Hyperinflation in Zimbabwe

Encyclopedia

Zimbabwe

Zimbabwe is a landlocked country located in the southern part of the African continent, between the Zambezi and Limpopo rivers. It is bordered by South Africa to the south, Botswana to the southwest, Zambia and a tip of Namibia to the northwest and Mozambique to the east. Zimbabwe has three...

's civil war and confiscation of white-owned farmland

Land reform in Zimbabwe

Land reform in Zimbabwe officially began in 1979 with the signing of the Lancaster House Agreement, an effort to more equitably distribute land between the historically disenfranchised blacks and the minority-whites who ruled Zimbabwe from 1890 to 1979...

. Food output capacity fell 45%, manufacturing output 29% in 2005, 26% in 2006 and 28% in 2007, and unemployment rose to 80%. During the height of inflation from 2008–09, it was difficult to accurately account and monitor for Zimbabwe's hyperinflation because the government of Zimbabwe stopped filing official inflation statistics. This cessation in filing made it difficult to accurately observe how severe inflation was in the country. In 2009 Zimbabwe abandoned its currency; at present in 2011 a new currency has yet to be introduced, so currencies from other countries are used.

Historical context

On April 18, 1980 the new sovereign republic of Zimbabwe was born from the former BritishUnited Kingdom

The United Kingdom of Great Britain and Northern IrelandIn the United Kingdom and Dependencies, other languages have been officially recognised as legitimate autochthonous languages under the European Charter for Regional or Minority Languages...

colony of Rhodesia

Rhodesia

Rhodesia , officially the Republic of Rhodesia from 1970, was an unrecognised state located in southern Africa that existed between 1965 and 1979 following its Unilateral Declaration of Independence from the United Kingdom on 11 November 1965...

. The Rhodesian Dollar

Rhodesian dollar

The dollar was the currency of Rhodesia between 1970 and 1980. It was subdivided into 100 cents.-History:The dollar was introduced on February 17, 1970, less than a month before the declaration of a republic on March 2, 1970. It replaced the pound at a rate of 2 dollars to 1 pound...

was replaced by the Zimbabwe dollar at par value

Par value

Par value, in finance and accounting, means stated value or face value. From this comes the expressions at par , over par and under par ....

. At the time when Zimbabwe gained its independence, the Zimbabwean dollar was more valuable than the US dollar. After the sovereign republic of Zimbabwe was born, the country experienced a period of strong growth and development. Wheat production for non-drought years was proportionally higher than in the past. The tobacco industry was thriving as well. For all practical purposes the economic indicators for the country were strong.

In the 1990s Zimbabwe entered a period of land reforms

Land reform in Zimbabwe

Land reform in Zimbabwe officially began in 1979 with the signing of the Lancaster House Agreement, an effort to more equitably distribute land between the historically disenfranchised blacks and the minority-whites who ruled Zimbabwe from 1890 to 1979...

. During this period from 1999–2009, the country experienced a sharp drop in production in all sectors. Unemployment rose and life expectancy

Life expectancy

Life expectancy is the expected number of years of life remaining at a given age. It is denoted by ex, which means the average number of subsequent years of life for someone now aged x, according to a particular mortality experience...

dropped. The land reforms were implemented under president Robert Mugabe

Robert Mugabe

Robert Gabriel Mugabe is the President of Zimbabwe. As one of the leaders of the liberation movement against white-minority rule, he was elected into power in 1980...

. The land reforms were intended to redistribute land from the white landowners back to the black farmers. When the land was redistributed, the food production dropped sharply. Many argue that this occurred because the black farmers had no experience or training in running large scale farms.

The Zanu-PF government holds that the majority of Zimbabwe's economic woes are a result of the economic sanctions

Economic sanctions

Economic sanctions are domestic penalties applied by one country on another for a variety of reasons. Economic sanctions include, but are not limited to, tariffs, trade barriers, import duties, and import or export quotas...

imposed by the United States of America and the European Union

European Union

The European Union is an economic and political union of 27 independent member states which are located primarily in Europe. The EU traces its origins from the European Coal and Steel Community and the European Economic Community , formed by six countries in 1958...

. This claim is unfounded because the sanctions are targeted at a specific group of 200 Zimbabweans who are closely tied to the Mugabe regime. The sanctions are not generalized sanctions, but instead involve asset freezes and visa denials.

Causes

Unstable governments, civic unrest, and lack of fiscal discipline are causes for hyperinflation.According to Transparency International Zimbabwe's government ranks 134th of 176 in terms of institutionalized corruption. This corruption directly affects the country causing instability and negative economic effects. The violent land reform program destroyed the agricultural sector in Zimbabwe and in particular the tobacco industry which accounted for one-third of Zimbabwe's foreign exchange earnings. The manufacturing and mining sectors also suffered great declines. An economy in free fall is a prime target for inflation and in this case hyperinflation. Instead of instituting constructive policies, the government continued to spend and print money. The government refuses to accept the magnitude of the problem, and therefore solutions cannot be reached.

The second cause of hyperinflation in Zimbabwe is civic unrest. Zimbabwe experienced a bloody massacre in the 1980s in the southern provinces of Matabeleland

Matabeleland

Modern day Matabeleland is a region in Zimbabwe divided into three provinces: Matabeleland North, Bulawayo and Matabeleland South. These provinces are in the west and south-west of Zimbabwe, between the Limpopo and Zambezi rivers. The region is named after its inhabitants, the Ndebele people...

and Midlands

Midlands (Zimbabwe)

Midlands is a province of Zimbabwe. It has an area of 49,166 km² and a population of approximately 1.5 million . Gweru is the capital of the province. It is home to various peoples...

. The massacre was carried out by Zimbabwe's Fifth Brigade Elite Army Division which was trained by North Korea

North Korea

The Democratic People’s Republic of Korea , , is a country in East Asia, occupying the northern half of the Korean Peninsula. Its capital and largest city is Pyongyang. The Korean Demilitarized Zone serves as the buffer zone between North Korea and South Korea...

n soldiers. The massacre was responsible for the deaths of over 20,000 ethnic Ndebele People

Ndebele

- Ethnic groups :*South Ndebele people, located in the South Africa*Northern Ndebele people, located in Zimbabwe, and Botswana- Languages :*Southern Ndebele language, the language of the South Ndebele...

. This massacre was a response by Mugabe's government after guerrilla attacks on civilian and state targets. The Ndebele people are a minority, while Mugabe's Shona People

Shona people

Shona is the name collectively given to two groups of people in the east and southwest of Zimbabwe, north eastern Botswana and southern Mozambique.-Shona Regional Classification:...

are the ruling ethnic majority. This has led to many clashes. In addition to minority and majority unrest, there is also unrest between the blacks and the whites. As mentioned before the late 1990s saw a period of land reform, which further contributed to the unrest. Indigenization law seeks to correct the injustices of colonialism and give the black Zimbabweans controlling stakes in all companies. The law also seeks to bar whites from business ownership. These new laws are scaring the whites out of the country and furthering the discord. A final cause of civic unrest is the cycle of poverty and violence. Hyperinflation continues to cause more poverty and poverty in turn causes more violence and discord. This discord then contributes to inflation. Zimbabwe has one of the lowest life expectancies in the world. The country lacks open media channels and violence is frequently used against citizens who oppose the current regime. There is a vicious cycle of poverty and violence and researchers are finding that in addition to the "poverty trap

Poverty trap

A poverty trap is "any self-reinforcing mechanism which causes poverty to persist." If it persists from generation to generation, the trap begins to reinforce itself if steps are not taken to break the cycle.-Developing world:...

", there is also a "violence trap".

Lack of fiscal discipline is the third reason for hyperinflation in Zimbabwe. Mugabe's government was printing money to finance troops in the Democratic Republic of the Congo

Democratic Republic of the Congo

The Democratic Republic of the Congo is a state located in Central Africa. It is the second largest country in Africa by area and the eleventh largest in the world...

. In 2000 Mugabe authorized Zimbabwean troops to fight in the Second Congo War

Second Congo War

The Second Congo War, also known as Coltan War and the Great War of Africa, began in August 1998 in the Democratic Republic of the Congo , and officially ended in July 2003 when the Transitional Government of the Democratic Republic of the Congo took power; however, hostilities continue to this...

. The involvement in the Congolese war cost millions of dollars a month. One of the main costs of this war involvement was paying higher salaries to army and government officials. This required the printing of currency. Zimbabwe was grossly under-reporting its spending involvement in this war to the International Monetary Fund

International Monetary Fund

The International Monetary Fund is an organization of 187 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world...

. Some reports cite a discrepancy of $22 million a month. Zimbabwe was involved in this conflict not because the Democratic Republic of the Congo was a bordering nation and posed a threat, but instead because rebel territory contained diamond mines. These mines were the motivating factor for involvement in the conflict. The Government of Zimbabwe struck a deal with the Government of the Democratic Republic of the Congo

Government of the Democratic Republic of the Congo

The Government of the Democratic Republic of the Congo is the second institution in the central executive branch of the Democratic Republic of the Congo, the first institution being the President of the Democratic Republic of the Congo, who has the title of head of state.- Description :Under the...

that involved a joint venture in diamond and gold mines to serve as payment for involvement. It has been rumored that many of the diamonds and the revenue from the mine have been funneled into the corrupt government purse or former soldiers have illegally removed diamonds from the mines.

The final factor that ties all of these causes together is that while the government lacked stability and fiscal discipline and the citizens were experiencing serious bouts of malcontent and strife, the perception of strength of the currency was dropping. When the citizens perceive a weak government with poor policies and instability, they lose faith in the currency. This loss of faith then caused hyperinflation. Taken together, all of these events contributed to the drop in positive perception and the rise of inflation. As trends in perception change due to government policies and stability so does the faith in the currency. The demand for a currency is a function of the expectation of future inflation. In the case of Zimbabwe, this expectation was high.

Taken together all of these elements created the optimal conditions for hyperinflation to explode in Zimbabwe. The government was excessively printing money to finance corruption and war, the people were struggling with citizen unrest and dissatisfaction with standards of living, and the black market was thriving all leading to hyperinflation.

Inflation rates

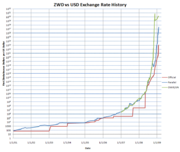

Over the course of the five-year span of hyperinflation, the inflation rate fluctuated greatly. At one point, the US Ambassador to Zimbabwe predicted that it would reach 1.5 million percent. In June 2008 the annual rate of price growth was 11.2 million percent. The worst of the inflation occurred in 2008 and 2009, leading to the abandonment of the currency. The price of $1USD cost $Z2,621,984,228 in October of 2008.Money in circulation

In 2007 the government tried to declare inflation illegal. Anyone who raised the prices for goods and services was subject to arrest. During this period of price freezes Zimbabwean officials arrested numerous corporate executives for changing their prices. Usually measures such as price freezes do not work in halting inflation.In December 2008 the use of foreign currency in Zimbabwe was expanded. Citizens were increasingly using foreign currency as a medium for daily exchanges. Local shops were offering fewer and fewer goods and services available in the local currency, and due to this, local businesses were suffering from chronic shortages of foreign currency that they used to import foreign goods. The Central Bank of Zimbabwe recognized this problem and licensed around 1,000 shops to officially deal in foreign currency. Even though only licensed businesses were allowed to accept foreign currencies, non-licensed businesses and even street vendors were using foreign currency. Many businesses had already illegally adopted this practice.

In January 2009, the acting Finance Minister Patrick Chinamasa

Patrick Chinamasa

Patrick Antony Chinamasa is a Zimbabwean politician, currently serving as the Minister of Justice.-Career:A leading member of the ruling ZANU-PF party, Chinamasa became first deputy Agriculture Minister, and then Attorney General of Zimbabwe; he also holds the role of Leader of the Zimbabwean...

announced that the restriction for using only Zimbabwean Dollars would be lifted. This announcement was long overdue, considering many citizens and vendors alike had already been dealing in foreign currencies. Citizens would be allowed to conduct business using other currencies alongside the Zimbabwean Dollar; some of the other approved currencies are the United States dollar, the euro

Euro

The euro is the official currency of the eurozone: 17 of the 27 member states of the European Union. It is also the currency used by the Institutions of the European Union. The eurozone consists of Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg,...

, and the South African rand

South African rand

The rand is the currency of South Africa. It takes its name from the Witwatersrand , the ridge upon which Johannesburg is built and where most of South Africa's gold deposits were found. The rand has the symbol "R" and is subdivided into 100 cents, symbol "c"...

. This was a much needed move because many shops were already demanding payment in currencies other than the Zimbabwean dollar. This was creating a problem because teachers and civil servants were still being paid in Zimbabwean dollars. Even though their salaries were in the trillions per month, this amounted to around $1USD a month; to put this in perspective, it costs about $2USD to ride the bus to work, and the salaries of the workers were not even enough to pay for their daily needs. In addition to the currency restrictions, there was also a bank withdrawal restriction in place. This was a policy that attempted to limit the amount of money that was in circulation and slow inflation. This policy was ineffective and limited the amount of cash withdrawals that citizens could make to $Z500,000, which was around $0.25USD.

Living with a hyper-inflated currency was posing a challenge for Zimbabweans. Prices in shops and restaurants were still quoted in Zimbabwean dollars, but due to the ever changing nature of inflation, they were adjusted multiple times a day. Because hyperinflation was so severe, and the Zimbabwean dollar depreciated in value so rapidly, it needed to be exchanged for foreign currency on the parallel market immediately. For example, a mini-bus driver will still charge his clients in Zimbabwean dollars, but his rates will be higher depending on what time of day it is. The evening commute garners the highest price. As he collects his fares he will sometimes exchange money up to three times a day. These exchanges were not taking place in centralized banks, but instead they were taking place in back office rooms and parking lots, contributing to a thriving black market.

The black market

Currency denominations

In 1980 when Zimbabwe became independent, the Zimbabwe dollar became the common currency. The currency originally had six denominations in paper notes and eight denominations in coinage. The paper notes were Z$20,10,5 and 2. The coins were Z$1, 50, 20, 10, 5, and 1 cents. As the inflation rose, larger bills were needed to pay for menial amounts. The bills that ultimately were printed ranged from the original denominations up to Z$100billion. The Central Bank of Zimbabwe planned to print and circulate denominations of up to Z$10, 20, 50, and 100 trillion. The Central Bank would no sooner print and distribute one denomination of its currency and within days there would be a new announcement of a higher denomination being printed. The announcement for the Z$200,000,000 bill came just days after the printing of the Z$100,000,000 bill.As inflation rose, the government continued to print larger and larger bills. They did not attempt to combat the inflation with other fiscal and monetary policy. In 2006 before the hyperinflation reached its peak, the bank had already announced that it would be printing larger bills to buy foreign currencies. This led the Reserve Bank to print a Z$21 trillion bill to pay off debts owed to the International Monetary Fund

International Monetary Fund

The International Monetary Fund is an organization of 187 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world...

.

In an attempt to revalue and combat inflation, the Central Bank of Zimbabwe undertook three efforts to change the denomination of the currency. The first effort was undertaken in August 2006. The Central Bank asked citizens to turn in notes and exchange for new notes with three zeros slashed from the currency. This was in attempt to slow the inflation. The bank attempted this policy again in July 2008. The governor of the Reserve Bank of Zimbabwe, Gideon Gono

Gideon Gono

Gideon Gono is the current Governor of the Reserve Bank of Zimbabwe and former CEO of the Jewel Bank, formerly known as the Commercial Bank of Zimbabwe...

announced that a new Zimbabwean dollar would be printed, but this time 10 zeros would be slashed. This would mean that the Z$10 billion would be redemoninated to be Z$1. The 10 zeros were not only cut to try to slow inflation, but also to make the currency more manageable for the people who were using it.

A third redenomination, producing the "fourth zimbabwe dollar" occurred in February 2009, and dropped 12 more zeros from the currency. It was thus worth 10 trillion trillion ZWD (first dollar), so overall the ratio of the redenominations was 103 * 1010 * 1012 = 1025.

Solutions

Usually hyperinflation can be halted within a few months provided the necessary steps are taken by the government to halt the growing rates. In most cases governments would simply stop printing excess money, but in the case of Zimbabwe, it was too late for this solution to work. In this case hyperinflation has lasted for a period of roughly five years. A common solution is for the country to abandon its currency altogether and use another, more stable currency. Zimbabwe could adopt any number of currencies ranging from the US dollar to the Euro or the South African Rand. It is less important what currency is officially adopted because generally if people mutually agree to conduct trade or business in a currency, this is good for the economy. Eventually, because of how economies arise, the usual tendency is for one currency to dominate even when people have the ability to choose. There are pros and cons to adopting either of the currencies mentioned above, but the US dollar had the most credibility and is the most widely traded.Another suggestion to stop inflation is for Zimbabwe to join the special currency zone known as the Common Monetary Area

Common Monetary Area

The Common Monetary Area links South Africa, Lesotho and Swaziland into a monetary union. It is allied to the Southern African Customs Union . Namibia automatically became a member upon independence, but withdrew with the introduction of the Namibian dollar in 1993...

, or "Rand Zone". The Rand Zone is a formal group of countries that collectively use one currency for better trade and stability. Zimbabwe could join this union of Lesotho

Lesotho

Lesotho , officially the Kingdom of Lesotho, is a landlocked country and enclave, surrounded by the Republic of South Africa. It is just over in size with a population of approximately 2,067,000. Its capital and largest city is Maseru. Lesotho is a member of the Commonwealth of Nations. The name...

, Namibia

Namibia

Namibia, officially the Republic of Namibia , is a country in southern Africa whose western border is the Atlantic Ocean. It shares land borders with Angola and Zambia to the north, Botswana to the east and South Africa to the south and east. It gained independence from South Africa on 21 March...

, South Africa

South Africa

The Republic of South Africa is a country in southern Africa. Located at the southern tip of Africa, it is divided into nine provinces, with of coastline on the Atlantic and Indian oceans...

, and Swaziland

Swaziland

Swaziland, officially the Kingdom of Swaziland , and sometimes called Ngwane or Swatini, is a landlocked country in Southern Africa, bordered to the north, south and west by South Africa, and to the east by Mozambique...

. A currency union, like the Rand Zone, would allow openness and ideally boost the Zimbabwean economy which has slumped since the onslaught of hyperinflation.

If the country did not want to abandon their currency immediately, they could also maintain the Zimbabwean dollar, but enact a strict monetary policy. The government can allow the exchange rate

Exchange rate

In finance, an exchange rate between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency...

to float

Floating exchange rate

A floating exchange rate or fluctuating exchange rate is a type of exchange rate regime wherein a currency's value is allowed to fluctuate according to the foreign exchange market. A currency that uses a floating exchange rate is known as a floating currency....

. This floating period would last for around 30 days and then the government could declare a fixed exchange rate

Fixed exchange rate

A fixed exchange rate, sometimes called a pegged exchange rate, is a type of exchange rate regime wherein a currency's value is matched to the value of another single currency or to a basket of other currencies, or to another measure of value, such as gold.A fixed exchange rate is usually used to...

with the Rand and declare that the Rand would be a simultaneous currency with the Zimbabwean dollar. The Rand would be the domestic currency, but the government would continue to accept Zimbabwean dollars to pay taxes at the fixed rate until all of the Zimbabwean dollars are out of circulation. There exist a host of other solutions, but these are the most widely discussed and the most feasible. Currently Zimbabwe uses a combination of foreign currencies, but mostly US dollars. A solution in its entirety has not been decided on as of 2011, and the economy is still in a slump.

Further reading

- Steve H. Hanke, “Zimbabwe: From Hyperinflation to Growth.” Development Policy Analysis No. 6. Washington, D.C.: Cato Institute, Center for Global Liberty and Prosperity. (June 25, 2008) (http://www.cato.org/pubs/dpa/dpa6.pdf)

- Steve H. Hanke, "New Hyperinflation Index (HHIZ) Puts Zimbabwe Inflation at 89.7 Sextillion Percent.” Washington, D.C.: Cato Institute. (Retrieved 17 November 2008) (http://www.cato.org/zimbabwe)

- Steve H. Hanke and Alex K. F. Kwok, "On the Measurement of Zimbabwe’s Hyperinflation." Cato Journal, Vol. 29, No. 2 (Spring/Summer 2009). ( http://www.cato.org/pubs/journal/cj29n2/cj29n2-8.pdf)