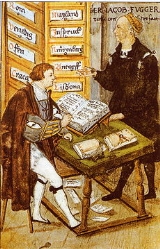

Accountant

Encyclopedia

An accountant is a practitioner of accountancy

Accountancy

Accountancy is the process of communicating financial information about a business entity to users such as shareholders and managers. The communication is generally in the form of financial statements that show in money terms the economic resources under the control of management; the art lies in...

(UK) or accounting (US), which is the measurement, disclosure or provision of assurance about financial information that helps managers, investors, tax authorities and others make decisions about allocating resources.

The Big Four auditors

Big Four auditors

The Big Four are the four largest international professional services networks in accountancy and professional services, which handle the vast majority of audits for publicly traded companies as well as many private companies, creating an oligopoly in auditing large companies...

are the largest employers of accountants worldwide.

However, most accountants are employed in commerce and industry.

British Commonwealth

In the Commonwealth of NationsCommonwealth of Nations

The Commonwealth of Nations, normally referred to as the Commonwealth and formerly known as the British Commonwealth, is an intergovernmental organisation of fifty-four independent member states...

, which includes the United Kingdom

United Kingdom

The United Kingdom of Great Britain and Northern IrelandIn the United Kingdom and Dependencies, other languages have been officially recognised as legitimate autochthonous languages under the European Charter for Regional or Minority Languages...

, Canada

Canada

Canada is a North American country consisting of ten provinces and three territories. Located in the northern part of the continent, it extends from the Atlantic Ocean in the east to the Pacific Ocean in the west, and northward into the Arctic Ocean...

, Australia

Australia

Australia , officially the Commonwealth of Australia, is a country in the Southern Hemisphere comprising the mainland of the Australian continent, the island of Tasmania, and numerous smaller islands in the Indian and Pacific Oceans. It is the world's sixth-largest country by total area...

, New Zealand

New Zealand

New Zealand is an island country in the south-western Pacific Ocean comprising two main landmasses and numerous smaller islands. The country is situated some east of Australia across the Tasman Sea, and roughly south of the Pacific island nations of New Caledonia, Fiji, and Tonga...

, Hong Kong

Hong Kong

Hong Kong is one of two Special Administrative Regions of the People's Republic of China , the other being Macau. A city-state situated on China's south coast and enclosed by the Pearl River Delta and South China Sea, it is renowned for its expansive skyline and deep natural harbour...

pre 1997 and several dozen other states, commonly recognised accounting qualifications are Chartered Accountant

Chartered Accountant

Chartered Accountants were the first accountants to form a professional body, initially established in Britain in 1854. The Edinburgh Society of Accountants , the Glasgow Institute of Accountants and Actuaries and the Aberdeen Society of Accountants were each granted a royal charter almost from...

(CA or ACA), Chartered Certified Accountant

Chartered Certified Accountant

Chartered Certified Accountant was historically seen as a British qualified accountant designation awarded by the Association of Chartered Certified Accountants . However, although ACCA is UK based, it is a global body for professional accountants with 147,000 qualified members and 424,000...

(ACCA

Association of Chartered Certified Accountants

Founded in 1904, the Association of Chartered Certified Accountants is the global body for professional accountants offering the Chartered Certified Accountant qualification . it is one of the largest and fastest-growing global accountancy bodies with 147,000 members and 424,000 students in 170...

), Chartered Management Accountant (ACMA) and International Accountant (AAIA). Other qualifications in particular countries include Certified Public Accountant (CPA - Ireland and CPA - Hong Kong), Certified Management Accountant (CMA - Canada), Certified General Accountant (CGA - Canada), Certified Practising Accountant (CPA - Australia) and members of the IPA (Australia), and Certified Public Practising Accountant (CPPA - New Zealand).

- A Chartered AccountantChartered AccountantChartered Accountants were the first accountants to form a professional body, initially established in Britain in 1854. The Edinburgh Society of Accountants , the Glasgow Institute of Accountants and Actuaries and the Aberdeen Society of Accountants were each granted a royal charter almost from...

must be a member of one of the following:- the Institute of Chartered Accountants in England & WalesInstitute of Chartered Accountants in England & WalesThe Institute of Chartered Accountants in England and Wales was established by a Royal Charter in 1880. It has over 130,000 members. Over 15,000 of these members live and work outside the UK...

(ICAEW) (designatory letters ACA or FCA) - the Institute of Chartered Accountants of ScotlandInstitute of Chartered Accountants of ScotlandThe Institute of Chartered Accountants of Scotland is the Scottish professional body of Chartered Accountants . It is a regulator, educator and influencer.ICAS act as a thought leader and voice of the professional business community...

(ICAS) (designatory letters CA) - Chartered Accountants Ireland (CAI)

- a recognised equivalent body from another Commonwealth country (designatory letters being CA (name of country) e.g. CA (Canada))

- the Institute of Chartered Accountants in England & Wales

- A Chartered Certified AccountantChartered Certified AccountantChartered Certified Accountant was historically seen as a British qualified accountant designation awarded by the Association of Chartered Certified Accountants . However, although ACCA is UK based, it is a global body for professional accountants with 147,000 qualified members and 424,000...

must be a member of the Association of Chartered Certified AccountantsAssociation of Chartered Certified AccountantsFounded in 1904, the Association of Chartered Certified Accountants is the global body for professional accountants offering the Chartered Certified Accountant qualification . it is one of the largest and fastest-growing global accountancy bodies with 147,000 members and 424,000 students in 170...

(designatory letters ACCA or FCCA). - A Chartered Management Accountant must be a member of the Chartered Institute of Management AccountantsChartered Institute of Management AccountantsThe Chartered Institute of Management Accountants is a United Kingdom-based professional body offering training and qualification in management accountancy and related subjects, focused on accounting for business; together with ongoing support for members.CIMA is one of a number of professional...

(designatory letters ACMA or FCMA). - A Chartered Public Finance Accountant must be a member of the Chartered Institute of Public Finance and AccountancyChartered Institute of Public Finance and AccountancyThe Chartered Institute of Public Finance and Accountancy is a professional institute for accountants working in the public services.CIPFA has 14,000 members who work throughout the public services, in national audit agencies, in major accountancy firms, and in other bodies where public money...

(designatory letters CPFA). - An International Accountant is a member of the Association of International AccountantsAssociation of International AccountantsThe Association of International Accountants is a professional accountancy body. It was founded in the UK in 1928 and since that date has promoted the concept of ‘international accounting’ to create a global network of accountants in over 85 countries worldwide.AIA is recognised by the UK...

(designatory letters AIAA or FAIA). - An Incorporated Financial Accountant is a member of the Institute of Financial AccountantsInstitute of Financial AccountantsThe Institute of Financial Accountants is a professional body representing financial accountants in the United Kingdom as well as abroad....

(designatory letters AFA or FFA). - An Associate Professional Accountant is a member of the Institute of Professional Accountants(designatory letters APA-UK or FPA).

- A Certified Public Accountant may be a member of the Association of Certified Public AccountantsAssociation of Certified Public AccountantsThe Association of Certified Public Accountants is an amalgamation of The Society of Public Accountants which was founded in 1989, and the Association of Certified Public Accountants which was formed in 1991...

(designatory letters AICPA or FCPA) or its equivalent in another country, and is usually designated as such after passing the Uniform Certified Public Accountant ExaminationUniform Certified Public Accountant ExaminationThe Uniform Certified Public Accountant Examination is the examination administered to people who wish to become Certified Public Accountants in the United States....

. - A Public Accountant may be a member of the Institute of Public Accountants (designatory letters AIPA, MIPA or FIPA).

Excepting the Association of Certified Public Accountants, each of the above bodies admits members only after passing examinations and undergoing a period of relevant work experience. Once admitted, members are expected to comply with ethical guidelines and gain appropriate professional experience.

Chartered, Chartered Certified, Chartered Public Finance, and International Accountants engaging in practice (i.e. selling services to the public rather than acting as an employee) must gain a "practising certificate" by meeting further requirements such as purchasing adequate insurance and undergoing inspections.

The ICAEW, ICAS, ICAI, ACCA, AIA and CIPFA are six statutory RQB Qualification Bodies in the UK. A member of one them may also become a Registered Auditor in accordance with the Companies Act, providing they can demonstrate the necessary professional ability in that area and submit to regular inspection. It is illegal for any individual or firm that is not a Registered Auditor to perform a company audit.

All six RQBs are listed under EU mutual recognition directives to practise in 27 EU member states and individually entered into agreement with the Hong Kong Institute of Certified Public Accountants (HKICPA).

Further restrictions apply to accountants who carry out insolvency work.

In addition to the bodies above, technical qualifications are offered by the Association of Accounting Technicians

Association of Accounting Technicians

The Association of Accounting Technicians, or AAT, is an accountancy organisation with over 120,000 members worldwide. The AAT is a technician level qualification which entitles those who have completed the exams and obtained relevant supervised work experience to call themselves associate...

, ACCA and AIA, which are respectively called AAT Technician, CAT (Certified Accounting Technician

Certified Accounting Technician

The Certified Accounting Technician UK qualification is offered by the Association of Chartered Certified Accountants . Upon completion of the exams and required practical work experience the CAT graduate will be able to apply to use the letters CAT after his or her name...

) and IAT (International Accounting Technician).

Australia

In Australia, there are three recognised professional accounting bodies: the Institute of Public Accountants (IPA), CPA AustraliaCPA Australia

CPA Australia is one of three professional accounting bodies in Australia, the others being the Institute of Public Accountants and the Institute of Chartered Accountants of Australia....

(CPA) and the Institute of Chartered Accountants of Australia

Institute of Chartered Accountants of Australia

The Institute of Chartered Accountants in Australia is the professional accounting body representing Chartered Accountants in Australia. It has over 50,000 members and has some 12,000 students. It is a founding member of the Global Accounting Alliance .-History:The Institute of Chartered...

(ICAA).

Canada

In Canada, there are four recognized accounting bodies: the Canadian Institute of Chartered AccountantsCanadian Institute of Chartered Accountants

The Canadian Institute of Chartered Accountants was incorporated by a Private Act of the Canadian Parliament in 1902. This Act, now known as the Canadian Institute of Chartered Accountants Act, was last amended in 1990 to reflect the CICA’s current mandate and powers.Working in collaboration with...

(CA) and the provincial and territorial CA Institutes, the Certified General Accountants Association of Canada

Certified General Accountant

Certified General Accountant is the designation of professionals who are jointly members of the Certified General Accountants Association of Canada and a provincial or territorial CGA association, or a CGA association overseas...

(CGA), the Society of Management Accountants of Canada

Society of Management Accountants of Canada

The Society of Management Accountants of Canada, also known as Certified Management Accountants of Canada and CMA Canada, awards the Certified Management Accountant designation in Canada.-Activities:...

, also known as the Certified Management Accountants (CMA), and the Society of Professional Accountants of Canada (RPA). CA and CGA were created by Acts of Parliament in 1902 and 1913 respectively, CMA was established in 1920 and RPA in 1938.

The CA program is the most focused on public accounting and most candidates obtain auditing experience from public accounting firms, although recent changes allow candidates to obtain their experience requirements in industry at companies that have been accredited for training CAs; the CGA program takes a general approach allowing candidates to focus in their own financial career choices; the CMA program focuses in management accounting, but also provides a general approach to financial accounting and tax. The CA and CMA programs require a candidate to obtain a degree as a program entry requirement. The CGA program requires a degree as an exit requirement prior to certification.

Auditing and Public Accounting are regulated by the provinces. In British Columbia

British Columbia

British Columbia is the westernmost of Canada's provinces and is known for its natural beauty, as reflected in its Latin motto, Splendor sine occasu . Its name was chosen by Queen Victoria in 1858...

, Ontario

Ontario

Ontario is a province of Canada, located in east-central Canada. It is Canada's most populous province and second largest in total area. It is home to the nation's most populous city, Toronto, and the nation's capital, Ottawa....

and Prince Edward Island

Prince Edward Island

Prince Edward Island is a Canadian province consisting of an island of the same name, as well as other islands. The maritime province is the smallest in the nation in both land area and population...

, CAs and CGAs have equal status regarding public accounting and auditing; In the rest of Canada

Canada

Canada is a North American country consisting of ten provinces and three territories. Located in the northern part of the continent, it extends from the Atlantic Ocean in the east to the Pacific Ocean in the west, and northward into the Arctic Ocean...

, CAs, CMAs, and CGAs are considered equivalents pursuant to provincial and territorial legislation. However, in practice, most public accounting and auditing in Canada is performed by CAs.

, the Chartered Certified Accountant (ACCA

Association of Chartered Certified Accountants

Founded in 1904, the Association of Chartered Certified Accountants is the global body for professional accountants offering the Chartered Certified Accountant qualification . it is one of the largest and fastest-growing global accountancy bodies with 147,000 members and 424,000 students in 170...

or FCCA) is also recognized by the Canadian government as an eligible qualification to audit federal government institutions in Canada. Furthermore, The Canadian branch of ACCA

Association of Chartered Certified Accountants

Founded in 1904, the Association of Chartered Certified Accountants is the global body for professional accountants offering the Chartered Certified Accountant qualification . it is one of the largest and fastest-growing global accountancy bodies with 147,000 members and 424,000 students in 170...

is pursuing recognition for statutory audit purposes in the province of Ontario under the province's Public Accounting Act of 2004.

New Zealand

In New Zealand, there are two local accountancy bodies the New Zealand Institute of Chartered AccountantsNew Zealand Institute of Chartered Accountants

The New Zealand Institute of Chartered Accountants is the operating name for the Institute of Chartered Accountants of New Zealand. The Institute represents over 32,000 members in New Zealand and overseas...

(NZICA) and the New Zealand Association of Certified Public Accountants (NZACPA) the operating name of New Zealand Association of Accountants Inc (NZAA).

To audit public companies an individual must be a member of either the NZICA or an otherwise gazetted body. Chartered Certified Accountant (Association of Chartered Certified Accountants or FCCA) qualification has also been gazetted under ). An ACCA member can practice as long as they hold an ACCA public practice certificate (with audit qualification) in their country of origin.

Sri Lanka

In Sri Lanka, a Chartered Accountant must be a member of the Institute of Chartered Accountants of Sri LankaInstitute of Chartered Accountants of Sri Lanka

The Institute of Chartered Accountants of Sri Lanka is a professional accountancy body in Sri Lanka. The Institute is established by Act of Parliament, No. 23 of 1959 as the sole organisation in Sri Lanka with the right to award the Chartered Accountant designation...

(designatory letters ACA or FCA), therefore it is the sole local accountancy body. To audit public companies an individual must be a member of the ICASL.

In Pakistan there is a big concept of doing acca, ca, acma and higher qualification about accountancy.

Austria

In Austria the accountancy profession is regulated by the Bilanzbuchhaltungsgesetz 2006 (BibuG - Management Accountancy Law).Hong Kong

In Hong KongHong Kong

Hong Kong is one of two Special Administrative Regions of the People's Republic of China , the other being Macau. A city-state situated on China's south coast and enclosed by the Pearl River Delta and South China Sea, it is renowned for its expansive skyline and deep natural harbour...

, the accountancy industry is regulated by the HKICPA under the Professional Accountants Ordinance (Chapter 50, Laws of Hong Kong

Hong Kong

Hong Kong is one of two Special Administrative Regions of the People's Republic of China , the other being Macau. A city-state situated on China's south coast and enclosed by the Pearl River Delta and South China Sea, it is renowned for its expansive skyline and deep natural harbour...

). The Auditing industry for limited companies is regulated under the Companies Ordinance (Chapter 32, Laws of Hong Kong

Hong Kong

Hong Kong is one of two Special Administrative Regions of the People's Republic of China , the other being Macau. A city-state situated on China's south coast and enclosed by the Pearl River Delta and South China Sea, it is renowned for its expansive skyline and deep natural harbour...

), and other Ordinances such as the Securities and Futures Ordinance, the Listing Rules, etc.

HKICPA terminated all recognition of oversea bodies in 2005 for accreditation under Professional Accountants Ordinance. In general, all British RQBs except for CIPFA were re-accredited. Please refer to HKICPA for latest recognition.

Removal of requirement for a qualified accountant in the Listing Rules of Hong Kong

In November 2008, the Stock Exchange of Hong Kong Limited has removed the requirement for a qualified accountant from the Listing Rules but expanded the Code Provisions in the Code on Corporate Governance Practices regarding internal controls to make specific references to the responsibility of the directors to conduct an annual review of the adequacy of staffing of the financial reporting function and the oversight role of the audit committee.

Portugal

In Portugal, there are two accountancy qualifications: the Técnicos Oficiais de Contas (TOC), responsible for producing accounting and tax information, and the Revisor Oficial de Contas (ROC), more related to auditing practices. The TOC certification is exclusively awarded by the professional organization Ordem dos Técnicos Oficiais de ContasOrdem dos Técnicos Oficiais de Contas

Ordem dos Técnicos Oficiais de Contas is a professional organization responsible for regulating the accountancy practice in Portugal. OTOC runs an admittance examination every four months and everyone that passes it becomes a Técnico Oficial de Contas , the authorized tax and accountancy...

(OTOC), and the certification to become an auditor is awarded by another professional organization, the Ordem dos Revisores Oficiais de Contas (OROC). In general, accountants or auditors accredited by OTOC or OROC are individuals with university

University

A university is an institution of higher education and research, which grants academic degrees in a variety of subjects. A university is an organisation that provides both undergraduate education and postgraduate education...

graduation diplomas in business management, economics

Economics

Economics is the social science that analyzes the production, distribution, and consumption of goods and services. The term economics comes from the Ancient Greek from + , hence "rules of the house"...

, mathematics

Mathematics

Mathematics is the study of quantity, space, structure, and change. Mathematicians seek out patterns and formulate new conjectures. Mathematicians resolve the truth or falsity of conjectures by mathematical proofs, which are arguments sufficient to convince other mathematicians of their validity...

or law

Law

Law is a system of rules and guidelines which are enforced through social institutions to govern behavior, wherever possible. It shapes politics, economics and society in numerous ways and serves as a social mediator of relations between people. Contract law regulates everything from buying a bus...

who, after further studies, applied for an exam and received the certification to be a TOC or ROC. That certification is only received after a 1-year (TOC) or 3-years (ROC) internship. Any citizen having a polytechnic

Polytechnic (Portugal)

A polytechnic is a higher education educational institution in Portugal created in the 1980s. After 1998 they were upgraded to institutions which are allowed to confer licenciatura degrees. Before then, they only awarded short-cycle degrees which were known as bacharelatos and didn't provide...

degree as accounting technician is also entitled to apply for the exam and certification at the OTOC.

United States

In the United StatesUnited States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

, legally practicing accountants are Certified Public Accountant

Certified Public Accountant

Certified Public Accountant is the statutory title of qualified accountants in the United States who have passed the Uniform Certified Public Accountant Examination and have met additional state education and experience requirements for certification as a CPA...

s (CPAs), and other non-statutory accountants are Certified Internal Auditors (CIAs), Certified Management Accountant

Certified Management Accountant

The title Certified Management Accountant is used by various professional bodies around the world to designate their different professional certifications....

s (CMAs) and Accredited Business Accountant

Accredited Business Accountant

An Accredited Business Accountant is a professional designation for accountants. It requires a test and 3 years work experience. The test is based on knowledge of accounting, taxes, and business law....

s (ABAs). The difference between these certifications is primarily the legal status and the types of services provided, although individuals may earn more than one certification. Additionally, much accounting work is performed by uncertified individuals, who may be working under the supervision of a certified accountant. However, as noted above the majority of accountants work in the private sector or may offer their services without the need for certification.

A CPA is licensed by the state of their residence to provide auditing services to the public, although most CPA firms also offer accounting, tax, litigation support, and other financial advisory services. The requirements for receiving the CPA license varies from state to state, although the passage of the Uniform Certified Public Accountant Examination

Uniform Certified Public Accountant Examination

The Uniform Certified Public Accountant Examination is the examination administered to people who wish to become Certified Public Accountants in the United States....

is required by all states. This examination is designed and graded by the American Institute of Certified Public Accountants

American Institute of Certified Public Accountants

Founded in 1887, the American Institute of Certified Public Accountants is the national professional organization of Certified Public Accountants in the United States, with more than 370,000 CPA members in 128 countries in business and industry, public practice, government, education, student...

.

A CIA is granted a certificate from the Institute of Internal Auditors (IIA), provided that the candidate passed a rigorous examination of four parts. A CIA mostly provides their services directly to their employer rather than the public.

A CMA is granted a certificate from the Institute of Management Accountants (IMA), provided that the candidate passed a rigorous examination of two parts and meet the practical experience requirement from the IMA. A CMA mostly provides their services directly to their employers rather than the public. A CMA can also provide their services to the public, but to an extent much lesser than that of a CPA.

An ABA is granted accreditation from the Accreditation Council for Accountancy and Taxation (ACAT), provided that the candidate passed the eight-hour Comprehensive Examination for Accreditation in Accounting which tests proficiency in financial accounting, reporting, statement preparation, taxation, business consulting services, business law, and ethics. An ABA specializes in the needs of small-to-mid-size businesses and in financial services to individuals and families. In states where use of the word "accountant” is not permitted by non state licensed individuals, the practitioner may use Accredited Business Adviser.

Public Accountants. In certain states, state law grants State Public Accountant to practice accountancy and taxation (except for audit).

The United States Department of Labor

United States Department of Labor

The United States Department of Labor is a Cabinet department of the United States government responsible for occupational safety, wage and hour standards, unemployment insurance benefits, re-employment services, and some economic statistics. Many U.S. states also have such departments. The...

's Bureau of Labor Statistics

Bureau of Labor Statistics

The Bureau of Labor Statistics is a unit of the United States Department of Labor. It is the principal fact-finding agency for the U.S. government in the broad field of labor economics and statistics. The BLS is a governmental statistical agency that collects, processes, analyzes, and...

estimates that there are about one million persons employed as accountants and auditors in the U.S.

U.S. tax law

Taxation in the United States

The United States is a federal republic with autonomous state and local governments. Taxes are imposed in the United States at each of these levels. These include taxes on income, property, sales, imports, payroll, estates and gifts, as well as various fees.Taxes are imposed on net income of...

grants accountants a limited form of accountant-client privilege

Accountant-client privilege

Accountant–client privilege is a confidentiality privilege, or more precisely, a group of privileges, available in American federal and state law. Accountant–client privileges may be classified in two categories: evidentiary privileges and non-evidentiary privileges.An evidentiary privilege is one...

.