Geolibertarianism

Encyclopedia

Geolibertarianism is a political movement

that strives to reconcile libertarianism

and Georgism

(or geoism).

Geolibertarians are advocates of geoism, which is the position that all natural resource

s – most importantly land

– are common assets to which all individuals have an equal right to access; therefore if individuals claim land as their private property they must pay rent

to the community for doing so. Rent need not be paid for the mere use of land, but only for the right to exclude others from that land, and for the protection of one's title by government. They simultaneously agree with the libertarian position that each individual has an exclusive right to the fruits of his or her labor as their private property

, as opposed to this product being owned collectively by society or the community, and that "one's labor, wages, and the products of labor" should not be taxed. Also, with traditional libertarians they advocate "full civil liberties, with no crimes unless there are victims who have been invaded." Geolibertarians generally advocate distributing the land rent to the community via a land value tax

, as proposed by Henry George

and others before him. For this reason, they are often called "single taxers". Fred E. Foldvary

coined the word "geo-libertarianism" in an article so titled in Land and Liberty. In the case of geoanarchism, the voluntary form of geolibertarianism as described by Foldvary, rent would be collected by private associations with the opportunity to secede from a geocommunity (and not receive the geocommunity's services) if desired.

Geolibertarians are generally influenced by Georgism

, but the ideas behind it pre-date Henry George

, and can be found in different forms in the writings of John Locke

, the French Physiocrats

, Thomas Jefferson

, Adam Smith

, Thomas Paine

, James Mill

(John Stuart Mill's father), David Ricardo

, John Stuart Mill

, Herbert Spencer

and Thomas Spence

. Perhaps the best summary of geolibertarianism is Thomas Paine's assertion that "Men did not make the earth. It is the value of the improvements only, and not the earth itself, that is individual property. Every proprietor owes to the community a ground rent for the land which he holds." On the other hand, Locke wrote that private land ownership should be praised, as long as its product was not left to spoil and there was "enough, and as good left in common for others"; when this Lockean proviso

is violated, the land earns rental value. Some would argue that "as good" is unlikely to be achieved in an urban setting because location is paramount, and that therefore Locke's proviso in an urban setting requires the collection and equal distribution of ground rent.

to be the common property of all humankind. They say that private property is derived from an individual's right to the fruits of their labor. Since land was not created by anyone's labor, it cannot be rightfully owned. Thus, geolibertarians recognize a right to secure possession of land (land tenure), on the condition that the full rental value

be paid to the community. This, they say, has the effect of both giving back the value that belongs to the community and encouraging landholders to only use as much land as they need, leaving unneeded land for others.

Some geolibertarians claim that the same reasoning justifies a pollution tax against those who degrade the value of common resources. Also, the common nature of the radio wave spectrum

is sometimes viewed as a justification for the taxation of its exclusive use as well.

This strict definition of property as all fruits of labor makes geolibertarians fervent advocates of free market

s.

the guiding parameter behind wages is what is called the margin of production. Roughly speaking, the margin of production is the amount of wealth that a person could produce working on land that is free of rent (marginal land): when anyone chooses to work for someone else instead of working for himself on the free land, it is because he gets a higher wage. Thus, the margin of production represents an absolute floor on wage level in any society, under free market circumstances.

The differences between geolibertarians and other libertarians arise at this point. Geolibertarians recognize that the rule of law

, protection of private property and provision of public goods are undoubtedly public benefits, but the resulting economic advantages go wholly to landowners because they control access to those benefits. As a result, it is economically feasible for many to hold economically valuable land out of use and still profit from the general rise of rents. This is in contrast to most capital goods, which can benefit their owner only if they're put into the service of others, that is, if they're used for production rather than withheld from production. Thus, as the great self-made industrialist Andrew Carnegie observed, "The most comfortable, but also the most unproductive way for a capitalist to increase his fortune, is to put all monies in sites and await that point in time when a society, hungering for land, has to pay his price."

The combination of private retention of publicly created increases in land value and land-use zoning laws creates an even stronger economic pressure to hold valuable land out of use or in an inferior use: rezoning a land parcel to allow more intensive, higher-density use often results in a very large increase in the land's value. If the owner of a vacant site permits productive use of the site, that will normally mean constructing substantial improvements; but once the newly built improvements are in place, local land-use and zoning authorities are extremely reluctant to redesignate the land's permitted use until the improvements have depreciated to the point where they are worth only a small fraction of the land's value, typically a period measured in decades. The owner knows that eventually, the land must be rezoned as the community grows. His hope and expectation of rezoning and the resulting increase in value in the near term consequently makes him unwilling to permit improvement and use of the land lest it delay his inevitable rezoning windfall.

Though speculation in idle sites is for these reasons often profitable to their owner (and even when not profitable, keeping sites idle is often the rational choice from the standpoint of the owner's financial expectation), continued retention of land without usage (or in sub-optimal use) causes those who actually desire to use land to settle for lower quality of land. This pushes the margin of production downwards, resulting in lower wages.

Elimination of the incentive to hold land out of use, along with higher employment (because more land is in use) and lower prices of land (resulting in lesser need of financial capital for going into business) is expected to result in a high level of prosperity and substantially reduce the need for welfare. Historical examples of jurisdictions with high land taxes bear this view out. In addition, recovery of the publicly created rent of land for the purposes and benefit of the public that creates it would allow replacement of current taxes on sales, incomes, etc. that impose costs not only on those who directly pay them but on all other producers and consumers, who pay a portion of such taxes as a result of burden shifting. Such taxes are a significant cost even for people too poor to pay any income tax.

Perhaps most importantly to the problem of poverty, private property in land violates people's rights to liberty—the pre-existing, natural liberty to use the opportunities nature provided. The requirement that the producer pay a landowner for access to the economic advantages government, the community and nature provide is a burden that the most productive and even ordinary working people may be able to bear with passable grace; but absent poverty relief programs, it consigns the least productive workers to the least productive land, and thus to destitution. Most geolibertarians advocate restoration of the equal individual right to use land via either a flat, universal, personal land tax exemption, or an equivalent citizens' dividend paid for out of recovered land rent that can be applied to one's own land tax liabilities. As land rent typically accounts for the great majority of the poor's housing costs, a personal land tax exemption applicable to tenants as well as owners would reduce their housing costs to near zero, greatly reducing the need for poverty relief programs, associated cash payments, or indeed a citizens' dividend.

Other libertarians dispute the geolibertarians' theory on the economics of private property and note that a property owner would need to own a significant portion of all available land in order to be able to affect rent prices by refusing to allow that land to be put to use, and that this scenario is unrealistic. However, this criticism misses the point: as aggregate land rent is a slowly rising fraction of GDP, the land is increasing in value anyway, no matter what any individual landowner may be doing or not doing with it, and the growth of communities makes rezoning all but inevitable. The prospect of a rezoning windfall in the near term provides all the incentive needed for the owner to keep land out of productive use indefinitely.

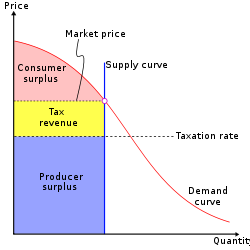

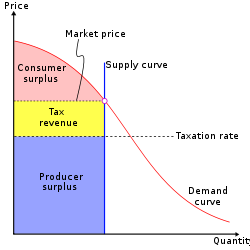

Geolibertarians advocate the land value tax

for a number of reasons. As explained already, it is seen as a means of upholding the equal right to access and use land. It is also the tax most compatible with the free market. It does not distort the price of goods, nor does it discourage productivity, since it does not affect the cost of production.

Geolibertarians argue that since public utilities and services increase land value, they could essentially fund themselves through the land value tax. In this way, the tax can fund the functions of government so long as it contributes to the community. As government spending on services and infrastructure becomes land rent, recovery of land rent for public purposes is the necessary and sufficient condition for government spending to pay for itself. Some geolibertarians believe that all tax revenues beyond these functions should go towards a citizen's dividend

, an equal payment to each individual in the community. Some others have argued that the citizens' dividend should come first, and then individuals can arrange by contract to have portions of it go to fund specified services. Exclusive land tenure is necessary if the economy and society are to function at a level higher than that of hunter-gatherer tribes. As exclusive private land tenure through either private property in land or payment of rent to the community necessarily violates the right to liberty—the pre-existing right to use what nature provided, which all would otherwise be at liberty to use—consistent advocacy of liberty requires restoration of the liberty to use land through either an equal universal personal land tax exemption or an equivalent citizens' dividend that can be used to pay for access to land.

Political movement

A political movement is a social movement in the area of politics. A political movement may be organized around a single issue or set of issues, or around a set of shared concerns of a social group...

that strives to reconcile libertarianism

Libertarianism

Libertarianism, in the strictest sense, is the political philosophy that holds individual liberty as the basic moral principle of society. In the broadest sense, it is any political philosophy which approximates this view...

and Georgism

Georgism

Georgism is an economic philosophy and ideology that holds that people own what they create, but that things found in nature, most importantly land, belong equally to all...

(or geoism).

Geolibertarians are advocates of geoism, which is the position that all natural resource

Natural resource

Natural resources occur naturally within environments that exist relatively undisturbed by mankind, in a natural form. A natural resource is often characterized by amounts of biodiversity and geodiversity existent in various ecosystems....

s – most importantly land

Land (economics)

In economics, land comprises all naturally occurring resources whose supply is inherently fixed. Examples are any and all particular geographical locations, mineral deposits, and even geostationary orbit locations and portions of the electromagnetic spectrum. Natural resources are fundamental to...

– are common assets to which all individuals have an equal right to access; therefore if individuals claim land as their private property they must pay rent

Economic rent

Economic rent is typically defined by economists as payment for goods and services beyond the amount needed to bring the required factors of production into a production process and sustain supply. A recipient of economic rent is a rentier....

to the community for doing so. Rent need not be paid for the mere use of land, but only for the right to exclude others from that land, and for the protection of one's title by government. They simultaneously agree with the libertarian position that each individual has an exclusive right to the fruits of his or her labor as their private property

Private property

Private property is the right of persons and firms to obtain, own, control, employ, dispose of, and bequeath land, capital, and other forms of property. Private property is distinguishable from public property, which refers to assets owned by a state, community or government rather than by...

, as opposed to this product being owned collectively by society or the community, and that "one's labor, wages, and the products of labor" should not be taxed. Also, with traditional libertarians they advocate "full civil liberties, with no crimes unless there are victims who have been invaded." Geolibertarians generally advocate distributing the land rent to the community via a land value tax

Land value tax

A land value tax is a levy on the unimproved value of land. It is an ad valorem tax on land that disregards the value of buildings, personal property and other improvements...

, as proposed by Henry George

Henry George

Henry George was an American writer, politician and political economist, who was the most influential proponent of the land value tax, also known as the "single tax" on land...

and others before him. For this reason, they are often called "single taxers". Fred E. Foldvary

Fred E. Foldvary

Fred Emanuel Foldvary is a lecturer in economics at Santa Clara University, California, and a research fellow at The Independent Institute...

coined the word "geo-libertarianism" in an article so titled in Land and Liberty. In the case of geoanarchism, the voluntary form of geolibertarianism as described by Foldvary, rent would be collected by private associations with the opportunity to secede from a geocommunity (and not receive the geocommunity's services) if desired.

Geolibertarians are generally influenced by Georgism

Georgism

Georgism is an economic philosophy and ideology that holds that people own what they create, but that things found in nature, most importantly land, belong equally to all...

, but the ideas behind it pre-date Henry George

Henry George

Henry George was an American writer, politician and political economist, who was the most influential proponent of the land value tax, also known as the "single tax" on land...

, and can be found in different forms in the writings of John Locke

John Locke

John Locke FRS , widely known as the Father of Liberalism, was an English philosopher and physician regarded as one of the most influential of Enlightenment thinkers. Considered one of the first of the British empiricists, following the tradition of Francis Bacon, he is equally important to social...

, the French Physiocrats

Physiocrats

Physiocracy is an economic theory developed by the Physiocrats, a group of economists who believed that the wealth of nations was derived solely from the value of "land agriculture" or "land development." Their theories originated in France and were most popular during the second half of the 18th...

, Thomas Jefferson

Thomas Jefferson

Thomas Jefferson was the principal author of the United States Declaration of Independence and the Statute of Virginia for Religious Freedom , the third President of the United States and founder of the University of Virginia...

, Adam Smith

Adam Smith

Adam Smith was a Scottish social philosopher and a pioneer of political economy. One of the key figures of the Scottish Enlightenment, Smith is the author of The Theory of Moral Sentiments and An Inquiry into the Nature and Causes of the Wealth of Nations...

, Thomas Paine

Thomas Paine

Thomas "Tom" Paine was an English author, pamphleteer, radical, inventor, intellectual, revolutionary, and one of the Founding Fathers of the United States...

, James Mill

James Mill

James Mill was a Scottish historian, economist, political theorist, and philosopher. He was a founder of classical economics, together with David Ricardo, and the father of influential philosopher of classical liberalism, John Stuart Mill.-Life:Mill was born at Northwater Bridge, in the parish of...

(John Stuart Mill's father), David Ricardo

David Ricardo

David Ricardo was an English political economist, often credited with systematising economics, and was one of the most influential of the classical economists, along with Thomas Malthus, Adam Smith, and John Stuart Mill. He was also a member of Parliament, businessman, financier and speculator,...

, John Stuart Mill

John Stuart Mill

John Stuart Mill was a British philosopher, economist and civil servant. An influential contributor to social theory, political theory, and political economy, his conception of liberty justified the freedom of the individual in opposition to unlimited state control. He was a proponent of...

, Herbert Spencer

Herbert Spencer

Herbert Spencer was an English philosopher, biologist, sociologist, and prominent classical liberal political theorist of the Victorian era....

and Thomas Spence

Thomas Spence

Thomas Spence was an English Radical and advocate of the common ownership of land.-Life:Spence was born in Newcastle-on-Tyne, England and was the son of a Scottish net and shoe maker....

. Perhaps the best summary of geolibertarianism is Thomas Paine's assertion that "Men did not make the earth. It is the value of the improvements only, and not the earth itself, that is individual property. Every proprietor owes to the community a ground rent for the land which he holds." On the other hand, Locke wrote that private land ownership should be praised, as long as its product was not left to spoil and there was "enough, and as good left in common for others"; when this Lockean proviso

Lockean proviso

The Lockean Proviso is a portion of John Locke's labor theory of property which says that though individuals have a right to acquire private property from nature, that they must leave "enough and as good in common...to others."...

is violated, the land earns rental value. Some would argue that "as good" is unlikely to be achieved in an urban setting because location is paramount, and that therefore Locke's proviso in an urban setting requires the collection and equal distribution of ground rent.

Property rights

Geolibertarians consider landLand (economics)

In economics, land comprises all naturally occurring resources whose supply is inherently fixed. Examples are any and all particular geographical locations, mineral deposits, and even geostationary orbit locations and portions of the electromagnetic spectrum. Natural resources are fundamental to...

to be the common property of all humankind. They say that private property is derived from an individual's right to the fruits of their labor. Since land was not created by anyone's labor, it cannot be rightfully owned. Thus, geolibertarians recognize a right to secure possession of land (land tenure), on the condition that the full rental value

Economic rent

Economic rent is typically defined by economists as payment for goods and services beyond the amount needed to bring the required factors of production into a production process and sustain supply. A recipient of economic rent is a rentier....

be paid to the community. This, they say, has the effect of both giving back the value that belongs to the community and encouraging landholders to only use as much land as they need, leaving unneeded land for others.

Some geolibertarians claim that the same reasoning justifies a pollution tax against those who degrade the value of common resources. Also, the common nature of the radio wave spectrum

Electromagnetic spectrum

The electromagnetic spectrum is the range of all possible frequencies of electromagnetic radiation. The "electromagnetic spectrum" of an object is the characteristic distribution of electromagnetic radiation emitted or absorbed by that particular object....

is sometimes viewed as a justification for the taxation of its exclusive use as well.

This strict definition of property as all fruits of labor makes geolibertarians fervent advocates of free market

Free market

A free market is a competitive market where prices are determined by supply and demand. However, the term is also commonly used for markets in which economic intervention and regulation by the state is limited to tax collection, and enforcement of private ownership and contracts...

s.

Poverty and welfare

According to the Law of RentLaw of Rent

The law of rent was formulated by David Ricardo around 1809, and this is the origin of the term Ricardian rent. Ricardo's formulation of the law was the first clear exposition of the source and magnitude of land rents, and is among the most important and firmly established principles of economics. ...

the guiding parameter behind wages is what is called the margin of production. Roughly speaking, the margin of production is the amount of wealth that a person could produce working on land that is free of rent (marginal land): when anyone chooses to work for someone else instead of working for himself on the free land, it is because he gets a higher wage. Thus, the margin of production represents an absolute floor on wage level in any society, under free market circumstances.

The differences between geolibertarians and other libertarians arise at this point. Geolibertarians recognize that the rule of law

Rule of law

The rule of law, sometimes called supremacy of law, is a legal maxim that says that governmental decisions should be made by applying known principles or laws with minimal discretion in their application...

, protection of private property and provision of public goods are undoubtedly public benefits, but the resulting economic advantages go wholly to landowners because they control access to those benefits. As a result, it is economically feasible for many to hold economically valuable land out of use and still profit from the general rise of rents. This is in contrast to most capital goods, which can benefit their owner only if they're put into the service of others, that is, if they're used for production rather than withheld from production. Thus, as the great self-made industrialist Andrew Carnegie observed, "The most comfortable, but also the most unproductive way for a capitalist to increase his fortune, is to put all monies in sites and await that point in time when a society, hungering for land, has to pay his price."

The combination of private retention of publicly created increases in land value and land-use zoning laws creates an even stronger economic pressure to hold valuable land out of use or in an inferior use: rezoning a land parcel to allow more intensive, higher-density use often results in a very large increase in the land's value. If the owner of a vacant site permits productive use of the site, that will normally mean constructing substantial improvements; but once the newly built improvements are in place, local land-use and zoning authorities are extremely reluctant to redesignate the land's permitted use until the improvements have depreciated to the point where they are worth only a small fraction of the land's value, typically a period measured in decades. The owner knows that eventually, the land must be rezoned as the community grows. His hope and expectation of rezoning and the resulting increase in value in the near term consequently makes him unwilling to permit improvement and use of the land lest it delay his inevitable rezoning windfall.

Though speculation in idle sites is for these reasons often profitable to their owner (and even when not profitable, keeping sites idle is often the rational choice from the standpoint of the owner's financial expectation), continued retention of land without usage (or in sub-optimal use) causes those who actually desire to use land to settle for lower quality of land. This pushes the margin of production downwards, resulting in lower wages.

Elimination of the incentive to hold land out of use, along with higher employment (because more land is in use) and lower prices of land (resulting in lesser need of financial capital for going into business) is expected to result in a high level of prosperity and substantially reduce the need for welfare. Historical examples of jurisdictions with high land taxes bear this view out. In addition, recovery of the publicly created rent of land for the purposes and benefit of the public that creates it would allow replacement of current taxes on sales, incomes, etc. that impose costs not only on those who directly pay them but on all other producers and consumers, who pay a portion of such taxes as a result of burden shifting. Such taxes are a significant cost even for people too poor to pay any income tax.

Perhaps most importantly to the problem of poverty, private property in land violates people's rights to liberty—the pre-existing, natural liberty to use the opportunities nature provided. The requirement that the producer pay a landowner for access to the economic advantages government, the community and nature provide is a burden that the most productive and even ordinary working people may be able to bear with passable grace; but absent poverty relief programs, it consigns the least productive workers to the least productive land, and thus to destitution. Most geolibertarians advocate restoration of the equal individual right to use land via either a flat, universal, personal land tax exemption, or an equivalent citizens' dividend paid for out of recovered land rent that can be applied to one's own land tax liabilities. As land rent typically accounts for the great majority of the poor's housing costs, a personal land tax exemption applicable to tenants as well as owners would reduce their housing costs to near zero, greatly reducing the need for poverty relief programs, associated cash payments, or indeed a citizens' dividend.

Other libertarians dispute the geolibertarians' theory on the economics of private property and note that a property owner would need to own a significant portion of all available land in order to be able to affect rent prices by refusing to allow that land to be put to use, and that this scenario is unrealistic. However, this criticism misses the point: as aggregate land rent is a slowly rising fraction of GDP, the land is increasing in value anyway, no matter what any individual landowner may be doing or not doing with it, and the growth of communities makes rezoning all but inevitable. The prospect of a rezoning windfall in the near term provides all the incentive needed for the owner to keep land out of productive use indefinitely.

The land value tax and the citizen's dividend

Geolibertarians advocate the land value tax

Land value tax

A land value tax is a levy on the unimproved value of land. It is an ad valorem tax on land that disregards the value of buildings, personal property and other improvements...

for a number of reasons. As explained already, it is seen as a means of upholding the equal right to access and use land. It is also the tax most compatible with the free market. It does not distort the price of goods, nor does it discourage productivity, since it does not affect the cost of production.

Geolibertarians argue that since public utilities and services increase land value, they could essentially fund themselves through the land value tax. In this way, the tax can fund the functions of government so long as it contributes to the community. As government spending on services and infrastructure becomes land rent, recovery of land rent for public purposes is the necessary and sufficient condition for government spending to pay for itself. Some geolibertarians believe that all tax revenues beyond these functions should go towards a citizen's dividend

Citizen's dividend

Citizen's dividend or citizen's income is a proposed state policy based upon the principle that the natural world is the common property of all persons . It is proposed that all citizens receive regular payments from revenue raised by the state through leasing or selling natural resources for...

, an equal payment to each individual in the community. Some others have argued that the citizens' dividend should come first, and then individuals can arrange by contract to have portions of it go to fund specified services. Exclusive land tenure is necessary if the economy and society are to function at a level higher than that of hunter-gatherer tribes. As exclusive private land tenure through either private property in land or payment of rent to the community necessarily violates the right to liberty—the pre-existing right to use what nature provided, which all would otherwise be at liberty to use—consistent advocacy of liberty requires restoration of the liberty to use land through either an equal universal personal land tax exemption or an equivalent citizens' dividend that can be used to pay for access to land.

See also

- FreiwirtschaftFreiwirtschaftis an economic idea founded by Silvio Gesell in 1916. He called it . In 1932, a group of Swiss businessmen used his ideas to found WIR....

- GeorgismGeorgismGeorgism is an economic philosophy and ideology that holds that people own what they create, but that things found in nature, most importantly land, belong equally to all...

- American individualist anarchism

- Individualist anarchismIndividualist anarchismIndividualist anarchism refers to several traditions of thought within the anarchist movement that emphasize the individual and his or her will over external determinants such as groups, society, traditions, and ideological systems. Individualist anarchism is not a single philosophy but refers to a...

- AgorismAgorismAgorism is a political philosophy founded by Samuel Edward Konkin III and developed with contributions by J. Neil Schulman that holds as its ultimate goal bringing about a society in which all "relations between people are voluntary exchanges – a free market." The term comes from the Greek...

- Green libertarianismGreen libertarianismGreen Libertarianism is a hybrid political philosophy that has developed in the United States. Based upon a mixture of political third party values, such as the environmental platform from the Green Party and the civil liberties platform of the Libertarian Party, the green libertarian philosophy...

- Left-LibertarianismLeft-libertarianismLeft-libertarianism names several related but distinct approaches to politics, society, culture, and political and social theory, which stress equally both individual freedom and social justice.-Schools of thought:...

- Libertarian DemocratLibertarian DemocratIn American politics, a libertarian Democrat is a member of the Democratic Party with libertarian leaning political viewpoints or views that are relatively libertarian compared to the views of the national party...

- Lockean provisoLockean provisoThe Lockean Proviso is a portion of John Locke's labor theory of property which says that though individuals have a right to acquire private property from nature, that they must leave "enough and as good in common...to others."...

External links

- Thomas Paine Network

- A Landlord is a Government - The Libertarian Basis for Land Rights

- Geo-Rent: A Plea to public economists by Fred E. FoldvaryFred E. FoldvaryFred Emanuel Foldvary is a lecturer in economics at Santa Clara University, California, and a research fellow at The Independent Institute...

- Between State and Anarchy: A Model of Governance by Fred E. FoldvaryFred E. FoldvaryFred Emanuel Foldvary is a lecturer in economics at Santa Clara University, California, and a research fellow at The Independent Institute...

- Really Natural Rights

- Geoism in American Quaker John Woolman's "Plea for the Poor"

- Murray Rothbard and Henry George — a critical review of GeorgismGeorgismGeorgism is an economic philosophy and ideology that holds that people own what they create, but that things found in nature, most importantly land, belong equally to all...

/Geolibertarianism from an Austrian SchoolAustrian SchoolThe Austrian School of economics is a heterodox school of economic thought. It advocates methodological individualism in interpreting economic developments , the theory that money is non-neutral, the theory that the capital structure of economies consists of heterogeneous goods that have...

perspective.