KOSPI

Encyclopedia

Common stock

Common stock is a form of corporate equity ownership, a type of security. It is called "common" to distinguish it from preferred stock. In the event of bankruptcy, common stock investors receive their funds after preferred stock holders, bondholders, creditors, etc...

s traded on the Stock Market Division—previously, Korea Stock Exchange—of the Korea Exchange

Korea Exchange

Korea Exchange is the sole securities exchange operator in South Korea. It is headquartered in Busan, and has an office for cash markets and market oversight in Seoul.- History :...

.

It's the representative stock market index

Stock market index

A stock market index is a method of measuring a section of the stock market. Many indices are cited by news or financial services firms and are used as benchmarks, to measure the performance of portfolios such as mutual funds....

of South Korea

South Korea

The Republic of Korea , , is a sovereign state in East Asia, located on the southern portion of the Korean Peninsula. It is neighbored by the People's Republic of China to the west, Japan to the east, North Korea to the north, and the East China Sea and Republic of China to the south...

, like the Dow Jones Industrial Average

Dow Jones Industrial Average

The Dow Jones Industrial Average , also called the Industrial Average, the Dow Jones, the Dow 30, or simply the Dow, is a stock market index, and one of several indices created by Wall Street Journal editor and Dow Jones & Company co-founder Charles Dow...

or S&P 500

S&P 500

The S&P 500 is a free-float capitalization-weighted index published since 1957 of the prices of 500 large-cap common stocks actively traded in the United States. The stocks included in the S&P 500 are those of large publicly held companies that trade on either of the two largest American stock...

in the U.S.

KOSPI was introduced in 1983 with the base value of 100 as of January 4, 1980. It's calculated based on market capitalization

Market value-weighted index

A capitalization-weighted index is an index whose components are weighted according to the total market value of their outstanding shares. Also called a market-value-weighted index...

.

As of 2007, KOSPI's daily volume is hundreds of millions of shares or (trillions of won

South Korean won

The won is the currency of South Korea. A single won is divided into 100 jeon, the monetary subunit. The jeon is no longer used for everyday transactions, and appears only in foreign exchange rates...

).

History

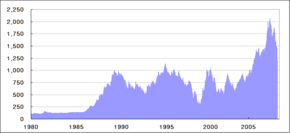

KOSPI (한국종합주가지수 Hanguk jonghap juga jisu) was introduced in 1983, replacing Dow-style KCSPI (Korea Composite Stock Price Index).For years, KOSPI moved below 1,000, peaking above 1,000 in April 1989, November 1994, and January 2000.

On June 17, 1998, KOSPI recorded its largest one-day percentage gain of 8.50% (23.81 points), recovering from the bottom of the Asian financial crisis.

On September 12, 2001, KOSPI had its largest one-day percentage drop of 12.02% (64.97 points) just after 9/11.

On February 28, 2005, KOSPI closed at 1,011.36.

It then plunged to 902.88 until April.

But unlike previous bull traps, it kept moving upward breaking the long-standing 1,000 point resistance level.

In November 2005, the index's Korean name was officially changed to Koseupi jisu (코스피지수).

On July 24, 2007, KOSPI broke 2,000 level for the first time. On July 25 it closed at 2,004.22.

On August 20, 2007, the index recovered 93.20 (5.69%), its largest one-day point gain, after the U.S. Federal Reserve lowered the discount rate.

Then on October 16, 2008, the index dropped 126.50 (9.44%), after Dow Jones index dropped 7.87%.

Components

As of October 2007, KOSPI has over 700 components.Top 10 stocks by market capitalization are:

- Samsung ElectronicsSamsung ElectronicsSamsung Electronics is a South Korean multinational electronics and information technology company headquartered in Samsung Town, Seoul...

(005930) - POSCOPOSCOPOSCO is a multinational steel-making company headquartered in Pohang, South Korea. It is the world's third-largest steelmaker by market value and the most profitable Asia-based steelmaker....

(005490) - Hyundai Heavy IndustriesHyundai Heavy IndustriesHyundai Heavy Industries Co., Ltd. is the world's largest shipbuilding company, headquartered in Ulsan, South Korea. The company is a subsidiary of Hyundai Heavy Industries Group...

(009540) - Kookmin BankKookmin BankKB Kookmin Bank or KB is the largest bank by both asset value and market capitalization in South Korea.The bank is led by Kang Chung-Won who previously worked for Seoulbank and oversaw its sale to competitor Hana Bank before moving to Kookmin.Kookmin intended to take over Korea Exchange Bank, a...

(060000) - Korea Electric PowerKorea Electric PowerKorea Electric Power Corporation, better known as KEPCO, is the largest electric utility in South Korea,...

(015760) - Shinhan Financial GroupShinhan Financial GroupShinhan Financial Group Co., Ltd. is a South Korean financial holding company. As of 2007, Shinhan is the largest financial company in Korea; Shinhan Bank, its main subsidiary, is the first among banks....

(055550) - SK TelecomSK TelecomSK Telecom Co., Ltd. or Sunkyoung Telecom is a South Korean wireless telecommunications operator, controlled by the SK Group, one of the country's largest chaebol. As a part of SK Group, SK stands for Sun Kyung.SK Telecom is a provider of mobile service in Korea, with 50.5% of the market share as...

(017670) - Woori Finance HoldingsWoori Financial GroupWoori Financial Group is a Seoul-based banking and financial services holdings company and is the largest bank in South Korea.Woori has had a short history as a financial institution. It was formed in 2001 from the forced merger of 4 predecessor commercial banks and an investment bank...

(053000) - LG Display (034220)

- Hyundai Motor (005380)

Other indices

- KOSPI 200, KOSPI 100, and KOSPI 50

- LargeCap, MidCap, and SmallCap indices based on market capitalizationMarket capitalizationMarket capitalization is a measurement of the value of the ownership interest that shareholders hold in a business enterprise. It is equal to the share price times the number of shares outstanding of a publicly traded company...

- KOGI corporate governance index

- KODI dividend index

- Industry indices like chemicals, electrical & electronic equipments, transport equipment, or banks.

- KRX 100 and other KRX indices which take into account both stock markets of Korea Exchange (KRX) — Stock Market Division and KOSDAQKOSDAQKOSDAQ is a trading board of Korea Exchange in South Korea established in 1996. Initially set up by Korea Financial Investment Association as an independent stock market from the Korean Stock Exchange, it was benchmarked from the American counterpart, NASDAQ.KOSDAQ is an electronic stock market,...

Division

KOSPI 200

The KOSPI 200 index consists of 200 big companies of the Stock Market Division. The base value of 100 was set on January 3, 1990.It has over 70% market value of the KOSPI, and so moves along with the KOSPI index.

KOSPI 200 is important because it's listed on futures and option markets and is one of the most actively traded indexes in the world. The KOSPI is calculated as current market capitalization (at the time of comparison) divided by base market capitalization (as of January 4, 1980).

That is: Current index = Current total market cap of constituents × 100 / Base Market Capitalization

Its all-time low is 31.96, reached on June 16, 1998 during the financial crisis.

It closed above 200 for the first time on April 24, 2007.

KRX 100

KRX 100 is the index of 100 companies listed on Korea Exchange, including KOSDAQ's NHN and other big companies.It's meant to replace KOSPI 200 as the key futures index, but has not been very successful to date.

KRX derivatives products

- Stock Index Products: KOSPI 200 Futures, KOSPI 200 Options, STAR Futures

- Individual Equity Products: Individual Equity Futures, Individual Equity Options

- Interest Rate Products: 3 Year Korea Treasury Bond Futures(KTB3), 5 Year Korea Treasury Bond Futures(KTB5), 10 Year Korea Treasury Bond Futures(KTB10), MSB Futures

- Currency Products: USD Futures, USD Options, Japanese Yen Futures, Euro Futures

- Commodity Products: Gold Futures, Lean Hog Futures

Investment procedures for foreigners

To trade futures and options contracts listed on KRX, a foreign investor may designate custodian banks standing proxy) through custodian bank agreement and standing proxy agreement to facilitate operations related to futures and options trading.A custodian bank as a standing proxy opens accounts at foreign exchange banks and futures companies, deposits and withdrawals investors' money and monitors investors' properties for them. A foreign investor should designate foreign exchange banks through a foreign currency exchange agreement to execute his foreign exchange transactions and transfers. Most foreign exchange banks also do custodian bank and standing proxy operations. A foreign investor should designate securities and futures companies to trade futures and options traded on KRX.

External links

- Guide to KOSPI, KRX.

- KOSPI 200 Profile via Wikinvest