollar as a world currency have arisen. During the 1980s, the Japanese yen

became increasingly used as an international currency, but that usage diminished with the Japanese recession in the 1990s. More recently, the euro has increasingly competed with the United States dollar in international finance.

Since the mid-20th century, the de facto world currency has been the United States dollar. According to Robert Gilpin

in Global Political Economy: Understanding the International Economic Order (2001): "Somewhere between 40 and 60 percent of international financial transactions are denominated in dollars. For decades the dollar has also been the world's principal reserve currency; in 1996, the dollar accounted for approximately two-thirds of the world's foreign exchange reserves" (255).

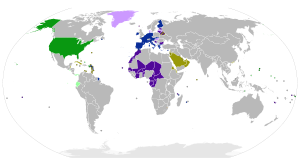

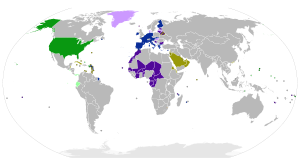

Many of the world's currencies are pegged against the dollar. Some countries, such as Ecuador

, El Salvador, and Panama

, have gone even further and eliminated their own currency (see dollarization

) in favor of the United States dollar. The U.S. dollar continues to dominate global currency reserves, with 63.9% held in dollars, as compared to 26.5% held in euros (see Reserve Currency

).

A 2011 study about the current dominant reserve currency in central banks shows that dollar may not be the obvious dominant currency, because of the major part of Unallocated Reserves reported by central banks.

(DM), and since then its contribution to official reserves has risen as banks seek to diversify their reserves and trade in the eurozone

continues to expand.

As with the dollar, some of the world's currencies are pegged against the euro. They are usually Eastern European currencies like the Bulgarian lev

, plus several west African currencies like the Cape Verdean escudo and the CFA franc

. Other European countries, while not being EU members, have adopted the euro due to currency unions with member states, or by unilaterally superseding their own currencies: Andorra

, Monaco

, Montenegro

, San Marino

, and Vatican City

.

, the euro surpassed the dollar in the combined value of cash in circulation. The value of euro notes in circulation has risen to more than €610 billion

, equivalent to US$800 billion at the exchange rates at the time (today equivalent to circa US$968 billion).

s or "pieces of eight" spread from the Spanish territories in the Americas westwards to Asia and eastwards to Europe forming the first ever worldwide currency. Spain's political supremacy on the world stage, the importance of Spanish commercial routes across the Atlantic and the Pacific, and the coin's quality and purity of silver helped it become internationally accepted for over two centuries. It was legal tender in Spain's Pacific territories of the Philippines

, Micronesia, Guam

and the Caroline Islands

and later in China and other Southeast Asian countries until the mid-19th century. In the Americas it was legal tender in all of South and Central America (except Brazil) as well as in the US and Canada

until the mid-19th century. In Europe the Spanish dollar was legal tender in the Iberian Peninsula

, in most of Italy

including: Milan

, the Kingdom of Naples

, Sicily, Sardinia

, the Franche-Comté

(France), and in the Spanish Netherlands. It was also used in other European states including the Austrian Habsburg

territories.

When the colony of New South Wales was founded in Australia in 1788, it ran into the problem of a lack of coinage. Governor Lachlan Macquarie took the initiative of using £10,000 in Spanish dollars sent by the British government to produce suitable coins, they simply punched out the centers of the coins. Both the central plug and rims were stamped with a sunburst. The punched centers passed as shillings and the outer rims as five-shilling pieces. The mutilated coins were thereafter no longer acceptable outside of the island, so as a consequence, became the official currency there. These coins to the value of 40,000 Spanish dollars came on the 26 November 1812 on the merchant ship the Samarang from Madras, via the Honourable East India Company. To stop them from leaving the colony the centres were punched out to create two different issues of coins.

There was a central plug (known as a dump) which was valued at 15 pence and was restruck with a new design (a crown on the obverse, the denomination on the reverse), whilst the dollars received an overstamp around the hole ("New South Wales 1813" on the obverse, "Five Shillings" on the reverse). The holey dollar became the first official currency produced specifically for circulation in Australia.

There are other coins/currencies that have been used over the centuries. The Austrian Maria Theresa thaler

is still used in some back areas of the Middle East and Africa and was first issued in 1741. There was also the Roman Denarius, which for hundreds of years was the world's premier currency.

, the Kremlin

called for a supranational reserve currency as part of a reform of the global financial system. In a document containing proposals for the G20 meeting, it suggested that the International Monetary Fund

(IMF) (or an Ad Hoc Working Group of G20) should be instructed to carry out specific studies to review the following options:

On 24 March 2009, Zhou Xiaochuan

, President of the People's Bank of China

, called for "creative reform of the existing international monetary system towards an international reserve currency," believing it would "significantly reduce the risks of a future crisis and enhance crisis management capability." Zhou suggested that the IMF's Special Drawing Rights

(a currency basket comprising dollars, euros, yen, and sterling

) could serve as a super-sovereign reserve currency, not easily influenced by the policies of individual countries. US President Obama

, however, rejected the suggestion stating that "the dollar is extraordinarily strong right now."

At the G8 summit in July 2009, the Russian president expressed Russia's desire for a new supranational reserve currency by showing off a coin minted with the words "unity in diversity". The coin, an example of a future world currency, emphasized his call for creating a mix of regional currencies as a way to address the global financial crisis.

On 30 March 2009, at the Second South America-Arab League Summit in Qatar

, Venezuelan President Hugo Chavez

proposed the creation of the Petro

as a supranational currency, in order to face the instability that the generation of fiat currency has caused in the world economy. The petrocurrency

would be backed by the huge oil reserves of the oil producing countries.

(FDI).

An often over-looked alternative to an establishment-created global reserve currency is for anyone to adopt already existing mechanisms that traditionally have worked very well in conducting international business. There are, for example, no obstacles for legal or physical persons to start drawing contracts and invoicing in XAU – Gold – as opposed to the USD, EUR or JPY (Japanese Yen).

which is used for all transactions around the world, regardless of the nationality of the entities (individuals, corporations, governments, or other organizations) involved in the transaction. No such official currency currently exists.

There are many different variations of the idea, including a possibility that it would be administered by a global central bank

or that it would be on the gold standard

. Supporters often point to the euro as an example of a supranational currency successfully implemented by a union of nations with disparate languages, cultures, and economies. Alternatively, digital gold currency

can be viewed as an example of how global currency can be implemented without achieving national government consensus.

A limited alternative would be a world reserve currency issued by the International Monetary Fund

, as an evolution of the existing Special Drawing Rights

and used as reserve assets by all national and regional central banks. On 26 March 2009, a UN panel of expert economists called for a new global currency reserve scheme to replace the current US dollar-based system. The panel's report pointed out that the "greatly expanded SDR (Special Drawing Rights), with regular or cyclically adjusted emissions calibrated to the size of reserve accumulations, could contribute to global stability, economic strength and global equity."

In addition to the idea of a single world currency, some evidence suggests the world may evolve multiple global currencies that exchange on a singular market system. The rise of digital global currencies owned by privately held companies or groups such as Ven

suggest that multiple global currencies may offer wider formats for trade as they gain strength and wider acceptance.

, then it would be economically inefficient for the world to share one currency.

In Christianity this is especially true, although awareness of the taboo

has been lost to most Christians. Islam bans usury

, called riba

.

A large number of religious adherents who oppose the paying of interest are currently able to use banking facilities in their countries which are to regulate interest. An example of this is the Islamic banking

system, which is characterized by a nation's central bank setting interest rates for most other transactions.

Foreign exchange market

The foreign exchange market is a global, worldwide decentralized financial market for trading currencies. Financial centers around the world function as anchors of trading between a wide range of different types of buyers and sellers around the clock, with the exception of weekends...

and international finance

International finance

International finance is the branch of economics that studies the dynamics of exchange rates, foreign investment, global financial system, and how these affect international trade. It also studies international projects, international investments and capital flows, and trade deficits. It includes...

, a world currency, supranational currency, or global currency refers to a currency in which the vast majority of international transactions take place and which serves as the world's primary reserve currency

Reserve currency

A reserve currency, or anchor currency, is a currency that is held in significant quantities by many governments and institutions as part of their foreign exchange reserves...

. In March 2009, as a result of the global economic crisis, China pressed for urgent consideration of a global currency. A UN panel of expert economists has proposed replacing the current US dollar-based system by greatly expanding the International Monetary Fund

International Monetary Fund

The International Monetary Fund is an organization of 187 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world...

's Special Drawing Rights

Special Drawing Rights

Special Drawing Rights are supplementary foreign exchange reserve assets defined and maintained by the International Monetary Fund . Not a currency, SDRs instead represent a claim to currency held by IMF member countries for which they may be exchanged...

(SDRs).

Currencies have many forms depending on several properties: type of issuance, type of issuer and type of backing. The particular configuration of those properties leads to different types of money. The pros and cons of a currency are strongly influenced by the type proposed. Consider, for example, the properties of a complementary currency

Complementary currency

Complementary currency is a currency meant to be used as a complement to another currency, typically a national currency. Complementary currency is sometimes referred to as complementary community currency or as community currency...

.

Recent history: pound sterling

Before 1944, the world reference currency was the United Kingdom's pound sterling. The transition between pound sterling and United States dollar and its impact for central banks was described recently.U.S. dollar

Exchange rate

In finance, an exchange rate between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency...

s around the world were pegged

Fixed exchange rate

A fixed exchange rate, sometimes called a pegged exchange rate, is a type of exchange rate regime wherein a currency's value is matched to the value of another single currency or to a basket of other currencies, or to another measure of value, such as gold.A fixed exchange rate is usually used to...

against the United States dollar, which could be exchanged for a fixed amount of gold. This reinforced the dominance of the US dollar as a global currency.

Since the collapse of the fixed exchange rate

Fixed exchange rate

A fixed exchange rate, sometimes called a pegged exchange rate, is a type of exchange rate regime wherein a currency's value is matched to the value of another single currency or to a basket of other currencies, or to another measure of value, such as gold.A fixed exchange rate is usually used to...

regime and the gold standard

Gold standard

The gold standard is a monetary system in which the standard economic unit of account is a fixed mass of gold. There are distinct kinds of gold standard...

and the institution of floating exchange rate

Floating exchange rate

A floating exchange rate or fluctuating exchange rate is a type of exchange rate regime wherein a currency's value is allowed to fluctuate according to the foreign exchange market. A currency that uses a floating exchange rate is known as a floating currency....

s following the Smithsonian Agreement

Smithsonian Agreement

The Smithsonian Agreement was a December 1971 agreement that ended the fixed exchange rates established at the Bretton Woods Conference of 1944.-History:...

in 1971, most currencies around the world have no longer been pegged against the United States dollar. However, as the United States remained the world's preeminent economic superpower, most international transactions continued to be conducted with the United States dollar, and it has remained the de facto

De facto

De facto is a Latin expression that means "concerning fact." In law, it often means "in practice but not necessarily ordained by law" or "in practice or actuality, but not officially established." It is commonly used in contrast to de jure when referring to matters of law, governance, or...

world currency.

Only two serious challengers to the status of the United States dollar as a world currency have arisen. During the 1980s, the Japanese yen

Japanese yen

The is the official currency of Japan. It is the third most traded currency in the foreign exchange market after the United States dollar and the euro. It is also widely used as a reserve currency after the U.S. dollar, the euro and the pound sterling...

became increasingly used as an international currency, but that usage diminished with the Japanese recession in the 1990s. More recently, the euro has increasingly competed with the United States dollar in international finance.

Since the mid-20th century, the de facto world currency has been the United States dollar. According to Robert Gilpin

Robert Gilpin

Robert Gilpin is a scholar of International Political Economy and the professor emeritus of Politics and International Affairs at the Woodrow Wilson School of Public and International Affairs at Princeton University. He holds the Eisenhower professorship...

in Global Political Economy: Understanding the International Economic Order (2001): "Somewhere between 40 and 60 percent of international financial transactions are denominated in dollars. For decades the dollar has also been the world's principal reserve currency; in 1996, the dollar accounted for approximately two-thirds of the world's foreign exchange reserves" (255).

Many of the world's currencies are pegged against the dollar. Some countries, such as Ecuador

Ecuador

Ecuador , officially the Republic of Ecuador is a representative democratic republic in South America, bordered by Colombia on the north, Peru on the east and south, and by the Pacific Ocean to the west. It is one of only two countries in South America, along with Chile, that do not have a border...

, El Salvador, and Panama

Panama

Panama , officially the Republic of Panama , is the southernmost country of Central America. Situated on the isthmus connecting North and South America, it is bordered by Costa Rica to the northwest, Colombia to the southeast, the Caribbean Sea to the north and the Pacific Ocean to the south. The...

, have gone even further and eliminated their own currency (see dollarization

Dollarization

Dollarization occurs when the inhabitants of a country use foreign currency in parallel to or instead of the domestic currency. The term is not only applied to usage of the United States dollar, but generally to the use of any foreign currency as the national currency.The biggest economies to have...

) in favor of the United States dollar. The U.S. dollar continues to dominate global currency reserves, with 63.9% held in dollars, as compared to 26.5% held in euros (see Reserve Currency

Reserve currency

A reserve currency, or anchor currency, is a currency that is held in significant quantities by many governments and institutions as part of their foreign exchange reserves...

).

A 2011 study about the current dominant reserve currency in central banks shows that dollar may not be the obvious dominant currency, because of the major part of Unallocated Reserves reported by central banks.

Euro

Since 1999, the dollar's dominance has begun to be eroded by the euro, which represents a larger size economy, and has the prospect of more countries adopting the euro as their national currency. The euro inherited the status of a major reserve currency from the German markGerman mark

The Deutsche Mark |mark]], abbreviated "DM") was the official currency of West Germany and Germany until the adoption of the euro in 2002. It is commonly called the "Deutschmark" in English but not in German. Germans often say "Mark" or "D-Mark"...

(DM), and since then its contribution to official reserves has risen as banks seek to diversify their reserves and trade in the eurozone

Eurozone

The eurozone , officially called the euro area, is an economic and monetary union of seventeen European Union member states that have adopted the euro as their common currency and sole legal tender...

continues to expand.

As with the dollar, some of the world's currencies are pegged against the euro. They are usually Eastern European currencies like the Bulgarian lev

Bulgarian lev

The lev is the currency of Bulgaria. It is divided in 100 stotinki . In archaic Bulgarian the word "lev" meant "lion".It is speculated that Bulgaria, as a member of the European Union will adopt the Euro in 2015 .- First lev, 1881–1952 :...

, plus several west African currencies like the Cape Verdean escudo and the CFA franc

CFA franc

The CFA franc is the name of two currencies used in Africa which are guaranteed by the French treasury. The two CFA franc currencies are the West African CFA franc and the Central African CFA franc...

. Other European countries, while not being EU members, have adopted the euro due to currency unions with member states, or by unilaterally superseding their own currencies: Andorra

Andorra

Andorra , officially the Principality of Andorra , also called the Principality of the Valleys of Andorra, , is a small landlocked country in southwestern Europe, located in the eastern Pyrenees mountains and bordered by Spain and France. It is the sixth smallest nation in Europe having an area of...

, Monaco

Monaco

Monaco , officially the Principality of Monaco , is a sovereign city state on the French Riviera. It is bordered on three sides by its neighbour, France, and its centre is about from Italy. Its area is with a population of 35,986 as of 2011 and is the most densely populated country in the...

, Montenegro

Montenegro

Montenegro Montenegrin: Crna Gora Црна Гора , meaning "Black Mountain") is a country located in Southeastern Europe. It has a coast on the Adriatic Sea to the south-west and is bordered by Croatia to the west, Bosnia and Herzegovina to the northwest, Serbia to the northeast and Albania to the...

, San Marino

San Marino

San Marino, officially the Republic of San Marino , is a state situated on the Italian Peninsula on the eastern side of the Apennine Mountains. It is an enclave surrounded by Italy. Its size is just over with an estimated population of over 30,000. Its capital is the City of San Marino...

, and Vatican City

Vatican City

Vatican City , or Vatican City State, in Italian officially Stato della Città del Vaticano , which translates literally as State of the City of the Vatican, is a landlocked sovereign city-state whose territory consists of a walled enclave within the city of Rome, Italy. It has an area of...

.

, the euro surpassed the dollar in the combined value of cash in circulation. The value of euro notes in circulation has risen to more than €610 billion

1000000000 (number)

1,000,000,000 is the natural number following 999,999,999 and preceding 1,000,000,001.In scientific notation, it is written as 109....

, equivalent to US$800 billion at the exchange rates at the time (today equivalent to circa US$968 billion).

Spanish dollar (17th – 19th centuries)

In the 17th and 18th century, the use of silver Spanish dollarSpanish dollar

The Spanish dollar is a silver coin, of approximately 38 mm diameter, worth eight reales, that was minted in the Spanish Empire after a Spanish currency reform in 1497. Its purpose was to correspond to the German thaler...

s or "pieces of eight" spread from the Spanish territories in the Americas westwards to Asia and eastwards to Europe forming the first ever worldwide currency. Spain's political supremacy on the world stage, the importance of Spanish commercial routes across the Atlantic and the Pacific, and the coin's quality and purity of silver helped it become internationally accepted for over two centuries. It was legal tender in Spain's Pacific territories of the Philippines

Philippines

The Philippines , officially known as the Republic of the Philippines , is a country in Southeast Asia in the western Pacific Ocean. To its north across the Luzon Strait lies Taiwan. West across the South China Sea sits Vietnam...

, Micronesia, Guam

Guam

Guam is an organized, unincorporated territory of the United States located in the western Pacific Ocean. It is one of five U.S. territories with an established civilian government. Guam is listed as one of 16 Non-Self-Governing Territories by the Special Committee on Decolonization of the United...

and the Caroline Islands

Caroline Islands

The Caroline Islands are a widely scattered archipelago of tiny islands in the western Pacific Ocean, to the north of New Guinea. Politically they are divided between the Federated States of Micronesia in the eastern part of the group, and Palau at the extreme western end...

and later in China and other Southeast Asian countries until the mid-19th century. In the Americas it was legal tender in all of South and Central America (except Brazil) as well as in the US and Canada

Canada

Canada is a North American country consisting of ten provinces and three territories. Located in the northern part of the continent, it extends from the Atlantic Ocean in the east to the Pacific Ocean in the west, and northward into the Arctic Ocean...

until the mid-19th century. In Europe the Spanish dollar was legal tender in the Iberian Peninsula

Iberian Peninsula

The Iberian Peninsula , sometimes called Iberia, is located in the extreme southwest of Europe and includes the modern-day sovereign states of Spain, Portugal and Andorra, as well as the British Overseas Territory of Gibraltar...

, in most of Italy

Italy

Italy , officially the Italian Republic languages]] under the European Charter for Regional or Minority Languages. In each of these, Italy's official name is as follows:;;;;;;;;), is a unitary parliamentary republic in South-Central Europe. To the north it borders France, Switzerland, Austria and...

including: Milan

Milan

Milan is the second-largest city in Italy and the capital city of the region of Lombardy and of the province of Milan. The city proper has a population of about 1.3 million, while its urban area, roughly coinciding with its administrative province and the bordering Province of Monza and Brianza ,...

, the Kingdom of Naples

Kingdom of Naples

The Kingdom of Naples, comprising the southern part of the Italian peninsula, was the remainder of the old Kingdom of Sicily after secession of the island of Sicily as a result of the Sicilian Vespers rebellion of 1282. Known to contemporaries as the Kingdom of Sicily, it is dubbed Kingdom of...

, Sicily, Sardinia

Sardinia

Sardinia is the second-largest island in the Mediterranean Sea . It is an autonomous region of Italy, and the nearest land masses are the French island of Corsica, the Italian Peninsula, Sicily, Tunisia and the Spanish Balearic Islands.The name Sardinia is from the pre-Roman noun *sard[],...

, the Franche-Comté

Franche-Comté

Franche-Comté the former "Free County" of Burgundy, as distinct from the neighbouring Duchy, is an administrative region and a traditional province of eastern France...

(France), and in the Spanish Netherlands. It was also used in other European states including the Austrian Habsburg

Habsburg

The House of Habsburg , also found as Hapsburg, and also known as House of Austria is one of the most important royal houses of Europe and is best known for being an origin of all of the formally elected Holy Roman Emperors between 1438 and 1740, as well as rulers of the Austrian Empire and...

territories.

When the colony of New South Wales was founded in Australia in 1788, it ran into the problem of a lack of coinage. Governor Lachlan Macquarie took the initiative of using £10,000 in Spanish dollars sent by the British government to produce suitable coins, they simply punched out the centers of the coins. Both the central plug and rims were stamped with a sunburst. The punched centers passed as shillings and the outer rims as five-shilling pieces. The mutilated coins were thereafter no longer acceptable outside of the island, so as a consequence, became the official currency there. These coins to the value of 40,000 Spanish dollars came on the 26 November 1812 on the merchant ship the Samarang from Madras, via the Honourable East India Company. To stop them from leaving the colony the centres were punched out to create two different issues of coins.

There was a central plug (known as a dump) which was valued at 15 pence and was restruck with a new design (a crown on the obverse, the denomination on the reverse), whilst the dollars received an overstamp around the hole ("New South Wales 1813" on the obverse, "Five Shillings" on the reverse). The holey dollar became the first official currency produced specifically for circulation in Australia.

There are other coins/currencies that have been used over the centuries. The Austrian Maria Theresa thaler

Maria Theresa thaler

The Maria Theresa thaler is a silver bullion-coin that has been used in world trade continuously. Maria Theresa Thalers were first minted in 1741, using the then Reichsthaler standard of 9 thalers to the Vienna mark. In 1750 the thaler was debased to 10 thalers to the Vienna Mark...

is still used in some back areas of the Middle East and Africa and was first issued in 1741. There was also the Roman Denarius, which for hundreds of years was the world's premier currency.

Gold Standard (19th – 20th centuries)

Prior to and during most of the 19th century, international trade was denominated in terms of currencies that represented weights of gold. Most national currencies at the time were in essence merely different ways of measuring gold weights (much as the yard and the meter both measure length and are related by a constant conversion factor). Hence some assert that gold was the world's first global currency. The emerging collapse of the international gold standard around the time of World War I had significant implications for global trade.Recently proposed (21st century)

On 16 March 2009, in connection with the April 2009 G20 summit2009 G-20 London summit

The 2009 G-20 London Summit is the second meeting of the G-20 heads of state in discussion of financial markets and the world economy, which was held in London on 2 April 2009 at the ExCeL Exhibition Centre. It followed the first G-20 Leaders Summit on Financial Markets and the World Economy, which...

, the Kremlin

Kremlin

A kremlin , same root as in kremen is a major fortified central complex found in historic Russian cities. This word is often used to refer to the best-known one, the Moscow Kremlin, or metonymically to the government that is based there...

called for a supranational reserve currency as part of a reform of the global financial system. In a document containing proposals for the G20 meeting, it suggested that the International Monetary Fund

International Monetary Fund

The International Monetary Fund is an organization of 187 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world...

(IMF) (or an Ad Hoc Working Group of G20) should be instructed to carry out specific studies to review the following options:

- Enlargement (diversification) of the list of currencies used as reserve ones, based on agreed measures to promote the development of major regional financial centers. In this context, we should consider possible establishment of specific regional mechanisms which would contribute to reducing volatility of exchange rates of such reserve currencies.

- Introduction of a supra-national reserve currency to be issued by international financial institutions. It seems appropriate to consider the role of IMF in this process and to review the feasibility of and the need for measures to ensure the recognition of SDRs as a "supra-reserve" currency by the whole world community."

On 24 March 2009, Zhou Xiaochuan

Zhou Xiaochuan

Zhou Xiaochuan is a Chinese economist, banker, reformist and bureaucrat. As governor of the People's Bank of China since December 2002, he has been in charge of the monetary policy of the People's Republic of China....

, President of the People's Bank of China

People's Bank of China

The People's Bank of China is the central bank of the People's Republic of China with the power to control monetary policy and regulate financial institutions in mainland China...

, called for "creative reform of the existing international monetary system towards an international reserve currency," believing it would "significantly reduce the risks of a future crisis and enhance crisis management capability." Zhou suggested that the IMF's Special Drawing Rights

Special Drawing Rights

Special Drawing Rights are supplementary foreign exchange reserve assets defined and maintained by the International Monetary Fund . Not a currency, SDRs instead represent a claim to currency held by IMF member countries for which they may be exchanged...

(a currency basket comprising dollars, euros, yen, and sterling

Pound sterling

The pound sterling , commonly called the pound, is the official currency of the United Kingdom, its Crown Dependencies and the British Overseas Territories of South Georgia and the South Sandwich Islands, British Antarctic Territory and Tristan da Cunha. It is subdivided into 100 pence...

) could serve as a super-sovereign reserve currency, not easily influenced by the policies of individual countries. US President Obama

Barack Obama

Barack Hussein Obama II is the 44th and current President of the United States. He is the first African American to hold the office. Obama previously served as a United States Senator from Illinois, from January 2005 until he resigned following his victory in the 2008 presidential election.Born in...

, however, rejected the suggestion stating that "the dollar is extraordinarily strong right now."

At the G8 summit in July 2009, the Russian president expressed Russia's desire for a new supranational reserve currency by showing off a coin minted with the words "unity in diversity". The coin, an example of a future world currency, emphasized his call for creating a mix of regional currencies as a way to address the global financial crisis.

On 30 March 2009, at the Second South America-Arab League Summit in Qatar

Qatar

Qatar , also known as the State of Qatar or locally Dawlat Qaṭar, is a sovereign Arab state, located in the Middle East, occupying the small Qatar Peninsula on the northeasterly coast of the much larger Arabian Peninsula. Its sole land border is with Saudi Arabia to the south, with the rest of its...

, Venezuelan President Hugo Chavez

Hugo Chávez

Hugo Rafael Chávez Frías is the 56th and current President of Venezuela, having held that position since 1999. He was formerly the leader of the Fifth Republic Movement political party from its foundation in 1997 until 2007, when he became the leader of the United Socialist Party of Venezuela...

proposed the creation of the Petro

Petro

Petro is the name of a supranational currency proposed by Venezuelan President Hugo Chavez at the second South America-Arab League Summit in Qatar in 2009, to face the instability that the generation of fiat currency has caused the world economy....

as a supranational currency, in order to face the instability that the generation of fiat currency has caused in the world economy. The petrocurrency

Petrocurrency

Petrocurrency is a portmanteau neologism used with three distinct meanings, though often confused:#Trading surpluses of oil producing nations, originally called petrodollars...

would be backed by the huge oil reserves of the oil producing countries.

Views in favor of a supranational currency

Advocates, notably Keynes, of a global currency often argue that such a currency would not suffer from inflation, which, in extreme cases, has had disastrous effects for economies. In addition, many argue that a global currency would make conducting international business more efficient and would encourage foreign direct investmentForeign direct investment

Foreign direct investment or foreign investment refers to the net inflows of investment to acquire a lasting management interest in an enterprise operating in an economy other than that of the investor.. It is the sum of equity capital,other long-term capital, and short-term capital as shown in...

(FDI).

An often over-looked alternative to an establishment-created global reserve currency is for anyone to adopt already existing mechanisms that traditionally have worked very well in conducting international business. There are, for example, no obstacles for legal or physical persons to start drawing contracts and invoicing in XAU – Gold – as opposed to the USD, EUR or JPY (Japanese Yen).

Single world currency

An alternative definition of a world or global currency refers to a hypothetical single global currency or supercurrency, as the proposed terra or the DEY (acronym for Dollar Euro Yen), produced and supported by a central bankCentral bank

A central bank, reserve bank, or monetary authority is a public institution that usually issues the currency, regulates the money supply, and controls the interest rates in a country. Central banks often also oversee the commercial banking system of their respective countries...

which is used for all transactions around the world, regardless of the nationality of the entities (individuals, corporations, governments, or other organizations) involved in the transaction. No such official currency currently exists.

There are many different variations of the idea, including a possibility that it would be administered by a global central bank

Central bank

A central bank, reserve bank, or monetary authority is a public institution that usually issues the currency, regulates the money supply, and controls the interest rates in a country. Central banks often also oversee the commercial banking system of their respective countries...

or that it would be on the gold standard

Gold standard

The gold standard is a monetary system in which the standard economic unit of account is a fixed mass of gold. There are distinct kinds of gold standard...

. Supporters often point to the euro as an example of a supranational currency successfully implemented by a union of nations with disparate languages, cultures, and economies. Alternatively, digital gold currency

Digital gold currency

Digital gold currency is a form of electronic money based on ounces of gold. It is a kind of representative money, like a US paper gold certificate at the time that these were exchangeable for gold on demand. The typical unit of account for such currency is the gold gram or the troy ounce,...

can be viewed as an example of how global currency can be implemented without achieving national government consensus.

A limited alternative would be a world reserve currency issued by the International Monetary Fund

International Monetary Fund

The International Monetary Fund is an organization of 187 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world...

, as an evolution of the existing Special Drawing Rights

Special Drawing Rights

Special Drawing Rights are supplementary foreign exchange reserve assets defined and maintained by the International Monetary Fund . Not a currency, SDRs instead represent a claim to currency held by IMF member countries for which they may be exchanged...

and used as reserve assets by all national and regional central banks. On 26 March 2009, a UN panel of expert economists called for a new global currency reserve scheme to replace the current US dollar-based system. The panel's report pointed out that the "greatly expanded SDR (Special Drawing Rights), with regular or cyclically adjusted emissions calibrated to the size of reserve accumulations, could contribute to global stability, economic strength and global equity."

In addition to the idea of a single world currency, some evidence suggests the world may evolve multiple global currencies that exchange on a singular market system. The rise of digital global currencies owned by privately held companies or groups such as Ven

Ven

Ven may refer to:* Ven, Sweden, a Swedish island*Ven, Tajikistan* Ven , a hamlet in the Netherlands* Ven , a hamlet in the Netherlands* Ven, Heeze-Leende, a hamlet in the Netherlands...

suggest that multiple global currencies may offer wider formats for trade as they gain strength and wider acceptance.

Limited additional benefit with extra cost

Some economists argue that a single world currency is unnecessary, because the U.S. dollar is providing many of the benefits of a world currency while avoiding some of the costs. If the world does not form an optimum currency areaOptimum currency area

In economics, an optimum currency area , also known as an optimal currency region , is a geographical region in which it would maximize economic efficiency to have the entire region share a single currency. It describes the optimal characteristics for the merger of currencies or the creation of a...

, then it would be economically inefficient for the world to share one currency.

Economically incompatible nations

In the present world, nations are not able to work together closely enough to be able to produce and support a common currency. There has to be a high level of trust between different countries before a true world currency could be created. A world currency might even undermine national sovereignty of smaller states.Wealth redistribution

The interest rate set by the central bank indirectly determines the interest rate customers must pay on their bank loans. This interest rate affects the rate of interest among individuals, investments, and countries. Lending to the poor involves more risk than lending to the rich. As a result of the larger differences in wealth in different areas of the world, a central bank's ability to set interest rate to make the area prosper will be increasingly compromised, since it places wealthiest regions in conflict with the poorest regions in debt.Usury

Usury – the accumulation of interest on loan principal – is outlawed by most major religions.In Christianity this is especially true, although awareness of the taboo

Taboo

A taboo is a strong social prohibition relating to any area of human activity or social custom that is sacred and or forbidden based on moral judgment, religious beliefs and or scientific consensus. Breaking the taboo is usually considered objectionable or abhorrent by society...

has been lost to most Christians. Islam bans usury

Usury

Usury Originally, when the charging of interest was still banned by Christian churches, usury simply meant the charging of interest at any rate . In countries where the charging of interest became acceptable, the term came to be used for interest above the rate allowed by law...

, called riba

Riba

Riba means one of the senses of "usury" . Riba is forbidden in Islamic economic jurisprudence fiqh and considered as a major sin...

.

A large number of religious adherents who oppose the paying of interest are currently able to use banking facilities in their countries which are to regulate interest. An example of this is the Islamic banking

Islamic banking

Islamic banking is banking or banking activity that is consistent with the principles of Islamic law and its practical application through the development of Islamic economics. Sharia prohibits the fixed or floating payment or acceptance of specific interest or fees for loans of money...

system, which is characterized by a nation's central bank setting interest rates for most other transactions.

See also

- BitcoinBitcoinBitcoin is a decentralized, peer-to-peer network over which users make transactions that are tracked and verified through this network. The word Bitcoin also refers to the digital currency implemented as the currency medium for user transactions over this network...

- Digital gold currencyDigital gold currencyDigital gold currency is a form of electronic money based on ounces of gold. It is a kind of representative money, like a US paper gold certificate at the time that these were exchangeable for gold on demand. The typical unit of account for such currency is the gold gram or the troy ounce,...

- Dollar hegemonyDollar hegemonyDollar hegemony is the hypothesized monetary hegemony of the US dollar in the global economy. Henry C.K. Liu popularized the term in the article "Dollar Hegemony has to go" in Asia Times, April 11, 2002...

- Fractional Reserve Banking

- Monetary hegemonyMonetary hegemonyMonetary hegemony is an economic and political phenomenon in which a single state has decisive influence over the functions of the international monetary system...

- Special Drawing RightsSpecial Drawing RightsSpecial Drawing Rights are supplementary foreign exchange reserve assets defined and maintained by the International Monetary Fund . Not a currency, SDRs instead represent a claim to currency held by IMF member countries for which they may be exchanged...

(SDRs) - VenVenVen may refer to:* Ven, Sweden, a Swedish island*Ven, Tajikistan* Ven , a hamlet in the Netherlands* Ven , a hamlet in the Netherlands* Ven, Heeze-Leende, a hamlet in the Netherlands...

by Hub CultureHub CultureHub Culture is a social network service that operates the global digital currency Ven, and according to its website, is "the first to merge online and physical world environments." It was founded in November 2002. The Hub Culture group of companies is privately held with offices in Bermuda, Geneva,... - WocuWocuThe World Currency Unit Wocu is a standardized basket of currencies: the national currencies of the 20 largest national economies measured by GDP...

- World Currency UnitWorld Currency UnitA world currency unit is a concept of monetary foreign exchange that surfaced after the Great Depression and the financial crisis created by World War II uncovered the deficiencies of the Gold Standard....

External links

- Global Imbalances and Developing Countries: Remedies for a Failing International Financial System, Jan Joost Teunissen and Age Akkerman (eds.), 2007, downloadable pdf book

- Single Global Currency Association.

- A Single Global Currency? Sure, why not. But, only if it's Gold and Silver Bullion!.

- Illustrated map "Money of the states of the world"

- World Currency site.

- Money.cnn.com