History of central banking in the United States

Encyclopedia

This article is about the history of central banking in the United States, from the 1790s to the present.

were strongly opposed to the formation of a central banking system; the fact that England tried to place the colonies under the monetary control of the Bank of England

was seen by many as the 'last straw' of English oppression and that it led directly to the American Revolutionary War

.

Other Founding Fathers were strongly in favor of a central bank. Robert Morris, as Superintendent of Finance, helped to open the Bank of North America in 1782, and has been accordingly called by Thomas Goddard "the father of the system of credit and paper circulation in the United States." As ratification in early 1781 of the Articles of Confederation & Perpetual Union had extended to Congress the sovereign power to emit bills of credit, it passed later that year an ordinance to incorporate a privately subscribed national bank following in the footsteps of the Bank of England. However, it was thwarted in fulfilling its intended role as a nationwide central bank due to objections of "alarming foreign influence and fictitious credit," favoritism to foreigners and unfair competition against less corrupt state banks issuing their own notes, such that Pennsylvania's legislature repealed its charter to operate within the Commonwealth in 1785.

, the Secretary of the Treasury, struck a deal with Southern lawmakers to ensure the continuation of Morris's Bank project; in exchange for support by the South for a national bank, Hamilton agreed to ensure sufficient support to have the national or federal capital moved from its temporary Northern location, New York, to a Southern location on the Potomac

. As a result, the First Bank of the United States

(1791–1811) was chartered by Congress within the year and signed by George Washington

soon after. The First Bank of the United States was modeled after the Bank of England

and differed in many ways from today's central banks. For example, it was partly owned by foreigners, who shared in its profits. Also, it wasn't solely responsible for the country's supply of bank notes. It was responsible for only 20% of the currency supply; state banks accounted for the rest. Several founding fathers bitterly opposed the Bank. Thomas Jefferson

saw it as an engine for speculation, financial manipulation, and corruption. In 1811 its twenty year charter expired and was not renewed by Congress. The next several years witnessed a proliferation of federally issued Treasury Notes as the government struggled to finance the War of 1812

and an eventual suspension of specie payment by most banks.

(1816–1836). James Madison

signed this charter, expressing the hope that it would end the runaway inflation of the five year interim. It was basically a copy of the First Bank, with branches across the country. Andrew Jackson

, who became president in 1828, denounced it as an engine of corruption. His destruction of the bank was a major political issue in the 1830s and shaped the Second Party System

, as Democrats in the states opposed banks and Whigs

supported them. He did not get the bank dissolved, but refused to renew its charter. The end of the bank saw a period of runaway inflation, until Jackson's executive order requiring all federal land payments be made in gold or silver, driving all banks to require payments in gold and silver, producing the depression of 1837, which lasted for four years.

In this period, only state-chartered banks existed. They could issue bank notes against specie (gold

and silver

coins

) and the states heavily regulated their own reserve requirement

s, interest rate

s for loan

s and deposit

s, the necessary capital ratio etc. These banks had existed from 1781, in parallel with the Banks of the United States. The Michigan Act (1837) allowed the automatic chartering of banks that would fulfill its requirements without special consent of the state legislature. This legislation made creating unstable banks easier by lowering state supervision in states that adopted it. The real value of a bank bill was often lower than its face value, and the issuing bank's financial strength generally determined the size of the discount. By 1797 there were 24 chartered banks in the U.S.; with the beginning of the Free Banking Era (1837) there were 712.

During the free banking era, the banks were short-lived compared to today's commercial banks, with an average lifespan of five years. About half of the banks failed, and about a third of which went out of business because they could not redeem their notes. (See also "Wildcat banking

".)

During the free banking era, some local banks took over the functions of a central bank. In New York, the New York Safety Fund provided deposit insurance for member banks. In Boston

, the Suffolk Bank

guaranteed that bank notes would trade at near par value, and acted as a private bank note clearinghouse

.

of 1863, besides providing loans in the Civil War

effort of the Union

, included provisions:

As described by Gresham's Law

, soon bad money from state banks drove out the new, good money; the government imposed a 10% tax on state bank bills, forcing most banks to convert to national banks. By 1865, there were already 1,500 national banks. In 1870, 1,638 national banks stood against only 325 state banks. The tax led in the 1880s

and 1890s

to the creation and adoption of checking accounts. By the 1890s

, 90% of the money supply was in checking accounts. State banking had made a comeback.

Two problems still remained in the banking sector. The first was the requirement to back up the currency with treasuries. When the treasuries fluctuated in value, bank

s had to recall loan

s or borrow from other banks or clearinghouse

s. The second problem was that the system created seasonal liquidity spikes. A rural bank had deposit account

s at a larger bank, that it withdrew from when the need for funds was highest, e.g., in the planting season. When combined liquidity demands were too big, the bank again had to find a lender of last resort

.

These liquidity crises led to bank run

s, causing severe disruptions and depressions, the worst of which was the Panic of 1907

.

's (a partner of Kuhn, Loeb and Co.) first official reform plan, entitled "A Plan for a Modified Central Bank," in which he outlined remedies that he thought might avert panics. Early in 1907, Jacob Schiff

, the chief executive officer

of Kuhn, Loeb and Co., in a speech to the New York Chamber of Commerce, warned that "unless we have a central bank with adequate control of credit resources, this country is going to undergo the most severe and far reaching money panic in its history." "The Panic of 1907" hit full stride in October. [Herrick]

Bankers felt the real problem was that the United States was the last major country without a central bank, which might provide stability and emergency credit in times of financial crisis. While segments of the financial community were worried about the power that had accrued to JP Morgan and other 'financiers', most were more concerned about the general frailty of a vast, decentralized banking system that could not regulate itself without the extraordinary intervention of one man. Financial leaders who advocated a central bank with an elastic currency after the Panic of 1907

include Frank Vanderlip, Myron T. Herrick

, William Barret Ridgely

, George E. Roberts

, Isaac Newton Seligman

and Jacob H. Schiff. They stressed the need for an elastic money supply that could expand or contract as needed. After the scare of 1907 the bankers demanded reform; the next year, Congress established a commission of experts to come up with a nonpartisan solution.

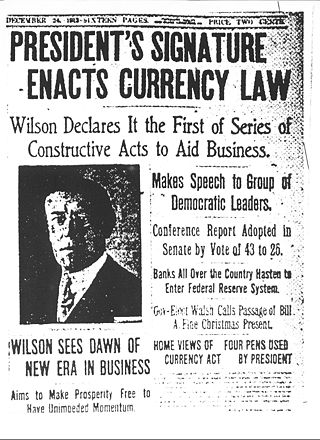

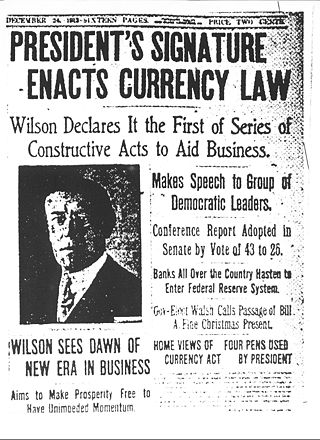

, now Secretary of State, long-time enemy of Wall Street and still a power in the Democratic party, threatened to destroy the bill. Wilson masterfully came up with a compromise plan that pleased bankers and Bryan alike. The Bryanites were happy that Federal Reserve currency became liabilities of the government rather than of private banks—a symbolic change—and by provisions for federal loans to farmers. The Bryanite demand to prohibit interlocking directorates did not pass. Wilson convinced the anti-bank Congressmen that because Federal Reserve notes were obligations of the government, the plan fit their demands. Wilson assured southerners and westerners that the system was decentralized into 12 districts, and thus would weaken New York City's Wall Street influence and strengthen the hinterlands. After much debate and many amendments Congress passed the Federal Reserve Act

or Glass-Owen Act, as it was sometimes called at the time, in late 1913. President Wilson signed the Act into law on December 23, 1913.

, the Fed was better positioned than the Treasury

to issue war bond

s, and so became the primary retailer for war bonds under the direction of the Treasury. After the war, the Fed, led by Paul Warburg and New York Governor Bank President Benjamin Strong, convinced Congress to modify its powers, giving it the ability to both create money, as the 1913 Act intended, and destroy money, as a central bank could.

During the 1920s, the Fed experimented with a number of approaches, alternatively creating and then destroying money which, in the eyes of Milton Friedman

, helped create the late-1920s stock market

bubble.

After Franklin D. Roosevelt

took office in 1933, the Fed was subordinated to the Executive Branch, where it remained until 1951, when the Fed and the Treasury department signed an accord

granting the Fed full independence over monetary matters while leaving fiscal matters to the Treasury.

The Fed's monetary powers did not dramatically change for the rest of the 20th century, but in the 1970s it was specifically charged by Congress to effectively promote "the goals of maximum employment, stable prices, and moderate long-term interest rates" as well as given regulatory responsibility over many consumer credit protection laws.

Bank of North America

Some Founding FathersFounding Fathers of the United States

The Founding Fathers of the United States of America were political leaders and statesmen who participated in the American Revolution by signing the United States Declaration of Independence, taking part in the American Revolutionary War, establishing the United States Constitution, or by some...

were strongly opposed to the formation of a central banking system; the fact that England tried to place the colonies under the monetary control of the Bank of England

Bank of England

The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694, it is the second oldest central bank in the world...

was seen by many as the 'last straw' of English oppression and that it led directly to the American Revolutionary War

American Revolutionary War

The American Revolutionary War , the American War of Independence, or simply the Revolutionary War, began as a war between the Kingdom of Great Britain and thirteen British colonies in North America, and ended in a global war between several European great powers.The war was the result of the...

.

Other Founding Fathers were strongly in favor of a central bank. Robert Morris, as Superintendent of Finance, helped to open the Bank of North America in 1782, and has been accordingly called by Thomas Goddard "the father of the system of credit and paper circulation in the United States." As ratification in early 1781 of the Articles of Confederation & Perpetual Union had extended to Congress the sovereign power to emit bills of credit, it passed later that year an ordinance to incorporate a privately subscribed national bank following in the footsteps of the Bank of England. However, it was thwarted in fulfilling its intended role as a nationwide central bank due to objections of "alarming foreign influence and fictitious credit," favoritism to foreigners and unfair competition against less corrupt state banks issuing their own notes, such that Pennsylvania's legislature repealed its charter to operate within the Commonwealth in 1785.

First Bank of the United States

In 1791, former Morris aide and chief advocate for Northern mercantile interests, Alexander HamiltonAlexander Hamilton

Alexander Hamilton was a Founding Father, soldier, economist, political philosopher, one of America's first constitutional lawyers and the first United States Secretary of the Treasury...

, the Secretary of the Treasury, struck a deal with Southern lawmakers to ensure the continuation of Morris's Bank project; in exchange for support by the South for a national bank, Hamilton agreed to ensure sufficient support to have the national or federal capital moved from its temporary Northern location, New York, to a Southern location on the Potomac

Potomac River

The Potomac River flows into the Chesapeake Bay, located along the mid-Atlantic coast of the United States. The river is approximately long, with a drainage area of about 14,700 square miles...

. As a result, the First Bank of the United States

First Bank of the United States

The First Bank of the United States is a National Historic Landmark located in Philadelphia, Pennsylvania within Independence National Historical Park.-Banking History:...

(1791–1811) was chartered by Congress within the year and signed by George Washington

George Washington

George Washington was the dominant military and political leader of the new United States of America from 1775 to 1799. He led the American victory over Great Britain in the American Revolutionary War as commander-in-chief of the Continental Army from 1775 to 1783, and presided over the writing of...

soon after. The First Bank of the United States was modeled after the Bank of England

Bank of England

The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694, it is the second oldest central bank in the world...

and differed in many ways from today's central banks. For example, it was partly owned by foreigners, who shared in its profits. Also, it wasn't solely responsible for the country's supply of bank notes. It was responsible for only 20% of the currency supply; state banks accounted for the rest. Several founding fathers bitterly opposed the Bank. Thomas Jefferson

Thomas Jefferson

Thomas Jefferson was the principal author of the United States Declaration of Independence and the Statute of Virginia for Religious Freedom , the third President of the United States and founder of the University of Virginia...

saw it as an engine for speculation, financial manipulation, and corruption. In 1811 its twenty year charter expired and was not renewed by Congress. The next several years witnessed a proliferation of federally issued Treasury Notes as the government struggled to finance the War of 1812

War of 1812

The War of 1812 was a military conflict fought between the forces of the United States of America and those of the British Empire. The Americans declared war in 1812 for several reasons, including trade restrictions because of Britain's ongoing war with France, impressment of American merchant...

and an eventual suspension of specie payment by most banks.

Second Bank of the United States

After a five-year interval, the federal government chartered its successor, the Second Bank of the United StatesSecond Bank of the United States

The Second Bank of the United States was chartered in 1816, five years after the First Bank of the United States lost its own charter. The Second Bank of the United States was initially headquartered in Carpenters' Hall, Philadelphia, the same as the First Bank, and had branches throughout the...

(1816–1836). James Madison

James Madison

James Madison, Jr. was an American statesman and political theorist. He was the fourth President of the United States and is hailed as the “Father of the Constitution” for being the primary author of the United States Constitution and at first an opponent of, and then a key author of the United...

signed this charter, expressing the hope that it would end the runaway inflation of the five year interim. It was basically a copy of the First Bank, with branches across the country. Andrew Jackson

Andrew Jackson

Andrew Jackson was the seventh President of the United States . Based in frontier Tennessee, Jackson was a politician and army general who defeated the Creek Indians at the Battle of Horseshoe Bend , and the British at the Battle of New Orleans...

, who became president in 1828, denounced it as an engine of corruption. His destruction of the bank was a major political issue in the 1830s and shaped the Second Party System

Second Party System

The Second Party System is a term of periodization used by historians and political scientists to name the political party system existing in the United States from about 1828 to 1854...

, as Democrats in the states opposed banks and Whigs

Whig Party (United States)

The Whig Party was a political party of the United States during the era of Jacksonian democracy. Considered integral to the Second Party System and operating from the early 1830s to the mid-1850s, the party was formed in opposition to the policies of President Andrew Jackson and his Democratic...

supported them. He did not get the bank dissolved, but refused to renew its charter. The end of the bank saw a period of runaway inflation, until Jackson's executive order requiring all federal land payments be made in gold or silver, driving all banks to require payments in gold and silver, producing the depression of 1837, which lasted for four years.

1837–1862: "Free Banking" Era

| Period | % Change in Money Supply | % Change in Price Level |

|---|---|---|

| 1832-37 | + 61 | + 28 |

| 1837-43 | - 58 | - 35 |

| 1843-48 | + 102 | + 9 |

| 1848-49 | - 11 | 0 |

| 1849-54 | + 109 | + 32 |

| 1854-55 | - 12 | + 2 |

| 1855-57 | + 18 | + 1 |

| 1857-58 | - 23 | - 16 |

| 1858-61 | + 35 | - 4 |

In this period, only state-chartered banks existed. They could issue bank notes against specie (gold

Gold

Gold is a chemical element with the symbol Au and an atomic number of 79. Gold is a dense, soft, shiny, malleable and ductile metal. Pure gold has a bright yellow color and luster traditionally considered attractive, which it maintains without oxidizing in air or water. Chemically, gold is a...

and silver

Silver

Silver is a metallic chemical element with the chemical symbol Ag and atomic number 47. A soft, white, lustrous transition metal, it has the highest electrical conductivity of any element and the highest thermal conductivity of any metal...

coins

COinS

ContextObjects in Spans, commonly abbreviated COinS, is a method to embed bibliographic metadata in the HTML code of web pages. This allows bibliographic software to publish machine-readable bibliographic items and client reference management software to retrieve bibliographic metadata. The...

) and the states heavily regulated their own reserve requirement

Reserve requirement

The reserve requirement is a central bank regulation that sets the minimum reserves each commercial bank must hold of customer deposits and notes...

s, interest rate

Interest rate

An interest rate is the rate at which interest is paid by a borrower for the use of money that they borrow from a lender. For example, a small company borrows capital from a bank to buy new assets for their business, and in return the lender receives interest at a predetermined interest rate for...

s for loan

Loan

A loan is a type of debt. Like all debt instruments, a loan entails the redistribution of financial assets over time, between the lender and the borrower....

s and deposit

Deposit account

A deposit account is a current account, savings account, or other type of bank account, at a banking institution that allows money to be deposited and withdrawn by the account holder. These transactions are recorded on the bank's books, and the resulting balance is recorded as a liability for the...

s, the necessary capital ratio etc. These banks had existed from 1781, in parallel with the Banks of the United States. The Michigan Act (1837) allowed the automatic chartering of banks that would fulfill its requirements without special consent of the state legislature. This legislation made creating unstable banks easier by lowering state supervision in states that adopted it. The real value of a bank bill was often lower than its face value, and the issuing bank's financial strength generally determined the size of the discount. By 1797 there were 24 chartered banks in the U.S.; with the beginning of the Free Banking Era (1837) there were 712.

During the free banking era, the banks were short-lived compared to today's commercial banks, with an average lifespan of five years. About half of the banks failed, and about a third of which went out of business because they could not redeem their notes. (See also "Wildcat banking

Wildcat banking

Wildcat banking refers to the unusual practices of banks chartered under state law during the periods of non-federally regulated state banking between 1816 and 1863 in the United States, also known as the Free Banking Era...

".)

During the free banking era, some local banks took over the functions of a central bank. In New York, the New York Safety Fund provided deposit insurance for member banks. In Boston

Boston

Boston is the capital of and largest city in Massachusetts, and is one of the oldest cities in the United States. The largest city in New England, Boston is regarded as the unofficial "Capital of New England" for its economic and cultural impact on the entire New England region. The city proper had...

, the Suffolk Bank

Suffolk Bank

Suffolk Bank was a clearinghouse bank in Boston, Massachusetts, that exchanged specie or locally backed bank notes for notes from country banks to which city-dwellers could not easily travel to redeem notes. It operated from 1818 until 1858....

guaranteed that bank notes would trade at near par value, and acted as a private bank note clearinghouse

Clearing house (finance)

A clearing house is a financial institution that provides clearing and settlement services for financial and commodities derivatives and securities transactions...

.

1863–1913: National Banks

The National Banking ActNational Banking Act

The National Banking Acts of 1863 and 1864 were two United States federal laws that established a system of national charters for banks, and created the United States National Banking System. They encouraged development of a national currency backed by bank holdings of U.S...

of 1863, besides providing loans in the Civil War

American Civil War

The American Civil War was a civil war fought in the United States of America. In response to the election of Abraham Lincoln as President of the United States, 11 southern slave states declared their secession from the United States and formed the Confederate States of America ; the other 25...

effort of the Union

Union (American Civil War)

During the American Civil War, the Union was a name used to refer to the federal government of the United States, which was supported by the twenty free states and five border slave states. It was opposed by 11 southern slave states that had declared a secession to join together to form the...

, included provisions:

- To create a system of national bankNational bankIn banking, the term national bank carries several meanings:* especially in developing countries, a bank owned by the state* an ordinary private bank which operates nationally...

s. They had higher standards concerning reserves and business practices than state bankState bankA state bank is generally a financial institution that is chartered by a state. It differs from a reserve bank in that it does not necessarily control monetary policy , but instead usually offers only retail and commercial services.A state bank that has been in operation for five years or less is...

s. The office of Comptroller of the Currency was created to supervise these banks. - To create a uniform national currencyCurrencyIn economics, currency refers to a generally accepted medium of exchange. These are usually the coins and banknotes of a particular government, which comprise the physical aspects of a nation's money supply...

. To achieve this, all national banks were required to accept each other's currencies at par value. This eliminated the risk of loss in case of bank default. The notes were printed by the Comptroller of the Currency to ensure uniform quality and prevent counterfeiting. - To finance the war. National banks were required to back up their notes with Treasury securitiesTreasury securityA United States Treasury security is government debt issued by the United States Department of the Treasury through the Bureau of the Public Debt. Treasury securities are the debt financing instruments of the United States federal government, and they are often referred to simply as Treasuries...

, enlarging the market and raising its liquidity.

As described by Gresham's Law

Gresham's Law

Gresham's law is an economic principle that states: "When a government compulsorily overvalues one type of money and undervalues another, the undervalued money will leave the country or disappear from circulation into hoards, while the overvalued money will flood into circulation." It is commonly...

, soon bad money from state banks drove out the new, good money; the government imposed a 10% tax on state bank bills, forcing most banks to convert to national banks. By 1865, there were already 1,500 national banks. In 1870, 1,638 national banks stood against only 325 state banks. The tax led in the 1880s

1880s

The 1880s was the decade that spanned from January 1, 1880 to December 31, 1889. They occurred at the core period of the Second Industrial Revolution. Most Western countries experienced a large economic boom, due to the mass production of railroads and other more convenient methods of travel...

and 1890s

1890s

The 1890s were sometimes referred to as the "Mauve Decade" - because William Henry Perkin's aniline dye allowed the widespread use of that colour in fashion - and also as the "Gay Nineties", under the then-current usage of the word "gay" which referred simply to merriment and frivolity, with no...

to the creation and adoption of checking accounts. By the 1890s

1890s

The 1890s were sometimes referred to as the "Mauve Decade" - because William Henry Perkin's aniline dye allowed the widespread use of that colour in fashion - and also as the "Gay Nineties", under the then-current usage of the word "gay" which referred simply to merriment and frivolity, with no...

, 90% of the money supply was in checking accounts. State banking had made a comeback.

Two problems still remained in the banking sector. The first was the requirement to back up the currency with treasuries. When the treasuries fluctuated in value, bank

Bank

A bank is a financial institution that serves as a financial intermediary. The term "bank" may refer to one of several related types of entities:...

s had to recall loan

Loan

A loan is a type of debt. Like all debt instruments, a loan entails the redistribution of financial assets over time, between the lender and the borrower....

s or borrow from other banks or clearinghouse

Clearing house (finance)

A clearing house is a financial institution that provides clearing and settlement services for financial and commodities derivatives and securities transactions...

s. The second problem was that the system created seasonal liquidity spikes. A rural bank had deposit account

Deposit account

A deposit account is a current account, savings account, or other type of bank account, at a banking institution that allows money to be deposited and withdrawn by the account holder. These transactions are recorded on the bank's books, and the resulting balance is recorded as a liability for the...

s at a larger bank, that it withdrew from when the need for funds was highest, e.g., in the planting season. When combined liquidity demands were too big, the bank again had to find a lender of last resort

Lender of last resort

A lender of last resort is an institution willing to extend credit when no one else will. The term refers especially to a reserve financial institution, most often the central bank of a country, intended to avoid bankruptcy of banks or other institutions deemed systemically important or 'too big to...

.

These liquidity crises led to bank run

Bank run

A bank run occurs when a large number of bank customers withdraw their deposits because they believe the bank is, or might become, insolvent...

s, causing severe disruptions and depressions, the worst of which was the Panic of 1907

Panic of 1907

The Panic of 1907, also known as the 1907 Bankers' Panic, was a financial crisis that occurred in the United States when the New York Stock Exchange fell almost 50% from its peak the previous year. Panic occurred, as this was during a time of economic recession, and there were numerous runs on...

.

Panic of 1907 Alarms Bankers

Early in 1907, New York Times Annual Financial Review published Paul WarburgPaul Warburg

Paul Moritz Warburg was a German-born American banker and early advocate of the U.S. Federal Reserve system.- Early life :...

's (a partner of Kuhn, Loeb and Co.) first official reform plan, entitled "A Plan for a Modified Central Bank," in which he outlined remedies that he thought might avert panics. Early in 1907, Jacob Schiff

Jacob Schiff

Jacob Henry Schiff, born Jakob Heinrich Schiff was a German-born Jewish American banker and philanthropist, who helped finance, among many other things, the Japanese military efforts against Tsarist Russia in the Russo-Japanese War.From his base on Wall Street, he was the foremost Jewish leader...

, the chief executive officer

Chief executive officer

A chief executive officer , managing director , Executive Director for non-profit organizations, or chief executive is the highest-ranking corporate officer or administrator in charge of total management of an organization...

of Kuhn, Loeb and Co., in a speech to the New York Chamber of Commerce, warned that "unless we have a central bank with adequate control of credit resources, this country is going to undergo the most severe and far reaching money panic in its history." "The Panic of 1907" hit full stride in October. [Herrick]

Bankers felt the real problem was that the United States was the last major country without a central bank, which might provide stability and emergency credit in times of financial crisis. While segments of the financial community were worried about the power that had accrued to JP Morgan and other 'financiers', most were more concerned about the general frailty of a vast, decentralized banking system that could not regulate itself without the extraordinary intervention of one man. Financial leaders who advocated a central bank with an elastic currency after the Panic of 1907

Panic of 1907

The Panic of 1907, also known as the 1907 Bankers' Panic, was a financial crisis that occurred in the United States when the New York Stock Exchange fell almost 50% from its peak the previous year. Panic occurred, as this was during a time of economic recession, and there were numerous runs on...

include Frank Vanderlip, Myron T. Herrick

Myron T. Herrick

Myron Timothy Herrick was a Republican politician from Ohio. He served as the 42nd Governor of Ohio.-Biography:...

, William Barret Ridgely

William Barret Ridgely

William B. Ridgely was a United States Comptroller of the Currency from 1901 to 1908.William B. Ridgely attended Rensselaer Polytechnic Institute, where he was a member of the Chi Phi Fraternity. Upon his graduation from RPI in 1881, Ridgely engaged in mining, manufacturing, and banking in...

, George E. Roberts

George E. Roberts

George Evan Roberts was Director of the United States Mint from 1898 to 1907, and again from 1910 to 1914.-Biography:...

, Isaac Newton Seligman

Isaac Newton Seligman

Isaac Newton Seligman was an American banker and communal worker.-Early life:Seligman attended Columbia Grammar School and Columbia College, from which he graduated in 1876...

and Jacob H. Schiff. They stressed the need for an elastic money supply that could expand or contract as needed. After the scare of 1907 the bankers demanded reform; the next year, Congress established a commission of experts to come up with a nonpartisan solution.

Aldrich Plan

Rhode Island Senator Nelson Aldrich, the Republican leader in the Senate, ran the Commission personally, with the aid of a team of economists. They went to Europe and were impressed at how well they believed the central banks in Britain and Germany handled the stabilization of the overall economy and the promotion of international trade. Aldrich's investigation led to his plan in 1912 to bring central banking to the United States, with promises of financial stability, expanded international roles, control by impartial experts and no political meddling in finance. Aldrich asserted that a central bank had to be (contradictorily) decentralized somehow, or it would be attacked by local politicians and bankers as had the First and Second Banks of the United States. The Aldrich plan was introduced in 62nd and 63rd Congresses (1912 and 1913) but never gained much traction as the Democrats in 1912 won control of both the House and the Senate as well as the White House.

A Regional Federal Reserve System

The new President, Woodrow Wilson, then became the principal mover for banking and currency reform in the 63rd Congress, working with the two chairs of the House and Senate Banking and Currency Committees, Rep. Carter Glass of Virginia and Sen. Robert L. Owen of Oklahoma. It was Wilson who insisted that the regional Federal reserve banks be controlled by a central Federal reserve board appointed by the President with the advice and consent of the U.S. Senate.Agrarian Demands Partly Met

William Jennings BryanWilliam Jennings Bryan

William Jennings Bryan was an American politician in the late-19th and early-20th centuries. He was a dominant force in the liberal wing of the Democratic Party, standing three times as its candidate for President of the United States...

, now Secretary of State, long-time enemy of Wall Street and still a power in the Democratic party, threatened to destroy the bill. Wilson masterfully came up with a compromise plan that pleased bankers and Bryan alike. The Bryanites were happy that Federal Reserve currency became liabilities of the government rather than of private banks—a symbolic change—and by provisions for federal loans to farmers. The Bryanite demand to prohibit interlocking directorates did not pass. Wilson convinced the anti-bank Congressmen that because Federal Reserve notes were obligations of the government, the plan fit their demands. Wilson assured southerners and westerners that the system was decentralized into 12 districts, and thus would weaken New York City's Wall Street influence and strengthen the hinterlands. After much debate and many amendments Congress passed the Federal Reserve Act

Federal Reserve Act

The Federal Reserve Act is an Act of Congress that created and set up the Federal Reserve System, the central banking system of the United States of America, and granted it the legal authority to issue Federal Reserve Notes and Federal Reserve Bank Notes as legal tender...

or Glass-Owen Act, as it was sometimes called at the time, in late 1913. President Wilson signed the Act into law on December 23, 1913.

The Federal Reserve

The Fed's power developed slowly in part due to an understanding at its creation that it was to function primarily as a reserve, a money-creator of last resort to prevent the downward spiral of withdrawal/withholding of funds which characterizes a monetary panic. At the outbreak of World War IWorld War I

World War I , which was predominantly called the World War or the Great War from its occurrence until 1939, and the First World War or World War I thereafter, was a major war centred in Europe that began on 28 July 1914 and lasted until 11 November 1918...

, the Fed was better positioned than the Treasury

United States Department of the Treasury

The Department of the Treasury is an executive department and the treasury of the United States federal government. It was established by an Act of Congress in 1789 to manage government revenue...

to issue war bond

War bond

War bonds are debt securities issued by a government for the purpose of financing military operations during times of war. War bonds generate capital for the government and make civilians feel involved in their national militaries...

s, and so became the primary retailer for war bonds under the direction of the Treasury. After the war, the Fed, led by Paul Warburg and New York Governor Bank President Benjamin Strong, convinced Congress to modify its powers, giving it the ability to both create money, as the 1913 Act intended, and destroy money, as a central bank could.

During the 1920s, the Fed experimented with a number of approaches, alternatively creating and then destroying money which, in the eyes of Milton Friedman

Milton Friedman

Milton Friedman was an American economist, statistician, academic, and author who taught at the University of Chicago for more than three decades...

, helped create the late-1920s stock market

Stock market

A stock market or equity market is a public entity for the trading of company stock and derivatives at an agreed price; these are securities listed on a stock exchange as well as those only traded privately.The size of the world stock market was estimated at about $36.6 trillion...

bubble.

After Franklin D. Roosevelt

Franklin D. Roosevelt

Franklin Delano Roosevelt , also known by his initials, FDR, was the 32nd President of the United States and a central figure in world events during the mid-20th century, leading the United States during a time of worldwide economic crisis and world war...

took office in 1933, the Fed was subordinated to the Executive Branch, where it remained until 1951, when the Fed and the Treasury department signed an accord

1951 Accord

The 1951 Accord, also known simply as the Accord, was an agreement between the U.S. Department of the Treasury and the Federal Reserve that restored independence to the Fed....

granting the Fed full independence over monetary matters while leaving fiscal matters to the Treasury.

The Fed's monetary powers did not dramatically change for the rest of the 20th century, but in the 1970s it was specifically charged by Congress to effectively promote "the goals of maximum employment, stable prices, and moderate long-term interest rates" as well as given regulatory responsibility over many consumer credit protection laws.

External links

- The Origins of the Federal Reserve by Murray N. Rothbard

- A History of Central Banking in the United States published by the Federal Reserve Bank of Minneapolis

- Historical Beginnings... The Federal Reserve from the Federal Reserve Bank of Boston

- Documents of the Reserve Bank Organizing Committee. Committee created by the Federal Reserve Act, charged with dividing the nation into reserve districts. Includes: decision of the Reserve Bank Organization Committee determining the Federal Reserve districts and the location of Federal Reserve Banks; hearings held at potential reserve bank cities; other reports, bulletins, and circulars.