Real estate economics

Encyclopedia

Real estate economics is the application of economic techniques to real estate markets. It tries to describe, explain, and predict patterns of prices, supply, and demand. The closely related fields of housing economics is narrower in scope, concentrating on residential real estate markets as does the research of real estate trends focus on the business and structural changes impacting the industry. Both draw on partial equilibrium analysis (supply and demand

), urban economics

, spatial economics, extensive research, surveys and finance

.

The owner/user, owner, and renter comprise the demand side of the market, while the developers and renovators comprise the supply side. In order to apply simple supply and demand analysis to real estate markets a number of modifications need to be made to standard microeconomic assumptions and procedures. In particular, the unique characteristics of the real estate market must be accommodated. These characteristics include:

The core demographic

variables are population size and population growth: the more people in the economy, the greater the demand for housing. But this is an oversimplification. It is necessary to consider family size, the age composition of the family, the number of first and second children, net migration (immigration minus emigration), non-family household formation, the number of double family households, death rates, divorce rates, and marriages. In housing economics, the elemental unit of analysis is not the individual as it is in standard partial equilibrium models. Rather, it is households that demand housing services: typically one household per house. The size and demographic composition of households is variable and not entirely exogenous. It is endogenous to the housing market in the sense that as the price of housing services increase, household size will tend also to increase.

Income is also an important determinant. Empirical measures of the income elasticity of demand in North America range from 0.5 to 0.9 (De Leeuw, F. 1971). If permanent income

elasticity is measured, the results are a little higher (Kain and Quigley 1975) because transitory income varies from year-to-year and across individuals so positive transitory income will tend to cancel out negative transitory income. Many housing economists use permanent income rather than annual income because of the high cost of purchasing real estate. For many people, real estate will be the most costly item they will ever buy.

The price of housing is also an important factor. The price elasticity

of the demand for housing services in North America is estimated as negative 0.7 by Polinsky and Ellwood (1979), and as negative 0.9 by Maisel, Burnham, and Austin (1971).

An individual household’s housing demand can be modeled with standard utility/choice theory. A utility function, such as U=U(X1,X2,X3,X4,...Xn), can be constructed in which the households utility is a function of various goods and services (Xs). This will be subject to a budget constraint

such as P1X1+P2X2+...PnXn=Y, where Y is the households available income and the Ps are the prices for the various goods and services. The equality indicates that the money spent on all the goods and services must be equal to the available income. Because this is unrealistic, the model must be adjusted to allow for borrowing and/or saving. A measure of wealth, lifetime income, or permanent income is required. The model must also be adjusted to account for the heterogeneousness of real estate. This can be done by deconstructing the utility function. If housing services (X4) is separated into the components that comprise it (Z1,Z2,Z3,Z4,...Zn), then the utility function can be rewritten as U=U(X1,X2,X3,(Z1,Z2,Z3,Z4,...Zn)...Xn) By varying the price of housing services (X4) and solving for points of optimal utility, that household's demand schedule for housing services can be constructed. Market demand is calculated by summing all individual household demands.

A production function

such as Q=f(L,N,M) can be constructed in which Q is the quantity of houses produced, N is the amount of labour employed, L is the amount of land used, and M is the amount of other materials. This production function must, however, be adjusted to account for the refurbishing and augmentation of existing buildings. To do this a second production function is constructed that includes the stock of existing housing, and their ages, as determinants. The two functions are summed yielding the total production function. Alternatively an hedonic pricing

model can be regressed.

The long-run price elasticity of supply

is quite high. George Fallis estimates it as 8.2 (Fallis, G. 1985), but in the short run supply tends to be very price inelastic. Supply price elasticity depends on the elasticity of substitution and supply restrictions. There is significant substitutability both between land and materials, and between labour and materials. In high-value locations, multi-story concrete buildings are typically built to reduce the amount of expensive land used. As labour costs increased since the 1950s, new materials and capital intensive techniques have been employed to reduce the amount of relatively expensive labour used. However supply restrictions can significantly affect substitutability. In particular the lack of supply of skilled labour (and labour union requirements), can constrain the substitution from capital to labour. Land availability can also constrain substitutability if the area of interest is delineated (that is, the larger the area, the more suppliers of land, and the more substitution that is possible). Land use controls such as zoning bylaws can also reduce land substitutability.

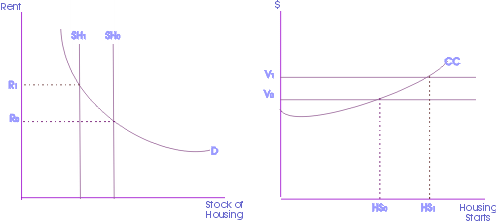

In the diagram to the right, the stock of housing supply is presented in the left panel while the new flow is in the right panel. There are four steps in the basic adjustment mechanism. First, the initial equilibrium price (Ro) is determined by the intersection of the supply of existing housing stock (SH) and the demand for housing (D). This rent is then translated into value (Vo) via discounting cash flows. Value is calculated by dividing current period rents by the discount rate, that is, as a perpetuity. Then value is compared to construction costs (CC) in order to determine whether profitable opportunities exist for developers. The intersection of construction costs and the value of housing services determine the maximum level of new housing starts (HSo). Finally the amount of housing starts in the current period is added to the available stock of housing in the next period. In the next period, supply curve SH will shift to the right by amount HSo.

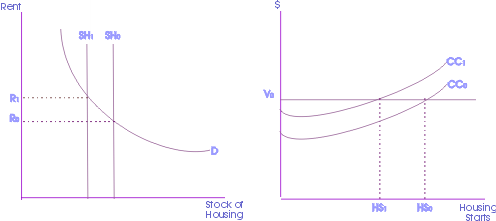

The diagram to the right shows the effects of depreciation. If the supply of existing housing deteriorates due to wear, then the stock of housing supply depreciates. Because of this, the supply of housing (SHo) will shift to the left (to SH1) resulting in a new equilibrium demand of R1 (since the amount of homes decreased, but demand still exists). The increase of demand from Ro to R1 will shift the value function up (from Vo to V1). As a result, more houses can be produced profitably and housing starts will increase (from HSo to HS1). Then the supply of housing will shift back to its initial position (SH1 to SHo).

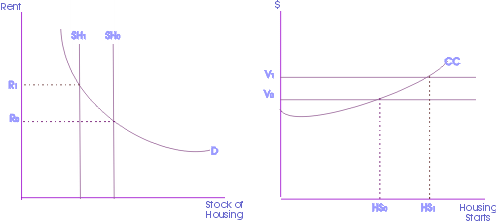

The diagram on the right shows the effects of an increase in demand in the short run. If there is an increase in the demand for housing, such as the shift from Do to D1 there will be either a price or quantity adjustment, or both. For the price to stay the same, the supply of housing must increase. That is, supply SHo must increase by HS.

The diagram on the right shows the effects of an increase in demand in the short run. If there is an increase in the demand for housing, such as the shift from Do to D1 there will be either a price or quantity adjustment, or both. For the price to stay the same, the supply of housing must increase. That is, supply SHo must increase by HS.

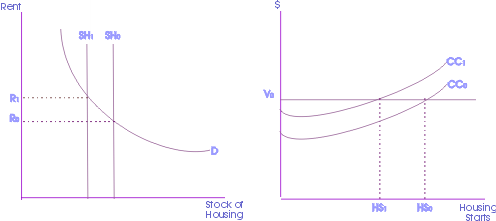

The diagram on the left shows the effects of an increase in costs in the short-run. If construction costs increase (say from CCo to CC1), developers will find their business less profitable and will be more selective in their ventures. In addition some developers may leave the industry. The quantity of housing starts will decrease (HSo to HS1). This will eventually reduce the level of supply (from SHo to SH1) as the existing stock of housing depreciates. Prices will tend to rise (from Ro to R1).

The most important purpose of these institutions is to make mortgage loans on residential property. These organizations, which also are known as savings associations, building and loan associations, cooperative banks (in New England

), and homestead associations (in Louisiana

), are the primary source of financial assistance to a large segment of American homeowners. As home-financing institutions, they give primary attention to single-family residences and are equipped to make loans in this area.

Some of the most important characteristics of a savings and loan association are:

Due to changes in banking laws and policies, commercial banks are increasingly active in home financing. In acquiring mortgages on real estate, these institutions follow two main practices:

In addition, dealer service companies, which were originally used to obtain car loans for permanent lenders such as commercial banks, wanted to broaden their activity beyond their local area. In recent years, however, such companies have concentrated on acquiring mobile home loans in volume for both commercial banks and savings and loan associations. Service companies obtain these loans from retail dealers, usually on a nonrecourse basis. Almost all bank/service company agreements contain a credit insurance policy that protects the lender if the consumer defaults.

These depository financial institutions are federally chartered, primarily accept consumer deposits, and make home mortgage loans.

Mortgage bankers are companies or individuals, who originate mortgage loans, sell them to other investors, service the monthly payments, and may act as agents to dispense funds for taxes and insurance.

Mortgage brokers present the consumer home buyer with the best loan from a variety of loan sources. Their income comes from the lender making the loan, just like with any other bank. Because they can tap a variety of lenders, they can shop on behalf of the borrower and achieve the best available terms. Despite legislation enacted that could favor the major banks, mortgage bankers and brokers keep the market competitive so the largest lenders must continue to compete on price and service. According to Don Burnette of Brightgreen Homeloans in Port Orange, Florida, "The mortgage banker and broker conduit is vital to maintain competitive balance in the mortgage industry. Without it, the largest lenders would be able to unduly influence rates and pricing, potentially hurting the consumer. Competition drives every organization in this industry to constantly improve on their performance, and the consumer is the winner in this scenario."

companies are another source of financial assistance. These companies lend on real estate as one form of investment and adjust their portfolios from time to time to reflect changing economic conditions. Individuals seeking a loan from an insurance company can deal directly with a local branch office or with a local real estate broker who acts as loan correspondent for one or more insurance companies.

These cooperative financial institutions are organized by people who share a common bond — for example, employees of a company, a labor union, or a religious group. Some credit unions offer home loans in addition to other financial services.

makes direct loans to creditworthy veterans in housing credit shortage areas designated by the VA's administrator. Such areas are generally rural areas and small cities and towns not near the metropolitan or commuting areas of large cities — areas where GI loans from private institutions are not available.

The federally supported agencies referred to here do not include the so-called second-layer lenders who enter the scene after the mortgage

is arranged between the lending institution and the individual home buyer.

Real estate investment trusts (REITs), which began when the Real Estate Investment Trust Act became effective January 1, 1961, are available. REITs, like savings and loan associations, are committed to real estate lending and can and do serve the national real estate market, although some specialization has occurred in their activities.

In the U.S., REITs generally pay little or no federal income tax, but are subject to a number of special requirements set forth in the Internal Revenue Code

, one of which is the requirement to annually distribute at least 90% of their taxable income in the form of dividend

s to shareholders.

Individual investors constitute a fairly large but somewhat declining source of money for home mortgage loans. Experienced observers claim that these lenders prefer shorter term obligations and usually restrict their loans to less than two-thirds of the value of the residential property. Likewise, building contractors sometimes accept second mortgages in part payment of the construction price of a home if the purchaser is unable to raise the total amount of down payment above the first mortgage money offered.

In addition, homebuyers or builders can save their money using FSBO in order not to pay extra fees.

Supply and demand

Supply and demand is an economic model of price determination in a market. It concludes that in a competitive market, the unit price for a particular good will vary until it settles at a point where the quantity demanded by consumers will equal the quantity supplied by producers , resulting in an...

), urban economics

Urban economics

Urban economics is broadly the economic study of urban areas; as such, it involves using the tools of economics to analyze urban issues such as crime, education, public transit, housing, and local government finance...

, spatial economics, extensive research, surveys and finance

Finance

"Finance" is often defined simply as the management of money or “funds” management Modern finance, however, is a family of business activity that includes the origination, marketing, and management of cash and money surrogates through a variety of capital accounts, instruments, and markets created...

.

Overview of real estate markets

The main participants in real estate markets are:- Owner/User - These people are both owners as well as tenants. They purchase houses or commercial propertyCommercial propertyThe term commercial property refers to buildings or land intended to generate a profit, either from capital gain or rental income.-Definition:...

as an investment and also to live in or utilize as a business. - Owner - These people are pure investors. They do not consume the real estate that they purchase. Typically they rent out or lease the property to someone else.

- Renter - These people are pure consumers.

- Developers - These people prepare raw land for building which results in new product for the market.

- Renovators - These people supply refurbished buildings to the market.

- Facilitators - This includes banks, Real Estate Brokers lawyers, and others that facilitate the purchase and sale of real estate.

The owner/user, owner, and renter comprise the demand side of the market, while the developers and renovators comprise the supply side. In order to apply simple supply and demand analysis to real estate markets a number of modifications need to be made to standard microeconomic assumptions and procedures. In particular, the unique characteristics of the real estate market must be accommodated. These characteristics include:

- Durability - Real estate is durable. A building can last for decades or even centuries, and the land underneath it is practically indestructible. Because of this, real estate markets are modeled as a stock/flow market. About 98% of supply consists of the stock of existing houses, while about 2% consists of the flow of new development. The stock of real estate supply in any period is determined by the existing stock in the previous period, the rate of deterioration of the existing stock, the rate of renovation of the existing stock, and the flow of new development in the current period. The effect of real estate market adjustments tend to be mitigated by the relatively large stock of existing buildings.

- Heterogeneous - Every piece of real estate is unique, in terms of its location, in terms of the building, and in terms of its financing. This makes pricing difficult, increases search costs, creates information asymmetryInformation asymmetryIn economics and contract theory, information asymmetry deals with the study of decisions in transactions where one party has more or better information than the other. This creates an imbalance of power in transactions which can sometimes cause the transactions to go awry, a kind of market failure...

and greatly restricts substitutability. To get around this problem, economists (beginning with Muth (1960)) define supply in terms of service units, that is, any physical unit can be deconstructed into the services that it provides. Olsen (1969) describes these units of housing services as an unobservable theoretical construct. Housing stock depreciates making it qualitatively different from a new building. The market equilibrating process operates across multiple quality levels. Further, the real estate market is typically divided into residential, commercial, and industrial segments. It can also be further divided into subcategories like recreational, income generating, area, historical/protected, etc. - High Transaction costs - Buying and/or moving into a home costs much more than most types of transactions. These costs include search costs, real estate fees, moving costs, legal fees, land transfer taxes, and deed registration fees. Transaction costs for the seller typically range between 1.5 - 6% of the purchase price. In some countries in Continental Europe, transaction costs for both buyer and seller can range between 15 - 20%.

- Long time delays - The market adjustment process is subject to time delays due to the length of time it takes to finance, design, and construct new supply, and also due to the relatively slow rate of change of demand. Because of these lags there is a great potential for disequilibrium in the short run. Adjustment mechanisms tend to be slow, relative to more fluid markets.

- Both an investment good and a consumption good - Real estate can be purchased with the expectation of attaining a return (an investment good), or with the intention of using it (a consumption good), or both. These functions can be separated (with market participants concentrating on one or the other function) or can be combined (in the case of the person that lives in a house that they own). This dual nature of the good means that it is not uncommon for people to over-investOver-investingOver-investing in finance, particularly personal finance, refers to the practice of investing more into an asset than what that asset is worth on the open market...

in real estate, that is, to invest more money in an asset than it is worth on the open market. - Immobility - Real estate is locationally immobile (save for mobile homeMobile homeMobile homes or static caravans are prefabricated homes built in factories, rather than on site, and then taken to the place where they will be occupied...

s, but the land underneath them is still immobile). Consumers come to the good rather than the good going to the consumer. Because of this, there can be no physical market-place. This spatial fixity means that market adjustment must occur by people moving to dwelling units, rather than the movement of the goods. For example, if tastes change and more people demand suburban houses, people must find housing in the suburbs, because it is impossible to bring their existing house and lot to the suburb (even a mobile home owner, who could move the house, must still find a new lot). Spatial fixity combined with the close proximity of housing units in urban areas suggest the potential for externalities inherent in a given location.

Demand for housing

The main determinants of the demand for housing are demographic. However other factors like income, price of housing, cost and availability of credit, consumer preferences, investor preferences, price of substitutes and price of complements all play a role.The core demographic

Demographics

Demographics are the most recent statistical characteristics of a population. These types of data are used widely in sociology , public policy, and marketing. Commonly examined demographics include gender, race, age, disabilities, mobility, home ownership, employment status, and even location...

variables are population size and population growth: the more people in the economy, the greater the demand for housing. But this is an oversimplification. It is necessary to consider family size, the age composition of the family, the number of first and second children, net migration (immigration minus emigration), non-family household formation, the number of double family households, death rates, divorce rates, and marriages. In housing economics, the elemental unit of analysis is not the individual as it is in standard partial equilibrium models. Rather, it is households that demand housing services: typically one household per house. The size and demographic composition of households is variable and not entirely exogenous. It is endogenous to the housing market in the sense that as the price of housing services increase, household size will tend also to increase.

Income is also an important determinant. Empirical measures of the income elasticity of demand in North America range from 0.5 to 0.9 (De Leeuw, F. 1971). If permanent income

Permanent income hypothesis

The permanent income hypothesis is a theory of consumption that was developed by the American economist Milton Friedman. In its simplest form, the hypothesis states that the choices made by consumers regarding their consumption patterns are determined not by current income but by their longer-term...

elasticity is measured, the results are a little higher (Kain and Quigley 1975) because transitory income varies from year-to-year and across individuals so positive transitory income will tend to cancel out negative transitory income. Many housing economists use permanent income rather than annual income because of the high cost of purchasing real estate. For many people, real estate will be the most costly item they will ever buy.

The price of housing is also an important factor. The price elasticity

Price elasticity of demand

Price elasticity of demand is a measure used in economics to show the responsiveness, or elasticity, of the quantity demanded of a good or service to a change in its price. More precisely, it gives the percentage change in quantity demanded in response to a one percent change in price...

of the demand for housing services in North America is estimated as negative 0.7 by Polinsky and Ellwood (1979), and as negative 0.9 by Maisel, Burnham, and Austin (1971).

An individual household’s housing demand can be modeled with standard utility/choice theory. A utility function, such as U=U(X1,X2,X3,X4,...Xn), can be constructed in which the households utility is a function of various goods and services (Xs). This will be subject to a budget constraint

Budget constraint

A budget constraint represents the combinations of goods and services that a consumer can purchase given current prices with his or her income. Consumer theory uses the concepts of a budget constraint and a preference map to analyze consumer choices...

such as P1X1+P2X2+...PnXn=Y, where Y is the households available income and the Ps are the prices for the various goods and services. The equality indicates that the money spent on all the goods and services must be equal to the available income. Because this is unrealistic, the model must be adjusted to allow for borrowing and/or saving. A measure of wealth, lifetime income, or permanent income is required. The model must also be adjusted to account for the heterogeneousness of real estate. This can be done by deconstructing the utility function. If housing services (X4) is separated into the components that comprise it (Z1,Z2,Z3,Z4,...Zn), then the utility function can be rewritten as U=U(X1,X2,X3,(Z1,Z2,Z3,Z4,...Zn)...Xn) By varying the price of housing services (X4) and solving for points of optimal utility, that household's demand schedule for housing services can be constructed. Market demand is calculated by summing all individual household demands.

Supply of housing

Housing supply is produced using land, labor, and various inputs such as electricity and building materials. The quantity of new supply is determined by the cost of these inputs, the price of the existing stock of houses, and the technology of production. For a typical single family dwelling in suburban North America, approximate percentage costs can be broken down as: acquisition costs 10%, site improvement costs 11%, labour costs 26%, materials costs 31%, finance costs 3%, administrative costs 15%, and marketing costs 4%. Multi-unit residential dwellings typically break down as: acquisition costs 7%, site improvement costs 8%, labour costs 27%, materials costs 33%, finance costs 4%, administrative costs 17%, and marketing costs 5%. Public subdivision requirements can increase development cost by up to 3% depending on the jurisdiction. Differences in building codes account for about a 2% variation in development costs. However these subdivision and building code costs typically increase the market value of the buildings by at least the amount of their cost outlays.A production function

Production function

In microeconomics and macroeconomics, a production function is a function that specifies the output of a firm, an industry, or an entire economy for all combinations of inputs...

such as Q=f(L,N,M) can be constructed in which Q is the quantity of houses produced, N is the amount of labour employed, L is the amount of land used, and M is the amount of other materials. This production function must, however, be adjusted to account for the refurbishing and augmentation of existing buildings. To do this a second production function is constructed that includes the stock of existing housing, and their ages, as determinants. The two functions are summed yielding the total production function. Alternatively an hedonic pricing

Hedonic regression

In economics, hedonic regression or hedonic demand theory is a revealed preference method of estimating demand or value. It decomposes the item being researched into its constituent characteristics, and obtains estimates of the contributory value of each characteristic...

model can be regressed.

The long-run price elasticity of supply

Price elasticity of supply

Price elasticity of supply is a measure used in economics to show the responsiveness, or elasticity, of the quantity supplied of a good or service to a change in its price....

is quite high. George Fallis estimates it as 8.2 (Fallis, G. 1985), but in the short run supply tends to be very price inelastic. Supply price elasticity depends on the elasticity of substitution and supply restrictions. There is significant substitutability both between land and materials, and between labour and materials. In high-value locations, multi-story concrete buildings are typically built to reduce the amount of expensive land used. As labour costs increased since the 1950s, new materials and capital intensive techniques have been employed to reduce the amount of relatively expensive labour used. However supply restrictions can significantly affect substitutability. In particular the lack of supply of skilled labour (and labour union requirements), can constrain the substitution from capital to labour. Land availability can also constrain substitutability if the area of interest is delineated (that is, the larger the area, the more suppliers of land, and the more substitution that is possible). Land use controls such as zoning bylaws can also reduce land substitutability.

The adjustment mechanism

The basic adjustment mechanism is a stock/flow model to reflect the fact that about 98% the market is existing stock and about 2% is the flow of new buildings.

In the diagram to the right, the stock of housing supply is presented in the left panel while the new flow is in the right panel. There are four steps in the basic adjustment mechanism. First, the initial equilibrium price (Ro) is determined by the intersection of the supply of existing housing stock (SH) and the demand for housing (D). This rent is then translated into value (Vo) via discounting cash flows. Value is calculated by dividing current period rents by the discount rate, that is, as a perpetuity. Then value is compared to construction costs (CC) in order to determine whether profitable opportunities exist for developers. The intersection of construction costs and the value of housing services determine the maximum level of new housing starts (HSo). Finally the amount of housing starts in the current period is added to the available stock of housing in the next period. In the next period, supply curve SH will shift to the right by amount HSo.

Adjustment with depreciation

The diagram to the right shows the effects of depreciation. If the supply of existing housing deteriorates due to wear, then the stock of housing supply depreciates. Because of this, the supply of housing (SHo) will shift to the left (to SH1) resulting in a new equilibrium demand of R1 (since the amount of homes decreased, but demand still exists). The increase of demand from Ro to R1 will shift the value function up (from Vo to V1). As a result, more houses can be produced profitably and housing starts will increase (from HSo to HS1). Then the supply of housing will shift back to its initial position (SH1 to SHo).

Increase in demand

Increase in costs

The diagram on the left shows the effects of an increase in costs in the short-run. If construction costs increase (say from CCo to CC1), developers will find their business less profitable and will be more selective in their ventures. In addition some developers may leave the industry. The quantity of housing starts will decrease (HSo to HS1). This will eventually reduce the level of supply (from SHo to SH1) as the existing stock of housing depreciates. Prices will tend to rise (from Ro to R1).

Real estate financing

There are different ways of real estate financing: governmental and commercial sources and institutions. A home buyer or builder can obtain financial aid from savings and loan associations, commercial banks, savings banks, mortgage bankers and brokers, life insurance companies, credit unions, federal agencies, individual investors, and builders.Savings and loan associations

Main article: Savings and loan associationSavings and loan association

A savings and loan association , also known as a thrift, is a financial institution that specializes in accepting savings deposits and making mortgage and other loans...

The most important purpose of these institutions is to make mortgage loans on residential property. These organizations, which also are known as savings associations, building and loan associations, cooperative banks (in New England

New England

New England is a region in the northeastern corner of the United States consisting of the six states of Maine, New Hampshire, Vermont, Massachusetts, Rhode Island, and Connecticut...

), and homestead associations (in Louisiana

Louisiana

Louisiana is a state located in the southern region of the United States of America. Its capital is Baton Rouge and largest city is New Orleans. Louisiana is the only state in the U.S. with political subdivisions termed parishes, which are local governments equivalent to counties...

), are the primary source of financial assistance to a large segment of American homeowners. As home-financing institutions, they give primary attention to single-family residences and are equipped to make loans in this area.

Some of the most important characteristics of a savings and loan association are:

- It is generally a locally owned and privately managed home-financing institution.

- It receives individuals' savings and uses these funds to make long-term amortized loans to home purchasers.

- It makes loans for the construction, purchase, repair, or refinancing of houses.

- It is state or federally chartered.

Commercial banks

Main article: Commercial bankCommercial bank

After the implementation of the Glass–Steagall Act, the U.S. Congress required that banks engage only in banking activities, whereas investment banks were limited to capital market activities. As the two no longer have to be under separate ownership under U.S...

Due to changes in banking laws and policies, commercial banks are increasingly active in home financing. In acquiring mortgages on real estate, these institutions follow two main practices:

- First, some of the banks maintain active and well-organized departments whose primary function is to compete actively for real estate loans. In areas lacking specialized real estate financial institutions, these banks become the source for residential and farm mortgage loans.

- Second, the banks acquire mortgages by simply purchasing them from mortgage bankers or dealers.

In addition, dealer service companies, which were originally used to obtain car loans for permanent lenders such as commercial banks, wanted to broaden their activity beyond their local area. In recent years, however, such companies have concentrated on acquiring mobile home loans in volume for both commercial banks and savings and loan associations. Service companies obtain these loans from retail dealers, usually on a nonrecourse basis. Almost all bank/service company agreements contain a credit insurance policy that protects the lender if the consumer defaults.

Savings banks

Main article: Savings bankSavings bank

A savings bank is a financial institution whose primary purpose is accepting savings deposits. It may also perform some other functions.In Europe, savings banks originated in the 19th or sometimes even the 18th century. Their original objective was to provide easily accessible savings products to...

These depository financial institutions are federally chartered, primarily accept consumer deposits, and make home mortgage loans.

Mortgage bankers and brokers

Main article: Mortgage brokerMortgage broker

A mortgage broker acts as an intermediary whose brokers mortgage loans on behalf of individuals or businesses.Traditionally, banks and other lending institutions have sold their own products. However as markets for mortgages have become more competitive, the role of the mortgage broker has become...

Mortgage bankers are companies or individuals, who originate mortgage loans, sell them to other investors, service the monthly payments, and may act as agents to dispense funds for taxes and insurance.

Mortgage brokers present the consumer home buyer with the best loan from a variety of loan sources. Their income comes from the lender making the loan, just like with any other bank. Because they can tap a variety of lenders, they can shop on behalf of the borrower and achieve the best available terms. Despite legislation enacted that could favor the major banks, mortgage bankers and brokers keep the market competitive so the largest lenders must continue to compete on price and service. According to Don Burnette of Brightgreen Homeloans in Port Orange, Florida, "The mortgage banker and broker conduit is vital to maintain competitive balance in the mortgage industry. Without it, the largest lenders would be able to unduly influence rates and pricing, potentially hurting the consumer. Competition drives every organization in this industry to constantly improve on their performance, and the consumer is the winner in this scenario."

Life insurance companies

Life insuranceLife insurance

Life insurance is a contract between an insurance policy holder and an insurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of the insured person. Depending on the contract, other events such as terminal illness or critical illness may also trigger...

companies are another source of financial assistance. These companies lend on real estate as one form of investment and adjust their portfolios from time to time to reflect changing economic conditions. Individuals seeking a loan from an insurance company can deal directly with a local branch office or with a local real estate broker who acts as loan correspondent for one or more insurance companies.

Credit unions

Main article: Credit unionCredit union

A credit union is a cooperative financial institution that is owned and controlled by its members and operated for the purpose of promoting thrift, providing credit at competitive rates, and providing other financial services to its members...

These cooperative financial institutions are organized by people who share a common bond — for example, employees of a company, a labor union, or a religious group. Some credit unions offer home loans in addition to other financial services.

Federally supported agencies

Under certain conditions and fund limitations the Veterans AdministrationUnited States Department of Veterans Affairs

The United States Department of Veterans Affairs is a government-run military veteran benefit system with Cabinet-level status. It is the United States government’s second largest department, after the United States Department of Defense...

makes direct loans to creditworthy veterans in housing credit shortage areas designated by the VA's administrator. Such areas are generally rural areas and small cities and towns not near the metropolitan or commuting areas of large cities — areas where GI loans from private institutions are not available.

The federally supported agencies referred to here do not include the so-called second-layer lenders who enter the scene after the mortgage

Mortgage loan

A mortgage loan is a loan secured by real property through the use of a mortgage note which evidences the existence of the loan and the encumbrance of that realty through the granting of a mortgage which secures the loan...

is arranged between the lending institution and the individual home buyer.

Real estate investment trusts

Main article: Real estate investment trustReal estate investment trust

A real estate investment trust or REIT is a tax designation for a corporate entity investing in real estate. The purpose of this designation is to reduce or eliminate corporate tax. In return, REITs are required to distribute 90% of their taxable income into the hands of investors...

Real estate investment trusts (REITs), which began when the Real Estate Investment Trust Act became effective January 1, 1961, are available. REITs, like savings and loan associations, are committed to real estate lending and can and do serve the national real estate market, although some specialization has occurred in their activities.

In the U.S., REITs generally pay little or no federal income tax, but are subject to a number of special requirements set forth in the Internal Revenue Code

Internal Revenue Code

The Internal Revenue Code is the domestic portion of Federal statutory tax law in the United States, published in various volumes of the United States Statutes at Large, and separately as Title 26 of the United States Code...

, one of which is the requirement to annually distribute at least 90% of their taxable income in the form of dividend

Dividend

Dividends are payments made by a corporation to its shareholder members. It is the portion of corporate profits paid out to stockholders. When a corporation earns a profit or surplus, that money can be put to two uses: it can either be re-invested in the business , or it can be distributed to...

s to shareholders.

Other sources

Main article: Creative real estate investingCreative Real Estate Investing

Creative real estate investing is a term used to describe non-traditional methods of buying and selling real estate. Typically, a buyer will secure financing from a lending institution and pay for the full amount of the purchase price with a combination of the borrowed funds and his own funds .One...

Individual investors constitute a fairly large but somewhat declining source of money for home mortgage loans. Experienced observers claim that these lenders prefer shorter term obligations and usually restrict their loans to less than two-thirds of the value of the residential property. Likewise, building contractors sometimes accept second mortgages in part payment of the construction price of a home if the purchaser is unable to raise the total amount of down payment above the first mortgage money offered.

In addition, homebuyers or builders can save their money using FSBO in order not to pay extra fees.

See also

- British housing market

- Housing bubbleUnited States housing bubbleThe United States housing bubble is an economic bubble affecting many parts of the United States housing market in over half of American states. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and may not yet have hit bottom as of 2011. On December 30, 2008 the...

- Investment Rating for Real EstateInvestment Rating for Real EstateAn investment rating of a real estate property measures the property’s risk-adjusted returns, relative to a completely risk-free asset. Mathematically, a property’s investment rating is the return a risk-free asset would have to yield to be termed as good an investment as the property whose rating...

- Real estate trendsReal estate trendsReal estate trends is a generic term used to describe any consistent pattern or change in the general direction of the real estate industry which, over the course of time, causes a statistically noticeable change...

- Short sale (real estate)Short sale (real estate)A short sale is a sale of real estate in which the proceeds from selling the property will fall short of the balance of debts secured by liens against the property and the property owner cannot afford to repay the liens' full amounts, whereby the lien holders agree to release their lien on the real...

- Effective gross incomeEffective gross incomeThis term used for an income-producing property, derived from the potential gross income, less the vacancy factor and a collection loss amount.This is the relationship or ratio between the sale price of the value of a property and its effective gross rental income.The anticipated income from all...

External links

- Humboldt Real Estate Economics Page

- Grant Thornton IBR 2008 Construction and real estate industry focus

- Residential Property Economics - allows calculation of real estate indexes worldwide and allows data analysis and extraction

- Southern California's Boom of the Eighties

- Housing Bubble Detection Methods, by J F Bellod