Taille

Encyclopedia

The taille was a direct land tax

on the French

peasant

ry and non-nobles in Ancien Régime France. The tax was imposed on each household and based on how much land it held.

", or lands that belonged to him directly), the taille became permanent in 1439, when the right to collect taxes in support of a standing army was granted to Charles VII of France

during the Hundred Years' War

. Unlike modern income taxes, the total amount of the taille was first set (after the Estates General

was suspended in 1484) by the French king from year to year, and this amount was then apportioned among the various provinces for collection.

Exempted from the tax were clergy and nobles (except for non-noble lands they held in "pays d'état" [see below]), officers of the crown, military personnel, magistrates, university professors and students, and franchises (villes franches) such as Paris.

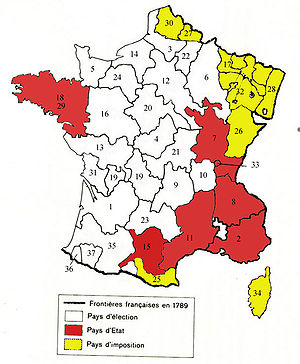

The provinces were of three sorts, the pays d'élection

, the pays d'état and the pays d'imposition. In the pays d'élection (the longest held possessions of the French crown; some of these provinces had had the equivalent autonomy of a pays d'état in an earlier period, but had lost it through the effects of royal reforms) the assessment and collection of taxes were entrusted to elected officials (at least originally; later, these positions were bought), and the tax was generally "personal", meaning it was attached to non-noble individuals. In the pays d'état ("provinces with provincial estates" Brittany

, Languedoc

, Burgundy, Auvergne

, Béarn

, Dauphiné

, Provence

, and such portions of Gascony

as Bigorre

, Comminges

, and the Quatre-Vallées

; these recently acquired provinces had been able to maintain a certain local autonomy in terms of taxation), the assessment of the tax was established by local councils and the tax was generally "real

", meaning that it was attached to non-noble lands (that is, even nobles possessing such lands were required to pay taxes on them). Finally, pays d'imposition were recently conquered lands which had their own local historical institutions (they were similar to the pays d'état under which they are sometimes grouped), although taxation was overseen by the royal intendant

.

In an attempt to reform the fiscal system, new administrative divisions were created in the 16th century. The Recettes générales, commonly known as généralité

s and overseen in the beginning by receveurs généraux or généraux conseillers (royal tax collectors), were initially only taxation districts. Their role steadily increased and by the mid 17th century, the généralités were under the authority of an intendant

, and they became a vehicle for the expansion of royal power in matters of justice, taxation, and policing. By the outbreak of the Revolution, there were 36 généralités; the last two were created as recently as 1784.

Until the late 17th century, tax collectors were called receveurs royaux. In 1680, the system of the Ferme Générale

Until the late 17th century, tax collectors were called receveurs royaux. In 1680, the system of the Ferme Générale

was established, a franchised customs and excise operation in which individuals bought the right to collect the taille on behalf of the king, through six-year adjudications (some taxes, including the aides and the gabelle, had been farmed out in this way as early as 1604). The major tax collectors in that system were known as the fermiers généraux ("farmers-general", in English).

. The taille became a major source of royal income (roughly half in the 1570s), the most important direct tax of pre-Revolutionary

France, and provided for the growing cost of warfare in the 15th and 16th centuries. Records show the taille increasing from 2.5 million livre

s in 1515 to six million after 1551; in 1589 the taille reached a record 21 million livres, before dropping.

The taille was only one of a number of taxes. There also existed the "taillon" (a tax for military expenditures), a national salt tax (the gabelle

), national tariffs (the "aides") on various products (including wine), local tariffs on speciality products (the "douane") or levied on products entering the city (the "octroi") or sold at fairs, and local taxes. Finally, the church benefited from a mandatory tax or tithe called the "dîme".

Louis XIV of France

created several additional tax systems, including the "capitation" (begun in 1695) which touched every person including nobles and the clergy (although exemption could be bought for a large one-time sum) and the "dixième" (1710–1717, restarted in 1733), which was a true tax on income and on property value and was meant to support the military.

In 1749, under Louis XV

, a new tax based on the "dixième", the "vingtième" (or "one-twentieth"), was enacted to reduce the royal deficit, and this tax continued through the ancien régime. This tax was based solely on revenues (5% of net earnings from land, property, commerce, industry and from official offices), and was meant to reach all citizens regardless of status, but the clergy, the regions with "pays d'état" and the parlements protested; the clergy won exemption, the "pays d'état" won reduced rates, and the parlements halted new income statements, effectively making the "vingtième" a far less efficient tax than it was designed to be. The financial needs of the Seven Years' War

led to a second (1756–1780), and then a third (1760–1763) "vingtième" being created. In 1754 the "vingtième" produced 11.7 million livres.

The taille eventually became one of the most hated taxes of the Ancien Régime.

Also the taille was used very heavily by the French to fund their many wars like the 100 years of war and the 30 years of war.

Tax

To tax is to impose a financial charge or other levy upon a taxpayer by a state or the functional equivalent of a state such that failure to pay is punishable by law. Taxes are also imposed by many subnational entities...

on the French

France

The French Republic , The French Republic , The French Republic , (commonly known as France , is a unitary semi-presidential republic in Western Europe with several overseas territories and islands located on other continents and in the Indian, Pacific, and Atlantic oceans. Metropolitan France...

peasant

Peasant

A peasant is an agricultural worker who generally tend to be poor and homeless-Etymology:The word is derived from 15th century French païsant meaning one from the pays, or countryside, ultimately from the Latin pagus, or outlying administrative district.- Position in society :Peasants typically...

ry and non-nobles in Ancien Régime France. The tax was imposed on each household and based on how much land it held.

History

Originally only an "exceptional" tax (i.e. imposed and collected in times of need, as the king was expected to survive on the revenues of the "domaine royalCrown lands of France

The crown lands, crown estate, royal domain or domaine royal of France refers to the lands, fiefs and rights directly possessed by the kings of France...

", or lands that belonged to him directly), the taille became permanent in 1439, when the right to collect taxes in support of a standing army was granted to Charles VII of France

Charles VII of France

Charles VII , called the Victorious or the Well-Served , was King of France from 1422 to his death, though he was initially opposed by Henry VI of England, whose Regent, the Duke of Bedford, ruled much of France including the capital, Paris...

during the Hundred Years' War

Hundred Years' War

The Hundred Years' War was a series of separate wars waged from 1337 to 1453 by the House of Valois and the House of Plantagenet, also known as the House of Anjou, for the French throne, which had become vacant upon the extinction of the senior Capetian line of French kings...

. Unlike modern income taxes, the total amount of the taille was first set (after the Estates General

French States-General

In France under the Old Regime, the States-General or Estates-General , was a legislative assembly of the different classes of French subjects. It had a separate assembly for each of the three estates, which were called and dismissed by the king...

was suspended in 1484) by the French king from year to year, and this amount was then apportioned among the various provinces for collection.

Exempted from the tax were clergy and nobles (except for non-noble lands they held in "pays d'état" [see below]), officers of the crown, military personnel, magistrates, university professors and students, and franchises (villes franches) such as Paris.

The provinces were of three sorts, the pays d'élection

Pays d'élection

A pays d'élection was a généralité, in fiscal and financial matters, in France under the Ancien Régime. The representative of the royal government, the intendant, split up the impôts in such an area at a local level with the aid of the élus A pays d'élection was a généralité, in fiscal and...

, the pays d'état and the pays d'imposition. In the pays d'élection (the longest held possessions of the French crown; some of these provinces had had the equivalent autonomy of a pays d'état in an earlier period, but had lost it through the effects of royal reforms) the assessment and collection of taxes were entrusted to elected officials (at least originally; later, these positions were bought), and the tax was generally "personal", meaning it was attached to non-noble individuals. In the pays d'état ("provinces with provincial estates" Brittany

Brittany

Brittany is a cultural and administrative region in the north-west of France. Previously a kingdom and then a duchy, Brittany was united to the Kingdom of France in 1532 as a province. Brittany has also been referred to as Less, Lesser or Little Britain...

, Languedoc

Languedoc

Languedoc is a former province of France, now continued in the modern-day régions of Languedoc-Roussillon and Midi-Pyrénées in the south of France, and whose capital city was Toulouse, now in Midi-Pyrénées. It had an area of approximately 42,700 km² .-Geographical Extent:The traditional...

, Burgundy, Auvergne

Auvergne (province)

Auvergne was a historic province in south central France. It was originally the feudal domain of the Counts of Auvergne. It is now the geographical and cultural area that corresponds to the former province....

, Béarn

Béarn

Béarn is one of the traditional provinces of France, located in the Pyrenees mountains and in the plain at their feet, in southwest France. Along with the three Basque provinces of Soule, Lower Navarre, and Labourd, the principality of Bidache, as well as small parts of Gascony, it forms in the...

, Dauphiné

Dauphiné

The Dauphiné or Dauphiné Viennois is a former province in southeastern France, whose area roughly corresponded to that of the present departments of :Isère, :Drôme, and :Hautes-Alpes....

, Provence

Provence

Provence ; Provençal: Provença in classical norm or Prouvènço in Mistralian norm) is a region of south eastern France on the Mediterranean adjacent to Italy. It is part of the administrative région of Provence-Alpes-Côte d'Azur...

, and such portions of Gascony

Gascony

Gascony is an area of southwest France that was part of the "Province of Guyenne and Gascony" prior to the French Revolution. The region is vaguely defined and the distinction between Guyenne and Gascony is unclear; sometimes they are considered to overlap, and sometimes Gascony is considered a...

as Bigorre

Bigorre

Bigorre is region in southwest France, historically an independent county and later a French province, located in the upper watershed of the Adour, on the northern slopes of the Pyrenees, part of the larger region known as Gascony...

, Comminges

Comminges

The Comminges is an ancient region of southern France in the foothills of the Pyrenees, corresponding closely to the arrondissement of Saint-Gaudens in the department of Haute-Garonne...

, and the Quatre-Vallées

Quatre-Vallées

Quatre-Vallées was a small province of France located in the southwest of France. It was made up of four constituent parts: Aure valley , Barousse valley , Magnoac valley , and Neste or Nestès valley .-General...

; these recently acquired provinces had been able to maintain a certain local autonomy in terms of taxation), the assessment of the tax was established by local councils and the tax was generally "real

Real property

In English Common Law, real property, real estate, realty, or immovable property is any subset of land that has been legally defined and the improvements to it made by human efforts: any buildings, machinery, wells, dams, ponds, mines, canals, roads, various property rights, and so forth...

", meaning that it was attached to non-noble lands (that is, even nobles possessing such lands were required to pay taxes on them). Finally, pays d'imposition were recently conquered lands which had their own local historical institutions (they were similar to the pays d'état under which they are sometimes grouped), although taxation was overseen by the royal intendant

Intendant

The title of intendant has been used in several countries through history. Traditionally, it refers to the holder of a public administrative office...

.

In an attempt to reform the fiscal system, new administrative divisions were created in the 16th century. The Recettes générales, commonly known as généralité

Généralité

Recettes générales, commonly known as généralités , were the administrative divisions of France under the Ancien Régime and are often considered to prefigure the current préfectures...

s and overseen in the beginning by receveurs généraux or généraux conseillers (royal tax collectors), were initially only taxation districts. Their role steadily increased and by the mid 17th century, the généralités were under the authority of an intendant

Intendant

The title of intendant has been used in several countries through history. Traditionally, it refers to the holder of a public administrative office...

, and they became a vehicle for the expansion of royal power in matters of justice, taxation, and policing. By the outbreak of the Revolution, there were 36 généralités; the last two were created as recently as 1784.

Ferme générale

The Ferme générale was, in ancien régime France, essentially an outsourced customs and excise operation which collected duties on behalf of the king, under six-year contracts...

was established, a franchised customs and excise operation in which individuals bought the right to collect the taille on behalf of the king, through six-year adjudications (some taxes, including the aides and the gabelle, had been farmed out in this way as early as 1604). The major tax collectors in that system were known as the fermiers généraux ("farmers-general", in English).

Collection

Efficient tax collection was one of the major causes for French administrative and royal centralization in the Early Modern periodEarly modern period

In history, the early modern period of modern history follows the late Middle Ages. Although the chronological limits of the period are open to debate, the timeframe spans the period after the late portion of the Middle Ages through the beginning of the Age of Revolutions...

. The taille became a major source of royal income (roughly half in the 1570s), the most important direct tax of pre-Revolutionary

French Revolution

The French Revolution , sometimes distinguished as the 'Great French Revolution' , was a period of radical social and political upheaval in France and Europe. The absolute monarchy that had ruled France for centuries collapsed in three years...

France, and provided for the growing cost of warfare in the 15th and 16th centuries. Records show the taille increasing from 2.5 million livre

French livre

The livre was the currency of France until 1795. Several different livres existed, some concurrently. The livre was the name of both units of account and coins.-Etymology:...

s in 1515 to six million after 1551; in 1589 the taille reached a record 21 million livres, before dropping.

The taille was only one of a number of taxes. There also existed the "taillon" (a tax for military expenditures), a national salt tax (the gabelle

Gabelle

The gabelle was a very unpopular tax on salt in France before 1790. The term gabelle derives from the Italian gabella , itself from the Arabic qabala....

), national tariffs (the "aides") on various products (including wine), local tariffs on speciality products (the "douane") or levied on products entering the city (the "octroi") or sold at fairs, and local taxes. Finally, the church benefited from a mandatory tax or tithe called the "dîme".

Louis XIV of France

Louis XIV of France

Louis XIV , known as Louis the Great or the Sun King , was a Bourbon monarch who ruled as King of France and Navarre. His reign, from 1643 to his death in 1715, began at the age of four and lasted seventy-two years, three months, and eighteen days...

created several additional tax systems, including the "capitation" (begun in 1695) which touched every person including nobles and the clergy (although exemption could be bought for a large one-time sum) and the "dixième" (1710–1717, restarted in 1733), which was a true tax on income and on property value and was meant to support the military.

In 1749, under Louis XV

Louis XV of France

Louis XV was a Bourbon monarch who ruled as King of France and of Navarre from 1 September 1715 until his death. He succeeded his great-grandfather at the age of five, his first cousin Philippe II, Duke of Orléans, served as Regent of the kingdom until Louis's majority in 1723...

, a new tax based on the "dixième", the "vingtième" (or "one-twentieth"), was enacted to reduce the royal deficit, and this tax continued through the ancien régime. This tax was based solely on revenues (5% of net earnings from land, property, commerce, industry and from official offices), and was meant to reach all citizens regardless of status, but the clergy, the regions with "pays d'état" and the parlements protested; the clergy won exemption, the "pays d'état" won reduced rates, and the parlements halted new income statements, effectively making the "vingtième" a far less efficient tax than it was designed to be. The financial needs of the Seven Years' War

Seven Years' War

The Seven Years' War was a global military war between 1756 and 1763, involving most of the great powers of the time and affecting Europe, North America, Central America, the West African coast, India, and the Philippines...

led to a second (1756–1780), and then a third (1760–1763) "vingtième" being created. In 1754 the "vingtième" produced 11.7 million livres.

The taille eventually became one of the most hated taxes of the Ancien Régime.

Also the taille was used very heavily by the French to fund their many wars like the 100 years of war and the 30 years of war.

See also

- TallageTallageTallage or talliage may have signified at first any tax, but became in England and France a land use or land tenure tax. Later in England it was further limited to assessments by the crown upon cities, boroughs, and royal domains...

- La DîmeTitheA tithe is a one-tenth part of something, paid as a contribution to a religious organization or compulsory tax to government. Today, tithes are normally voluntary and paid in cash, cheques, or stocks, whereas historically tithes were required and paid in kind, such as agricultural products...

- a land tax benefiting the church